Launched on December 26, 2022, Fatoora is e-invoicing platform created through the Zakat, Tax, and Customs Authority (ZATCA). Fatoora enables agencies to effortlessly generate, ship, and shop invoices electronically, making it less difficult to conform with tax policies while boosting operational performance. Fatoora targets to growth accuracy, minimize human errors, and streamline business enterprise procedures. It additionally lets in for real-time transaction reporting, which enables us to reduce tax evasion and increases transparency. The Fatoora Portal Guide is designed to help users navigate this important tool more efficiently. Fatoora aims to improve accuracy, reduce human error and simplify business processes. Additionally, it facilitates real-time reporting, helping to reduce tax evasion and providing greater transparency in the financial system.

What is the Fatoora Portal?

The Fatoora Portal is the digital platform that helps this e-invoicing device. It permits groups to trouble and manipulate their invoices electronically, changing traditional paper strategies with dependent virtual codecs. This shift complements efficiency and ensures compliance with tax reporting necessities.

ZATCA delivered e-invoicing to modernize the tax infrastructure in Saudi Arabia, streamline strategies, improve compliance, and fight tax evasion. The mandate for e-invoicing started out on December 4, 2021, and is being applied in phases. The 2d section commenced on January 1, 2023, requiring corporations to integrate their systems with ZATCA's platform for actual-time validation and reporting of invoices. This rollout occurs in waves primarily based on commercial enterprise turnover, making sure a smooth transition for all taxpayers.

Phases of E-Invoicing Implementation

Phase 1: Generation of E-Invoices

Saudi Arabia's e-invoicing initiative kicked off on December 4, 2021, requiring corporations to create and shop electronic and simplified tax invoices the usage of authorised Electronic Invoicing Generation Solutions. This first phase makes a speciality of making monetary reporting less difficult and ensuring compliance with ZATCA regulations, without the need for integration with authorities systems.

Phase 2: Integration with ZATCA’s Systems

Beginning January 1, 2023, Part 2 mandates that companies integrate their payment systems with the ZATCA platform for real-time verification and reporting. Compliance requires the use of XML format and cryptographic seals for enhanced security. ZATCA notifies businesses of their specific transition dates based on taxable income to ensure a smooth transition.

Overall, Fatoora represents an important step towards digitizing the financial system in Saudi Arabia, promoting efficiency and transparency in the administration and aligning with the country’s economic objectives.

Learn more about e-invoicing compliance phases in KSA

How to login to and register on the Fatoora portal?

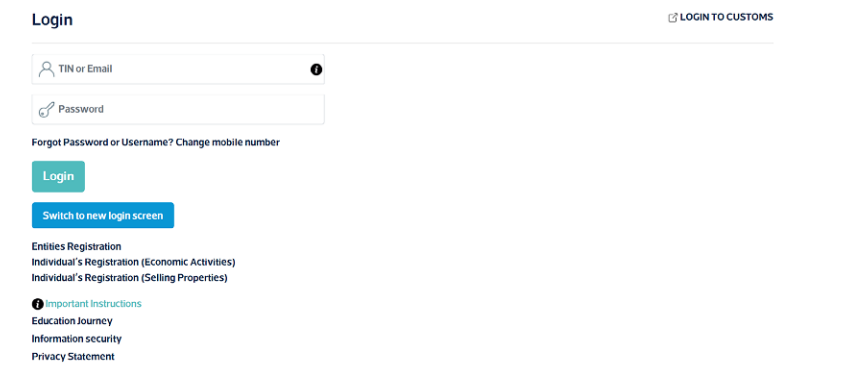

To access on the Fatoora portal,

- Go through https://fatoora.zatca.gov.sa/ or through ZATCA’s website by clicking on Fatoora’s icon to redirect to Fatoora portal.

You can access the portal with EARD credentials

- TIN (Taxpayer Identification Number) or Email registration

- Password

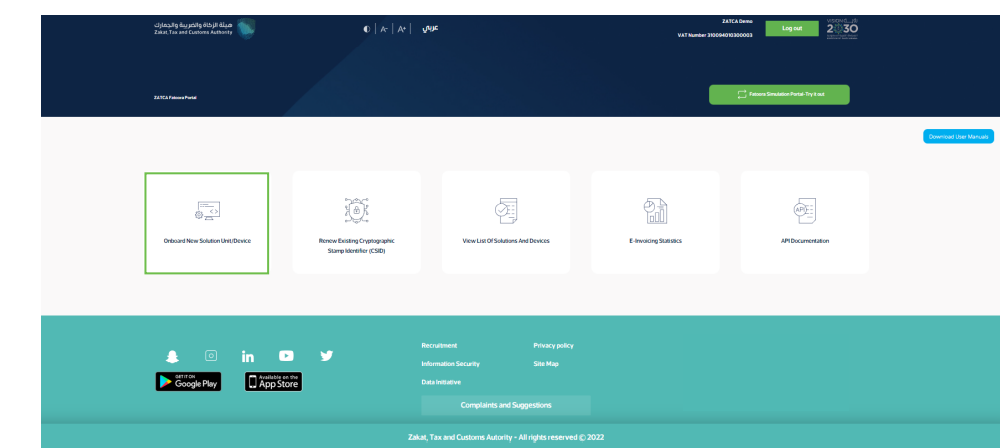

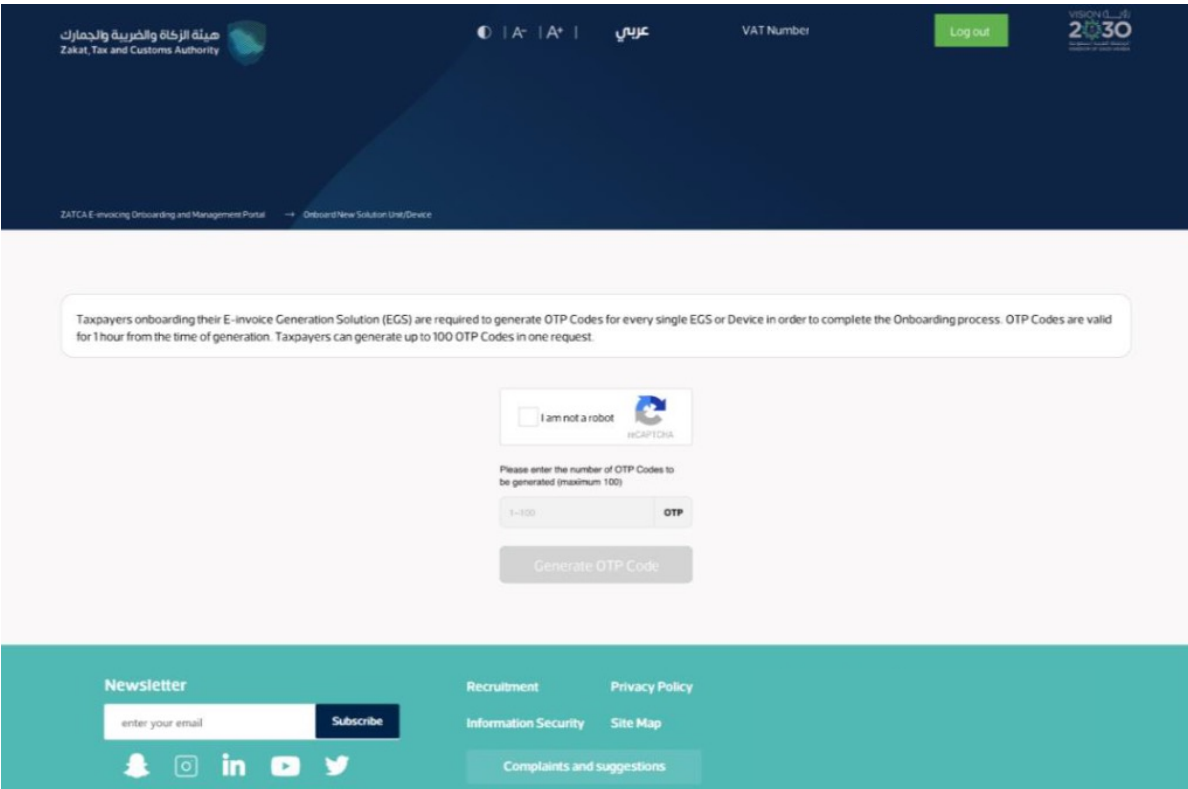

