In our previous article, we have learnt about deregistration and the process to be followed for de-registering an individual business under VAT. In this article, we will learn how to de-register or amend a tax group. A tax group is a group of 2 or more related parties registered as a single taxable person for the purpose of tax. A major benefit of registering as a tax group is that supplies between the members of a VAT Group are considered as out of scope of VAT and hence, VAT is not applicable. There are certain scenarios where the VAT registration of a VAT Group should be de-registered or amended. Let us understand the scenarios where de-registering or amending a tax group is required and the process for the same.

What are the scenarios for de-registering a tax group in UAE?

The scenarios which require de-registration of a tax group are:

a. The persons registered as a tax VAT group no longer meet the requirements for registration as a tax group

In our article VAT Group registration, we have discussed the requirements for registering as a tax group. If the persons in the tax group do not meet these conditions, the tax group should must be de-registered.

b. The persons no longer have an association based on economic, financial and regulatory practices

A condition for registering as a VAT group is that the persons should be related parties, where one person can control the others either by Law or through the acquisition of shares or voting rights. If the persons do not have such an association, the tax group should be de-registered.

c. There are serious grounds to believe that if the tax group registration is allowed to continue, it would lead to tax evasion or significantly decrease the tax paid to the FTA

If the FTA has reason to believe that the tax group is involved in tax evasion or non-compliance, the FTA can de-register a tax group.

What are the scenarios for amending a tax group in UAE?

The scenarios in which a tax group can be amended are:

- A person should be removed from the tax group, if the person no longer meets the requirements for registering as a tax group

- A person can be added to a tax group where it can be shown to the FTA that the person’s activities should be regarded as part of the business carried out by the tax group

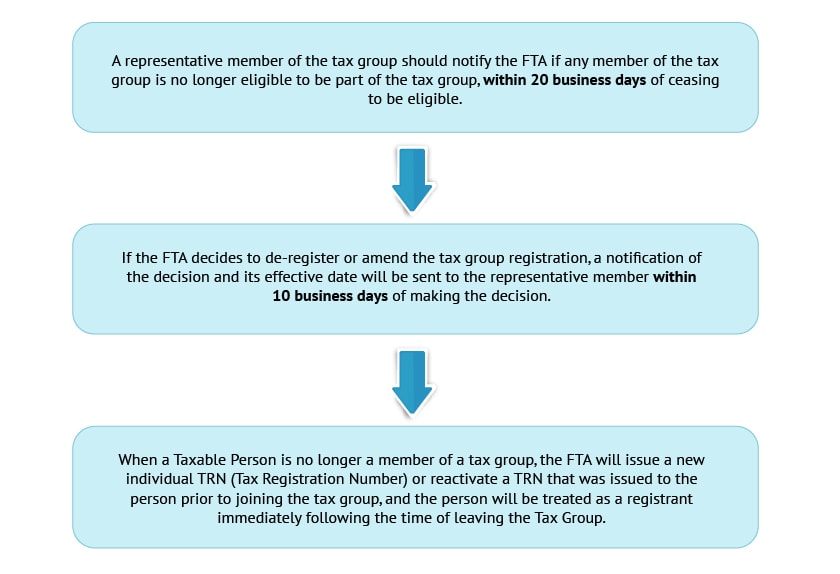

Process of de-registering or amending a tax group under VAT in UAE

Hence, persons registered as tax groups under VAT should note the above scenarios where it is important to de-register or amend the tax group. The process to be followed for de-registering or amending a tax group is similar to the process for de-registering an individual registration.