- What Are Generally Accepted Auditing Standards (GAAS)

- Requirements for accounting standards

- Data analysis and verification

- Auditing in TallyPrime

What Are Generally Accepted Auditing Standards (GAAS)?

Auditing is a crucial process in any organisation. An auditor’s primary job is to perform an audit or track changes that affect the integrity of a transaction. It could be changes made to date, ledger masters and amounts in the voucher. While performing such checks, there are a set of rules/guidelines which an auditor is supposed to mandatorily follow. These systematic guidelines are referred to as Generally Accepted Auditing Standards aka GAAS.

GAAS came into being by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). It ensures that the auditor who performs these checks has accuracy, consistency, and verifiability on the quality of companies' financial records. Once the auditors perform the necessary checks of the financial records, they must ensure that the audit report is reviewed as per the GAAS. Following this process helps auditors not only ensure correctness in the reports, but also determine if the company’s financial statements are as per GAAP (Generally accepted accounting principles).

Read more on: Accounting principles

Requirements for Accounting Standards

While we understood what GAAS is, let us take a look at what are the standards to which an auditor must comply with, in order to ensure that the auditing process is as per GAAS. 2 The general, field work, and reporting standards (the 10 standards) approved and adopted by the membership of the AICPA, as amended by the AICPA Auditing Standards Board (ASB), are as follows:

General Standards

- The auditor must have adequate technical training and proficiency to perform the audit

- The auditor must maintain independence in mental attitude in all matters relating to the audit

- The auditor must exercise due professional care in the performance of the audit and the preparation of the auditor's report.

Standards of Field Work

- The auditor must adequately plan the work and must properly supervise any assistants

- The auditor must obtain a sufficient understanding of the entity and its environment, including its internal control, to assess the risk of material misstatement of the financial statements whether due to error or fraud, and to design the nature, timing, and extent of further audit procedures

- The auditor must obtain sufficient appropriate audit evidence by performing audit procedures to afford a reasonable basis for an opinion regarding the financial statements under audit.

Standards of Reporting

- The auditor must state in the auditor's report whether the financial statements are presented in accordance with generally accepted accounting principles

- The auditor must identify in the auditor's report those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period

- If the auditor determines that informative disclosures in the financial statements are not reasonably adequate, the auditor must so state in the auditor's report

- The auditor's report must either express an opinion regarding the financial statements, taken as a whole, or state that an opinion cannot be expressed. When the auditor cannot express an overall opinion, the auditor should state the reasons in the auditor's report. In all cases where an auditor's name is associated with financial statements, the auditor should clearly indicate the character of the auditor's work, if any, and the degree of responsibility the auditor is taking, in the auditor's report.

Importance of analysis and verification and how it’s done in TallyPrime

Auditing is nothing but a process of verifying the pre-filled entries of various transactions. This is done to ensure that all your transactions match your books and there is no discrepancy in the financial statements/records.

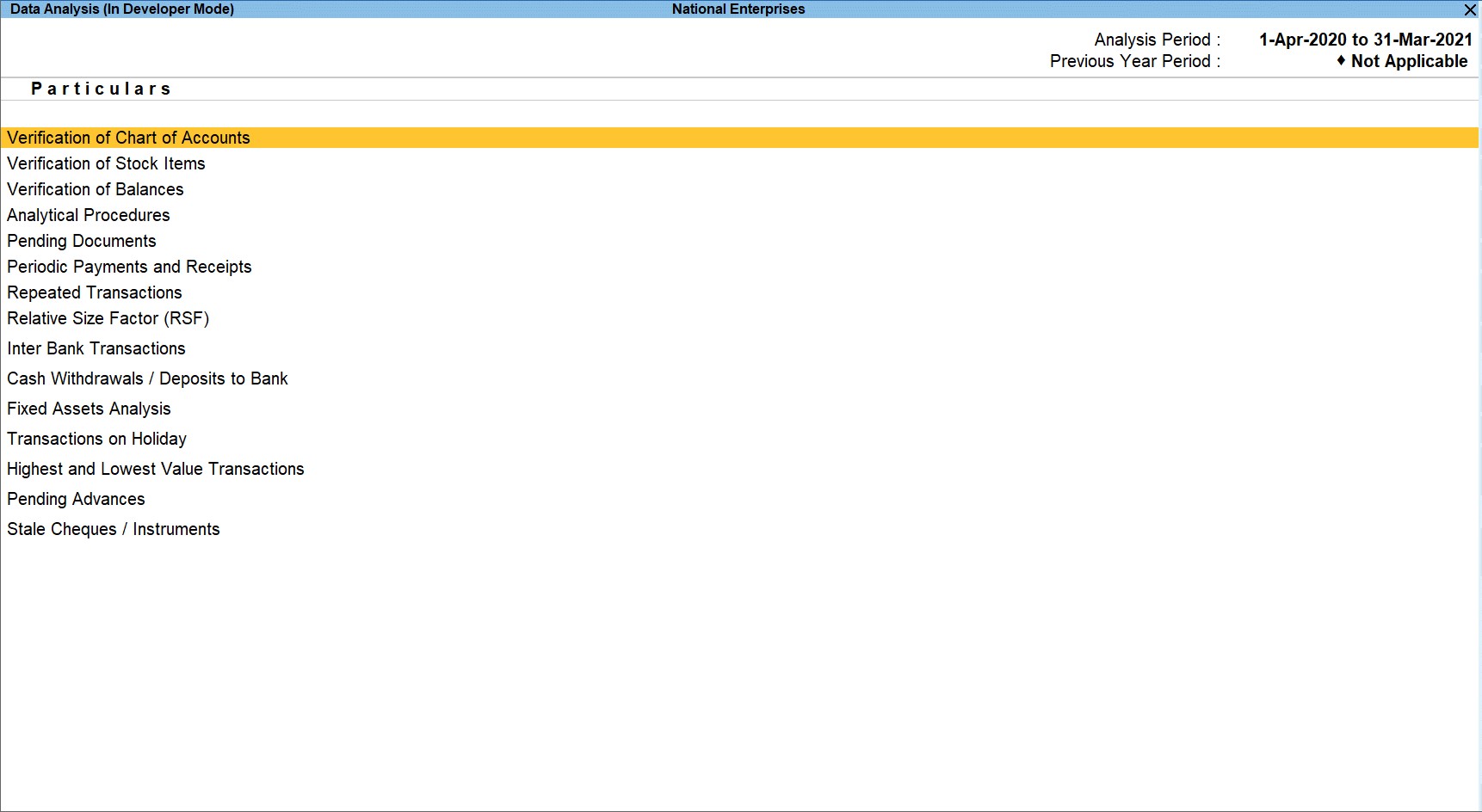

Data Analysis facilitates conducting internal analysis and verification of the company’s financial data. Data Analysis will help in identifying exceptional areas and thereby ease the process of verification. The data analysis and verification tools help auditors audit/perform various checks that will help business owners/accountants find inaccuracies and fix them.

In TallyPrime you can simply drill down to each report and scrutinise various options that play a huge part in company’s finances. You can draw comparisons between your current year and previous years, based on your preference, and take key decisions accordingly. From pending documents to repeated transactions to fixed asset analysis to many more, TallyPrime’s data analysis and verification functionality eases the work of an auditor greatly.

Auditing in TallyPrime

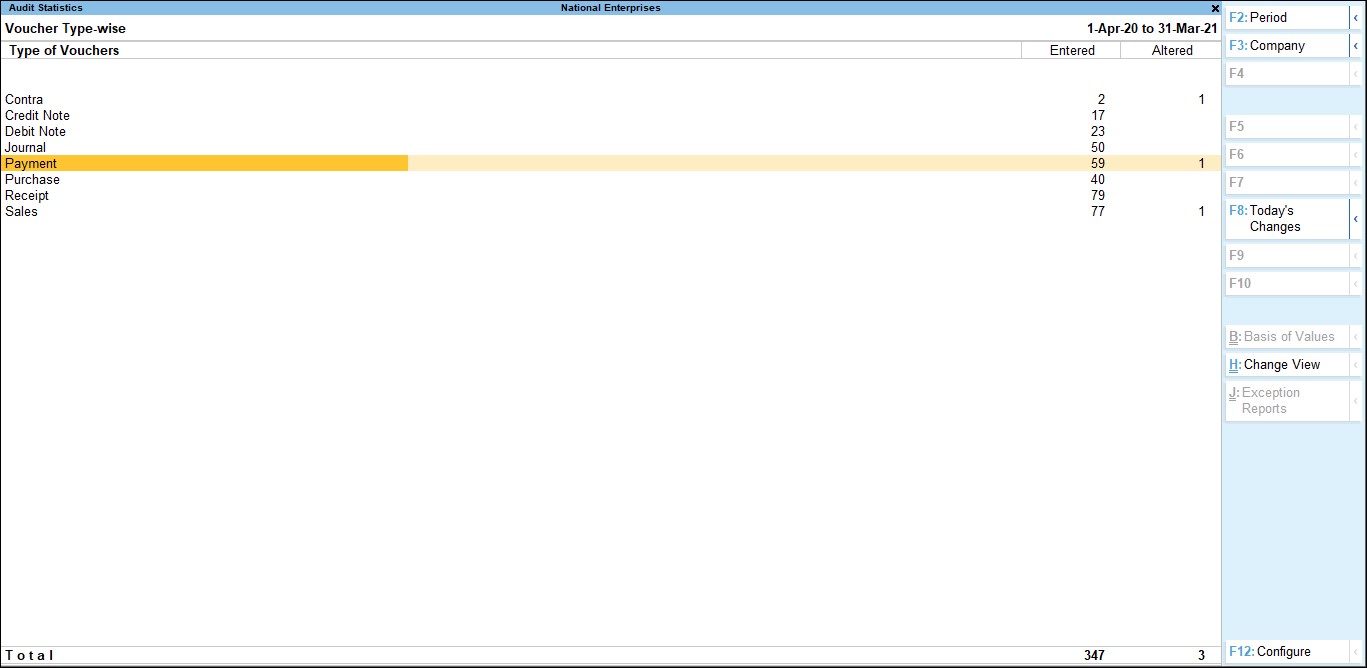

Since auditing is an extremely crucial process to validate the transactions of a business in terms of authenticity and correctness, TallyPrime has an inbuilt feature- Tally Audit which enables the auditor to perform an audit or track changes that affect the integrity of a transaction, such as changes made to Date, Ledger Masters and Amounts in the Voucher are reflected in the Tally Audit Listings. You can customise your view based on your preference by enabling various features like; audit listing for voucher types, masters and users.

You can even sort your vouchers alphabetically, status (Modified, Cancelled & Deleted Vouchers) by enabling pre-built functionalities in TallyPrime.

