- What is an e-invoice?

- The types of e-invoice in Kenya: electronic tax register

- The types of e-invoice in Kenya: tax invoice management system

- Benefits of e-invoicing

- Sample e-invoice format

- Mandatory details on an e-invoice in Kenya

- Important things to keep in mind

- Conclusion

What is an e-invoice?

An e-invoice is also known as electronic invoices. These invoices and their details are validated, signed, and transmitted to the Kenya Revenue Authority (KRA) portal on a real-time basis. This is on account of the Tax Invoice Management System, a new system.

|

How to Generate Electronic Tax Invoices Under the New TIMS: The Process Flow |

5 Must-Have Features in Business Software for Electronic Tax Invoice in Kenya |

The types of e-invoice in Kenya: electronic tax register

The Electronic Tax Register or ETR was an earlier electronic tax invoicing system introduced for VAT e-invoicing regulations. For this register system, business organizations have to ensure that each transaction is recorded in the tax register and that an invoice is sent to the buyer for each sale made.

There are four types of approved ETRs.

Type A: An integrated ETR that generates, validates, and sends tax invoices or receipts to the KRA portal. Small businesses and businesses on the move (like van sales) should use this type of register.

Type B: For validation and transmittance invoices, there are two ways.

- One-to-Many – One centralized tax register is connected to several Point of Sale (POS) systems.

- One-to-One – Each POS terminal is connected to an independent fiscal printer.

Retail outlets and businesses will find this type of register useful.

Type C: A control unit is connected to an enterprise resource planning for the validation and transmittance of invoices or receipts to the KRA. For this type, it is businesses that have invoice automation and electronic signature device usage.

Type D: This tax register is connected to different invoicing systems like ETR, point of sale, or enterprise resource planning. All types of businesses can use this type of ETR.

To make sure business organizations follow the tax regulations, KRA has published detailed guidelines and provided taxpayers with a list of approved suppliers and manufacturers of ETRs.

The types of e-invoice in Kenya: Tax Invoice Management System

The e-invoicing system is called Tax Invoice Management System (TIMS). In this system, VAT-registered companies inform the KRA about each transaction in real time.

The main purpose of TIMS are:

- Standardization of tax invoices and receipts being generated

- Streamlining the filling of the tax return (since the fields will be pre-filled)

- Invoice validation in real time

- Verification of invoice data continuously so tax fraud attempts are avoided

- Increase good governance practices for taxation

- Faster transfer of VAT fiscal data

- Decreased cost in compliance management

The TIMS system is an upgrade from the previous Electronic Tax Register (ETR) system. The purpose of TIMS is to make businesses more tax compliant. This is done by making the tax return filing process simpler and standardizing tax invoices and receipts.

TIMS integrates easily with trader systems (for example Point Of Sale, Enterprise Resource Planning, and Electronic Tax Register Type C systems) and iTax. It stores the tax invoices and provides details on the tax invoices' validity by requiring QR codes on the invoices or tax checkers on the iTax portal.

The new electronic tax invoice is applicable to all the business organizations registered under VAT. From 1st October 2022, every business registered under VAT must give an e-invoice to all customers.

The KRA does exempt certain businesses from paying VAT, so these particular businesses aren't required to apply for upgraded electronic tax invoices. These exemptions may include certain businesses run by Kenyans beyond the Kenyan jurisdiction and non-profit organizations.

Benefits of e-invoicing

There are several benefits of having an e-invoice:

- Creates a fair business environment and fair practices for everybody

- Gives a faster VAT refund process

- Automatic activation for the tax register

- Simplifies the filling of VAT returns with data being pre-filled

- Increases trust between the business and government entities

- Makes tax compliance easier for taxpayers

- Gives a solution to any invoice inconsistencies

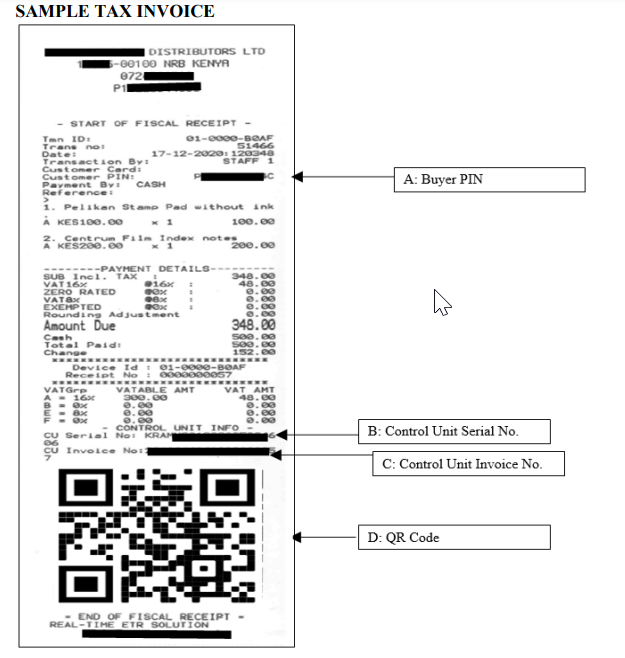

Sample e-invoice format

The KRA has released an electronic tax invoice presentation so that business organizations are better prepared and gained more knowledge about the upgraded e-invoicing system.

Below is a sample of an e-invoice.

Mandatory details on an e-invoice in Kenya

An e-invoice must have the following items:

- User's register PIN

- Buyer’s PIN

- Time and date

- Serial number

- Total gross amount

- Total tax quantity

- Item code

- Description of all the items

- Quantity of supply

- Measurement unit

- The tax rate for each item

- Control unit serial number

- Control Unit invoice number

- QR code

Important things to keep in mind

- When the existing tax register is replaced, the taxpayer must keep the old tax register since they need to have their tax records for five years as per Section 23 of the Tax Procedures Act, 2015.

- Businesses that are newly registered for VAT and the ones who will be replacing the ETRs will be using the TIMS system directly. Such entities will be given a period of 12 months to comply with the new tax regulations.

- Regarding the new guidelines being put into effect, taxpayers still need to file VAT returns on the 20th of each month as mentioned in Section 44 of the Value Added Tax Act, 2013. This rule hasn't changed in spite of the new regulations.

- If a taxpayer can't comply within the timeline set by the KRA, they need to apply for an extension to the Commissioner. The extension can't exceed six months, as mentioned in the regulations. The application for the extension must be done 30 days before the expiry of the period of 12 months mentioned in the rules.

Conclusion

The implementation of the e-invoice comes with several advantages like business transparency, seamless operations, a better revenue collection system, easier VAT refunds, increased improvement in the ease of doing business, and better chances of predicting the economy based on accurate tax data.

With regard to business organizations and taxpayers, they must comply with the KRA guidelines, have a valid tax register regarding TIMS, have valid electronic tax invoices, and keep excellent tax records.

A taxpayer can now do business in Kenya much more easily due to these new regulations regarding the electronic tax register and TallyPrime can help business organizations with all their queries.

Read More: