What is TRN?

Getting a Tax Registration Number (TRN) in the UAE is one of the most necessary procedures that a business needs to go through under the rules and regulations of the Value Added Tax (VAT) enforced by the Federal Tax Authority (FTA). This guide includes the complete procedure of applying for a TRN along with what documentations are required, and eligibility criteria, and the most common challenges befell by individuals at all stages.

Why is Tax Registration Number (TRN) Important?

A Tax Registration Number (TRN) is a unique 15-digit number assigned to businesses and individuals that get registered for VAT in the UAE. It becomes useful for:

Legal compliance: A business must mention its TRN on every tax-related document, including VAT returns and invoices for legal compliance with the tax laws of the UAE.

Financial transaction: Financial transactions can be traced up by the government with the help of TRNs; thus, it provides transparency and accountability.

Claim Input tax credits: Registered businesses can claim refunds from paying Vat on purchases, which helps maintain cash flow largely.

Required Documents to Get TRN – Tax Registration Number in UAE

To get a TRN number in the UAE for your business, you will have to submit the necessary documents to the concerned department. Hiring a trusted and experienced tax consultant from an organization like Avyanco would help you in getting the TRN number from Dubai, in the UAE. We make the whole process simple and straightforward and ensure timely registration of your TRN. Below is the list of documents you may have to provide:

- Company's MoA

- Company trade license

- Import or export declarations

- Company Bank Account details

- Company turnover declaration letter

- Company contact details and address

- Emirates IDs of shareholders/managers

- Passport photocopies of shareholder/manager

- Last Year's income statement and bank details

- Sample invoices from the suppliers and customers.

Step-by-Step Process to Apply for a TRN

With some easy and accurate steps, you can start online VAT registration in UAE and receive your TRN number and certificate.

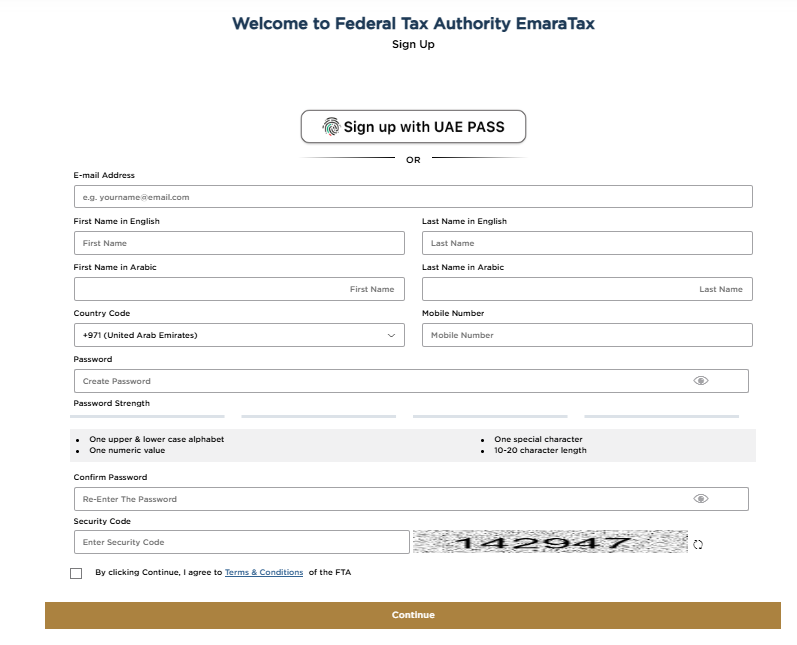

- Visit https://eservices.tax.gov.ae and click Sign up option on the left side of the box

- Fill in the sign-up form.

- An auto-email will be sent to verify your registered email address.

