Issuing invoices is one of the critical aspects of the business. With VAT, all the registered businesses should follow guidelines as prescribed in Law and regulation for issuing invoices. If you are making a taxable supply, as a business, you must ensure that a tax invoice is issued. Also, for a VAT registered buyer, the tax invoice enables the customer to support their reclaim of input tax for the VAT charged.

Types of VAT in Oman

Before we get into the mandatory elements that one should capture on the tax invoice, let’s understand different types of VAT invoices in Oman.

Tax invoice

A tax invoice is a detailed invoice that a VAT registered business must issue in the following cases:

- When making supplies, whether these are for a non-taxable person or a taxable person using the supplies for personal use

- On making deemed supplies

- On receiving the consideration, fully or partially, before the date of supply

| Record and Book Keeping Requirement under Oman VAT | Time of Supply in Oman VAT |

Simplified Tax invoice

A simplified tax invoice is a simplified version of a tax invoice, in which fewer details are required to be captured, as compared to a full detailed tax invoice. A registered business can issue a simplified tax invoice after obtaining the approval of the authority when the following conditions are met:

- The nature of the supplies does not require the issuance of immediate tax Invoices (that requires full details of tax invoice)

- The value of supplies excluding tax should be less than 500 Omani Rial

Tax invoice elements or components

Businesses issuing tax invoices should ensure the following elements/components are mentioned on the tax invoice.

- The term "Tax Invoice"

- The date of issuance of the tax invoice, the date of supply, and the date of payment

- The sequential number of the tax invoice

- The supplier's full name, address and tax identification number

- The customer's full name, address and tax identification number, if any, or it's equivalent in his country of residence if he has no place of residence in the Sultanate

- Description of the supplied goods and services

- The quantity of goods.

- Payment date of advance payment, if any,

- Total consideration excluding tax

- The applied tax rate

- Any price discounts, or reductions granted to the customer, or any subsidies granted by the State that were not included in the value of the consideration excluding tax

- Taxable value

- Value of the tax due

Simplified tax invoice elements or components

Following are components of simplified tax invoice:

- The phrase “Simplified Tax Invoice”

- The date of issuance of the simplified tax invoice, the date of supply and the date of payment

- The supplier's full name, address and tax identification number.

- Description of goods and services

- The quantity of goods

- The total consideration, excluding tax

- The applied tax rate

- Any price reductions, discounts granted to the customer, or any subsidies granted by the State that was not included in the value of the consideration excluding tax.

- Taxable value

- Tax due

Format of detailed tax invoice

There is no prescribed format or style of a tax invoice, but the Law and Regulations only mandate the minimum information that must be included on an invoice.

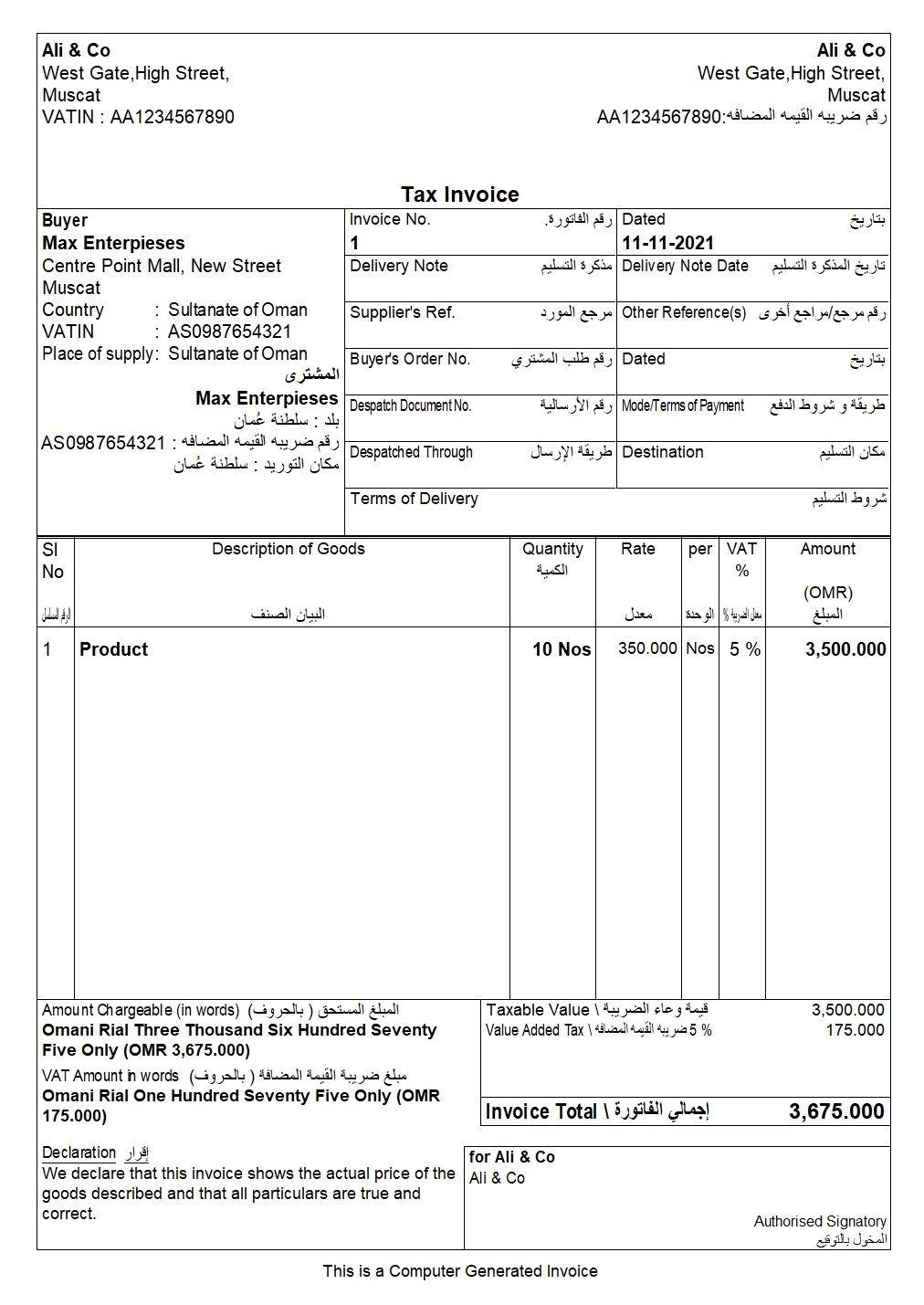

Bilingual tax invoice, both in Arabic and English, generated in TallyPrime

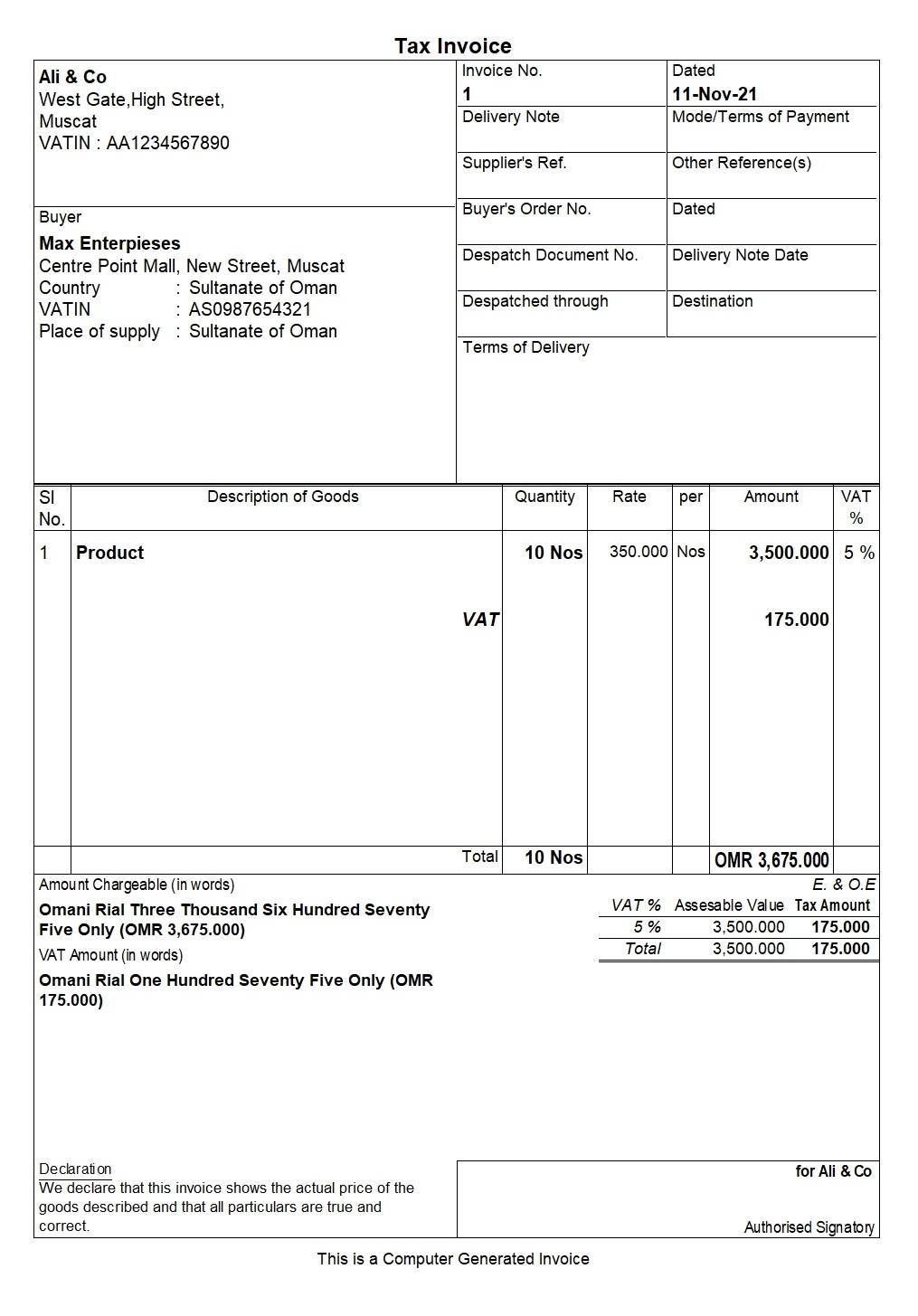

Tax invoice (format-1) generated in TallyPrime

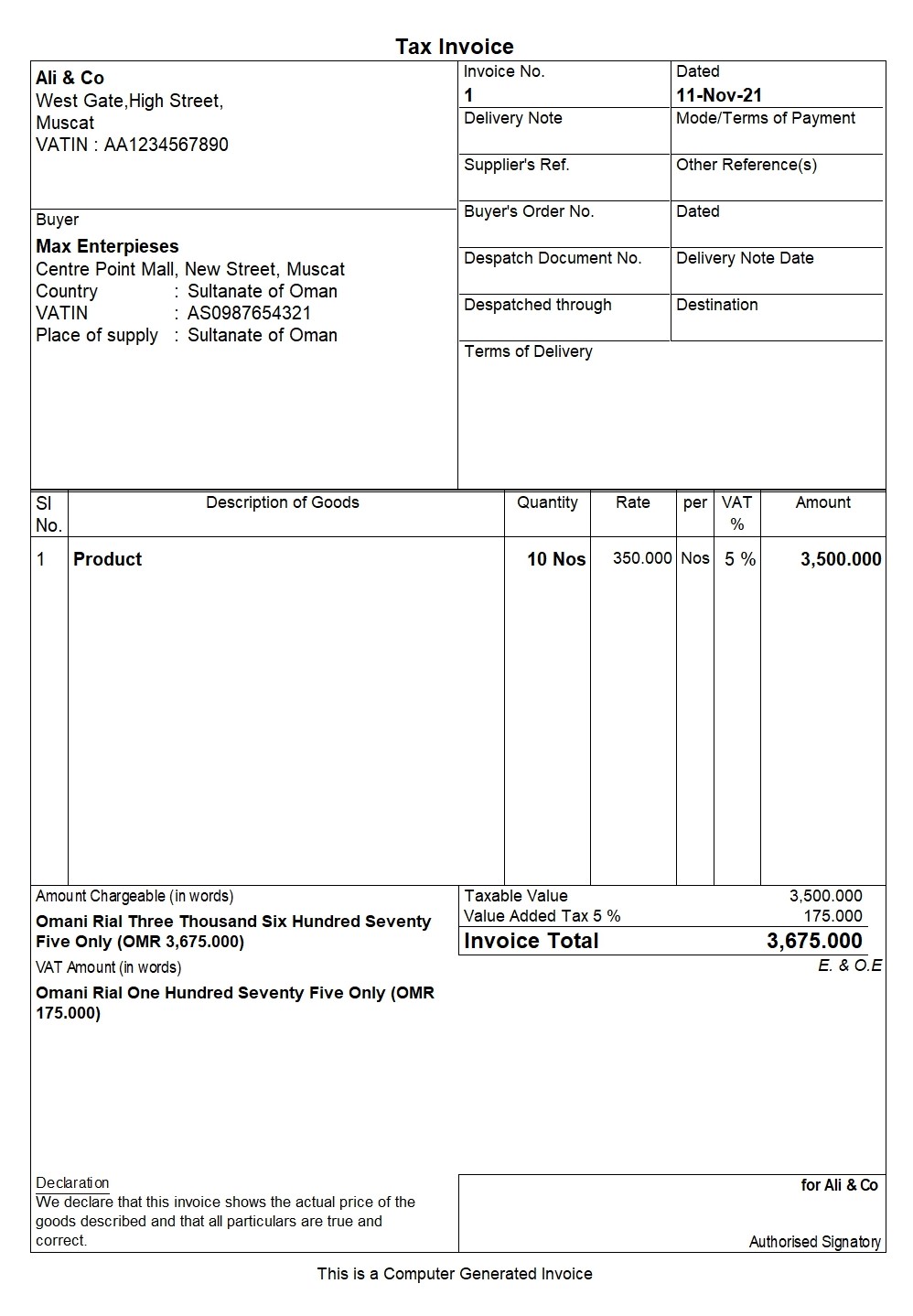

Tax invoice (format-2) generated in TallyPrime

