- What is KRA PIN?

- Who should have a PIN?

- How to Register for KRA PIN in iTax Portal?

- Creating Your iTax Login Password

- Documents required for iTax PIN Registration

- FAQs on KRA PIN Registration

The tax obligation under various Kenya Act requires businesses or individuals to register under KRA iTax Portal. Registering under KAR iTax portal enables the taxpayers to file the returns and make the tax payments. To be called a registered taxpayer, you should apply for PIN registration. While applying for the KRA PIN, you will be required to select the tax obligation applicable to you.

Read ‘KRA’ iTAX Returns’ to know different tax obligations in Kenya

What is KRA PIN?

A PIN is a Personal Identification Number used for doing business with Kenya Revenue Authority, other Government agencies and service providers. The KRA PIN will be issued once you complete the online PIN registration. The steps to obtain KRA iTax PIN are detailed in the section below.

Who should have a PIN?

Based on the tax obligation applicable on you, you are required to have a PIN if you are:

- Employee

- Business

- If you Have rental income

- Wish to apply for a HELB Loan

- Want to perform a certain type of transactions listed in the first schedule of the Act.

How to Register for KRA PIN in iTax Portal

For you to obtain a KRA PIN, you need to apply for PIN registration in KRA iTax Portal. The following are steps to register for KRA PIN in iTax Portal.

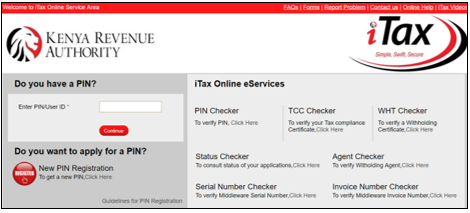

- Visit KRA iTax Portal using https://itax.kra.go.ke/KRA-Portal/

- Select "New PIN Registration" in the homepage of KAR iTax Portal.

Select the Taxpayer Type (Individual or Non-individual) and Mode of Registration (Online or Upload form) in e-Registration form as shown in the below.

- Based on the taxpayer type and registration mode, iTax PIN registration form will open. The type of details to be furnished in the PIN registration form are different for individual and Non-individual.

- For Non-individuals, the PIN registration form consists of 4 broad categories listed below:

- Basic Information

- Obligation

- Director Associates

- Agent Details

- You need to furnish all the mandatory details along with the required supporting documents and submit the KRA iTax PIN registration form

- On submitting, a pop-up to confirm the e-mail ID you had mentioned in the PIN registration form. You can confirm by clicking ‘OKAY’ if the ID is correct

- On successful submission of the iTAX PIN registration form, iTAX PIN will be displayed immediately on the iTax page. You can also download it and print. Another copy of your iTAX PIN will be mailed to your ID

Creating Your iTax Login Password

On successful submission, login to your email and you will find your iTax PIN and password generated by KRA iTax Portal. Visit KRA iTax Portal and mention the iTax PIN and password you have received. On mentioning, you will be re-directed password change page. Here, you can change the password and also you need to create a security question which will help you to recover your iTax profile.

Knowing these 5 Things you can do from your iTAX Portal will be helpful in using your iTax profile.

Documents required for iTax PIN Registration

A company applying for New PIN registration

The following are documents required to be submitted by a company applying for new PIN registration:

- Copy of Certificate of Incorporation

- Copy of CR12(a legal document listing shareholders or directors of the company)

- Copy of Memorandum and Article of Association (optional)

- Copy of PIN Certificate for one of the company’s directors

- Copy of Tax Compliance certificate of one of the company’s directors

- Copy of the Acknowledgement Receipt

Partnership firm applying for New PIN registration

The following are documents required to be submitted by a partnership firm applying for New PIN registration:

- Copy of the Acknowledgement Receipt

- PIN Certificate for one of the partners

- Deed of the partnership (optional)

- Tax Compliance certificate of the partners (optional)

FAQs on KRA PIN registration

- How can I get my KRA PIN online?

For you to obtain a KRA PIN, you need to apply for PIN registration in KRA iTax Portal.

- How much does it cost to apply for KRA PIN?

You just need to register online and apply for a KRA PIN

- How long does it take to get KRA PIN?

On successful submission of iTAX PIN registration form, iTAX PIN will be displayed immediately on the iTax page. You can also download it and print.

- How do I register my KRA PIN to iTax?

You need to visit KRA iTax Portal using https://itax.kra.go.ke/KRA-Portal/ and select "New PIN Registration" on the homepage of the KAR tax Portal.

Read more on TallyPrime Kenya

What is TallyPrime, TallyPrime’s ‘Go To’ Feature, TallyPrime’s Simplified Security and User Management System, Tally’s Exception Reporting to Address Data Anomalies, 5 Things You Can Do Using Save View Option in TallyPrime, 5 Things in TallyPrime for Enhanced Business Efficiency, Analysing Business Reports Just Got Easier with TallyPrime, Personalise the Business Reports the Way You Want

Software in Kenya

Payroll Software in Kenya, Best Inventory Management Software for Businesses in Kenya

iTax in Kenya

iTax in Kenya, KRA VAT Return, How to Make KRA iTax Payment, How to File VAT Returns in iTax Portal, How to File KRA iTax Returns Online in Kenya, KRA iTax Returns & Types of KRA Returns Forms, 5 Things you can do from your KRA iTAX Portal, Compliance in Kenya