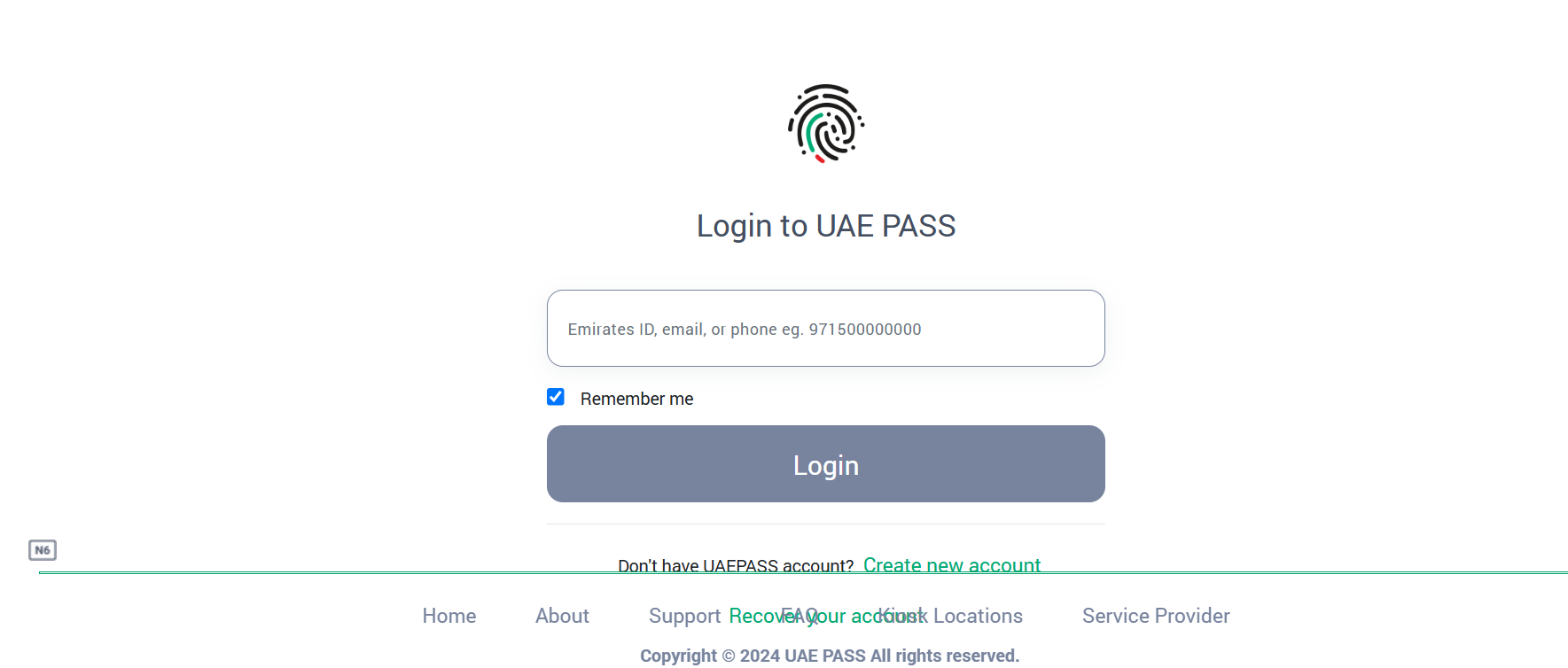

- Or you can Login with your UAE pass.

- Confirm your email, log in to your e-service account.

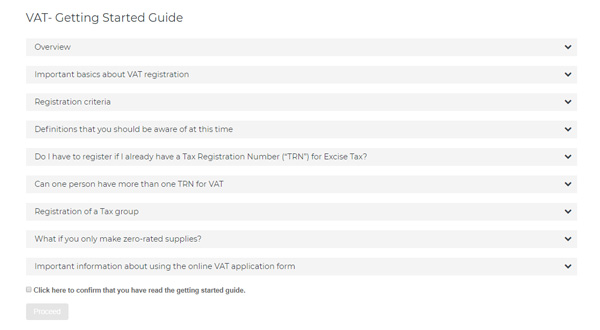

- Click Register for VAT in your dashboard, then navigate the Getting Started Guide. After reading the guide, tick Click here to confirm you have read the getting started guide, then click Proceed.

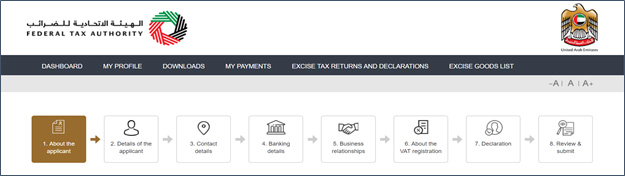

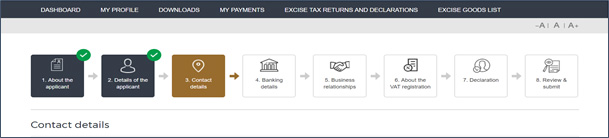

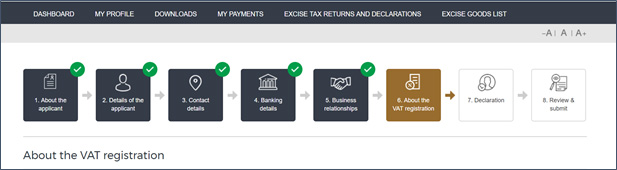

- An online form containing 8 sections will be opened

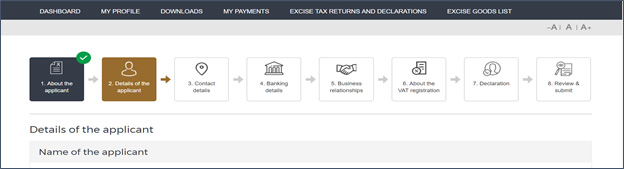

- During VAT registration, different color indicators will track application progress: in progress sections by brown and completed sections by green.

- Moving to the following sections is only allowed when mandatory details are completed

VAT registration form Sections

Section (1): About the applicant

On what basis are you applying for registration: select the appropriate option applicable to your business:

A natural person: That includes individuals and individuals operating in a partnership where the partnership itself does not have a specific legal form.

A legal person: That includes companies, partnerships, clubs, charities, associations, government entities, international organizations, and other entities with similar characteristics.

Do you hold a Trade License in the UAE: Any license issued by an authorized issuing body in the UAE, including UAE Free Zone. If you have one or more select Yes, otherwise, select No.

Are you registering mandatorily or voluntarily: Registration criteria is as the following:

- (Mandatory registration): Businesses resident in the GCC, if you are making supplies of goods or services in the UAE and either your turnover was more than AED 375,000 in the last 12 months, or expect that will be more than AED 375,000 in the next 30 days.

- (Voluntary registration): You are eligible to apply if either your turnover or expenses were more than AED 187,500 in the last 12 months; or expect it will be more than AED 187,500 in the next 30 days.

- All Designated Government Bodies and Designated Charities: Must register for VAT purposes.

- Businesses resident outside the GCC: When you are making or expect to make supplies of goods or services in the UAE and there is no other person who is required to account for the VAT due in the UAE on your behalf.

Are you also applying to create or join a Tax group: Select YES if it is applicable. Else, select NO. Click Save and continue. If you would like to visit the section later and complete it, click save as draft.

![]()

Section (2): Details of the applicant

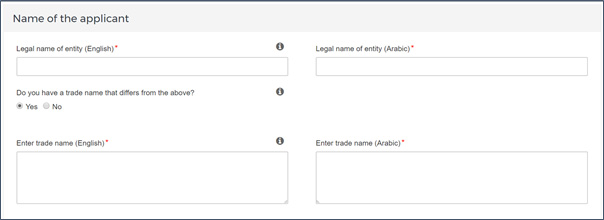

Name of the applicant: Write the legal and trade names in English and Arabic. For an individual, write the full name. For a legal person, write the legal name listed on your license. A trade name is which a person conducts business.

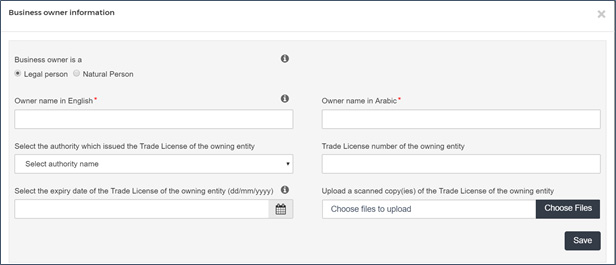

Identification of the applicant

Write all details like the following:

|

Select the name of the authority that issued the Trade License |

Select the relevant authority from the list |

|

Trade License number |

The registered number on your Trade License |

|

Select Trade License expiry date |

Click the calendar icon and identify the expiry date |

|

Upload scanned copy(ies) of Trade License |

PDF, JPG, PNG, or JPEG format, the file size is not more than 2MB |

|

Save Trade License |

Verify provided details and save it by clicking |

|

DO you have Certificate of Incorporation |

If applicable select YES otherwise select NO |

|

Upload a copy of the Certificate of Incorporation |

Only If you selected yes, upload PDF, JPG, PNG, or JPEG format, the file size is not more than 2MB |

|

Upload other relevant documents |

Applicable to businesses who neither have a UAE Trade License nor a Certificate of Incorporation. In this case, you have to upload documents such as: · Articles of Association · Partnership Agreement · Other documents show ownership information · Copy of the Decree (applicable for UAE Government Entities) · Copy of owner Emirates ID or a copy of owner passport (applicable for Natural persons) |

After saving, click Add Owner Details. If your Trade License(s) do not include information of all the owners.

Submit documents providing the requested details. If you have more than one Trade License under the legal entity name, first save the trade license then add another.

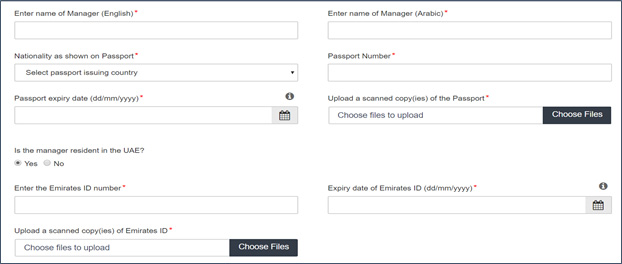

Details of the Manager of the business (CEO or equivalent)

Name of Manager: Write the name in Arabic and English as written in the Trade License. If no manager is listed in the license, write the CEO name or equivalent position.

Nationality: Select the manager nationality as in his passport, then write passport number, select passport expiry date and upload a copy of the passport.

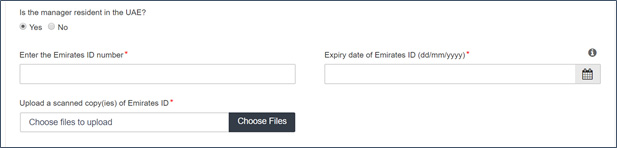

Is the manager resident in the UAE: Select Yes and write Emirate ID number, expiry date of Emirate ID and upload a copy of Emirates ID, otherwise select No, then Click Save and Continue.

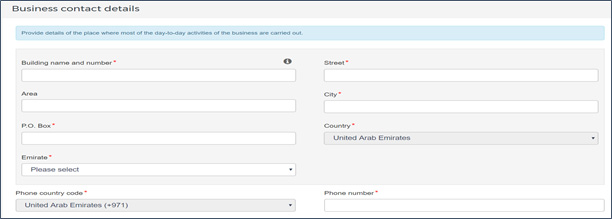

Section (3): Contact details

Write the address and contact details where the daily activities of your business are carried out. If your business is outside UAE, write the contact details of your tax agent in UAE.

