The introduction of new tables (14A and 14B) in the GSTR-1 return form, effective from January 1, 2024, marks a significant change in how Micro, Small, and Medium Enterprises (MSMEs) report e-commerce sales. This adjustment aligns with the government's efforts to enhance the transparency and tracking of e-commerce transactions through the Goods and Services Tax Network (GSTN). Given the nature of e-commerce sales, which are characterized by a high volume of transactions and significant sales returns compared to traditional retail, this change is particularly relevant.

To put this into a more relatable context, consider the example of a "Saree Boutique," a small business that has recently started selling its products on platforms like Amazon and Flipkart. Previously, the owner would manually track sales, returns, and net revenue, a process that was both time-consuming and prone to errors, especially during festive seasons when sales volumes would surge.

With the introduction of Tables 14A and 14B in GSTR-1, the owner can now report her e-commerce sales in a more organized manner, directly reflecting net sales after accounting for returns. Furthermore, this e-commerce report feature in TallyPrime Release 4.1 automates this reporting process, significantly reducing Priya's workload and allowing her to focus more on growing her business rather than getting bogged down with compliance and bookkeeping tasks.

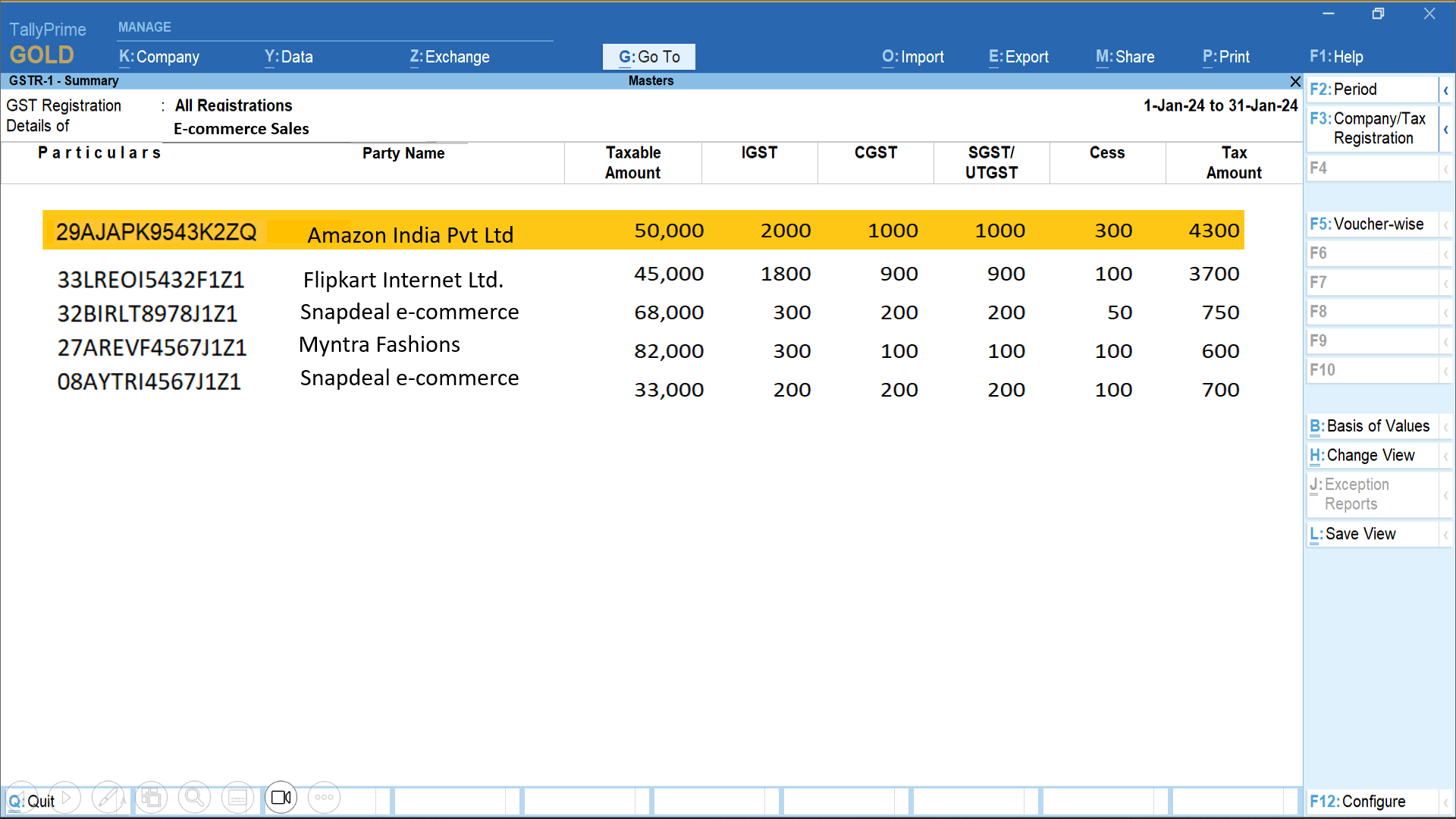

e-Commerce report in GSTR-1

The e-commerce report feature provided in TallyPrime Release 4.1 addresses this new reporting requirement directly. It's designed to simplify the compliance process for businesses engaged in e-commerce by offering a detailed report of e-commerce operator-wise net sales.

This feature not only helps in maintaining compliance with the new GSTN requirements but also aids in managing the complexities associated with e-commerce sales, including the handling of sales returns, which are more prevalent in this sector than in brick-and-mortar stores.

Steps to generate e-commerce report in GSTR-1

- Navigation: Users can easily navigate to the e-commerce report from within the GSTR-1 section in TallyPrime Release 4.1.

- Review: The report provides a detailed breakdown of e-commerce sales, including sales, debit notes, and credit notes, allowing for a thorough review of transactions.

- Verification and filing: Businesses can verify the details in the report. Post-confirmation, they can go to the GST/GSTN portal to fill out the GSTR-1 form. From the TallyPrime reports they can enter the summarized values directly into the new e-commerce tables (14A and 14B) of GSTR-1. With the accurate details entered, businesses can proceed to complete the GSTR-1 filing on time, ensuring compliance with the GST requirements.

|

Navigating Supply Chain Disruptions: Strategies for Resilience in Uncertain Times |

TallyPrime with WhatsApp for Instant and Secure Communication |

Impact on MSMEs

- Enhanced compliance: MSMEs selling goods online will now be able to comply more efficiently with the GST requirements by reporting e-commerce sales accurately.

- Error reduction: Automated reports minimize the risk of errors in data entry, which is crucial for maintaining accurate financial records and complying with GST regulations.

Conclusion

The new reporting requirements for e-commerce sales in GSTR-1 and the introduction of TallyPrime Release 4.1's e-commerce report feature represent a significant step forward in streamlining GST compliance for MSMEs engaged in online sales. This development not only helps in managing the high volume of transactions characteristic of e-commerce but also in navigating the complexities of sales returns, ultimately facilitating smoother operations and compliance for these businesses.