Have you got Multiple GST registration? Want to manage books in a consolidated way? No worries! We have covered it in Release 3.0, the latest release of TallyPrime.

TallyPrime Release 3.0 makes it delightfully simple to manage transactions and returns related to multiple GSTINS from the same company. This just means that you can easily consolidate your multi-GSTIN data at the end of a specific period and handle TDS Returns, Salary Payments, outstanding management etc., with greater efficiency.

How TallyPrime help businesses maintain multi-GSTIN in a single company?

Seamlessly generate GST returns GSTIN-wise

With the latest TallyPrime 3.0, you can now generate accurate GST returns basis transactions that have been passed for each GSTIN from the same company without needing to go anywhere. Additionally, you can easily view/export GSTR returns with single or multiple GSTINs, the way you prefer. What’s more? You can even export JSON of GSTR returns with single or multiple GSTINs, in one go.

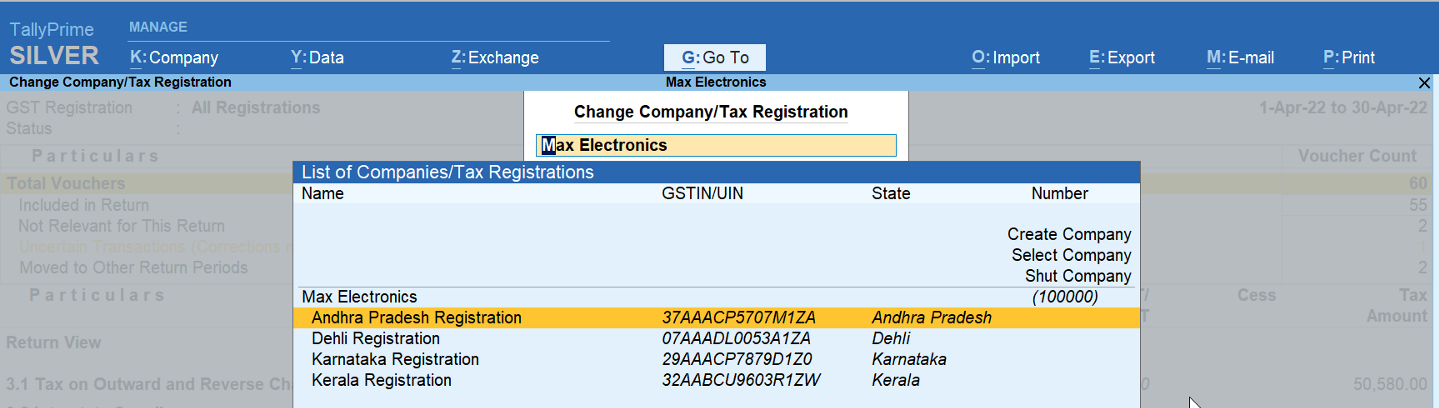

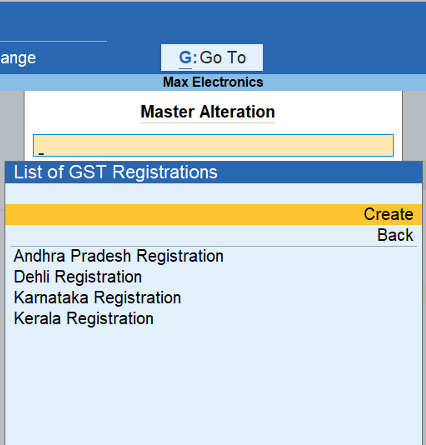

Create & manage multiple GST registration details

The new and powerful TallyPrime 3.0 helps businesses create multiple GST registration. Let’s say you have branches in 3 different states with separate GSTINs; you can easily create 3 different registrations in a single company. Not just creation, it also comes with the option to mark the registration status as ‘Active/Inactive,’ thereby helping you handle temporary suspension or surrendering of GST registrations easily.

Easily categorize or identify transactions GSTN-wise

With TallyPrime 3.0 transactions, you can easily categorize and identify transactions of your multi-GSTIN company, with applicable rules for each GSTIN. This further helps you to record transactions without needing to worry about anything else.

Let’s say you have created 3 GSTINS – Delhi, Karnataka, and Kerala. With TallyPrime 3.0, you easily record the transaction GSTIN-wise easily, for each of the GSTIN, and Tally will automatically populate the transaction details in respective GST returns and reports. You can even create a separate voucher type for each GSTIN or use a common voucher type.

Tag vouchers to specific GSTINs

With the latest TallyPrime 3.0, you can now tag voucher types to specific GSTIN. This enables you to record data faster. With TallyPrime 3.0, you now have the ability to tag voucher types to specific GSTINs. This feature allows you to easily record transactions for different GSTINs in your business. You can assign a specific GSTIN to a particular voucher type, such as sales invoices or purchase orders, and then all transactions of that type will automatically be assigned to the corresponding GSTIN. This can save you time and reduce errors in your record-keeping.

For instance, you own multiple warehouses in different states, and each warehouse is registered under a different GSTIN. Previously, when recording sales invoices for each warehouse, you had to manually select the appropriate GSTIN for each invoice, which was time-consuming and prone to errors. With TallyPrime 3.0, you can tag the sales invoice voucher type to each specific GSTIN for each warehouse.

Create voucher series

TallyPrime 3.0 also allows you to create voucher series for different tax units, which helps prevent the cross-utilization of vouchers. With this feature, you can set up unique voucher series for each tax unit, such as different branches or divisions within your business. Each voucher series can have its own numbering system, which helps you keep track of transactions more easily.

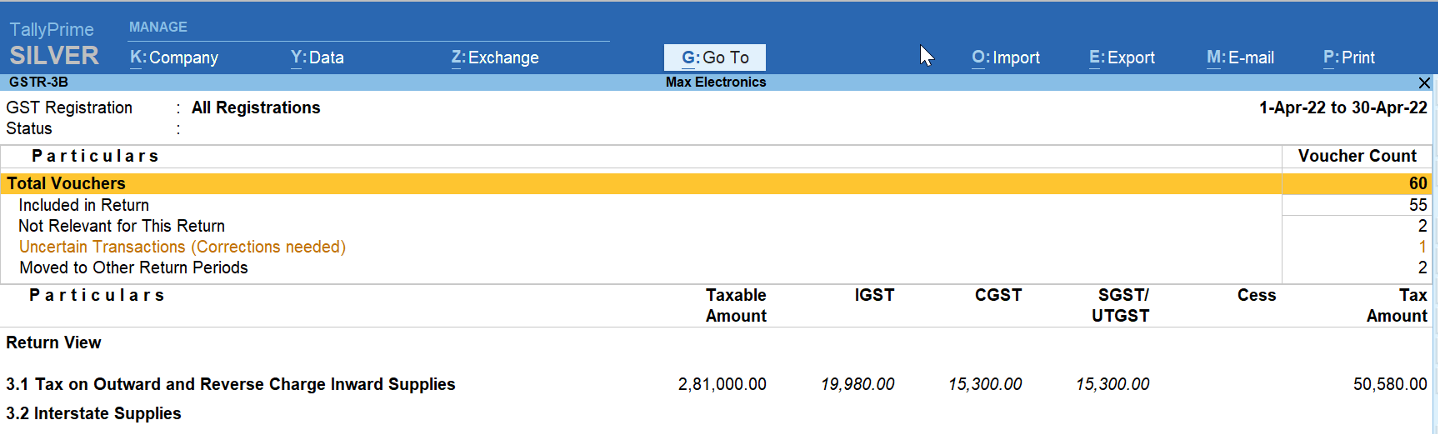

Combined Return and Reports view

Combined Return and Reports view: TallyPrime 3.0 allows businesses to view GST returns and reports combinedly. This feature is designed to help businesses get a comprehensive overview of their GST compliance status without having to switch between different screens or modules. This makes it easier to compare the data and identify any discrepancies or errors. You can also drill down into the details of each report or return to get a more granular view of your GST compliance status.

Track GST return activities

With the latest TallyPrime, you can now experience trailblazing speed w in tracking GST returns. No matter the size of your data, the GST return report will open instantly, helping you save precious time in your compliance activities along with added functionalities of amendment and transaction effective date.

You can even track those transactions which were modified after reconciliation or signing. GSTR-2B reconciliation will help you take the ‘right’ Input Tax Credit in GSTR-3B and keep the books aligned with auto-drafted GSTR-3B on the portal.

Bottomline

Being a powerful upgrade, TallyPrime 3.0 comes with an array of features to make GST compliance easier for businesses by managing multiple GSTINs (Goods and Services Tax Identification Numbers) seamlessly. This means that businesses with operations in multiple states or with multiple business verticals can easily manage and track their GST compliance for each GSTIN.

TallyPrime 3.0 also allows businesses to generate GST returns GSTN-wise, which simplifies the process of filing GST returns for each GSTIN. So, what are you waiting for? upgrade to TallyPrime 3.0 today and experience greater simplicity and efficiency. It is free if you have an active TSS subscription.

How to Use Multiple GST Registrations Feature in TallyPrime | Release 3.X