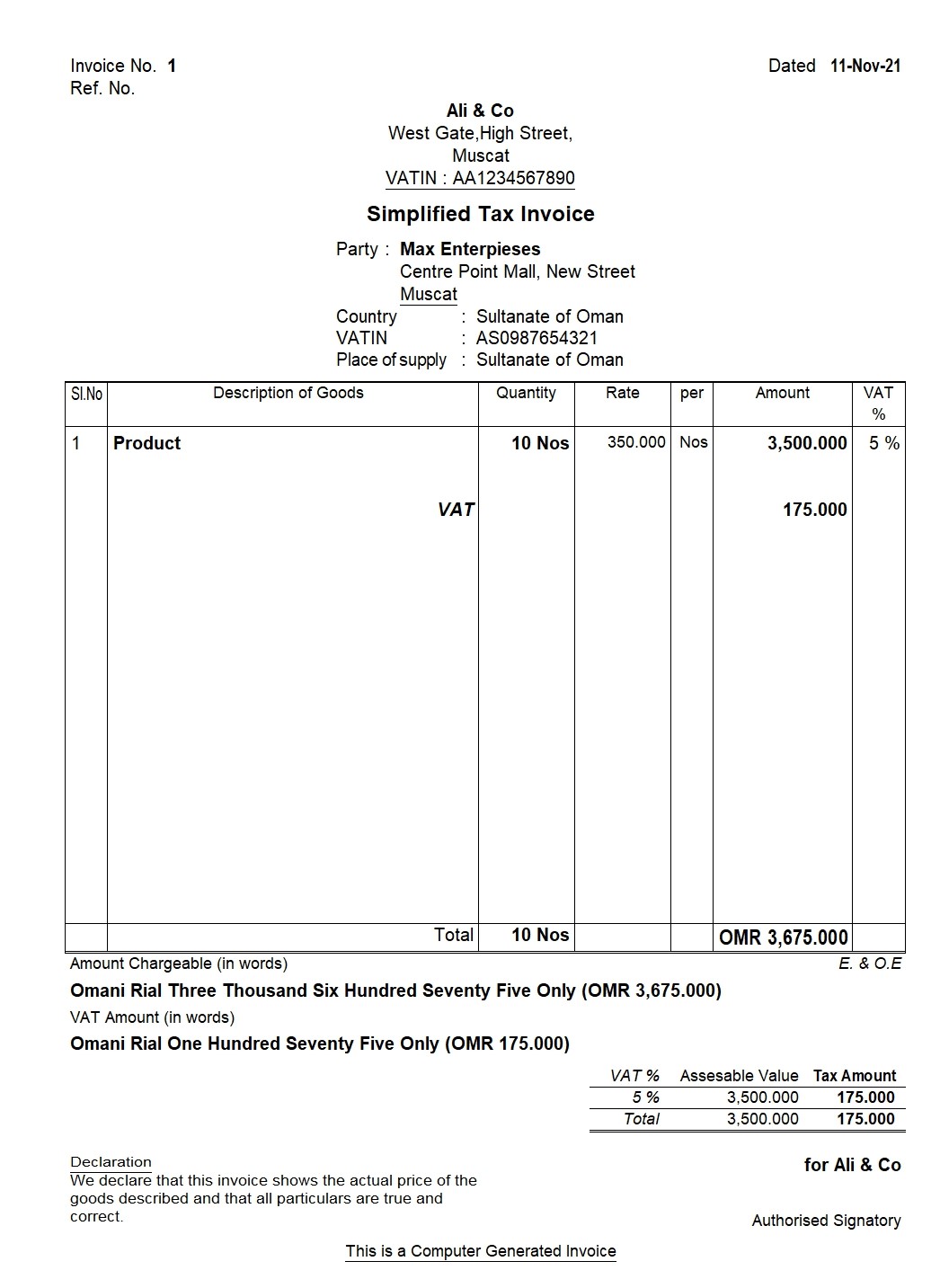

A simplified tax invoice generated in TallyPrime

How can TallyPrime help?

TallyPrime is a business management software with a complete VAT solution for Oman. It comes with the capability to auto calculate VAT and helps you generate VAT compliant tax invoices. Using TallyPrime, you can generate bilingual tax and POS invoices in Arabic and English. You can also generate invoices either only in English or Arabic as per your business needs.

What’s more? You can generate accurate VAT returns with the in-built prevention, detection, and correction capability.

Read more on Oman VAT: