n our previous article, we have learnt about Tax Agents, the conditions for registering as a Tax Agent and the duties to be fulfilled by a Tax Agent. In this article, let us understand the process to be followed by a person to register as a Tax Agent under UAE VAT.

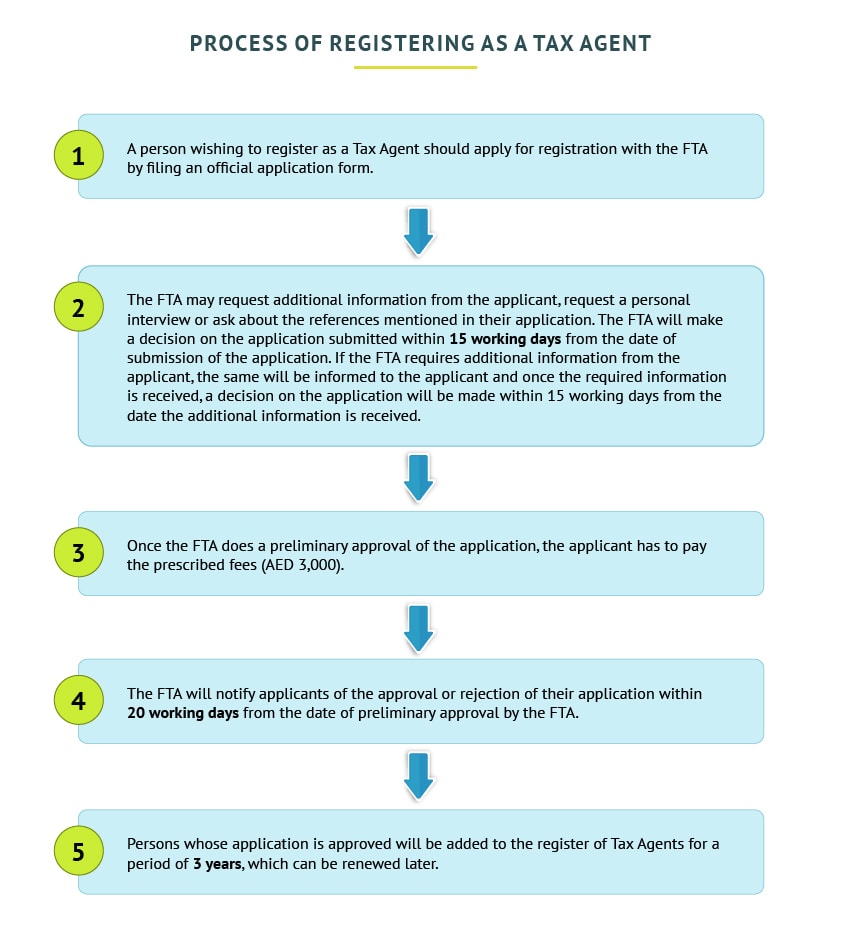

Process of registering as a Tax Agent

When can a person’s Tax Agent permit be revoked?

A registered Tax Agent's permit can be revoked in the following circumstances:

- The FTA finds that the Tax Agent is not qualified as per the requirements we discussed in our previous article

- The Tax Agent's work affects the integrity of the tax system

- The Tax Agent commits a serious violation of the tax Law

If a Tax Agent's registration is revoked, the FTA will notify the Tax Agent about this decision, within 5 working days of the registration being revoked.

Hence, the role of a Tax Agent is very important under UAE VAT. A Tax Agent will act as a mediator between the FTA and Taxable Persons. For persons registering as Tax Agents, it is a role with huge honour and responsibility. For Taxable Persons, making use of a Tax Agent will be helpful in easing compliance under VAT. A Tax Agent can help in reducing the time required for compliance activities as well as reduce errors in compliance. A Tax Agent can also represent the Taxable Person in matters related to compliance. Hence, persons interested in becoming Tax Agents under UAE VAT can follow the process mentioned above to become registered and licensed Tax Agents.