Imagine you’re on a diet.

But unlike the traditional “eat less” diet, yours is different—you don’t eat less; you eat smarter. You cut the midnight snacking, swap empty carbs for protein, and actually end up with more energy than before.

Now, what if your business could do the same with money?

That’s where cost optimisation comes in.

Too often, businesses confuse “saving costs” with “cutting budgets.” But here’s the truth: slashing costs is like starving your body—sure, you’ll lose weight, but you’ll also lose the strength to grow. Cost optimisation is smarter. It’s about eliminating waste, plugging leaks, and investing only where it truly fuels growth.

And the unsung hero of this transformation? Your finance team.

In 2025, as startups and SMBs juggle agility, resilience, and ambition, finance leaders can quietly (but powerfully) become the growth guardians. Let’s see how.

Driving efficiency without sacrificing growth

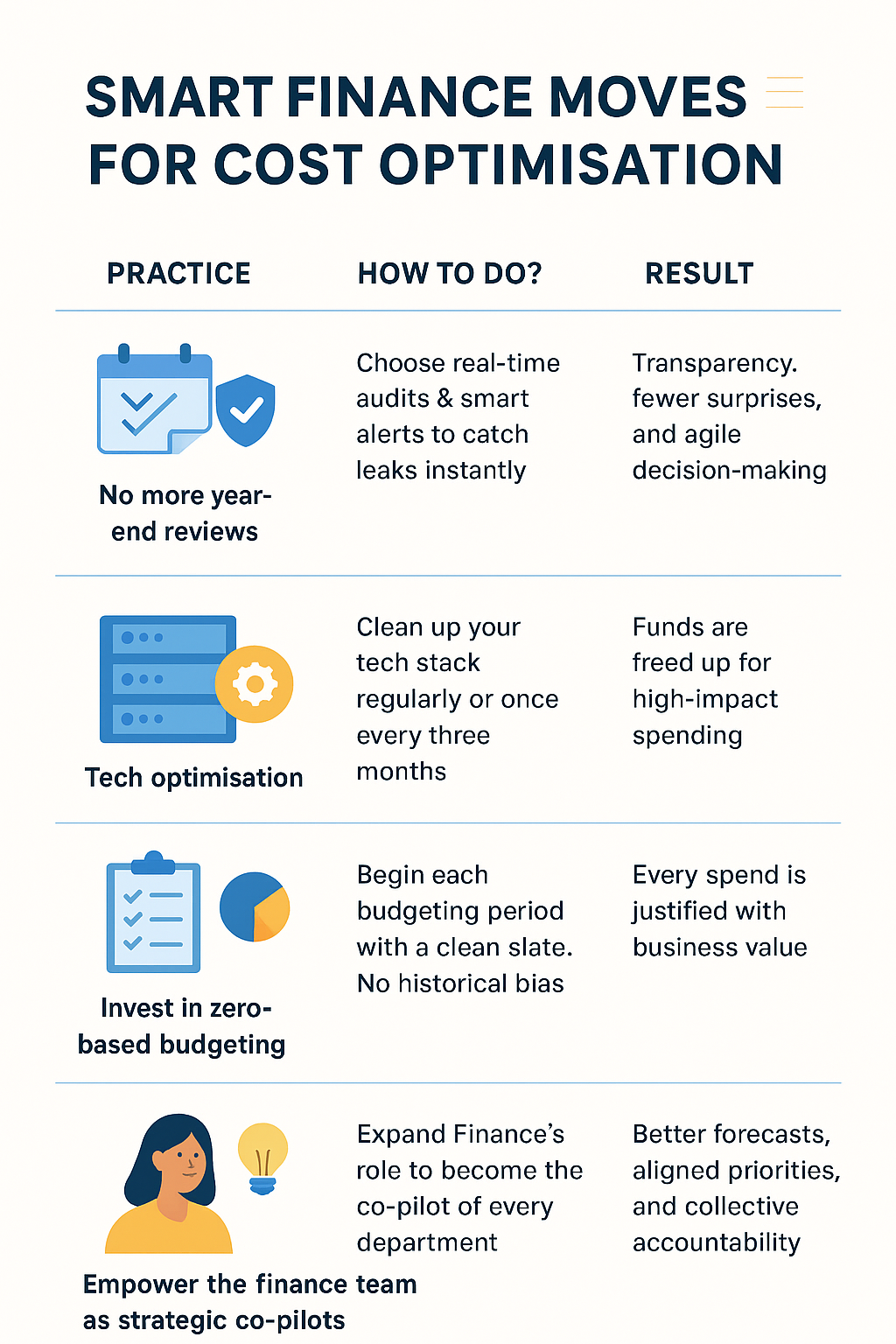

1. Spotting hidden inefficiencies (The “Leaky Tap” analogy)

Think of a leaky tap that silently adds to your water bill. That’s exactly what hidden costs do to your business.

From duplicate SaaS subscriptions, underused tech, outdated supplier contracts, to clunky manual processes—small leaks silently drain big money.

What finance teams can do:

-

Run regular expense audits

-

Revisit supplier contracts for better terms

-

Benchmark rent/utilities against industry averages

-

Monitor spending in real time with dashboards

Golden rule: Finance isn’t about micromanaging every rupee. It’s about asking: “Does this expense fuel growth?” If yes—keep it. If not—fix the leak.

2. Tech-First finance: From spreadsheets to smart systems

Still living in Excel? That’s like navigating with a paper map in a GPS world.

Finance teams must push businesses to adopt automation—think accounting software, AI-driven dashboards, and compliance tools that update with ever-changing tax and payroll laws.

Quick wins:

-

Automate recurring invoices & reconciliations

-

Use workflow approvals with digital audit trails

-

Try TallyPrime or similar tools for accounting, e-invoicing, and cash flow

