The GSTN has unveiled a game-changing feature on the GST portal that changes the way businesses interact with invoices. The Invoice Management System (IMS) is a new innovation that will allow B2B buyers to accept, reject, or keep invoices pending to have a better control over invoices raised and reach accurate ITC calculations.

The IMS was announced in the recent GST council meeting. The facility became available for taxpayers on October 14. Therefore, all businesses can now use the system to control over invoices that appear on GSTR - 2B and improve the pace of ITC reconciliation. It should be noted that it is not mandatory to accept or reject invoices in IMS dashboard for GSTR - 2B generation.

What is Invoice Management System (IMS)?

As the name suggests, the Invoice Management System is a new function in the GST portal that will help businesses manage the invoices raised against them by suppliers. This means that all B2B invoices issued for inward supplies will appear on IMS dashboard, so that the buyers/businesses can match the invoices issued by their suppliers to avail the correct Input Tax Credit (ITC).

On the IMS, businesses can either choose to accept or reject the invoices after verifying the invoices or keep it pending to avail the ITC later. With this new feature, GSTN is giving businesses the advantage of verifying the invoices before they go to GSTR -2B.

The IMS dashboard

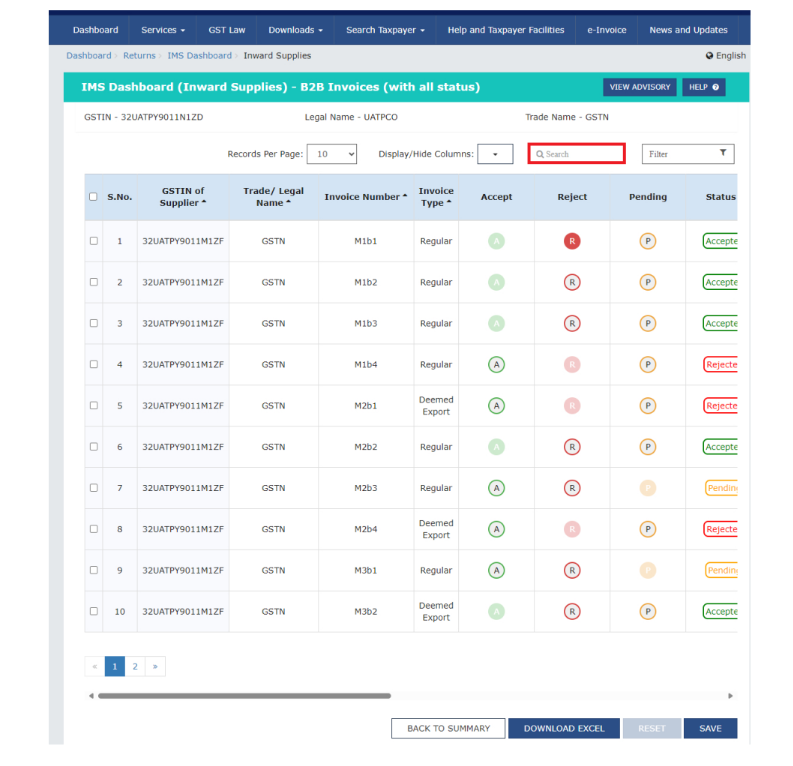

IMS facility makes things easier for businesses with an IMS dashboard where all the issued invoices against a business will be showcased. Have a look at the picture below to have a look at a sample IMS dashboard:

As you can see in the picture, buyers have three options to choose from:

- Accept – When a business has verified that the invoice raised against them is right it can click on ‘Accept’

- Reject – When a supplier has wrongly raised an invoice against a business, the business can reject the invoice

- Pending- A business can choose to keep the invoice pending in the system to avail the ITC later, whenever required

Given below is the action taken by IMS on the different statuses of invoices:

- No action taken: These are the invoices/records where no action has been taken by the buyer. These will be treated as deemed accepted at the time of GSTR-2B generation

- Accepted: These are the accepted records and will be part of GSTR-2B generation

- Rejected: These records will not be considered for GSTR-2B generation

- Pending: These records will not be considered for GSTR-2B generation for the month, same will be carried forward by IMS for further action in subsequent months.

What happens if you don’t use IMS?

It should be noted that it is not mandatory to accept or reject invoices on the IMS dashboard for GSTR-2B generation. If a taxpayer chooses not to take any action on the received invoices, then GSTR-2B would be generated on the 14th of the month, same as the currently existing process.

The invoices where no action was taken by the recipient would be treated as accepted by the system and a draft GSTR-2B shall be generated. This GSTR-2B will include only ‘accepted’ or ‘no action taken’ invoices. However, buyers are allowed to take action or change the action already taken on accepted invoices till the filing of Form GSTR-3B of the month.

How does IMS help ITC reconciliation?

Currently, all the invoices raised by the supplier as a part of GSTR- 1 appear on GSTR –2B for the buyer. The buyer must sit through GSTR-2B reconciliation to accept and reject invoices.

Now, with IMS, businesses get an opportunity to review the authenticity of the received invoices. Only the accepted invoices on IMS will be sent to GSTR – 2B and become a part of the ITC calculation.

The monthly tax filers can easily reconcile their transactions on a monthly basis using the IMS. The QRMP tax filers can reconcile their invoices quarterly through the IMS platform on the GST portal.

If you want to eliminate the process of manual reconciliation of GSTR 2A and GSTR 2B try TallyPrime. Our software can auto reconcile your data with the click of a button and help you file your GST returns without visiting the GST portal.