All the businesses registered under KRA VAT need to file VAT return on a monthly basis. In our previous article ‘KRA VAT returns’ we have discussed VAT Return Form-3 and the details to be mentioned in the VAT Return Excel Format. In this article, we will discuss about steps involved in filing VAT return in the iTax portal.

How to file VAT return in iTax portal?

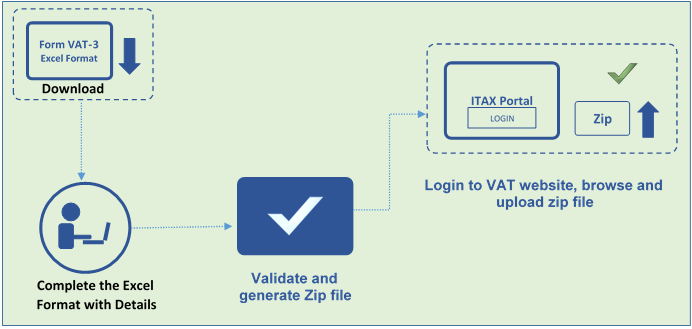

Broadly, filing VAT return is a 4-step process. First, you need to download the latest VAT return Excel format, next you need to complete the excel format by mentioning details in relevant sheets, then generate the zip file and finally, upload the zip file into the iTAX portal.

Let us understand the step-by-step process to file VAT returns in iTAX Portal.

- Downloading VAT return excel format

The first step in the process of filing VAT return is to download the VAT return excel template. To download the VAT return excel format, follow the steps given below:

- Visit iTax Portal by clicking https://itax.kra.go.ke/KRA-Portal/

- Click ‘Forms’ option available on the top left of the screen as shown below.

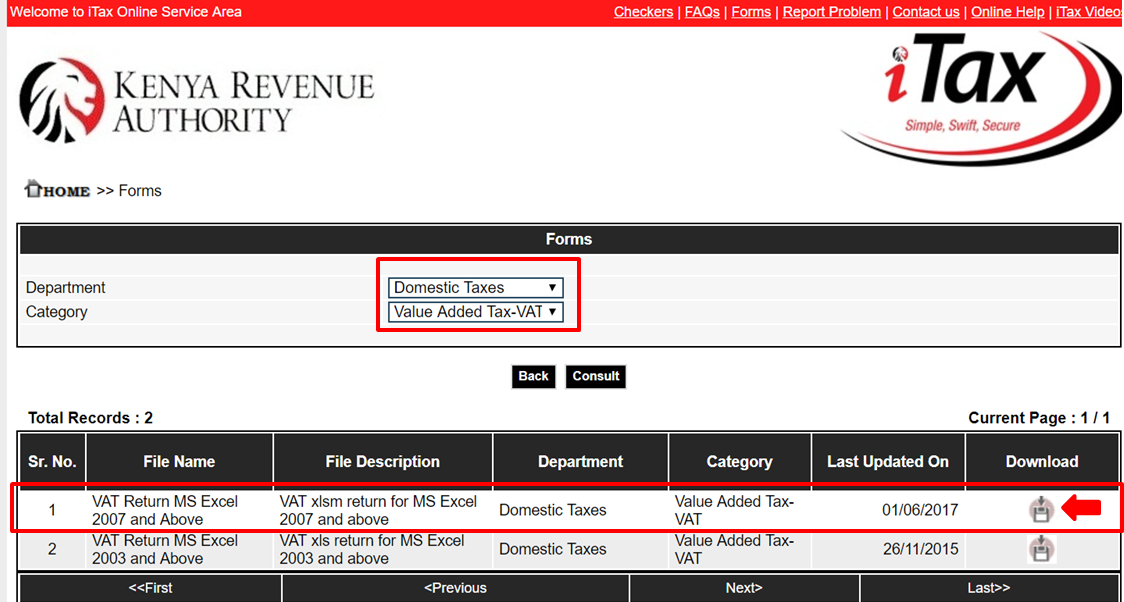

In the next screen, select the department as ‘Domestic Taxes’ and Category as ‘VAT’. Then proceed to download the VAT return Excel format by clicking ‘Save button’ as shown in the below image.

