July 27th, 2019 saw the 36th GST Council Meeting through a video conference. The meeting was primarily called to decide GST rate cut on electric vehicles that are currently taxed at 12%. The council was also likely to decide the valuation of goods and services in solar power generating systems and wind turbine projects for the purposes of levying GST.

Here's a graphical representation of the crucial decisions taken during the 36th GST Council Meeting.

Need detailed information about the changes? Read on...

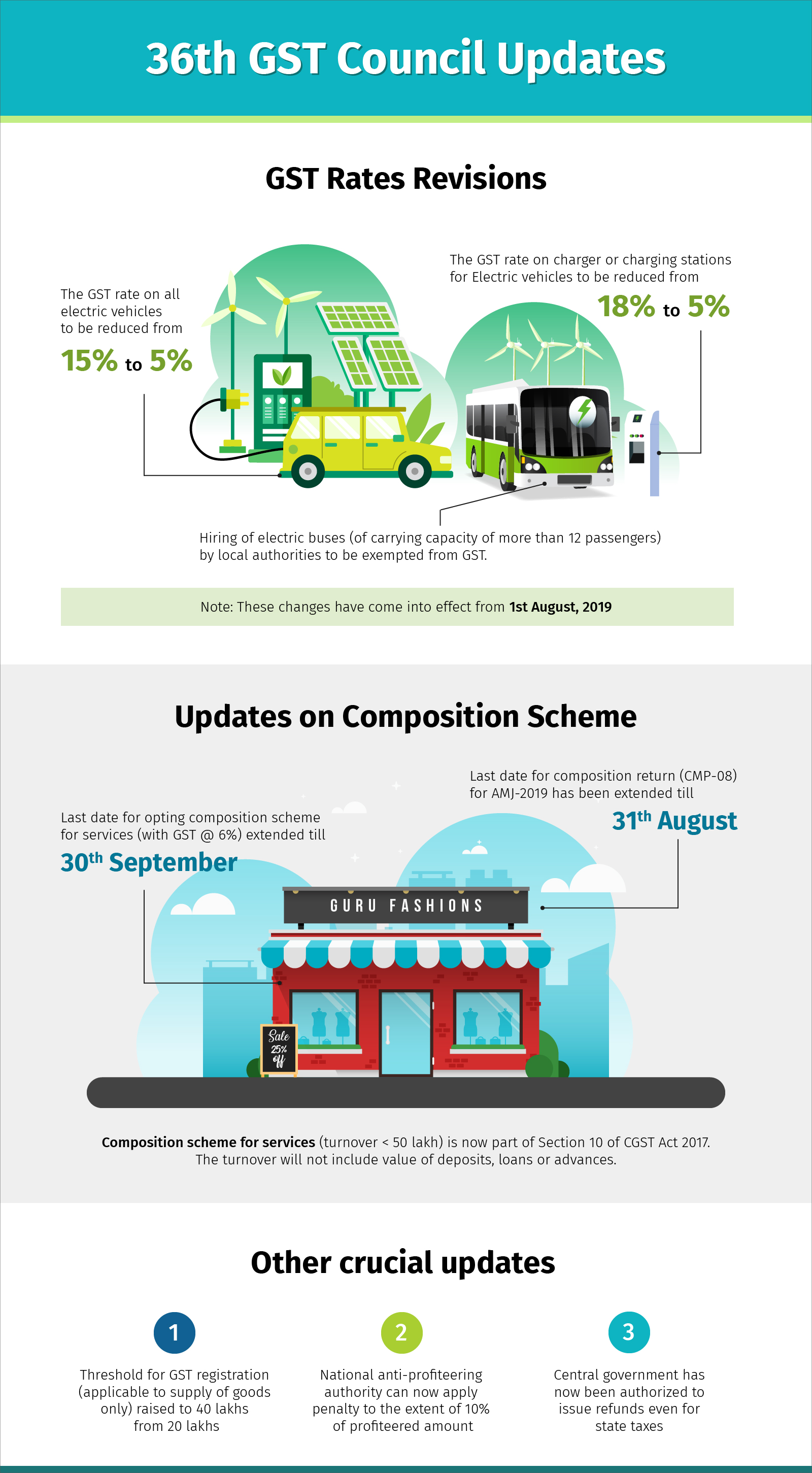

GST Rates Revision

- GST rates on all electric vehicles from 12% to 5% and GST rate on charger or charging stations of EVs reduced from 18% to 5%.

- Hiring of electric buses (carrying capacity >12 passengers) by local authorities to be exempted from GST.

- Above rate changes will be effective from 1st August 2019.