Result? Fewer errors, faster processes, stronger digital backbone—and more time for finance pros to focus on strategy, not spreadsheets.

3. Zero-based budgeting (ZBB): The “clean slate” mindset

Traditional budgeting is lazy: “We spent ₹10L on marketing last year, let’s make it ₹10.5L this year.”

Zero-Based Budgeting flips the script: “Do we need this at all?”

Why it works:

-

Every rupee must justify its place

-

Encourages smart prioritisation

-

Keeps resources aligned with business outcomes

Finance tip: Think of ZBB as “packing for a trip.” Don’t carry what you packed last time—carry only what you actually need this time.

4. Cross-functional collaboration (finance as GPS, not gatekeeper)

When finance works in silos, cost optimisation stays a dream.

Instead, imagine finance as the GPS of the company—guiding marketing, sales, HR, and ops toward efficient spending decisions.

Example:

Marketing swears by an expensive CRM. Finance asks: “Is it giving ROI?” If yes, keep it. If not, find a smarter tool.

How to make it work:

-

Monthly cost-benefit reviews with department heads

-

Encourage joint ownership of spending decisions

-

Bundle resources across teams for better vendor deals

5. From cost-cutting to value creation

The most powerful shift? Moving from “Where can we cut?” to “Where should we invest for maximum return?”

This mindset flips finance from being the “budget police” to being growth partners.

Smart finance leaders know:

-

Training employees might cost upfront but boosts productivity

-

Investing in automation software can cut future inefficiencies

-

Spending on customer experience could unlock long-term loyalty

It’s not about cutting the pie smaller—it’s about baking a bigger, better pie.

Wrapping up

Cost-cutting is a survival tactic. Cost optimisation is a growth strategy.

With the right mindset, your finance team becomes:

-

The efficiency detectives (spotting leaks),

-

The tech adopters (building smarter systems), and

-

The value champions (guiding smarter growth).

So, give finance a seat at the strategy table. Let them move beyond chasing receipts to driving ROI. Done right, cost optimisation isn’t about spending less—it’s about spending smart and growing stronger.