Under VAT in UAE, all businesses which have a place of residence in UAE, and whose value of supplies in the GCC member States in the previous 12 months exceeds AED 375,000, should mandatorily register under UAE VAT. Further, businesses in UAE which do not have a place of residence in UAE will have to compulsorily register under VAT, irrespective of their turnover.

For registered businesses which deal with other registered businesses, it is of great importance to issue a valid document evidencing that a supply has taken place. On the other hand, this document is of even greater importance to recipients who are registered under VAT, as it will serve as the basis for their input tax recovery on this transaction. To understand more about the eligibility and conditions to recover input tax on a supply, you can refer our blog 'Input tax recovery'.

The document to be issued by all suppliers registered under VAT to registered recipients is called 'Tax Invoice'. A Tax Invoice is the document which evidences that a supply has taken place and serves as the basis for a recipient to recover input tax on a supply. Hence, a Tax Invoice is of great importance under VAT in UAE. The VAT Law has also laid down the details that are mandatorily required in a Tax Invoice.

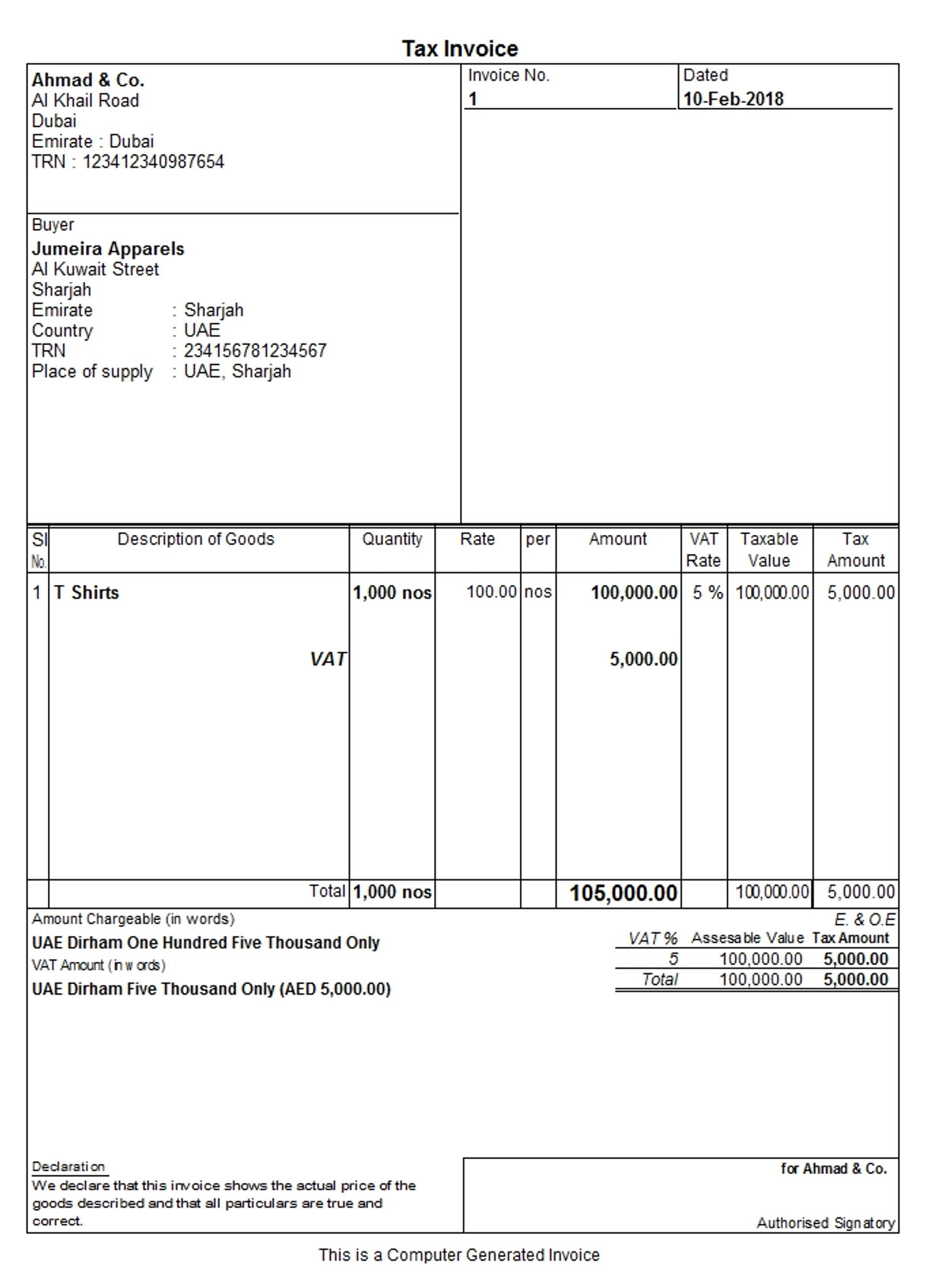

Let us understand how a registered supplier can issue a Tax Invoice under VAT. For example: Ahmad & Co., a registered apparel supplier in Dubai, supplies 1,000 T-Shirts @ AED 100 to a registered customer, Jumeira Apparels, in Sharjah. VAT @ 5%, amounting to AED 5,000 is charged. The Tax Invoice to be issued by Ahmad & Co. is shown below:

Businesses registered under VAT in UAE should take note of these details that are mandatorily required in a Tax Invoice. It is of utmost importance that none of the required details in a Tax Invoice are omitted. Registered businesses can explore the option of using a software that will automate the capturing of these details and generate Tax invoices accordingly. This will assist such businesses to save the time and effort required to record and generate Tax Invoices manually. Let us now answer some FAQs which businesses have, with respect to Tax Invoices.

FAQ 1: Is there a standard format for a Tax Invoice as per the VAT Law?

Answer: The VAT Law has not prescribed any standard format for a Tax Invoice. However, it has laid down the details that are mandatorily required in a Tax Invoice. These details must be given in every Tax Invoice issued by a registered supplier.

FAQ 2: Is a Tax Invoice a valid document for Input Tax Recovery?

Answer: Yes, a Tax Invoice is a valid document for Input Tax Recovery. However, a registered recipient should ensure that his/her Tax Registration Number is mentioned on the Tax Invoice issued by the supplier. Note that recovery of input tax is subject to certain conditions and eligibility. You can read more about the conditions and eligibility for input tax recovery in our articles 'Input Tax Recovery' and 'Supplies not eligible for input tax recovery'.