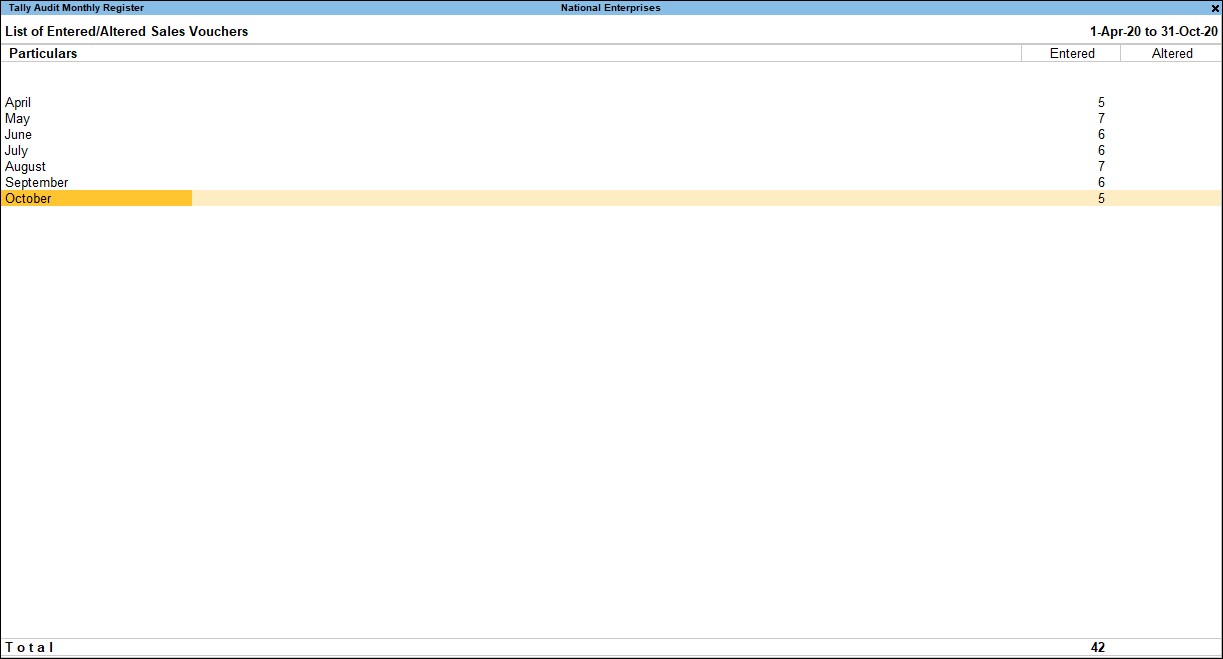

In case you want to verify transactions of a certain period, TallyPrime lets you set periodicity as required (4 week month, Daily, Fortnightly, Half Yearly, Monthly, Quarterly, Weekly, Yearly) based on selected periodicity data.

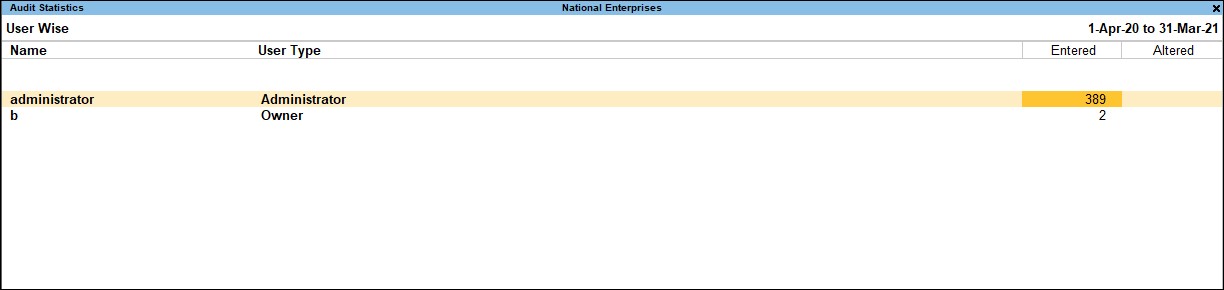

TallyPrime’s audit functionality also lets you define users. Along with username, user type is also shown, the total count of entered & altered for a particular user includes the count of Masters and vouchers. You can choose preferences to verify and validate the various voucher entries by specified users and take actions accordingly.

Be GAAS and GAAP compliant with TallyPrime’s extraordinary pre-built features that let you use the software, just the way you want to. Take a free-trial and make the most of these functionalities to boost your business’ efficiency.

Know more about Accounting

Accounting Software, Accounting System, Best Business Management Software for Start-ups & Small Businesses, Business Report, Financial Accounting, Accounting, Accounting Cycle