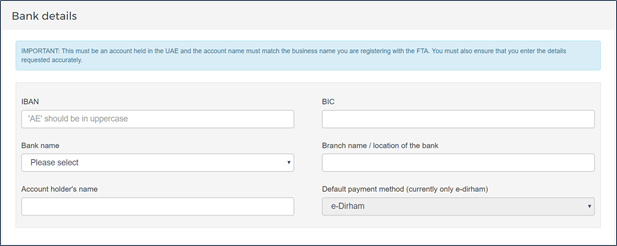

Section (4): Banking details

Write your bank account details accurately such as IBAN (Account Number), BIC (Bank Identifier Code) name of the bank, bank branch name, account holder’s name ...etc.

Be sure of the following:

- Your Bank Account is held with a bank established in UAE

- Your account name matches the legal name of the entity you are registering.

- If you are in the process of opening a bank account, provide copies of any relevant correspondence received from your bank

- Currently, e-Dirham is the only default payment option and by default selected in the form

- If you are unsure whether or not your bank provides an electronic payment facility, check first

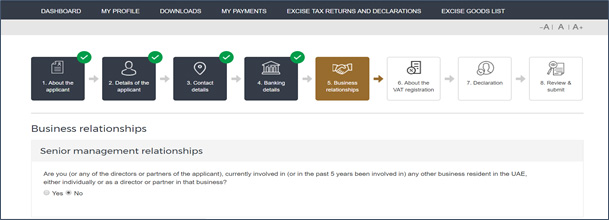

Section (5): Business relationships

If you or any of your directors or partners, currently or in the past 5 years have been involved in any other business resident in the UAE. Select Yes If it is applicable and provide details, otherwise select No.

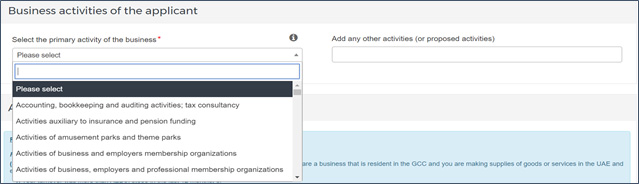

Section (6): About the VAT registration

Business activities of the applicant: Choose from the drop-down list, that best describes your current or intended main business activities. In Add any other activities (or proposed activities) select the other business activities.

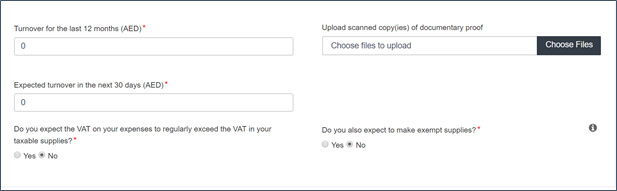

Actual or estimated financial transaction values: Write the turnover value in AED for the past 12 months. Upload a document as evidence of value such as an audit report, audited, or non-audited financial statement, Self-prepared calculation sheet or Revenue forecast, then write the Expected turnover in the next 30 days.

Do you expect the VAT on your expenses to regularly exceed the VAT in your taxable supplies: select Yes if your tax paid on purchases is higher than the tax collected on sales. Otherwise, select No. This helps the UAE government to understand whether or not you will be in a position for VAT payment or VAT refund.

Do you also expect to make exempt supplies: Select Yes if it is applicable otherwise select No.

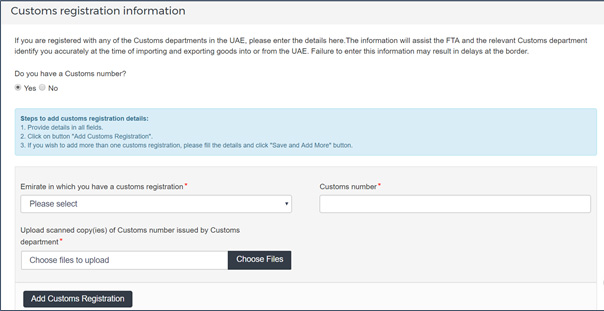

Customs registration information: Write details if you are registered in any UAE Customs department and upload a copy of the custom number, otherwise select No.

