- Deferred method of VAT payment on imported goods

- How to use deferred payment of VAT on imported goods?

- Managing Imports in TallyPrime

Just like domestic supplies, the import of goods into Oman is taxable at standard rate of VAT. If you are a business importing goods into Oman, you got to pay the VAT even though your supplier hasn't charged you with it. For example, if you are buying goods worth 200,000 OMR from India, you are liable to pay VAT on such supplies.

In most cases, the importer must pay the VAT before the clearance of goods from the customs. This is because the import VAT becomes due on the date of import of goods or the date of the entry of goods at the first point of entry. However, the VAT law and regulation are enacted with a special provision that allows businesses to pay import VAT on a deferred basis.

Let's understand more.

Deferred method of VAT payment on imported goods

Under this method, you are allowed to defer the VAT payable on the goods imports at a later date, i.e., at the time of filing VAT returns. Instead of paying the VAT before the customs clearance, you are required to pay at the time of filing VAT returns. In simple words, the deferred payment method shifts the VAT payable from customer clearance date to return filing date.

| VAT Payment on Import of Goods and Services in Oman | Value of Imported Goods in Oman |

Let's say you have imported goods worth 200,000 OMR from India. Instead of paying VAT at the time of customs clearance, you can defer the VAT payment to the return filing date. It implies that you can clear the goods from customs without paying the VAT.

The deferred payment method benefits in 2 ways, first being the seamless clearance of goods from the customs, and second, you can take advantage of cash flow for a little more time since your cash outflow is deferred.

How to use deferred payment of VAT on imported goods?

Businesses who wish to avail deferred payment option must file an application in the prescribed form to the authority. Upon receiving the request, the authorities will verify the request and grant permission for deferred payment of VAT on goods import.

In the process of getting permission for deferred payment of VAT on import of goods, the business needs to submit the necessary details, documents and meet the conditions prescribed in the VAT regulation. If your business has a high frequency of imports, you must try for a deferred VAT payment scheme.

Managing Imports in TallyPrime

No matter whether you have opted for paying VAT on imports of goods on a deferred or reverse charge mechanism (RCM) or pay VAT at customs, TallyPrime comes with a complete list of features that helps you record and manage all types of supplies.

You can calculate VAT on a forward charge basis, reverse charge basis for services and record imports, track and pay the VAT on the deferred method.

