In the recent update a new Dh10,000 penalty has been announced by the Ministry of Finance on 27th February 2024 for late Corporate Tax registration that will be implemented from March 1st 2024.

As per the UAE Corporate Tax Laws, in order to get a Tax Registration Number (TRN), it is mandatory that all Taxable Persons and specific types of Exempt Persons (such as Qualifying Public Benefit entities and Qualifying Investment Funds) register for Corporate Tax (CT) with the Federal Tax Authority (FTA) within the stipulated deadline. Failure to register for the Corporate Tax can incur severe legal consequences as well as a hefty fine.

Corporate Tax registration timeline

Federal Tax Authority(FTA) has made it compulsory for the Taxable Persons liable to register for Corporate Tax by certain deadlines to avoid breaking any tax rules. The law went into effect in June of last year and is applicable to Tax Periods beginning on or after June 1, 2023. The new FTA Decision, that went live on March 1, 2024, establishes deadlines for natural and juridical persons that are either resident or non-resident entities to apply for registration for corporate tax.

|

Month of License Issuance The year the license was issued is irrelevant |

Deadline to apply for Corporate Tax Registration |

|

January or February |

May 31, 2024 |

|

March or April |

June 30, 2024 |

|

May |

July 31, 2024 |

|

June |

August 31, 2024 |

|

July |

September 30, 2024 |

|

August or September |

31 October 2024 |

|

October or November |

30 November 2024 |

|

December |

31 December 2024 |

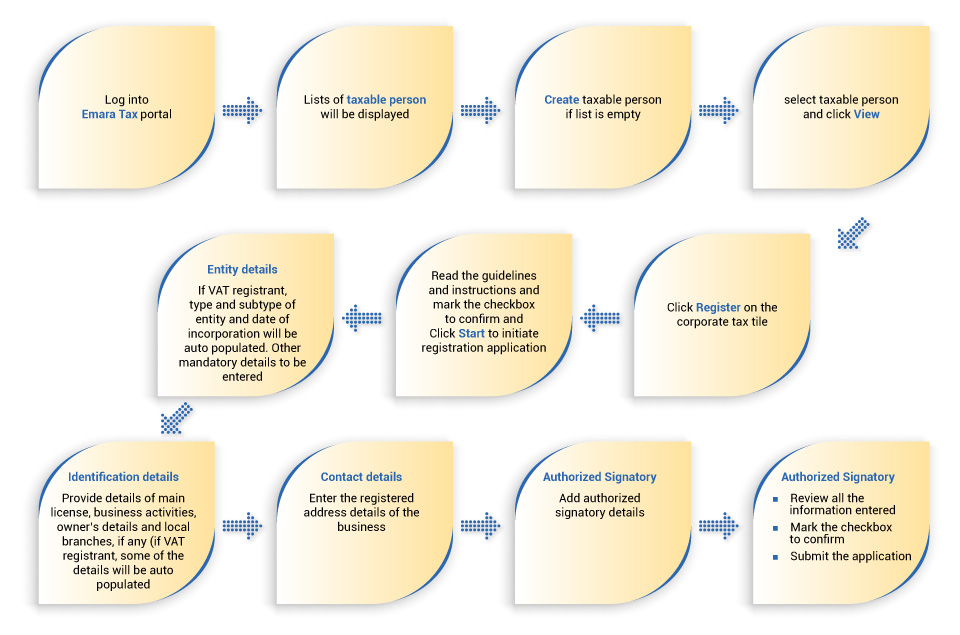

How to register for corporate tax?

The UAE CT Law mandates that all Taxable Persons and specific types of Exempt Persons (such as Qualifying Public Benefit entities and Qualifying Investment Funds) register for Corporate Tax (CT) with the Federal Tax Authority (FTA) to obtain a Tax Registration Number (TRN).

The deadlines for seeking for exemption for specific categories of Exempt Persons under the UAE CT Law and for acquiring CT registration were previously outlined in Decision No. 7 of 2023, which was issued by the FTA.

Penalty on late registration

The purpose of the penalty was to incentivize taxpayers to adhere to tax laws and timely register. The excise tax and value added tax penalties for late registration are correlated with the penalty amount for late tax registration.

Cabinet Decision of 2024, which was made public on 27th February 2024, the Cabinet Decision of 2023's schedule of infractions and administrative fines.

The latter detailed the administrative penalties that would be levied for infractions pertaining to the execution of the Corporate Tax Law by the Federal Tax Authority (FTA). These fines become operative on August 1, 2023. On March 1, 2024, the Cabinet decision will take effect. Hence, an administrative penalty of Dh 10,000 will be imposed for late corporate tax registration on businesses that don’t submit the corporate tax applications within the due date directed by the Federal Tax Authority.

How TallyPrime can help

If your company needs to manage financial transactions, procedures, reports, and more, TallyPrime is the ideal solution.

We provide our business management software, which can handle your company's expanding requirements. Along with many other capabilities, it offers complete support for UAE VAT, from creating tax invoices to accurately completing VAT reports.

- Create quick company reports that assist with calculating corporation tax, including accounting, inventory, and financial statements like balance sheets and profit and loss accounts

- Finishing VAT returns quickly, accurately, and consistently

- Produce invoices that adhere to VAT regulations while overseeing various VAT supply categories, including imports and exports

- Easily maintain your accounting records with excellent accuracy and consistency.

total adaptability to various sales and buying procedures - Different pricing levels may be created for items based on many price points, such as wholesaler, retailer, customer, etc.