Exception from VAT Registration:

Businesses making only zero-rated supplies can select Yes, otherwise select No. The following supplies are eligible for zero-rated supplies in UAE:

- Exports

- Certain international transportation services

- Certain aircraft or vessels

- Certain investments in precious metals

- First supply of certain buildings

- Crude oil and natural gas

- Certain educational services and

- Certain health care services

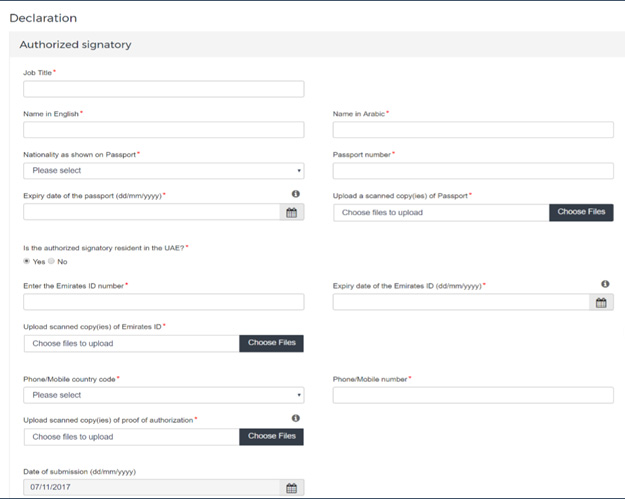

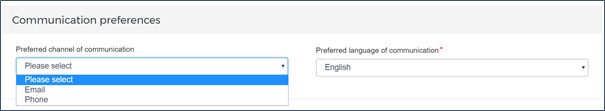

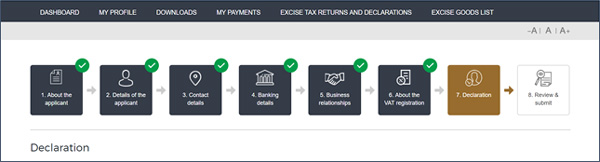

Section (7): Declaration

This is divided into 2 sub-sections:

|

Sub Section (A) Authorized Signatory: |

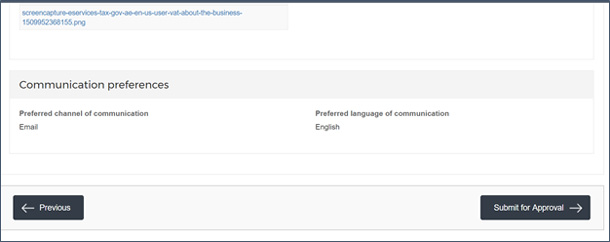

Sub Section (B) Communication Preference: |

|

Write details of the authorized person to represent the business including Job Title, Name, Passport details, Emirates ID, contact details, etc, and upload a copy of a document as evidence of authorization. |

Select the preferred communication and language. |

|

|

|

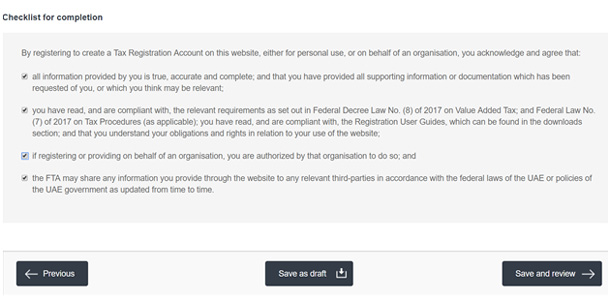

Tick the declarations under Checklist for completion, then click Save and review.

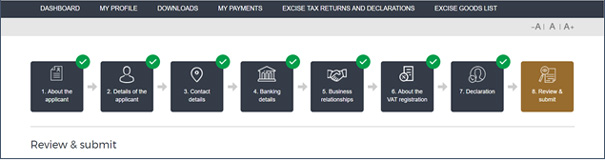

Section (8): Review & submit

Review and verify all details and information you have provided, to complete registration process, then click Submit for Approval.

