Whether you are running a startup, SME, or an established company, UAE corporate tax registration is no longer optional, it’s a legal requirement for businesses. This applies regardless of profit level. Even businesses earning below the taxable threshold must register.

Failing to register with the Federal Tax Authority (FTA) can result in penalties, compliance issues, and unnecessary stress down the line. That’s why understanding who needs to register, what documents are required, and how to complete the process correctly is essential.

In this guide, we’ll walk you through everything you need to know about UAE corporate tax registration, including eligibility, required documents, and step-by-step instructions to register smoothly through the EmaraTax portal.

What is corporate tax registration?

Corporate Tax Registration in the UAE lets you register as a company/taxable person with the UAE Federal Tax Authority (FTA). After successful registration, you will receive a Corporate Tax Registration Number (CTRN). It can be used for filing corporate tax returns and other regulatory obligations.

UAE corporate tax is a direct tax applied to the net profits of companies and business entities. The new tax regime was implemented on June 1, 2023, to align with international tax standards and transparency.

Businesses must complete corporate tax registrations through the FTA’s EmaraTax portal, which is the official platform for this process.

Documents required for corporate tax registration in the UAE

Before starting your registration on the EmaraTax portal, make sure you have the following ready:

- Trade license: A valid trade license is mandatory.

- Financial statements: Recent reports to verify income and meet threshold requirements.

- Company information: Details about the company’s legal structure, ownership, and business activities.

- Proof of authorisation: Documents confirming that the signatory is authorised to act on behalf of the company.

- Contact details: Registered business address and the contact information of the authorised person(s).

Having these documents ready will make the registration process smoother and faster.

How to register on the UAE corporate tax EmaraTax portal?

Check out these easy steps to register as a business entity in the UAE Corporate Tax system.

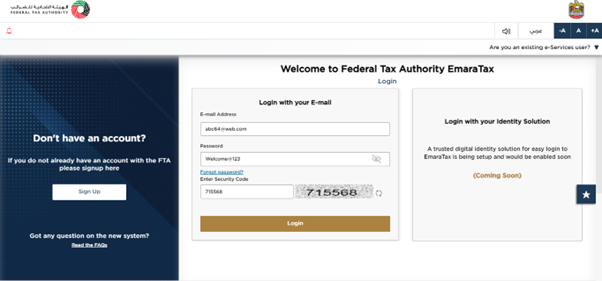

1. Go to the EmaraTax portal

If you already have an account, just log in with your details or use the UAE Pass. Alternatively, if you don’t have an account, you have to ‘Sign Up’ on the portal.

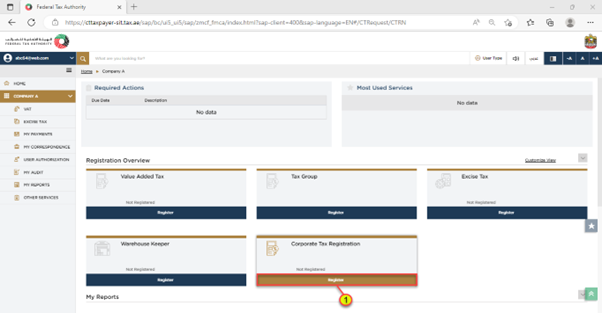

2. Start the application

You will be able to see the dashboard as soon as you log in, where you will find all the taxable entities linked with your account. Now select the taxable entity as per your account. Create a new taxable entity profile if there isn’t one.

Go to the Taxable Persons dashboard and look for the Corporate Tax tile, then click on the Register option.

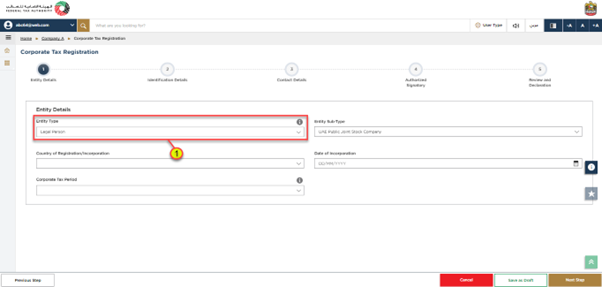

3. Enter business entity details

Provide the necessary details such as entity type, business details, financial year/tax details, etc. After adding details in the mandatory fields, click 'Next Step' to continue.