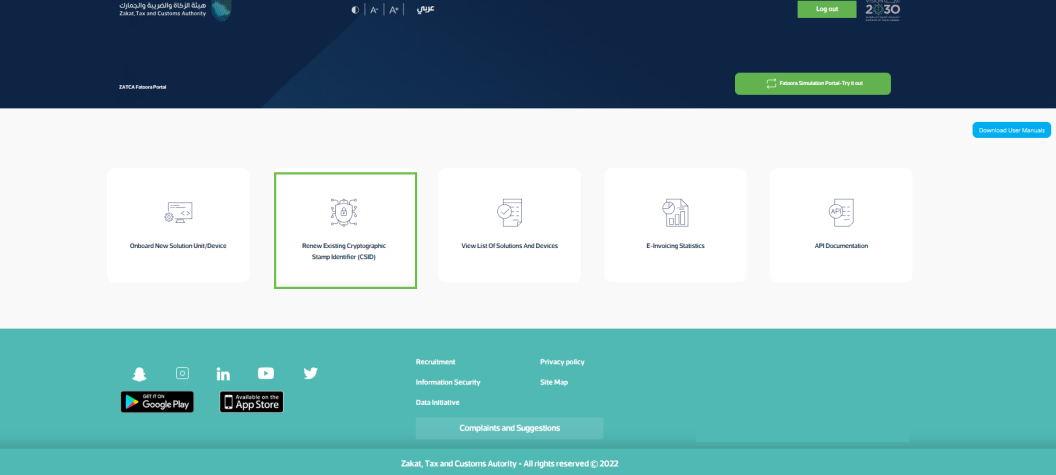

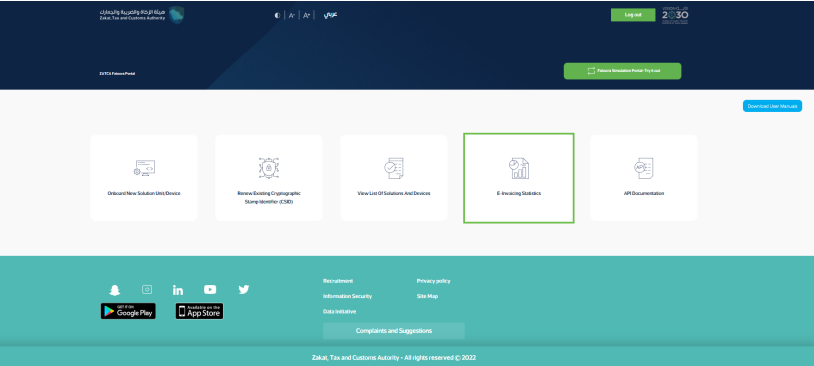

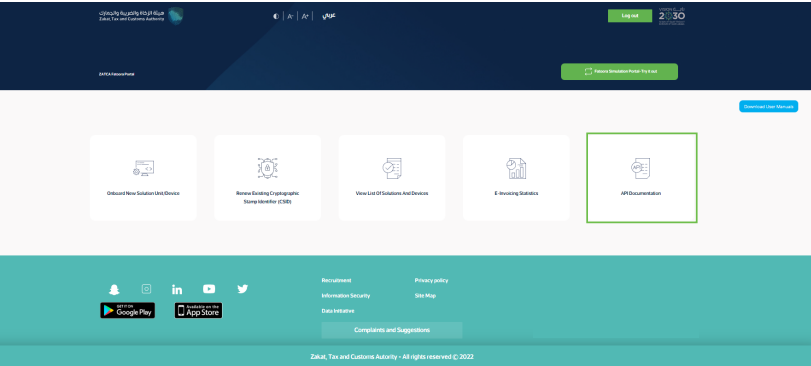

- After accessing Fatoora, click on “onboard new solution unit/device”.

