Effortless VAT Calculation at your Fingertips

INV-2026-##

Taxable Value:

AED 0

VAT Amount:

AED 0

Your Total amount inclusive of tax is

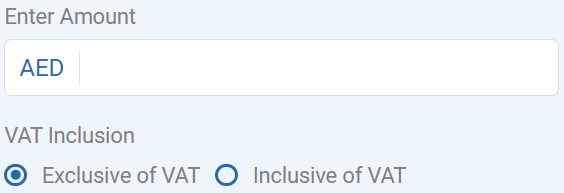

Calculating VAT is a breeze with our user-friendly VAT calculator. Just follow these simple steps:

Enter the price of VAT in the amount field and choose whether it's "Inclusive" or "Exclusive" of VAT.

Mention the VAT rate based on your service provided.

Hit the "Calculate" button to instantly get your VAT calculation.

To calculate VAT, all you need to know is the amount i.e. the price and the VAT rate. With the help of the VAT calculator, you can calculate exclusive and inclusive VAT.

The Federal Tax Authority (FTA) has imposed a value added tax (VAT) of 15% on the United Arab Emirates. Certain goods and services are classified as free or exempt goods, which means that VAT is not applicable to those goods.

| Scenario | Calculation | Result |

|---|---|---|

| Exclusive of VAT | VAT = AED 200 × 15% | AED 30 |

| Total Amount = AED 200 + AED 30(VAT) | AED 230 | |

| Inclusive of VAT | VAT = AED 200 × 15 / (100 + 15) | AED 26.09 |

| Net Sale Amount = AED 200 × 100/(100+ 15) | AED 173.48 |

The government of UAE has selected three separate slabs as per the annual turnover. The three slabs are:

To understand the VAT system, consider the following example of a mobile phone company.

| Particulars | Manufacturer | Wholesaler | Retailer |

|---|---|---|---|

| Sale Price | AED 100 | AED 200 | AED 300 |

| VAT on Sales @15% | AED 15 | AED 30 | AED 45 |

| VAT Paid on Purchases | AED 0 | AED 15 | AED 30 |

| Net VAT Payable | AED 15 | AED 15 | AED 15 |