Tally Solutions | Updated on: December 27, 2022

In Saudi Arabia, the e-invoicing system with the name Fatoorah was announced in December 2020, to acknowledge the whole process of electronic invoices and allow the handling of invoices, credit notes and debit notes through an integrated digital system.

Switching to electronic invoices in Saudi Arabia

Electronic invoices have many clear benefits, including easier invoice preparation that can be automated, as well as more secure storage. However, implementing the system will need a number of requirements to ensure its compliance and security.

A paper invoice that is scanned and converted to a digital format will never be accepted as an electronic invoice since the official e-invoice needs to be generated by a system with specific requirements.

| How to Generate e-invoices Instantly with TallyPrime in Saudi Arabia | How Phase-1 of e-Invoicing System Work? |

Types of e-invoices

The two types of invoices that will be included in the Fatoorah system include:

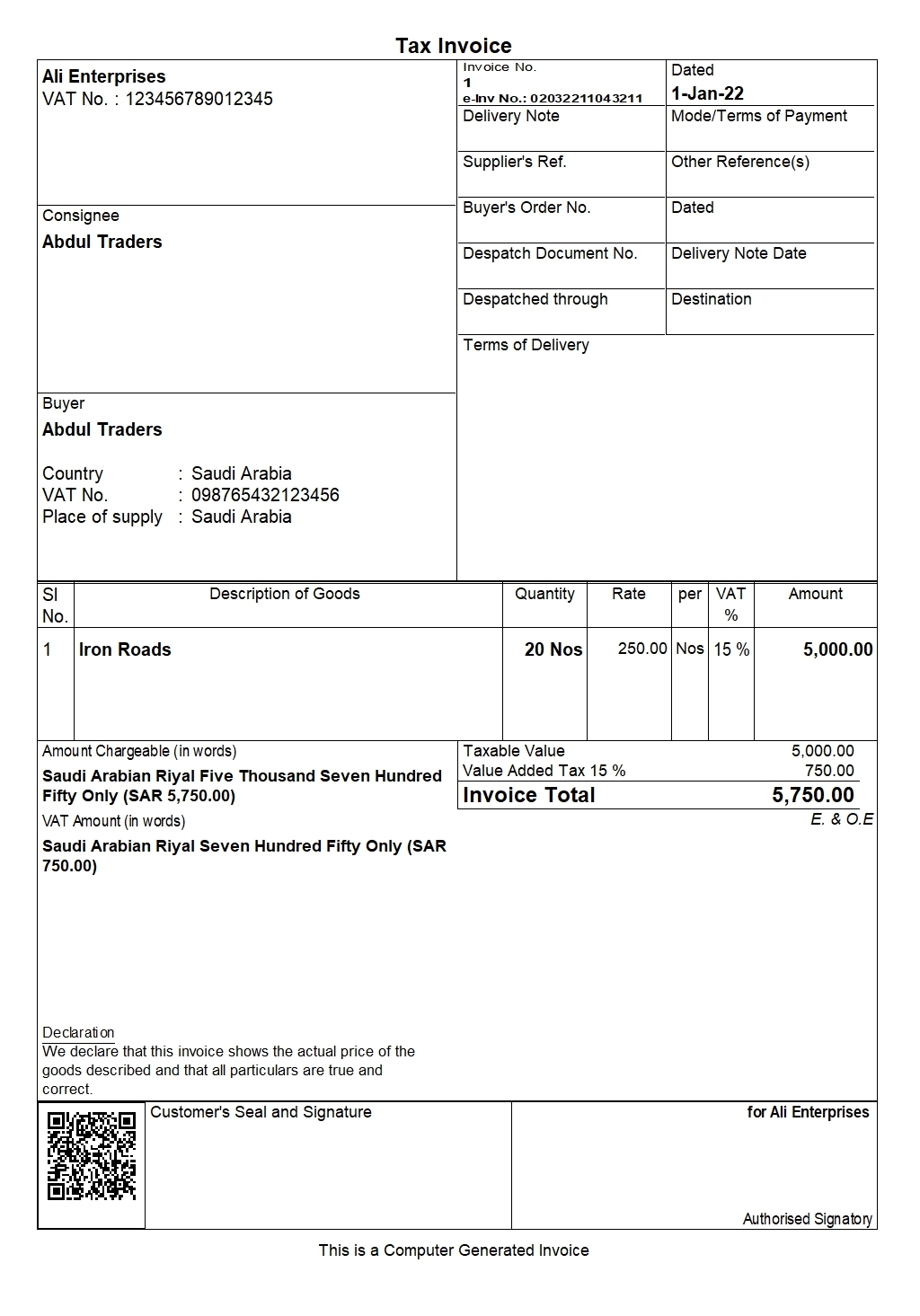

- Tax invoices that are usually issued by businesses to other businesses mentioning all tax-related information for a specific purchase.

