- What is VAT Reverse Charge Mechanism?

- Why VAT Reverse Charge Mechanism?

- What are the supplies liable for Reverse Charge VAT in UAE?

- Reverse Charge VAT Example

- How different is Reverse Charge VAT compared to Forward charge mechanism?

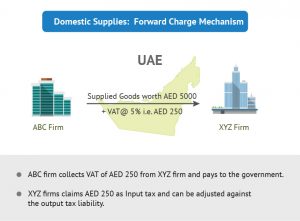

Under UAE VAT Law, the responsibility to levy, collect and pay tax to the government is on the person who is making taxable supplies i.e. on the supplier. This means, whenever a registered supplier is making a taxable supply, he needs to charge VAT and pay the same to the government. The mechanism of collecting tax by a registered supplier from his customers is known as forward charge mechanism. For example, A-One Spares Ltd sold spare parts worth AED 100000 to General Automobiles Ltd and collected VAT of AED 5000 at the rate of 5%. The VAT of AED 5000 is collected on a forward charge basis. However, the UAE VAT Law and Executive Regulations notifies certain type of supplies on which VAT need to be charged on Reverse Charge Mechanism.

Before understanding those supplies which are liable for Reverse Charge VAT, first let us understand the concept of reverse charge mechanism.

What is VAT Reverse Charge Mechanism?

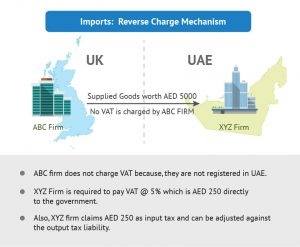

Under reverse charge mechanism, on certain notified supplies, the recipient or the buyer of goods or services is responsible to pay the tax to the Government, unlike in the forward charge, where the supplier is liable to pay the tax. The key change is the shift in the responsibility of paying tax, which is moved from the supplier to the buyer.

Why VAT Reverse Charge Mechanism?

In order to ensure that the VAT is collected on the supply of goods or service where the supplier is not a taxable person and the supply has been made in the state of UAE, the government has introduced the concept of reverse charge mechanism. Due to this, the recipient or the buyer is treated as a person making taxable supplies to himself and will be responsible to pay VAT to the government.

What are the supplies liable for Reverse Charge VAT in UAE?

In UAE VAT, broadly the import of concerned goods or services and supply of any crude or refined oil, unprocessed or processed natural gas, or any hydrocarbons for resale or to produce and distribute any form of energy are under reverse charge VAT. The UAE VAT Law has listed the following supplies which will be liable for VAT on reverse charge mechanism, provided the applicable conditions are met as prescribed in UAE Executive Regulations:

- Imports of concerned goods or concerned services for business purpose

- Taxable supply of any crude or refined oil, unprocessed or processed natural gas, or any hydrocarbons for resale or to produce and distribute any form of energy by registered supplier to registered buyer in the State of UAE

- Supply of goods or services by a supplier who does not have a place of residence in the state to a taxable person who has a place of residence in the State of UAE.

All of the above mention supplies are liable to reverse charge mechanism. However, for each of the above supplies, specific conditions are mentioned in the UAE VAT Executive Regulations which need to be full filled, to be liable for reverse charge VAT.

Reverse Charge VAT Example

In order to ensure that VAT is collected on the supplies where a supplier is not a taxable person in the state of UAE, the concept of Reverse Charge Mechanism is introduced in the UAE VAT. Under this, the recipient or the buyer of goods or services will be liable to pay tax to the government. Thus, as a recipient or buyer of goods or services under reverse charge mechanism, the following responsibility needs to be discharged:

- Determine the value on which tax needs to be levied

- Account the VAT due on reverse charge supplies

- Remit VAT to the government

- Claim Input Tax, if eligible.

- Maintain the records such as invoice and other documents to substantiate the tax payment and input tax claim

In order to make the concept of Reverse charge mechanism clearer, let us understand this with an example:

A-One Spare Ltd, a registered dealer in spare parts and accessories in Dubai imported spare parts worth AED 5500 from Speed Motors Ltd, located in India.

Here, A- One Spare Ltd, being a registered importer, is required to pay VAT @ 5% on AED 5500 i.e. AED 275 to the government.

How different is Reverse Charge VAT compared to Forward charge mechanism?

Let's make the comparative analysis of VAT on forward charge and reverse charge with an example of domestic supplies of goods at 5% versus the import of similar goods.

If you closely observe the illustration, the net result of reverse charge mechanism is same as that of forward charge basis. The only difference in reverse charge VAT is the shift in the responsibility of paying VAT which is moved from supplier to the recipient. In the above illustration, it is moved from ABC Firm to XYZ firm. In a way, the concept of reverse charge mechanism helps to alleviate the difference between local and international suppliers and puts both into the same position.