Enhanced bank reconciliation

One-click auto bank reconciliation with smart suggestions and assistance to help you match unreconciled transactions, available across leading banks.

Automated accounting capabilities

With automated accounting capability, you can create payment and receipt vouchers by simply importing bank statements in a few clicks.

Integrated payments and accounting

Record payments in TallyPrime, upload them to your bank, and update transaction status—all in one go. Send payment advice, simplify reconciliation, and speed up collections with payment links or UPI QR codes.

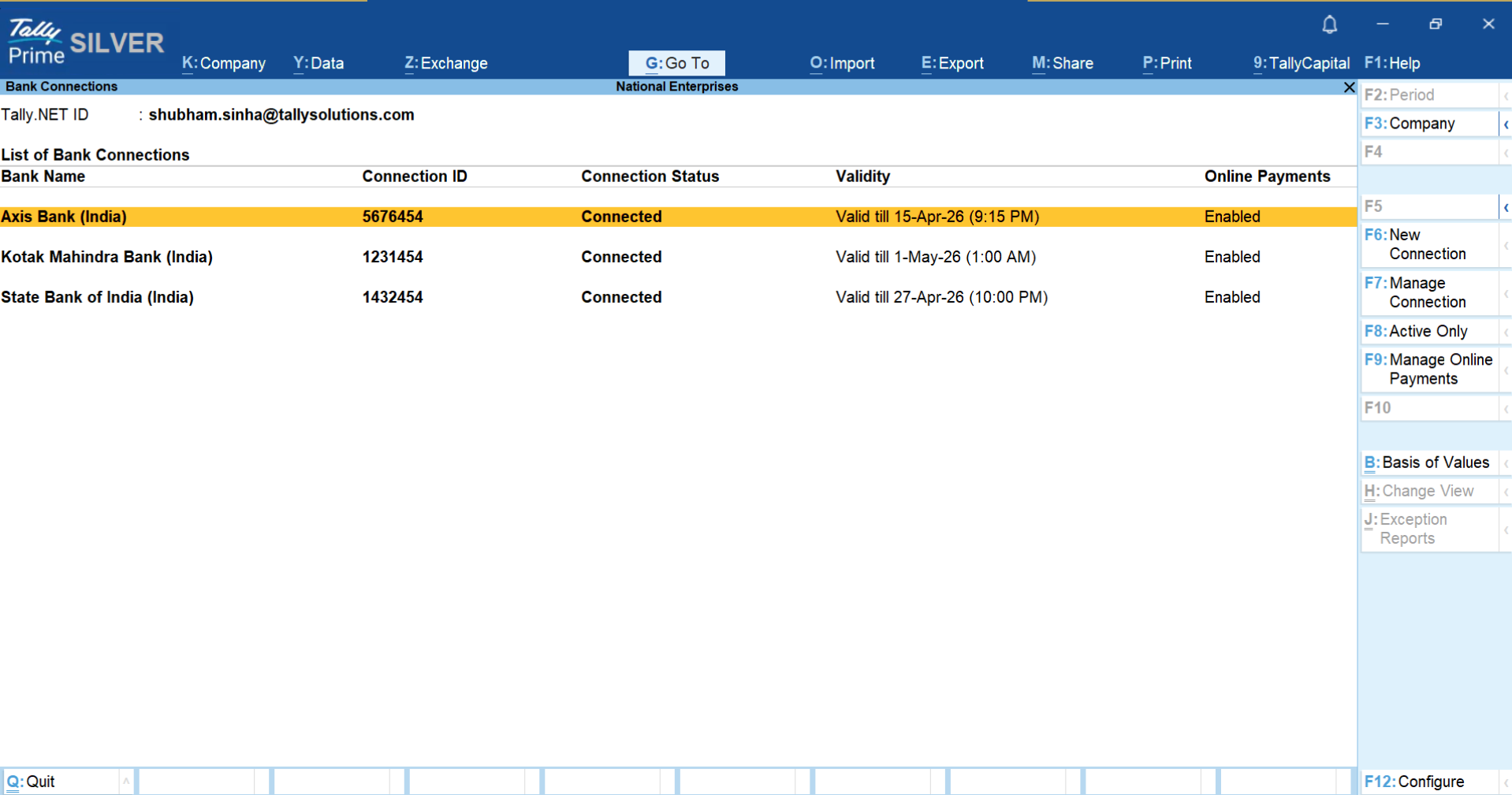

Connected banking

Securely connect your bank with TallyPrime for real-time updates and live balances via Axis, SBI & Kotak.

Make secure payments directly from TallyPrime through Axis & SBI.

Read More

Generate cash deposit slips and payment advice

Is depositing cash or cheques an everyday activity for you? Get rid of the hassle by generating cash and cheque deposit slips from TallyPrime. You only have to provide the denomination of notes and TallyPrime does the rest.

Cheque management

TallyPrime provides effective cheque management systems by allowing creation of multiple cheque books with unique ranges for every bank. Cheque register helps you to view, search, and track your cheque details.