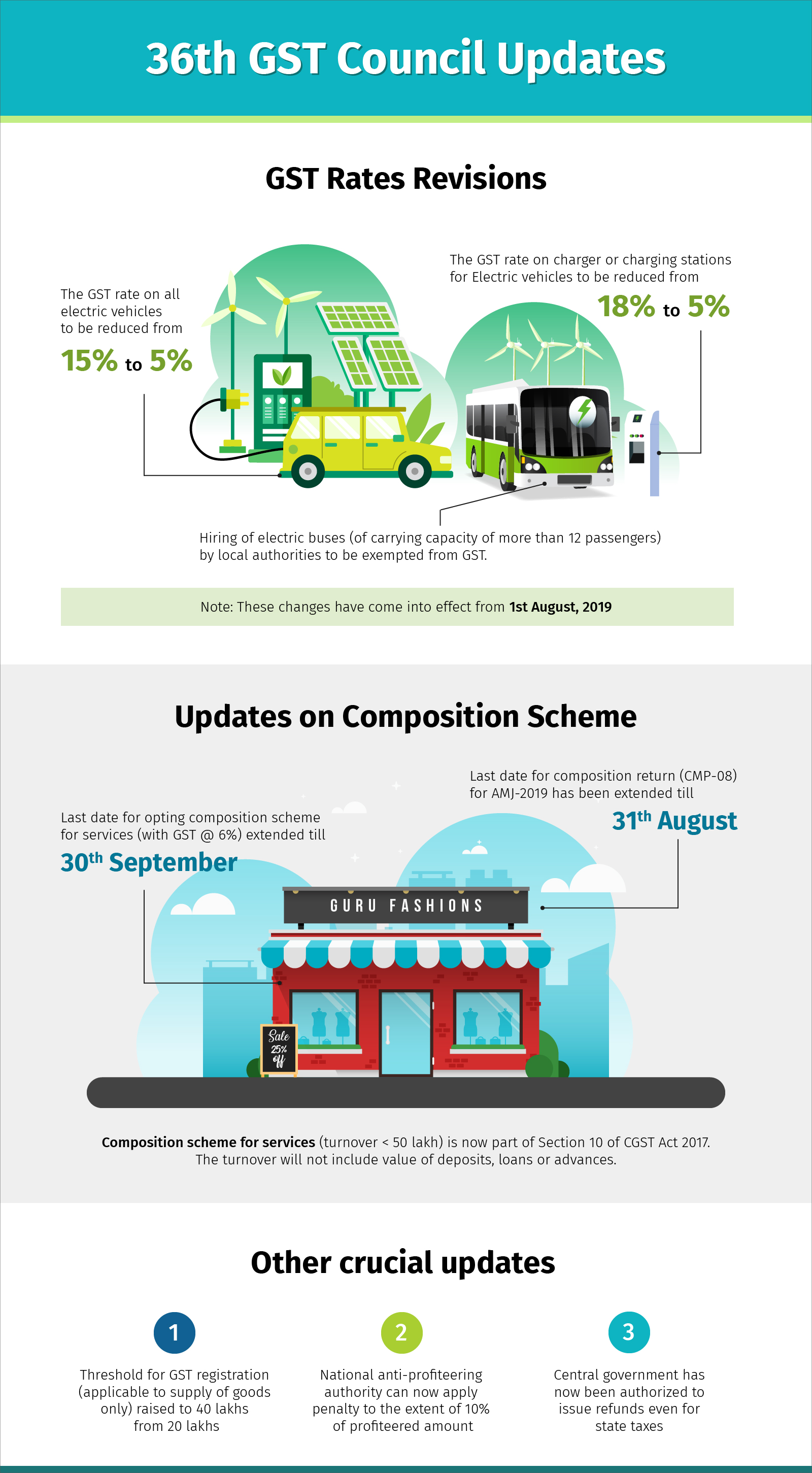

- Last date for opting composition scheme for services (with GST @6%) has been extended till 30th Sep from 31st July 2019

- Last date for composition return (CMP-08) for AMJ-2019 has been extended to 31st Aug (from 31st July).

GST Amendments done as part of Finance Bill 2019 (pending to be notified):

- Composition scheme for services (turnover below 50 lakh) is now part of Act. The turnover will not include value of deposits, loans or advances.

- Threshold for GST registration (applicable to supply of goods only) was raised to 40 lakhs from 20 lakhs in 32nd GST council which is now part of Act amendment.

- Aadhaar is now mandatory for GST registration (retrospectively) for authorized signatory including karta, MD, Board of trustees etc.

- Certain category of registered persons will be mandated to provide e-payment option to their vendors

- Act amended to allow quarterly filing by defined category of regular dealers and annual return by composition dealers

- If cash has been deposited under wrong head in e-Cash ledger, there will be option to move them to appropriate head (earlier only option was to claim refund and re-deposit to correct head). Taxpayers were earlier inconvenienced since amount in e-cash ledger cannot be cross utilized and any deposit to wrong head would block the money.

Other Crucial Updates

- Welcome move: Now interest on unpaid tax would be applied only to the extent of cash used for discharging liability. Since GSTN does not allow filing of return with partial payment, taxpayer would fail to discharge liability even to the extent of available ITC when cash is short. With this amendment if tax is paid with delay, interest will not be on entire liability but only to the extent of cash used.

- National anti-profiteering authority can now apply penalty to the extent of 10% of profiteered amount.

- National Appellate Authority for Advanced Ruling will be constituted which will give orders within 90 days (required since several state authorities have issued mutually contradicting orders)

- Central government has now been authorized to issue refunds even for state taxes.