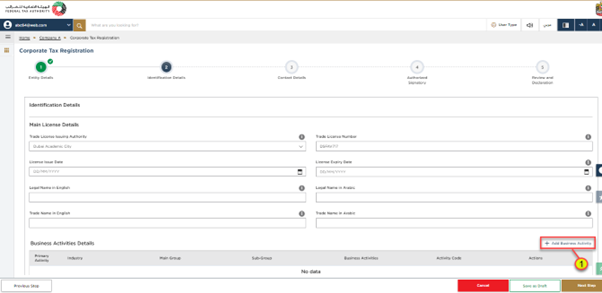

4. Provide identification details

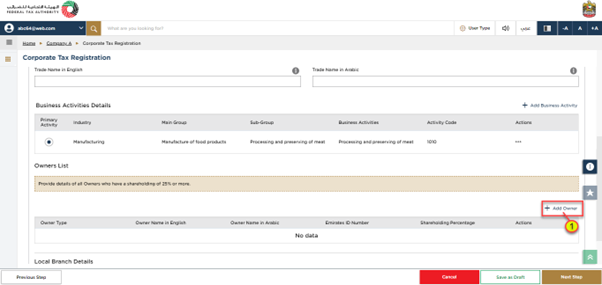

Enter the primary trade license details according to the type of entity. If there are persons/entities who owns 25% or more, you have to provide their ownership information as well.

5. Add business activities

Click on the ‘Add Business Activities’ options to add details about your business. In case there are multiple branches of your business, add the branch details separately.

6. Add names of owners

Click on Add Owner and add the information of the owners who own 25% or more of the company.

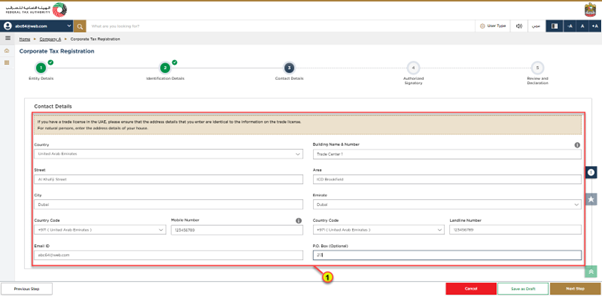

7. Provide contact information

Enter the business’s registered address and contact information, then click Next Step to proceed.

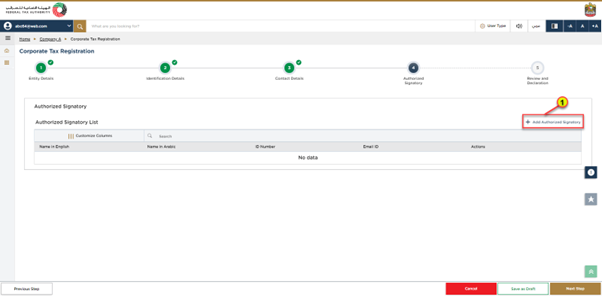

8. Add the names of Authorised Signatories

Select “Add Authorised Signatory” to add the necessary information of the signatories (you can include multiple if required). Upload proof for the authorisation wherever necessary.

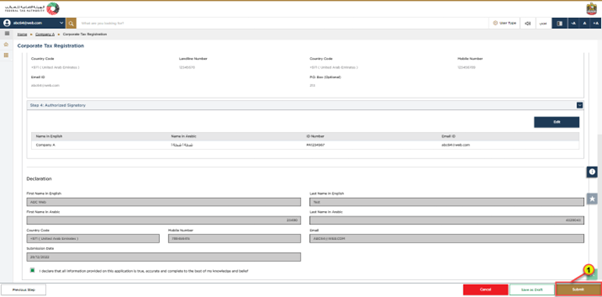

9. Review, declare, and submit

After entering all required information, the application should be thoroughly checked.

Please tick the box below to verify that all information provided is true and accurate.

Click on ‘Submit’.

