In our previous article ‘Process for unregistered persons to pay VAT on import’, we have learnt about the scenarios of import of goods by non-registrants. We have learnt of the 2 modes of payment of VAT by non-registrants:

- Pay VAT Payment on import

- Provide e-guarantee

We have also learnt of the process to be followed by non-registrants for VAT Payment on import. In brief, the process is as given below:

- Prepare and submit customs declaration in Customs portal

- A Customs official will validate the declaration details and approve the same. A notification on the approval will be sent to the importer and to the FTA

- The importer has to create an e-Services account

- Login to the FTA portal and make the VAT payment

In this article, let us understand the steps to be followed by a non-registrant to pay VAT in the FTA portal.

How to make VAT Payment in FTA portal

- Step 1: Log in to FTA e-Services portal

- Step 2: Click on the VAT tab as shown below:

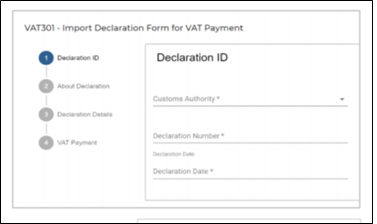

- Step 3: Click 'VAT 301- Import declaration form for VAT payment'

- Step 4: Fill in the Customs Authority, Customs Declaration Number and Declaration Date. Click Next.

- Step 5: The screen 'About Declaration' will open. The details of the customs declaration submitted earlier (Import date, destination, etc) will be automatically retrieved. Click Next.

- Step 6: The screen ‘Declaration details’ will open and the declaration details [for example, HS (Harmonized System) code, import value, customs duty, CIF (Cost, insurance and freight) value, etc] will be automatically retrieved. Click Next.

- Step 7: As the scenario of import requires payment of VAT, click ''Pay VAT button which will direct you to the e-Dirham gateway.

- Step 8: Once you are redirected to the e-Dirham gateway, you will be able to make the payment through an e-Dirham or non-e-Dirham card.

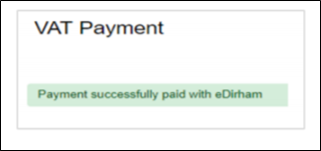

- Step 9: Once the payment is processed successfully, a confirmation message will appear on the screen and you will receive an email confirmation that the payment has been successfully completed. After this, the customs clearance process can be completed.

Hence, the process for payment of VAT on import has been made easy in the FTA portal. Non-registered importers can follow the above steps to pay VAT on import in the relevant scenarios.