What is Point Of Taxation?

The point in time when goods have been deemed to be supplied or services have been deemed to be provided explains the provisions of point of tax in GST. GST tax sale point enables us to determine the rate of tax, value, and due dates for payment of taxes.

- When Does GST Tax Sale Point Arise?

The point of taxation under GST, i.e.., the liability to pay CGST / SGST, will arise at the time of supply as determined for goods and services.

Different sets of provisions applies for time of supply for goods and time of supply for services. Here we will be discussing about point of taxation for goods in detail.

- How to Determine Point Of Taxation?

Case 1:

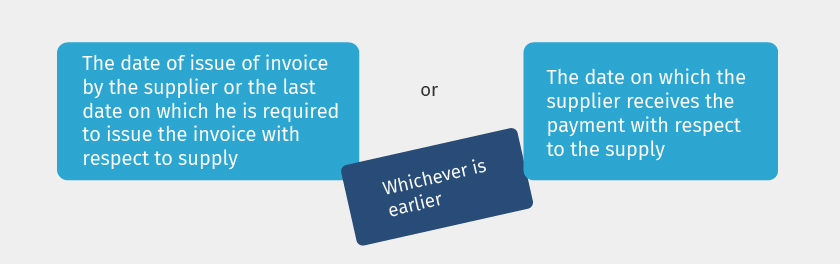

The GST Valuation and point of tax for goods shall be the earlier of the following dates –

|

Explanation 1 : |

“supply” shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment. |

|

Explanation 2 : |

“the date on which the supplier receives the payment” shall be (a) the date on which the payment is entered in his books of account or (b) the date on which the payment is credited to his bank account, (whichever is earlier) |

Case 2:Where Supplier of taxable goods receiving an amount up to Rs. 1000 in excess of the amount indicated in the tax invoice then the point of taxation to the extent of such excess amount shall be:

|

the date of issue of invoice in respect of such excess amount |

Case 3: For supplies in respect of which tax is paid or liable to be paid on reverse charge basis, point of taxation shall be the earliest of the following dates, namely:

|

the date of the receipt of goods; or |

|

the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or |

|

the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or |

|

Explanation 1 : |

Wherever it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply. |

Case 4: In case of supply of vouchers by a supplier, the GST Tax sale point for supply of goods shall be—

|

(a) |

the date of issue of voucher, if the supply is identifiable at that point; or |

|

(b) |

the date of redemption of voucher, in all other cases. |

Case 5: Where it is not possible to determine point of tax in GST, under Case 2, Case 3 and Case 4 enlisted above then the point of taxation shall be

|

in a case where a periodical return has to be filed, be the date on which such return is to be filed; or |

|

in any other case, be the date on which the tax is paid. |

Case 6: The point of taxation where it relates to additions in the value of supply by way of interest, late fee or penalty for delayed payment of any consideration shall be

|

the date on which the supplier receives such addition in value. |