- What is a pay stub?

- What information goes on a pay stub?

- Is a pay stub the same as a paycheck?

- Why should I provide a pay stub to employees and contractors?

- How to create a pay stub?

- Small business guide to pay stubs

All companies, big or small, pay their employees. Employees’ take-home pay is calculated after factoring in various taxes and deductions from the gross pay. The employee should be informed of the various deductions that have been made to calculate their take-home or net pay. The pay stub provides these details to the employee and is an important component of payroll processing.

What is a pay stub?

A pay stub refers to the payment statement, payslip or wage statement that is given to them by their employer. When the employee is paid through a bank transfer, the pay stub is given to them physically or digitally to inform them of the payment details. When the payment is made physically by check or cash, the pay stub is usually handed over physically with the payment. The paystub usually informs the employee of the taxes, deductions and other important details that relate to their salary payment. It is now common for the paystub details to be sent or be made accessible digitally.

Though the paystub is an extract of information from the payroll system, it is very important. It gives the employee essential information about their earnings. It is important that every employee should be able to transparently access the information related to their payroll. This avoids any miscommunication or confusion for the employee and employer. Properly recording the details of the paystub is also essential for accounting and payroll. The requirements and regulations with regard to pay stubs vary from state to state.

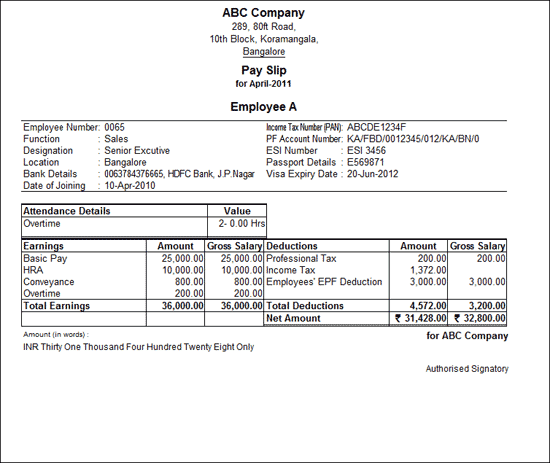

Printed Pay Stub/Pay Slip Generated By Tally

What information goes on a pay stub?

Employees do not take home the amount that is stated on their gross pay. Taxes and other deductions are factored in to calculate the actual take-home or net pay. The information that goes into the calculation of the payout to the employee is detailed on a pay stub. This includes the allowances and deductions that are calculated and made on the gross pay amount. The pay stub should give the employee all the information about the amount that they are being paid for the pay period with a complete breakup of the different deductions that have been made as well as the employer-paid taxes and other amounts. The pay stub must list all these amounts for the pay period as well as the total for the current year to date.

Employee-paid taxes

Of all the details, taxes usually comprise the most significant deductions on the gross pay. These taxes usually include; federal income tax, employee portion of FICA tax (Social Security and Medicare taxes), state income tax, local income tax, state unemployment tax (for certain states), and other taxes that are specific to the state or locality. The pay stub should clearly and individually detail the amount that has been deducted under each tax head. This amount is usually displayed for the pay period as well as the year to date. The employer and employee-paid taxes are also listed separately.

Various deductions

The deductions other than taxes that are made on the gross pay may vary from company to company. Some employees pay towards retirement plans or insurance. There may also be deductions towards the repayment of loans. The pay stub may also list deductions towards charities, as well as other voluntary and involuntary donations. It is common practice to list each of these deductions on a separate line with the deduction amount for the pay period and the current year to date.

Employer contributions

In some companies, the employer makes contributions towards certain heads. These items are listed on the pay stub and the amount is not deducted from the gross pay. The usual heads that the employer may contribute to are; health insurance premiums, health savings accounts (HSA), 401(k) plans as well as other retirement plans. These amounts that are contributed by the employer are also listed on the pay stub with the current amount and the current year total to date.

Employer-paid taxes

The taxes that the employer pays on the payroll are listed on the payroll stub with the pay period amount and the current year totals to date. Some of the payroll taxes that are paid by the employer include; federal unemployment taxes (FUTA tax), state unemployment taxes (SUTA tax), employer portion of FICA tax, and other state-specific employer-paid taxes.

Net pay

The net pay is the actual take-home pay that is paid out to the employee. It is the amount that results after the required deductions have been made from the gross pay. It may also include any income that is non-taxable. It is common practice to list the net pay for the pay period as well as the current year to-date payout on the pay stub.