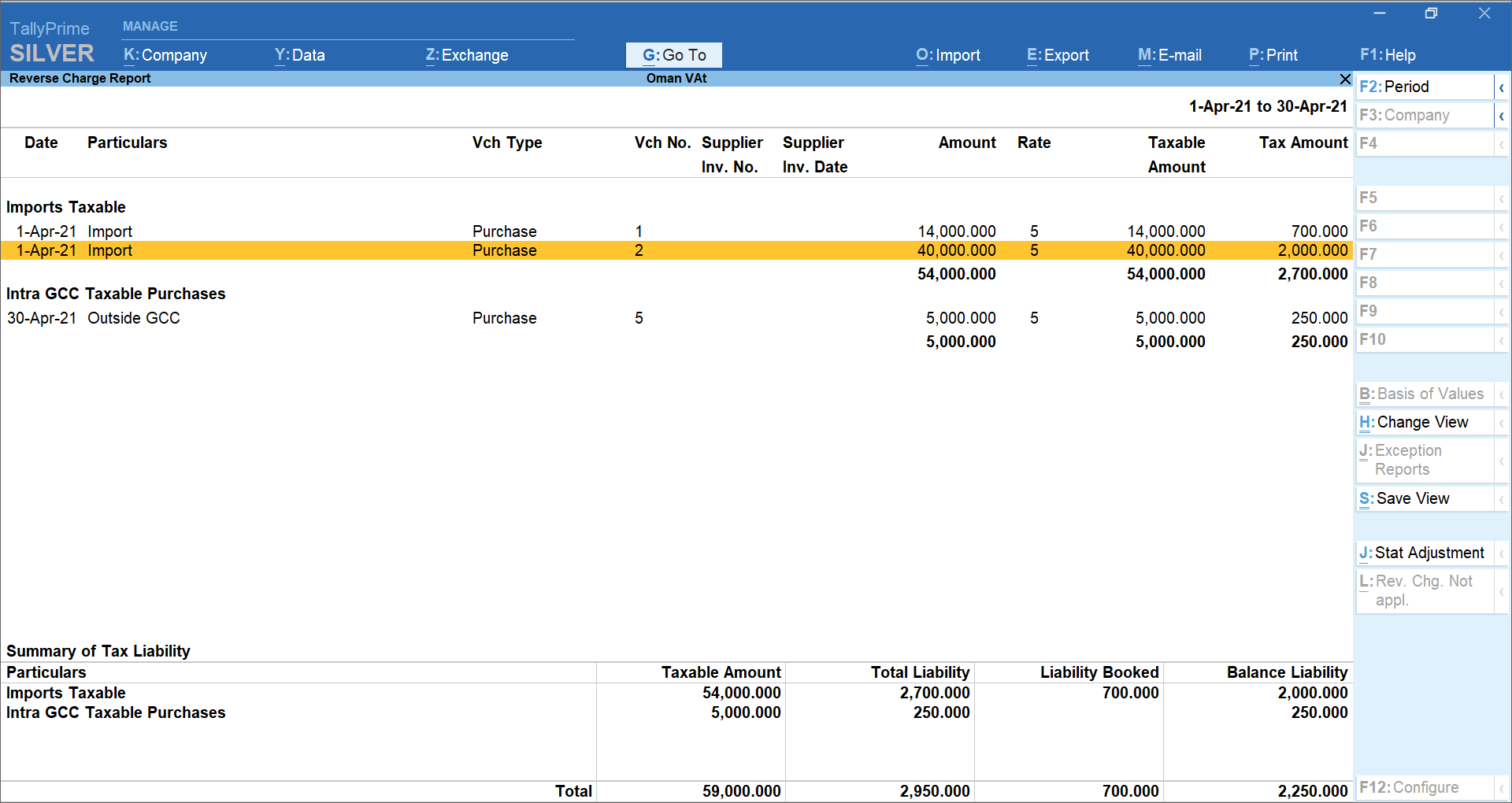

VAT report on deferred payment of VAT on import of goods using reverse charge mechanism in TallyPrime

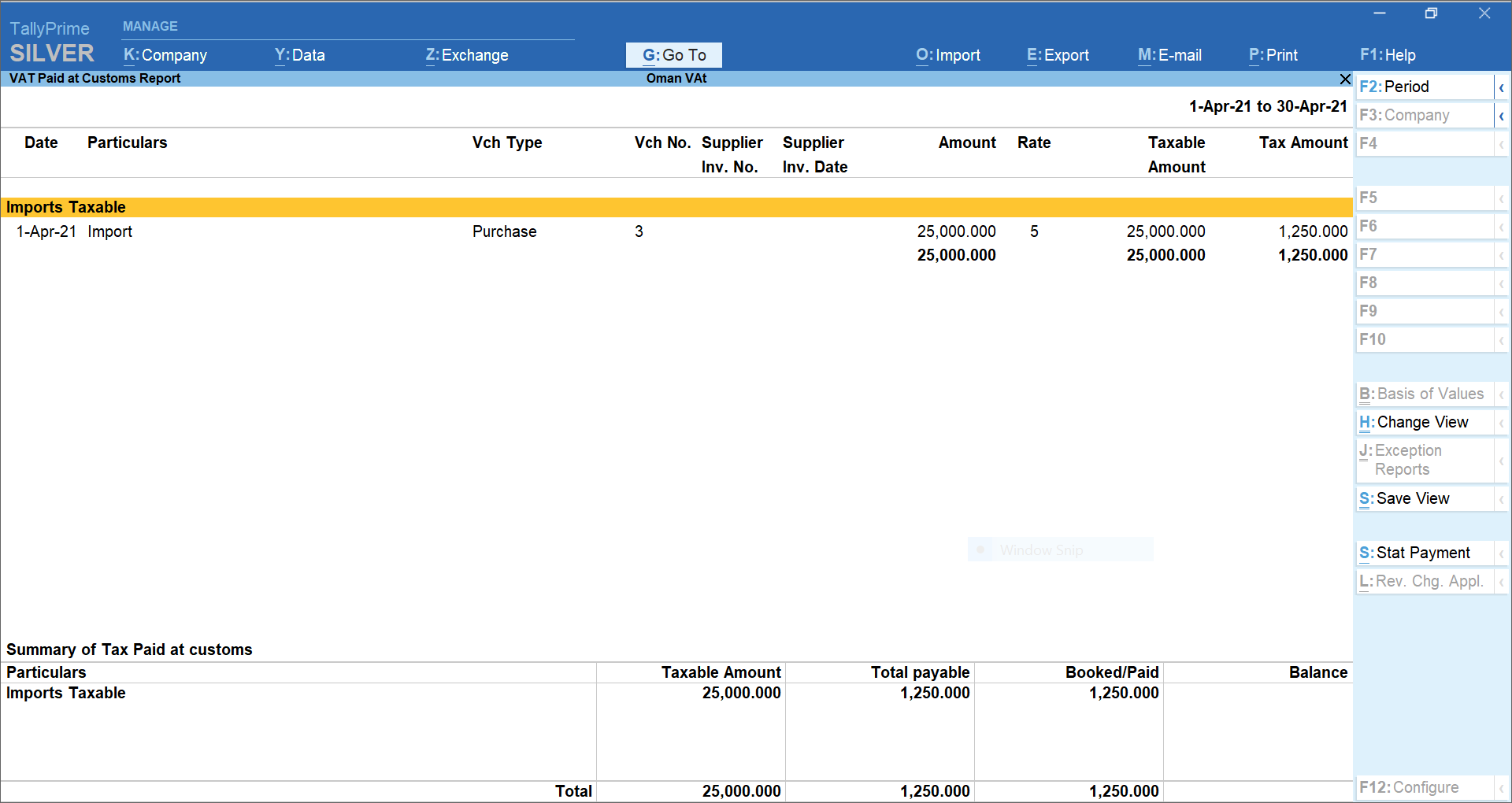

VAT report to track payment of VAT on import of goods at customs in TallyPrime

VAT return summary giving you break up tax as well as different nature of supplies made during the period

Read more on Oman VAT: