All the businesses registered under VAT need to file a monthly KRA VAT Return using VAT Form -3. VAT Form -3 is an online VAT Return form in which the details of Sales, Purchases, output VAT, Input VAT etc. are required to be furnished before filing VAT return.

In this article, we will understand the details required to be captured in the VAT Return Form -3

VAT return Form -3

Though filing of VAT Returns is online, KRA iTAX portal facilitates the taxpayers to capture all the details offline and file the returns. This is achieved by providing a pre-defined excel format of VAT Return Form-3. In order to file Vat returns, all the registered business need to download the VAT return excel format or template and capture all fields which are relevant for their businesses.

The VAT Return Excel format consists of 14 sub-sheets, out of which 11 sheets required details to be captured manually by the taxpayers. Most of these 11 sheets require details at invoice level, meaning you need to mention details of each invoice like invoice number, description of goods/services, taxable value, VAT amount etc.

To make the life of the taxpayer worse, the excel template does not allow you to copy and paste the details in excel format which means every single letter needs to be entered once again, even though the details are available in your books of accounts.

Don’t worry we have a solution to make it easier!

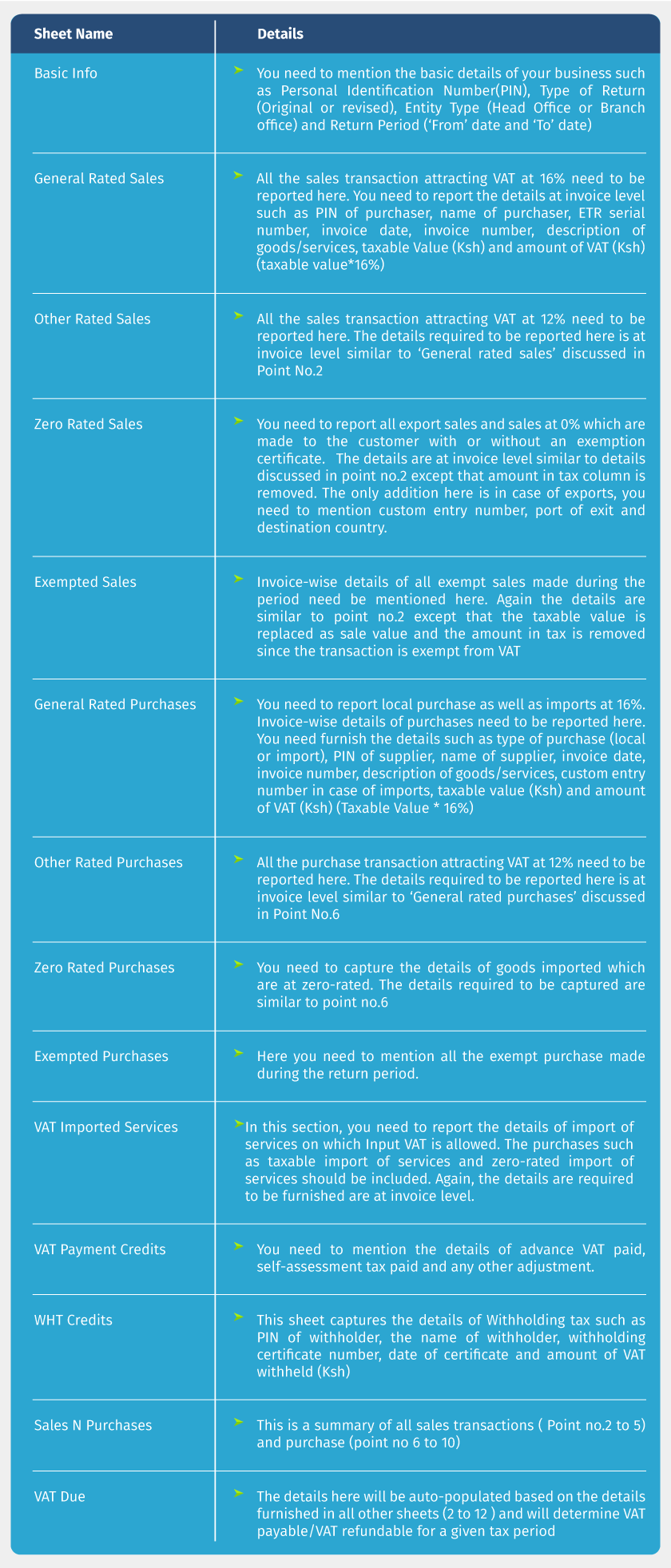

The following are the different types of sheets available in the VAT Return Excel Format. These sheets are also known as annexure which gets submitted along with the VAT Return Form.

- Basic_Info

- General_Rated_Sales

- Other_Rated_Sales

- Zero_Rated_Sales

- Exempted_Sales

- General_Rated_Purchases

- Other_Rated_Purchases

- Zero_Rated_Purchases

- Exempted_Purchases

- VAT_Imported_ Services

- VAT_Payment_Credits

- WHT_Credits

- Sales_N_Purchases

- VAT_Due

From Sheet 1 to 11, the details need to be mentioned manually by the taxpayer and the remaining 12 to 14 would auto-calculate the values based on the details mentioned in sheet 1 to 11.

Let us discuss each of these sheets in VAT Return form in detail.

To summarize, the details required in VAT return form is at invoice level and it has to be manually entered in the excel template. From the above discussion, it is clear that entering the details in excel format is not an easy task. It takes lot of time and efforts in completing the VAT return form.

For businesses, it may also sound like a duplication of work, because, all the records of purchases and sales are already recorded in the books of accounts and at the end of the month, all these details required to be entered once again in the VAT return excel format.

However, businesses can overcome this by having a business management software which not only allows you to record purchase and sales transaction but also automatically captures the details in excel format in a click of a button. Thus, saving time and efforts involved in completing VAT return form and helping businesses in on-time filing of accurate VAT Returns into the iTax portal.

FAQs on KRA VAT returns

- How do I file a VAT return?

The first step is to download the latest VAT return Excel format, next you need to complete the excel format by mentioning details in relevant sheets, then generate the zip file and finally, upload the zip file into the iTAX portal

- Who should file VAT returns in Kenya?

All the businesses registered under KRA VAT need to file VAT returns on a monthly basis

- Can I do a VAT return myself?

Yes, you can do it yourself or may take the help of a tax consultant to file accurate returns.

- How do I file a nil VAT returns in Kenya?

After login to iTax Portal, select ‘File Nil Return’ available under the file returns menu.

Read more on TallyPrime Kenya

What is TallyPrime, TallyPrime – Simple to learn and easier to use, TallyPrime’s ‘Go To’ Feature, TallyPrime’s Simplified Security and User Management System, Tally’s Exception Reporting to Address Data Anomalies, Analysing Business Reports Just Got Easier with TallyPrime, Multitasking Just Got Easier with TallyPrime, Personalise the Business Reports the Way You Want

Software in Kenya

Payroll Software in Kenya, Best Inventory Management Software for Businesses in Kenya

iTax in Kenya

iTax in Kenya, How to Make KRA iTax Payment, How to Register for KRA PIN in iTax Portal, How to File VAT Returns in iTax Portal, How to File KRA iTax Returns Online in Kenya, KRA iTax Returns & Types of KRA Returns Forms, 5 Things you can do from your KRA iTAX Portal, Compliance in Kenya