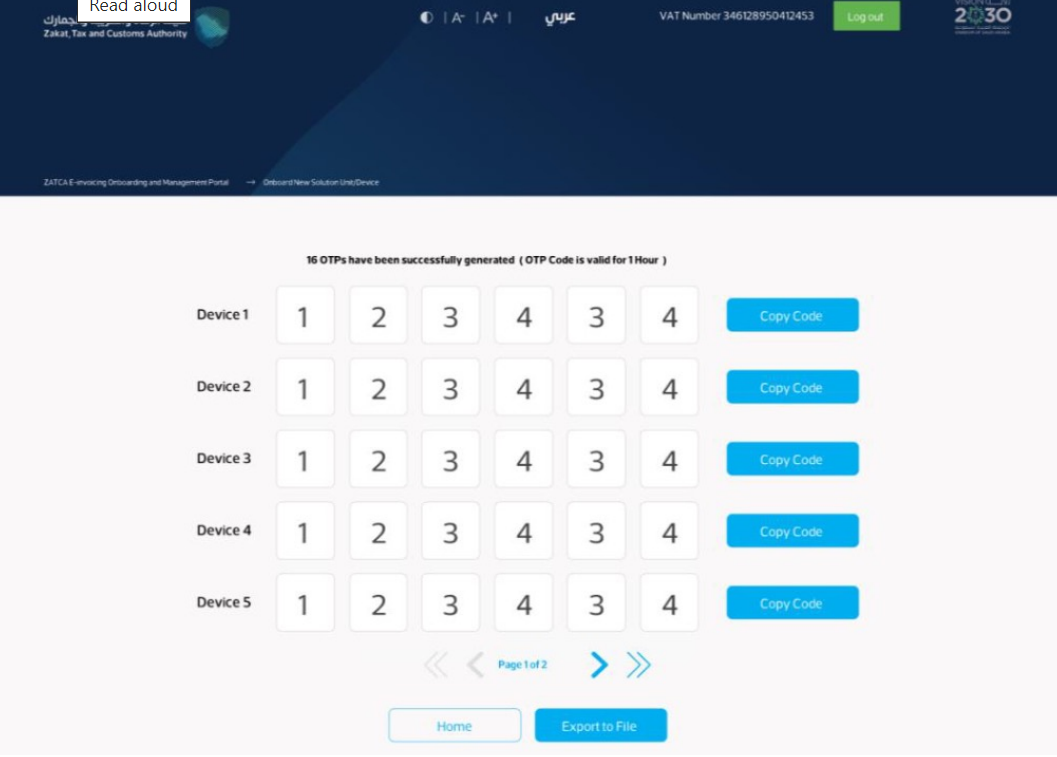

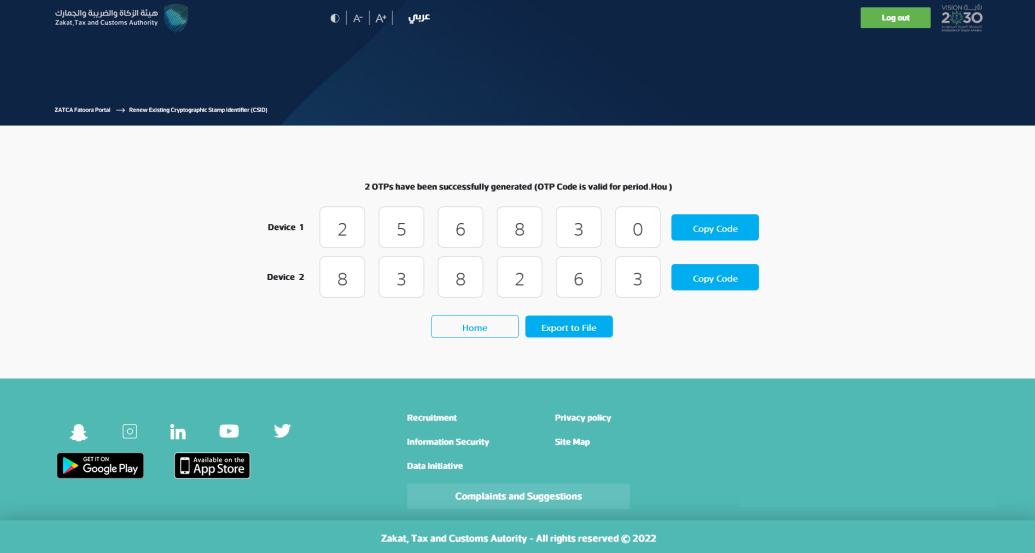

- The Taxpayer chooses to generate OTP code(s) for single or multiple EGS Unit(s) by entering the number of OTP codes they would like to be generated.

- The Fatoora Portal generates the OTP code(s) (valid for 1 hour), which will be displayed on the Portal and can be copied or downloaded in a file.

The Taxpayer enters the OTP code(s) on their own EGS Unit(s) within 1 hour of the OTP code's generation.

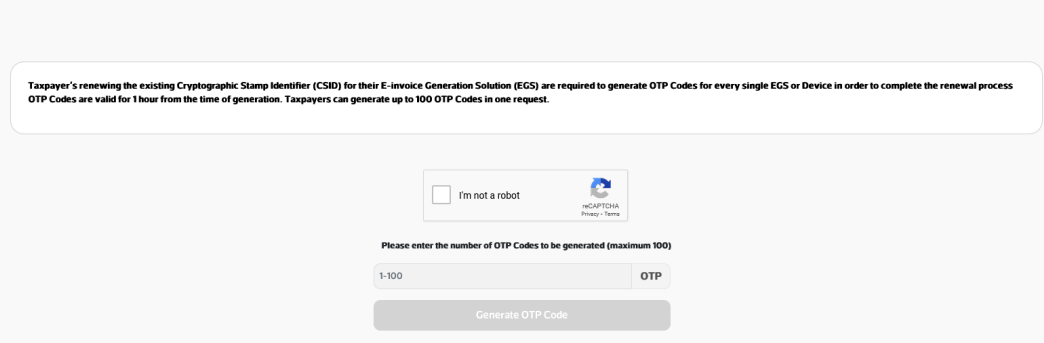

- After accessing Fatoora portal, click on “Renewing Existing Cryptographic Stamp Identifier (CSID)”.

The Taxpayer chooses to generate OTP code(s) for single or multiple EGS Unit(s) which require renewed Existing Cryptographic Stamp Identifiers (CSIDs) by entering the number of OTP codes they would like to be generated.

- The Fatoora Portal generates the OTP code(s) (valid for 1 hour), which will be displayed on the Portal and can be copied or downloaded in a file.

The Taxpayer enters the OTP code(s) on their own EGS Unit(s) which requires renewed Existing Cryptographic Stamp Identifier (CSID) within 1 hour of the OTP code's generation.

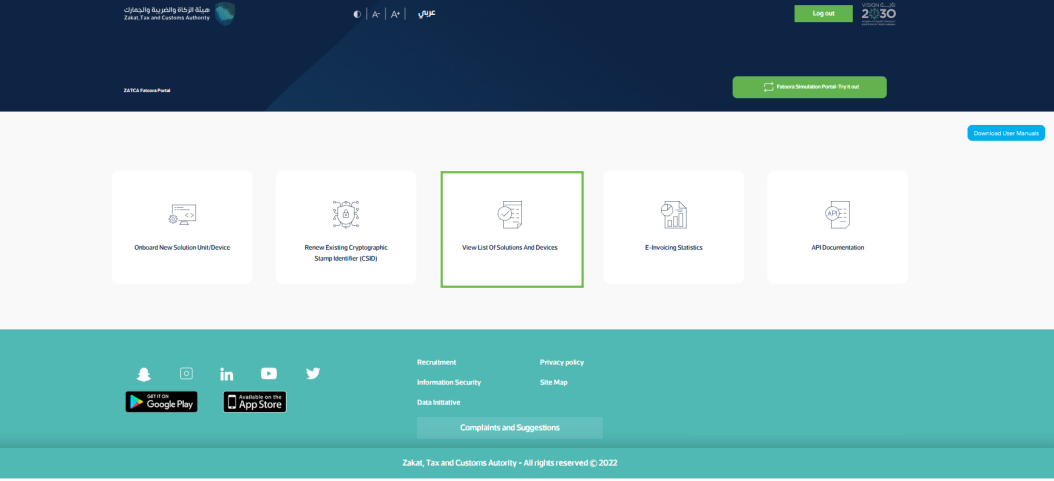

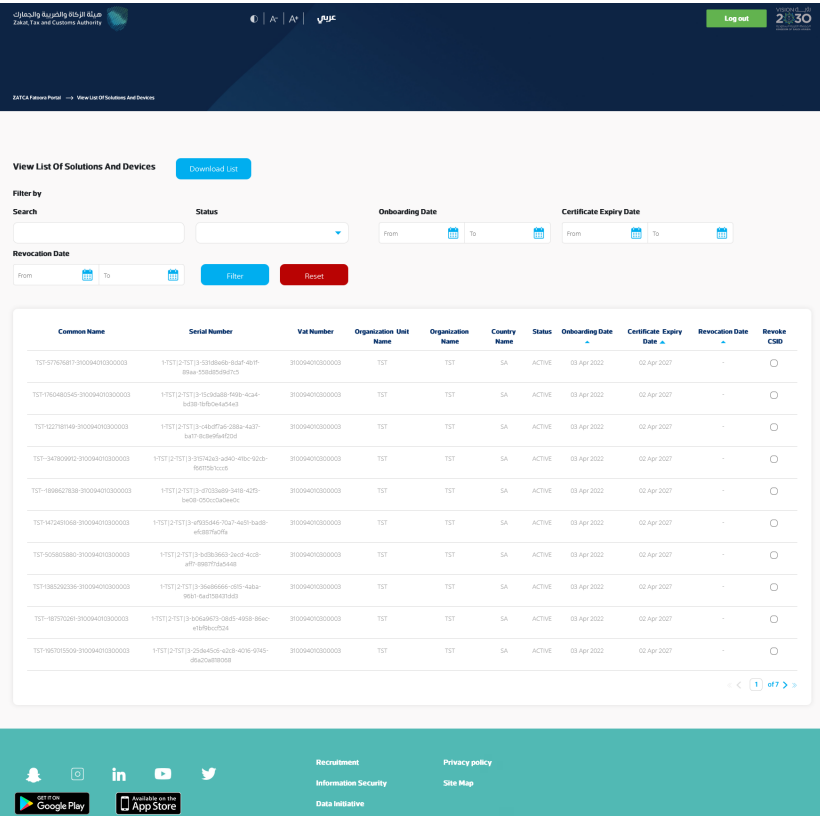

- After accessing Fatoora portal, click on “View list of solutions and devices”.

The user will be able to view a list that includes a summary of all EGS Unit(s) that have been onboarded by the user. In addition, the user can filter, sort and search based on specific inputs available in the list of Solutions and Devices. Also, he can revoke any of the listed devices by clicking on the device and then clicking “revoke”.

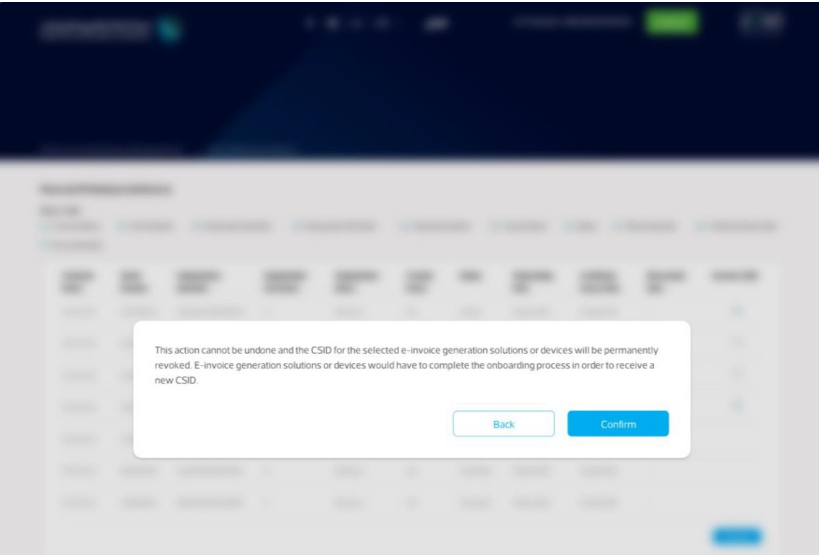

The user is prompted to click on a confirmation message before proceeding with the revocation.

