- What is the Difference Between Financial and Managerial Accounting?

- What Are The Main Objectives Of Financial and Managerial Accounting Practices

- Does Managerial Accounting Follow GAAP?

- Making Both Managerial And Financial Accounting A Breeze

Accounting is one of the most vital functions in an organization. It records the daily transactions within the organization as well as between the organization and other external parties. The two most significant types of accounting are financial and managerial accounting. Both of these types of accounting are essential for a business. Financial accounting is essential to prepare accounts for people outside the organization, such as government agencies, banks, investors, and the public. Managerial accounting is helpful to the internal management of the organization’s daily work.

What is the Difference Between Financial and Managerial Accounting?

Financial accounting is the recording and collection of transactions and accounting data to generate financial statements. These reports are usually generated for every accounting period, for example, quarterly, half-yearly, or annually. The financial reports use the exact precise transaction details recorded during the accounting period to prepare the reports. These reports are essential for the organization to stay compliant with the rules and regulations mandated. They strictly adhere to IFRS and GAAP (Generally Accepted Accounting Principles).

Managerial accounting is an internal process of collecting accounting data for business purposes. There is no necessity to follow any commonly defined accounting principles. The principles and systems used are entirely at the discretion of the organization. The internal managerial accounting reports are useful to make the decisions that affect the organization’s daily operations.

When you look at financial accounting vs managerial accounting, only when more details are required beyond the scope of the overall financial accounting reports would someone from outside the organization study the managerial accounting reports. An organisation needs accountants in both these specialties for the best results. Certified Public Accountants are trained in financial accounting, while Certified Management Accountants are trained in managerial accounting.

What Are The Main Objectives of Financial and Managerial Accounting Practices?

The financial statements and reports are required by investors, government agencies, and financial institutions are prepared by financial accountants. These reports give us information about the overall financial status and health of the organization. Managerial accountants are responsible for managing and generating the reports that the business uses internally, such as those relating to labor, payroll, equipment, raw material purchases, etc.

Systems

A financial accountant focuses on the company’s overall finances and whether it is generating a profit. There is no connection or interest in the internal systems of the organization or the day-to-day nitty-gritty. Managerial accountants are deeply involved in the daily activities of the company. They strive to improve the internal numbers such as efficiency, productivity, etc., and identify and remove bottlenecks to productivity and profitability.

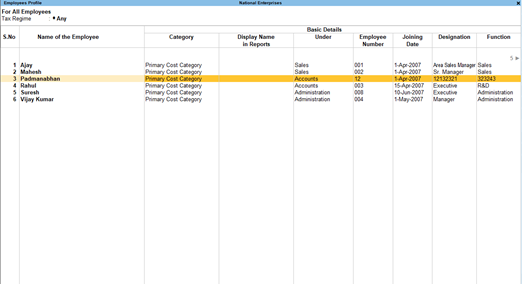

A Managerial Accounting Salary Detail Report

Reporting Focus

The reports generated by the different systems of accounting are also based on their focus. Financial accountants create financial reports and statements to be shared with the investors, owners, stakeholders, the public, financial institutions, and government institutions. They are focused on long-term strategies to grow the organization. Managerial accountants generate reports that are essential for the management of the internal day-to-day activities of the company. They are essential to make decisions and strategize for the short term. For example, the managerial reports may be used to determine the benefits of sourcing a part from outside versus making it in-house. So, considering financial accounting vs managerial accounting, one is external and the other internal in focus.

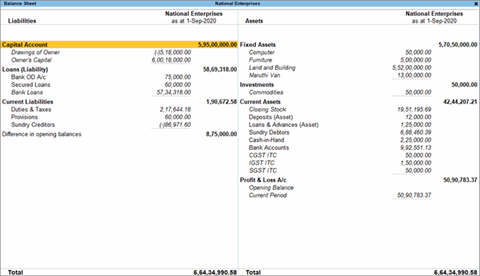

Financial Accounting: A Balance Sheet Gives An Overview Of The Company

Aggregation

If you want an overview of an entire business or organization, you will need to study the financial accounting reports. The financial accounting reports are of more interest to people outside of the organization. Managerial accounting reports are highly detailed. They follow the daily activities of the company and generate reports. Some of the internal reports would be about inventory, purchase, profits for each individual product, and reports that are aggregated by product, customer, or geography. These reports are more useful to the insiders and managers of the company. It is only when some aspect of the business is to be studied in depth that the same person would study both managerial vs financial accounting reports.

Efficiency & Timing

The overall efficiency and profitability of the company are reported in the financial accounting reports. If there is a problem, we need managerial accounting to dig deeper into the organization’s operations to find out. Financial accounting reports are usually made at the end of each accounting period. Managerial accounting reports are more frequent and can even be a daily occurrence.

Proven Information

When a financial accountant prepares a financial accounting report, the precision and accuracy of all the numbers are vital. These reports must be prepared precisely in line with government guidelines, and compliance is essential. On the other hand, managerial accounting reports often have approximations and estimations as part of their numbers. They follow whatever internally mandated standards the organization has evolved. Compliance is a significant difference between managerial vs financial accounting.

Time Period & Valuation

Financial accounting reports are generated at the end of an accounting period. So, they look back at the period and describe the organization’s performance. It is a compilation of historical data. Financial reports precisely list the values of the organizations’ assets and liabilities.

Managerial accounting is essential to the daily operations of the company. So, managerial accounting reports deal with the numbers of the day and estimates for the future. Managerial accounting reports may also include estimates, projections, and forecasts. These reports study the impact of estimates on the company’s operational productivity and profitability.

Is Managerial Accounting More Difficult Than Financial Accounting?

Since it largely entails planning and forecasting and calls for fewer journal entries, managerial or management accounting is thought to be simpler. It does not require financial statements to follow any particular set of accounting rules and is solely utilized internally.

Does Managerial Accounting Follow GAAP?

Financial accounting reports must be compliant with the guidelines of IFRS as well as GAAP (Generally Accepted Accounting Principles). Financial accounting reports are most often prepared for submission to government agencies, financial institutions, investors, and the public. It is essential that they adhere to common standards and prescribed guidelines and provide precise information calculated as specified.

Managerial accounting reports are prepared for the internal workings and decision-making of the organization. Their audience is usually within the company. These accounting reports do not have any standard rules or guidelines that must be followed. Managerial reports generally follow the particular style and format that the organization itself has evolved and implemented. It is the decision of the management of the organization to follow whichever system suits their needs best. Concerning freedom of systems in managerial vs financial accounting, managerial accounting has few restrictions as to the methods followed.

Tally Prime is the best choice for both financial accounting and managerial accounting!

- It collates all the relevant data and prepares financial accounting reports for you instantly

- You can also use Tally to manage the daily managerial accounting tasks like purchase, inventory, payroll, and production data

- You have all your accounting data in one system that syncs financial accounting vs managerial accounting appropriately for all your accounting needs

- TallyPrime accounting enables managing your accounting entities, inventory movements, financial & banking transactions, and provides real-time reports on all these

-

You can get customized views of various reports generated in TallyPrime, based on your preference, and save the views so each time when you open these reports, you can see them in the same view.

Frequent Asked Questions

- Which is harder management accounting and financial accounting?

Managerial accounting, also known as management accounting, is considered to be easier because it mostly involves planning and forecasting and requires fewer journal entries. It is only used internally and does not need financial statements to adhere to any certain set of accounting principles.

- What is the relationship between financial and management accounting?

Financial accounting is essential to prepare accounts for people outside the organization, such as government agencies, banks, investors, and the public. Managerial accounting is helpful to the internal management of the organization’s daily work.

Book a free demo of TallyPrime and bid your accounting woes a sweet goodbye!

Explore more Products

Best Accounting Software in USA, Accounting Software for Small Businesses in USA, Factors to Consider before Buying Bookkeeping Software in USA, Benefits of Payroll Management Software for Small Businesses in USA, Invoicing & Billing Software in USA That Best Suits Your Business

Read more on Accounting

COGS vs Expenses, What is Revenue Recognition?, Real Estate Accounting in US Best Practices and Bonus Tips, Difference Between an Estimate, Quote, Bid, and Proposal, How to Easily Build Great Estimates for Your Projects?

Popular Articles

Differences Between Trial Balance & Balance Sheet, What is the NOPAT Formula?, What is A Pay Stub?, What Are T Accounts?, What is a credit note?, How to Find Gross Profit?, What are Operating Expenses?, Break Even Point Formula, What is the Gross Margin Formula?, What is the Direct Write Off Method?, What Is Interest Expense?