Is a pay stub the same as a paycheck?

A paycheck is an actual check that is given as payment to an employee. The employee encashes the check to receive the money. Most companies deposit the paycheck directly in the employee’s account so that the paycheck amount is transferred to the employee’s account directly on payday.

A pay stub is not an actual payment. It is a slip or document that accompanies the paycheck. It may be given physically to the employee or made available digitally to the employee. The pay stub gives the employee complete information about every deduction that has been made to their gross pay as well as other employer-paid items. This information is given for the pay period and the total till date for the current year is also displayed.

Why should I provide a pay stub to employees and contractors?

Pay stubs are useful for the employer as well as the employee. An employee can understand the various items for which amounts have been deducted from their gross pay. They can also check and verify the correctness of the payroll calculation and their take-home pay. A pay stub ensures transparency in the calculation of payouts to employees and contractors. Verifying such details at the time of payout prevents future problems with the authorities, employees, and contractors.

Employers save themselves the trouble of answering routine payroll calculation queries by giving their employees detailed pay stubs. Employers can also use the information on the pay stub to resolve any disputes or confusion that may arise with regard to the payroll. Paycheck stubs are handy for the employer to fill out Form W-2 for each employee. Some states require that the employer give the employee pay stubs. Certain states also specify the information that must be listed on the paystub.

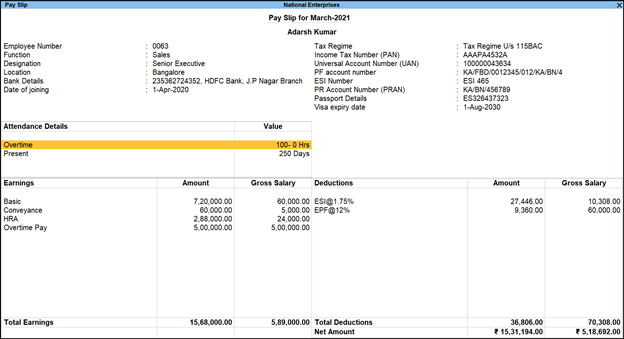

How to create a pay stub in TallyPrime?

Payroll stubs used to be calculated manually in companies. Some small businesses may still calculate and write pay stubs manually. This is both time-consuming and error-prone. Smart business management software such as TallyPrime calculates payroll and creates payroll stubs instantly. TallyPrime also updates all the relevant books of accounts with the payroll information.

The software also allows the creation of e-pay stubs or digital pay stubs that can be sent to the employee online or made available online. A record of the pay stubs is also maintained.

Tally Generated Pay Stub/Payslip

Small business guide to pay stubs

Being a small business does not necessarily mean that all processes should be done manually. In fact, it is a small business that will benefit most from automating routine tasks to increase productivity. Payroll automation makes one less time-consuming job for an accountant in a small concern. Creating pay stubs through a business management software solution such as TallyPrime makes it easy to generate them accurately and quickly. For example, when an employee quits or is terminated, it is essential to generate a pay stub quickly and the software does this instantly. While the manual process of creating pay stubs may be error-prone, the software makes the process error-free avoiding problems with the tax authorities and employees.

Frequent Ask Questions

- How to display payslip in TallyPrime?

Step 1: Go to Gateway of Tally

Step 2: Display

Step 3: More Reports

Step 4: Payroll Reports

Step 5: Pay Slip - How to enter salary payable in TallyPrime?

You can pay salaries from payroll vouchers or use the payroll vouchers to create the liability, and salary can be paid using a payment voucher.

Explore more Products

Best Accounting Software in USA, Accounting Software for Small Businesses in USA, Factors to Consider before Buying Bookkeeping Software in USA, Benefits of Payroll Management Software for Small Businesses in USA, Invoicing & Billing Software in USA That Best Suits Your Business

Read more on Accounting

COGS vs Expenses, What is Revenue Recognition?, Financial Accounting Vs. Managerial Accounting, Real Estate Accounting in US Best Practices and Bonus Tips, Difference Between an Estimate, Quote, Bid, and Proposal, How to Easily Build Great Estimates for Your Projects?

Popular Articles

Differences Between Trial Balance & Balance Sheet, What is the NOPAT Formula?, What Are T Accounts?, What is a credit note?, How to Find Gross Profit?, What are Operating Expenses?, Break Even Point Formula, What is the Gross Margin Formula?, What is the Direct Write Off Method?, What Is Interest Expense?