Have you used the new Tax Invoice Management System (TIMS) yet? Do you understand how it works?

Using the system can be challenging, considering it’s significantly different from the previous electronic tax record (ETR). If you’re a VAT-registered mlipa ushuru (taxpayer), this is the new system you’ll be using to generate tax invoices to help you stay compliant with KRA tax regulations.

It’s, therefore, necessary to understand how it works and how you can use it to generate invoices and perform other related compliance activities. This article will help you understand how the new tax invoice management system works so your business won’t be charged for non-compliance.

If you want a hassle-free way to manage all your tax activities as a business owner, robust business management software can lift the weight off your shoulders and help you stay compliant at all times.

|

What is the Difference Between an Electronic Tax Register and an Electronic Tax Invoice? |

How does the new electronic tax invoice system work?

Under the new e-invoicing system, different types of ETR machines are approved with the capability of validating and transmitting the invoices to the KRA portal on a near-to-real-time basis. In this blog, we have explained the e-invoicing system considering ‘Type ‘C’ machine.

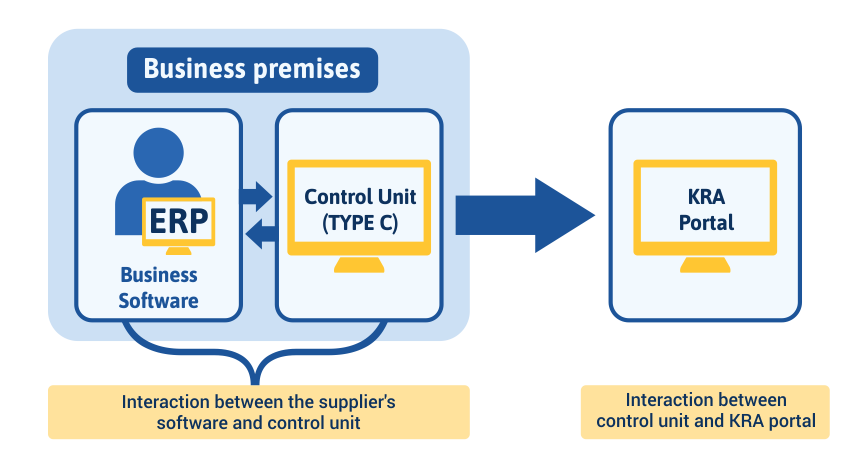

For us to understand the workflow of the e-invoice system, it is important to know the participants of the system. The key participants of the e-invoice system are represented in the below diagram, along with their interactions.

As shown in the above diagram, the workflow of the e-invoice system can be categorized into 2 parts. First is the interaction between the business software used by the trader and the ETR, known as a control unit. The second part is the interaction between the control unit and the KRA portal. Let’s now understand the e-invoice system in detail.

How Does the New Tax Invoice Management System Work

- The supplier generates the invoice using accounting or ERP software

- Since the Control unit and software used by the business are integrated, the invoice details are automatically shared to control unit for validation

- Control Unit validates the invoice details, including the tax calculation

- On successful validation, the control unit invoice number is generated, and a QR code is added by the control unit. Also, the unique control unit serial number will be added to added on the invoice

- Invoice number, QR code and control unit serial number are directly sent to the supplier’s system

- In the next step, the supplier prints the e-invoice along with the QR code and other details mentioned above

- In parallel, the control unit will electronically share the invoice details to the KRA system. In case if the system is offline (temporary disconnection of internet), the details will be stored in the control unit and transmitted once the internet connection is restored

Compliance is Hassle-free with TallyPrime

Understanding all the processes involved in the new TIMS system can be a hassle if you’re not a tax professional. TallyPrime is a business management software that makes it easier by handling all the activities for you, from generating VAT-compliant invoices to filing the VAT returns for you. The software auto-populates your tax information and automates the tax filing process so you can have more time to focus on kukuza biashara (business growth).

Get a free demo today and experience how the software can make tax compliance hassle-free for you as a business owner.

Read More: