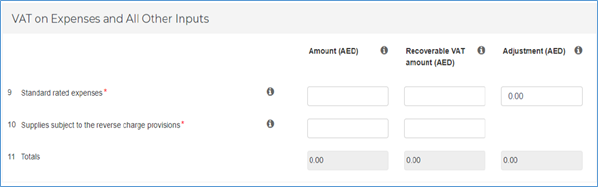

All the purchases and expenses which are subject to the standard rate of VAT at 5% needs to be reported under VAT on 'Expenses and All other Inputs' section of VAT form 201. This section contains two boxes:

- Box 9: Standard rated expenses

- Box 10: Supplies subject to reverse charge provisions

In this article, we will discuss about the details required to be captured in box no. 9 i.e. Standard rated expenses.

Standard Rated Expenses in VAT form 201

In box no. 9 i.e. standard rated expenses, you need to report those taxable purchases or expenses on which you are entitled to recover the Input VAT. In 'Amount (AED)', you need to furnish the value of standard-rated purchases and expenses incurred during the period. Subsequently, the VAT paid on the value of expenses and inputs reported in “Amount (AED)” column, should be mentioned in ‘Recoverable VAT Amount (AED)’ column.

Please note, you need to report only the input VAT you are entitled to recover, not the total value of VAT you have paid during the reporting period.

For example, if you have purchased 100,000 AED plus input of VAT of 5,000 AED which is directly used for making exempt supplies, the VAT of 5,000 AED is not allowed to be recovered since the input VAT recovery is not allowed for making exempt supplies. In such a scenario, the value of purchase i.e. AED 100,000 should be reported in 'Amount (AED)' column and the input VAT of 5,000 AED should not be included in 'Recoverable VAT Amount (AED) column'.

Similar treatment needs to be done for supplies on which input VAT recovery is restricted, like entertainment services provided to non-employees, motor vehicles used for personal use etc. To know more on supplies ineligible for input tax recovery, please read Supplies not eligible for input tax recovery under VAT in UAE.

The table explains the types of supplies which need to be reported along with the treatment, if any.

|

Type of Supplies |

Included or Excluded |

Treatment in VAT Return Form |

|

Standard Rated Purchase/Expenses |

Included |

Goods or services purchased for business purposes from VAT registered suppliers that were subject to VAT at 5%. |

|

Standard Rated Purchase/expenses at Discounted Rate |

Included |

Purchase/expenses at a discounted rate should be reported after reducing the discount value. For example, purchase goods for AED 1,000 and discount 10%. Here, the taxable value will be AED 900 (AED 1,000 - 10% discount) and VAT will be AED 45. |

|

Credit Note/Debit Note |

Included |

The value of the credit note received from your supplier needs to be reduced from your standard rated purchases/expenses and only the net needs to be reported. |

|

Purchases under Profit Margin Scheme |

Included |

The total price that you have paid for the goods purchased, which you are selling under the profit margin scheme. |

|

Errors that you are allowed to correct for previous Tax Periods. |

Included |

You will be allowed to correct the errors of previous tax periods in the current return period. You need to adjust the values and show only the net standard rated expenses and input VAT. This is allowed only when an error had resulted in more or less VAT payable, of not more than AED 10,000. If the tax value of the error you have discovered is more than AED 10,000 you should submit a voluntary disclosure in the Tax Period in which the error was found. |

|

Designated Zone supplies – Not Consumed in Designated Zone |

Excluded |

Purchase of goods located within Designated Zones which are not consumed within the Designated Zone or subsequently imported into the UAE mainland. |

|

Zero Rated Purchases |

Excluded |

Zero-rated supplies, such as exports of goods or services outside the UAE, zero-rated educational services, and zero-rated healthcare services, etc. should not be included in standard rated expenses. |

|

Purchases/Expense Ineligible for Input VAT Recovery |

Excluded |

Expenses where the input tax is specifically disallowed, such as entertainment costs, motor vehicles that are available for private use, supplies used for exempt supplies or non-business supplies, etc. |

|

Other Expenses |

Excluded |

Wages, salaries, gifts, or donations of money freely given for nothing in return, money invested into and taken out of the business by you, fines and penalty charges received like traffic fines, etc. |

Key Points to be considered for filing standard expenses in VAT Form 201

- Ensure that the value of credit notes/debit notes issued by your supplier during the return period are considered in arriving at the net value of standard-rated expenses and output VAT amount

- Ensure that supplies on which input VAT is restricted are not included in ‘Input VAT Recovery column

- Do not include the value of reverse charge supplies in box no. 9. It should be reported separately in box no. 10

- Adjustments column to be used only in the following cases :

- Input VAT adjustment due to VAT Bad Debt Relief made by your supplier

- Input tax apportionment annual adjustments – Applicable only from 2019 onwards

- Input VAT adjustments under capital assets scheme

To know more about the input VAT adjustments to be reported in VAT form 201, please read 'Input VAT Adjustment in VAT Return Form 201'.

Read more about Voluntary Disclosure