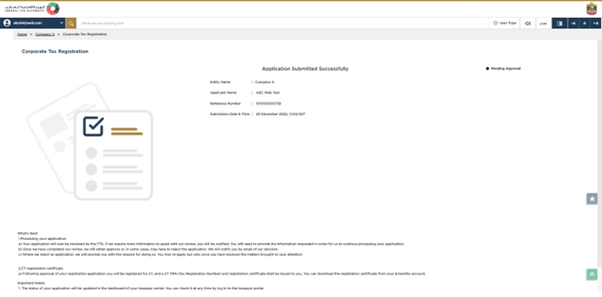

Once you have submitted the application, you will receive an application reference number.

Processing time for UAE corporate tax registration

After you submit your Corporate Tax registration application on the EmaraTax portal, the FTAwill review it. You will get a confirmation email within approximately 20 business days, along with your Tax Registration Number (TRN).

If the FTA needs additional information to verify your application, it will request it via EmaraTax/email.

Common mistakes to avoid during UAE corporate tax registration

Here are frequent issues that can cause delays or compliance risk:

- Entering trade licence details incorrectly

Mismatched licence numbers, legal names, issue/expiry dates, or licensing authority details often lead to follow-up requests.

- Misstating ownership and control details (25%+ owners)

Not adding owners who meet the 25% or more threshold, or adding them with incorrect identification details.

- Choosing the wrong entity type or financial year/tax period

Selecting an incorrect legal form, tax period, or financial year can create downstream filing and compliance complications.

- Assuming you’re exempt (or 0% applies) and skipping registration

Some entities are exempt, but many exemptions require specific conditions and/or recognition (e.g., listed by Cabinet decision or approval processes depending on category). Treat exemption as something to confirm and document, not assume.

- Ignoring Related Party/Connected Person considerations

Transactions with owners, directors, or group entities can fall under Related Parties/Connected Persons and may trigger transfer pricing obligations and disclosures. It’s best to map these relationships early so your registration and future filings are consistent.

- Arabic data/document issues

If the FTA requests records in Arabic, failing to provide them can create compliance risk. Also, if you input Arabic names/fields, double-check spelling to avoid mismatches.

Adhering to the UAE corporate tax regulations is mandatory. The FTA enforces strict rules, and non-compliance, such as late registration, delayed return filing, or incorrect tax payments, can lead to penalties. These penalties can affect both your company's financial health and reputation.

While Corporate Tax is a new chapter for many UAE businesses, it’s also an opportunity to strengthen financial discipline. Using the right systems can make compliance far less manual.

With TallyPrime, you can navigate this change effectively. This advanced business management software is designed to simplify your accounting and tax compliance needs, including the new corporate tax in the UAE.

Stay prepared with reliable financial reports and one-click statements, get full UAE VAT support, scalable modules for inventory and payroll, and enjoy the flexibility to access reports remotely when needed.

With more automation and fewer errors, you can stay compliant with confidence and focus on growth.

FAQs

What is EmaraTax in the UAE?

EmaraTax is the UAE Federal Tax Authority’s (FTA) online tax platform. It’s used to manage key tax services such as registration, return filing, payments, and refunds, and it can be accessed using channels like UAE Pass.

Who is required to register for Corporate Tax in the UAE?

In general, any person that is subject to UAE Corporate Tax must register with the FTA via the EmaraTax portal to obtain a Corporate Tax Registration Number. The law applies to both "Resident Persons" and "Non-Resident Persons." Businesses earning upto AED 375,000 annually fall below the 0% corporate Tax rate band, while businesses earning over AED 375,000 annually fall in the 9% corporate tax rate band.

What is the penalty for late Corporate Tax registration in the UAE?

If a taxpayer fails to submit a Corporate Tax registration application within the timelines specified by the FTA, an administrative penalty of AED 10,000 may apply under Cabinet Decision No. 10 of 2024 (effective 1 March 2024).

Is UAE corporate tax applicable to Free Zone companies?

Free zone businesses enjoy a 0% corporate tax rate as long as they meet certain conditions. However, these businesses must still register for corporate tax if they generate taxable income over AED 375,000 or if they have operations on the UAE mainland.

Who are exempt from paying UAE corporate tax?

Certain persons can be exempt, subject to the Corporate Tax law and any required conditions/approvals. Common categories include:

- Government Entities/Government Controlled Entities (for mandated activities)

- Extractive and Non-Extractive Businesses

- Qualifying Public Benefit Entities/Investment Funds

- Public/private pension and social security funds

- Certain wholly owned and controlled UAE subsidiaries of specific exempt persons