- Simplified tax invoices, which are issued by businesses to customers, also with all tax-related information.

Implementation phases of the Fatoorah electronic tax invoicing system in Saudi

Divided into two phases, the first phase was enforced on the 4th of December 2021, and it requires businesses to generate and store tax invoices through electronic systems that satisfy specific requirements. The second phase, known as the integration phase, is implemented from 1st January,2023.

The first wave of integration phase is applicable to businesses with revenue exceeding 3 billion from 1st January,2023. The second phase will apply to businesses with revenue exceeding 500 million in FY 2021 from 1st July,2023.

e-Invoicing format and requirements in Saudi Arabia for 1st Phase

- Generate e-invoice

The e-invoice concept requires businesses to generate and store electronic invoices that include tax invoice, simplified invoices, and notes using compliant e-invoicing software or any other electronic system. Any invoice generated used text editing tool, paper invoice or Excel or similar tools will not be considered as e-invoice

e-invoice generated using TallyPrime

- Archive in XML/PDF Format

One of the requirements of generating an electronic invoice in Saudi Arabia is that the invoice should be archived in XML format or PDF/A-3 format (with embedded XML). This means that any other format that is still readable but not one of them won't be accepted, which is a step to keep everything standardized from the outset.

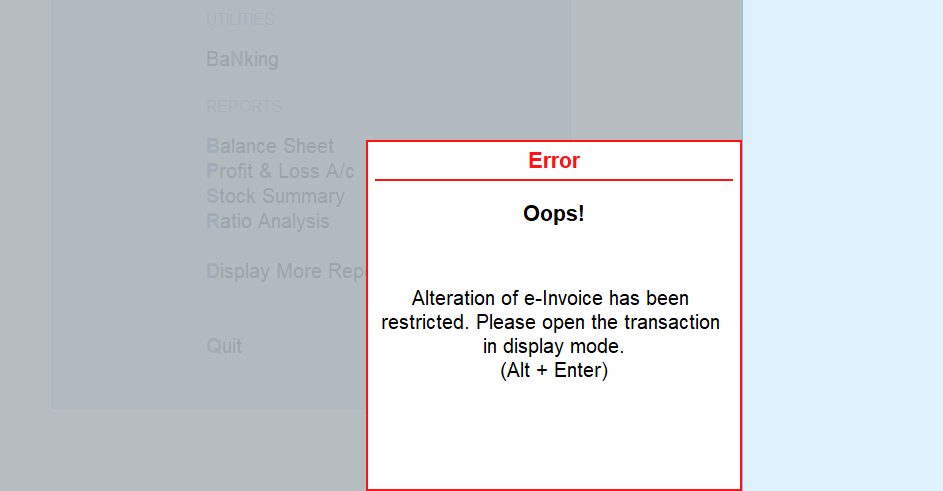

- Tamper proof

There is also a wide number of information security-related requirements for each solution to be used for invoice generation. The compliant software will need to offer a tamper-resistant mechanism to prevent any third party from altering invoice information. The Tax Authority has the right to determine if the solution complies or not, according to predefined criteria. Any alteration or deletion of generated e-invoices or associated notes (credit and debit notes) will lead to non-compliance.