The user is prompted to click on a confirmation message before proceeding with the revocation.

Once the user confirms, the CSID(s) is/are revoked and the EGS Unit(s) is/are longer active.

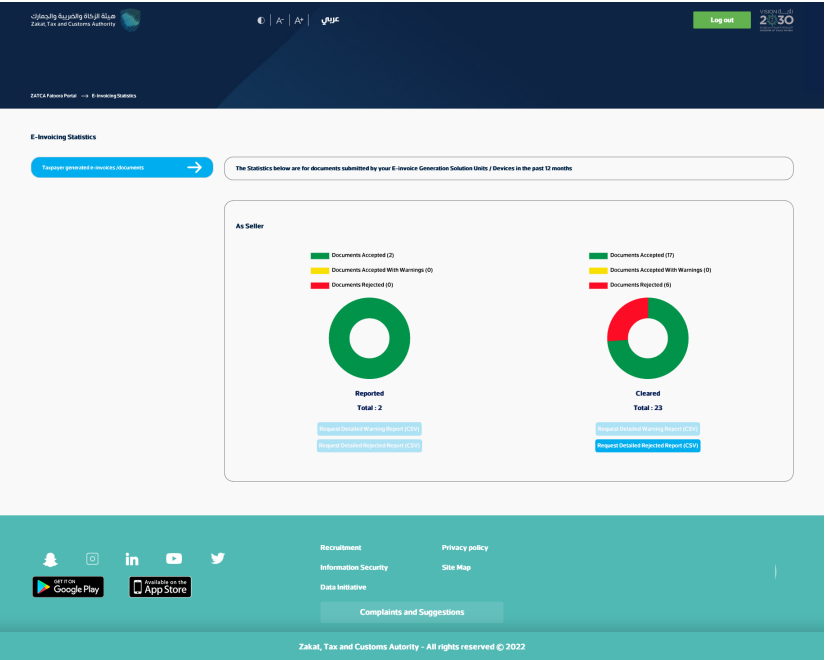

- After accessing Fatoora portal, click on “E-invoicing statistics”:

The user will be able to view summarized statistics of all documents submitted in the past 12 months for Reporting and Clearance, split in terms of "Accepted documents", "Accepted documents with warnings" and "Rejected documents". For the latter two, the Taxpayer can request the detailed CSV files of the errors and warnings.

- After accessing Fatoora portal, click on “API Documentation”.

The Taxpayer will be redirected to the Developer Portal. For instructions on how to use the Developer Portal, please review the Developer Portal User Manual. Please note, these credentials are different from credentials used for Fatoora Portal.

Uses and Facilities Available on the Fatoora Portal

The Fatoora portal is packed with tools designed to make business operations easier and more efficient:

Invoice Management:

- You can create, save, and access your e-invoices anytime.

- It takes care of invoice numbering automatically, ensuring you’re always in line with ZATCA’s standards.

Real-Time Integration:

- Submit invoices directly to ZATCA for instant verification.

- Keep track of your invoice statuses and quickly resolve any discrepancies.

Reporting Tools:

- Generate detailed reports to help with VAT filing and audits.

- Get a clear overview of your transactions and data insights with easy-to-read summaries.

Compliance Assistance:

- Ensure your invoices are formatted correctly and include all required details.

- Get alerts if there’s missing or incorrect information, so you can fix it right away.

Explore how TallyPrime simplifies tax compliance

Wrapping It Up

KSA Fatoora is more than just a regulatory requirement; it’s a step toward a more transparent, efficient, and compliant business environment. By understanding the Fatoora portal and its functionalities, businesses can not only adhere to ZATCA’s mandates but also gain operational advantages. Whether you’re navigating Phase 1 requirements or preparing for Phase 2 integration, staying informed is key to leveraging the full potential of e-invoicing in Saudi Arabia.