Penalties & Risks of Using Invalid TRNs in UAE

Penalties for using invalid TRNs in UAE tax transactions primarily target VAT and corporate tax compliance violations enforced by the Federal Tax Authority (FTA).

Key Penalties

Using an invalid Tax Registration Number (TRN) on invoices or claims triggers specific fines:

- AED 10,000 for charging VAT without valid registration.

- AED 5,000 per invoice for incorrect or missing TRN.

- AED 20,000 for late VAT registration beyond timelines.

- Repeated or audit-detected issues add escalating penalties, like 4% monthly on unpaid tax or 50% on errors.

Major Risks

Businesses face denial of input VAT credits on invalid TRN transactions, directly increasing tax liability and cash flow strain. Additional dangers include FTA audits leading to backdated assessments, interest, legal action, financial losses from fraud, reputational harm, and potential contract nullification.

Mitigation Steps

Verify TRNs via FTA's EmaraTax portal before transactions to avoid these issues; invalid ones signal non-registration or fraud. Consult tax advisors for past dealings with invalid TRNs to assess VAT impacts.

Eligibility Criteria

To be eligible for TRN registration:

- You must have a valid trade license issued in the UAE.

- Your business must meet certain turnover thresholds as defined by FTA regulations.

Common Challenges and Mistakes to Avoid

- Incomplete Applications: Ensure all mandatory fields are filled; otherwise, you will encounter errors during submission.

- Incorrect Document Formats: Upload documents in accepted formats (PDF, JPG) not exceeding 2MB each.

- Misunderstanding Tax Group Regulations: Clarify whether you need to join/create a tax group before proceeding.

How can Tally Prime help?

Whether you are a legal person or an individual, Tally Prime can easily manage your VAT requirements for UAE VAT. Right from generating VAT-compliant invoices to return filing, Tally Prime contains all that is required to be VAT compliant while you focus on your business growth.

The built-in capability of error detection and correction ensures that you file an accurate VAT return always. Depending on the location of your business, you can record transactions with relevant taxes for designated zones.

Tally Prime helps your business with its integrated features including:

- Easy and quick to configure the tax details via VAT Rate Set-up

- Ease of managing reverse charge transactions with complete visibility of liability booked and liability yet to be booked

- Account and manage VAT on advance receipts with the help of an advance receipt report

- Generate an Audit File as prescribed by Federal Tax Authority (FTA) at a click of a button.

Frequently Asked Questions

1. What is full form of TRN in the UAE?

The full form of TRN is Tax Registration Number (TRN), it's a unique 15-digit number issued by the UAE Federal Tax Authority (FTA) to businesses and individuals registered under VAT. It is essential for VAT compliance, invoicing, and tax filing.

2. Who is required to apply for a TRN in the UAE?

Businesses with an annual taxable supply exceeding AED 375,000 must register for VAT and obtain a TRN. Voluntary registration is available for businesses with taxable supplies above AED 187,500 per year.

3. What are the steps to apply for a TRN in the UAE?

To apply for a TRN, follow these steps:

Create an account on the Federal Tax Authority (FTA) portal.

Fill out the VAT registration form with required details such as business type, turnover, and financial information.

Submit the application along with supporting documents.

Wait for the FTA to review and approve your application.

4. What documents are required to apply for a TRN?

The necessary documents for TRN application include:

Trade license

Passport copy of the business owner

Emirates ID

Proof of business address

Financial records and turnover details

5. How long does it take to receive the TRN after applying?

The FTA typically reviews and processes TRN applications within 20 business days. You will receive your TRN once the application is approved.

6. How can I verify my TRN in the UAE?

You can verify a TRN by visiting the Federal Tax Authority (FTA) website and entering the TRN on the VAT verification page to confirm its validity.

7. Can I apply for a TRN online in the UAE?

Yes, the entire TRN application process can be completed online through the FTA's official portal.

8. What should I do if my TRN application is rejected?

If your TRN application is rejected, review the rejection reason provided by the FTA. Correct any errors or provide the necessary documentation and reapply.

Explore More Products