Alteration and deletion control for e-invoices in TallyPrime

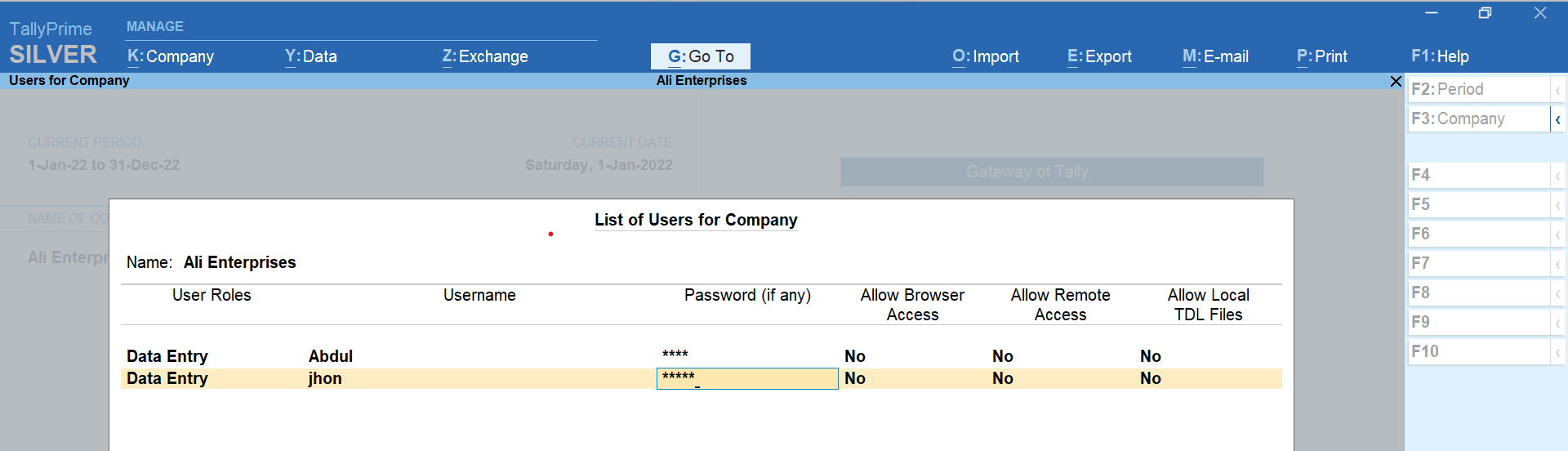

- Access Control

The e-invoice software should have an access control mechanism that ensures only the authorized users access the software and generate the e-invoice. Anonymous access, ability to operate with default password and absence of user session management are prohibited functionalities of e-invoice software as per the guidelines.

User management in TallyPrime

- QR code on simplified invoices

Another requirement is that the solution must be able to generate a QR code for simplified invoices, which can be scanned by smart devices to display additional information. It is optional for businesses to generate QR codes on tax invoices.

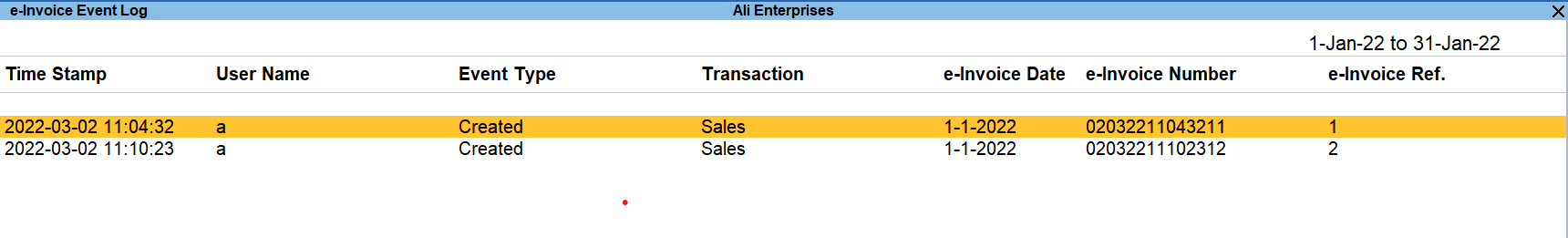

- Generate e-invoice in single Sequence

The software should generate e-invoices through a single sequence with no functionalities for generating parallel invoices. Generating multiple e-invoices in a sequence i.e., more than one e-invoice in a sequence at any given time is prohibited functionality.

e-invoice log in TallyPrime

e-invoice log in TallyPrime

e-Invoicing in TallyPrime

The e-invoicing or Fatoorah system has become obligatory for all companies in Saudi Arabia and there are specific requirements for the e-invoicing software to be used.

TallyPrime, a business management software with built-in e-invoicing solution can help your business to meet the requirements set by the Saudi tax authorities. Take a look at the wide range of e-invoicing features in TallyPrime

- Generate e-invoices in a single click

- Print QR code on invoices effortlessly

- Generate e-invoice for tax invoices and simplified invoices

- Exclusive e-invoice report will give you a single view of all e-invoicing tasks

- Intuitive prevention, detection, and correction mechanisms will help you deal with exceptions with ease

- Supports e-invoice for debit note, credit note POS invoice, and receipts

- Export e-invoice in an XML file/PDF as per ZATCA (GAZT) requirement

- Security control and User login management

- User session log register to view all the log details indicating the entire history of the masters & transactions

If you need software that is ready for e-invoicing with all the requirements of format and security, TallyPrime gives you a comprehensive solution to generate and archive the e-invoices without any additional steps and efforts.

Read more on e-invoicing in Saudi

Latest Blogs

Simplify Payments with Precision: Integrated Payments & Accounting in TallyPrime 6.0

Introducing TallyPrime Cloud Access Starting from AED 63/Month

Maximising Tax Benefits for Free Zone Entities under UAE Corporate Tax Law

Key Dates for Phases and Waves of e-Invoicing Compliance in KSA

Simplifying VAT Compliance for Financial Institutions Using SWIFT Messages in UAE