Occasionally, the VAT return excel format will undergo changes and the updated file will be available for download along with the date. Therefore, the taxpayer should always look for the last updated date and download the latest file.

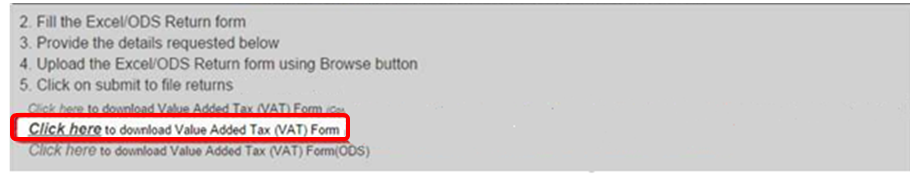

Alternatively, you can also download the VAT return Excel format by login to iTax portal-> Returns ->File returns -> VAT ->

- Furnishing details in VAT return excel Format

The downloaded VAT return excel format consists of 14 Sheets in which the details need to be mentioned by the taxpayers. The details of your Sales and purchases need to be mentioned in the prescribed format. An important point to be noted here is that the VAT return excel format does not allow you to copy and paste details. You need to manually enter.

Return filing process will be easier for businesses using accounting software with the capabilities to auto-capture the details into the VAT return excel format. Else, it takes a lot of efforts and time to complete the VAT return format.

To know more about the details to be mentioned in the VAT return excel format, please read our article ‘KRA VAT returns’

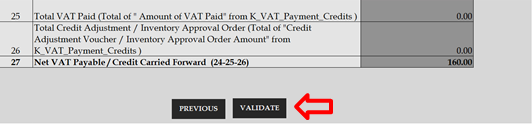

- Validate and generate zip file

Once the required details are captured in the VAT return excel format, Click ‘Validate’ option available in the last sheet ‘O_VAT’ of excel template.

If there are any errors, it will display the error message and take you to the sheet in which all the error messages are captured. You need to rectify the errors and again validate the details. If there are no errors, it will generate the zip file which needs to be uploaded.

- Upload VAT returns in the iTax portal.

The final step in filing VAT return in the iTax portal is to upload the zip file. To upload the zip file into the iTax portal, follow the steps given below:

- Visit the iTax online portal using https://itax.kra.go.ke/KRA-Portal/

- Login to iTax portal with PIN and password

- Click on ‘e-Returns’ or select ‘Returns’ from the navigation menu and click on ‘File Returns’

- Select the Type, enter your taxpayer’s PIN and select the Tax obligation as ‘VAT’ and Click ‘Next’

- Fill in all the details such as Type of return, Entity type, branch name, and return period available on the return filing page

- Click ‘Upload’ and select the zip file generated by following the step-3 discussed earlier

- Agree to the terms and conditions by ticking the checkbox.

- Finally, click the ‘Submit’ button to upload the VAT returns and click ‘OK’ for the pop-up message ‘Do you want to upload the form’

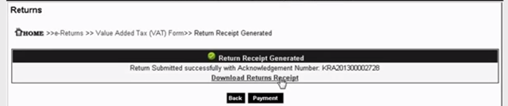

On submitting the VAT returns, an e-return receipt will be generated with the message 'Return Submitted Successfully' along with an acknowledgment number as shown in the below image.

Read more on TallyPrime Kenya

What is TallyPrime, TallyPrime’s ‘Go To’ Feature, TallyPrime’s Simplified Security and User Management System, Tally’s Exception Reporting to Address Data Anomalies, Analysing Business Reports Just Got Easier with TallyPrime, Multitasking Just Got Easier with TallyPrime, Mitigation of Risks in Business, Personalise the Business Reports the Way You Want

Software in Kenya

Payroll Software in Kenya, Best Inventory Management Software for Businesses in Kenya

iTax in Kenya

iTax in Kenya, KRA VAT Return, How to Make KRA iTax Payment, How to Register for KRA PIN in iTax Portal, How to File KRA iTax Returns Online in Kenya, KRA iTax Returns & Types of KRA Returns Forms, 5 Things you can do from your KRA iTAX Portal, Compliance in Kenya