The VAT Return Form 201 is categorized into 7 broad sections which are further split into various boxes in which the taxpayer has to furnish the required details. In this article, we will discuss furnishing 'Standard Rated Supplies' details under the 'VAT on sales and all other outputs' section of VAT Return Form 201.

To know more about how to file TAX Return and details to be furnished on other sections of VAT return form 201, read How to File VAT Return in UAE – Form VAT 201 .

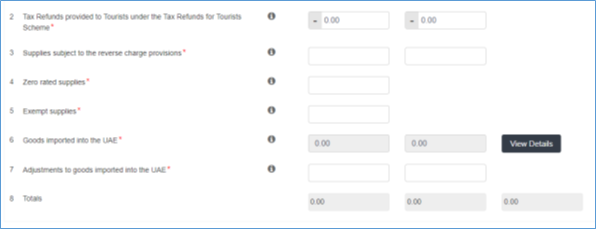

The VAT on sales and other outputs section contains 8 boxes in which the sales and output VAT details need to be furnished to complete the TAX Return filing. The details of boxes available under VAT on sales and all other outputs are given below:

As shown in the image above, against each box, you need to capture the details in the following columns:

- Amount (AED): You need to mention the amount in AED relating to sales and other outputs less VAT for each of the Emirates.

- VAT Amount (AED): You need to mention the output VAT amount levied on your sales for each Emirate.

- Adjustment (AED): Any adjustments required for Output Tax as a result of adjustments for bad debts, sales of commercial property in the UAE need to be reported here. If these adjustments are not applicable to you, please mention ‘0’.

Let us discuss the details required to be captured in standard rated supplies which determines your output VAT liability,

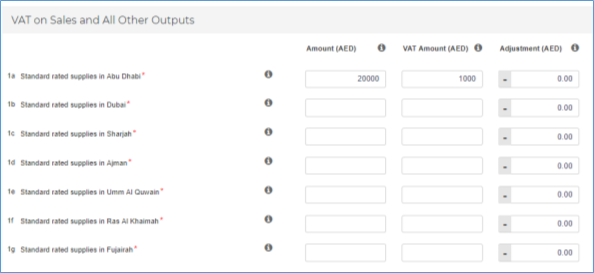

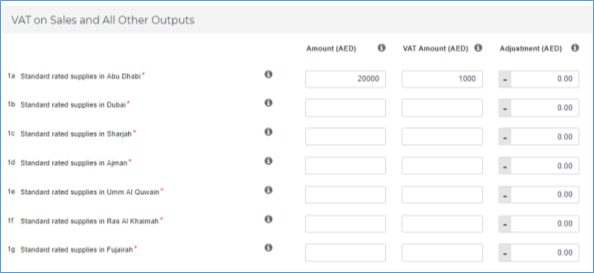

Standard Rated Supplies at Emirates Level

In the above box, the taxpayer is required to declare the net value of standard supplies and applicable output VAT. Standard rated supplies are those supplies that are subject to VAT at 5%. Here, net value refers to the value of the supplies excluding the VAT charged to the customer.

For example, if you have sold goods for AED 1000 plus VAT AED 50, you should report AED 1000 under 'Amount (AED) column and AED 50 under the 'VAT Amount (AED) column.

This information should be identified at the Emirate in which the supply was made and accordingly you need to furnish the details in boxes 1a to 1g.

For businesses with fixed establishments in the UAE, the supply should be reported in the Emirate where the fixed establishment, most closely connected to the supply is located. For non-established businesses, the supply should be reported in the Emirate where the supply was received.

The table explains the types of supplies which need to be reported along with the treatment if any.

|

Type of Supplies |

Included or Excluded |

Treatment in VAT Return Form |

|

Standard Rated Sales |

Included |

All supplies of goods and services subject to VAT at 5% need to be reported at Emirate Level. Mention the Net Value of supplies in ‘Amount’ column and output VAT levied in ‘VAT Amount’ column. |

|

Standard Rated Supplies at Discounted Rate |

Included |

Supplies of goods and services at a discounted rate should be reported after reducing the discount value. For example, selling goods for AED 1,000 and discount 10%. Here, the taxable value will be AED 900 (AED 1,000- 10% discount) and VAT will be AED 45. |

|

Advance Received |

Included |

Advance received against the taxable supply is taxable at 5%. In this case, you need to report 5% of advance received as ‘VAT Amount’ and remaining under ‘Amount Field. For example, if you have received AED 10,500 in advance, then you need to report AED 10,000 under the ‘Amount’ column and AED 500 under the ‘VAT Amount’ |

|

Credit Note |

Included |

The value of the credit note issued needs to be reduced from you standard rated supplies and only the net needs to be reported. |

|

Sales through Vending Machine |

Included |

These types of supplies should also be reported under standard rated supplies. The only change here is that you need to report it in the tax return period in which you have collected the funds from that vending machine. |

|

Deemed Supplies |

Included |

Deemed supplies, such as gifts of business assets that are above the permitted limits, business assets put to private use, etc. should be reported. The taxpayer needs to self-book such supplies and account for the output VAT. Also, goods and services that you own at the date of tax deregistration must also be reported here. |

|

Supplies under Profit Margin Scheme |

Included |

Even though the VAT due is calculated on the profit achieved, still it is required to report the full value of goods sold under the profit margin scheme less the value of VAT calculated on the margin. |

|

Supplies from the Non-Resident person. |

Included |

Supplies made by a non-resident who had to register in UAE since the recipient of goods or services is not registered in UAE. |

|

Designated Zone supplies – Consumed in Designated Zone |

Included |

Supplies of Goods within Designated Zone which are consumed within Designated Zone. |

|

Sale of Commercial Property |

Included |

If you are a seller of taxable commercial property in the UAE which has taken place in the tax period and the buyer has already paid for the output tax to the FTA, you must account for the output tax as normal and also include the output tax in the adjustments column. |

|

Errors that you are allowed to correct for previous Tax Periods. |

Included |

You will be allowed to correct the errors of the previous tax period in the current return period. You need to adjust the values and show only the net standard rated supplies and output. This is allowed only when an error that had resulted in more or less VAT payable not more than AED 10,000. If the tax value of the error you have discovered is more than AED 10,000 you should submit a voluntary disclosure in the Tax Period in which the error was found. |

|

Designated Zone supplies – Not Consumed in Designated Zone |

Excluded |

Sales of goods located within Designated Zones which are not consumed within the Designated Zone. |

|

Zero Rated Supplies |

Excluded |

Zero-rated supplies, such as exports of goods or services outside the UAE, zero-rated educational services, and zero-rated healthcare services, etc. should not be included in standard rated supplies. |

Key Points to be considered for filing standard rated supplies in VAT Return Form 201

- Insert all amounts in United Arab Emirates Dirhams (AED)

- Insert all amounts to the nearest fils (the form allows for two decimal places)

- Complete all mandatory fields. Mention ‘0’ in boxes that are not applicable to you

- Ensure that value of credit notes issued during the tax return period are considered in arriving at the net value standard rated supplies and output VAT amount

- You need to declare only the value of advance received for a taxable supply. If the amount received is not against a supply like a security deposit or received against exempt supply, such receipts are not required to be reported under this section

- Make sure the time of supply is determined for each of the supplies in accordance with the provisions of VAT Law. Thus you will have to identify and report only those supplies on which VAT is due in the current return period

- In case of sale of commercial property, ensure that output VAT amount is mentioned in the adjustment column as discussed above

Read more about Voluntary Disclosure