- Credit note in Oman VAT

- Conditions for issuing a Credit note

- Format of a Credit note

- Debit note in Oman VAT

- Difference between Credit and Debit note in Oman VAT

In business, return of goods by customers is a common scenario. Goods are returned for various reasons such as damage, faulty products, quality issues etc. The return of goods can be of partial quantity or the complete quantity supplied to the customer. For suppliers, this is known as Sales returns and purchase returns for the buyer.

With VAT in Oman, you can’t just go back to the original invoice and edit it to account for the return of goods. Just like you issue a tax invoice for supplying taxable goods, you need to record a Credit note/Debit note to account for the returns. When goods are returned, the supplier and the buyer need to adjust the output VAT and input VAT.

| VAT Return in Oman | Purchases/Expenses Eligible for Input VAT Deduction |

In this article, let’s understand more about Credit and Debit notes.

Credit note in Oman VAT

A Credit note is a document issued by a supplier when goods sold are returned by a customer. Apart from the sales return, businesses must issue a Credit note in all those situations that reduce the VAT liability. Post-sales discounts, incorrect VAT calculations, etc., are examples of issuing Credit for reducing tax liability.

Let us understand Credit note with an example.

Ali & Co. supplies 10 Monitors @ 70 OMR each to Max Electronics with VAT 5%, i.e. 35 OMR. On the same day, Max Electronics returned 1 monitor to Ali & Co., as it was damaged. In this case, Ali & Co. should issue a credit note to Max Electronics for the monitor returned and reverse the VAT charged on the monitor.

Conditions for issuing a Credit note

To adjust the tax value in the VAT return on account of the return of goods; the following conditions should be met:

- The cancellation or rejection occurs after the tax due date.

- The taxable person issues a credit note and must include a reference to the tax invoice numbers for which the cancelled supply was made.

- The reduction and adjustment are reflected in the accounting records.

- The goods are returned, and the value of the consideration is returned fully or partially- within 3 months from the date of supply. This is applicable if no party has earned a material or other benefit from this return.

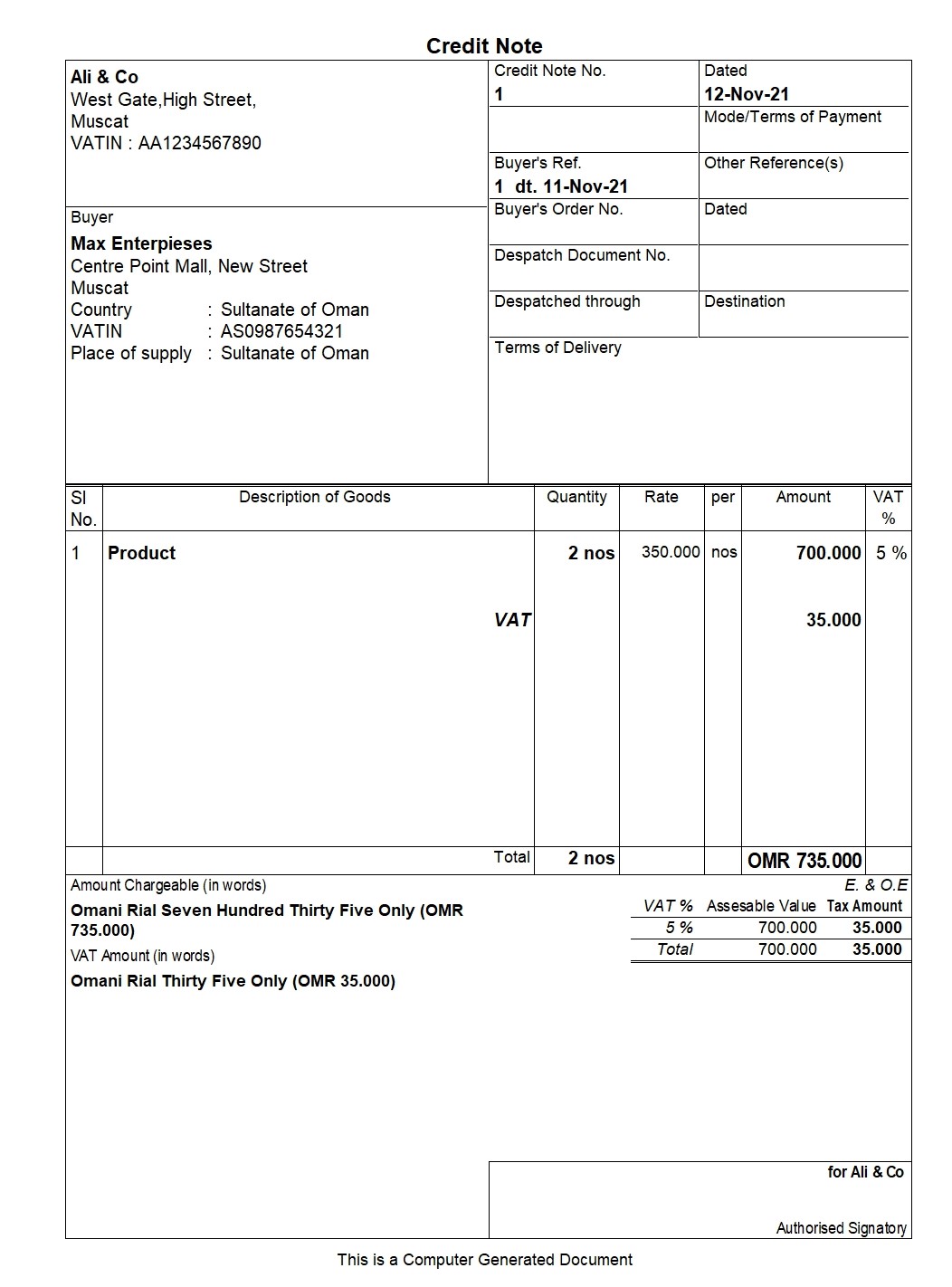

Format of a Credit note

The VAT law and regulation does not prescribe the format in which the credit note should be issued. However, it is best practice to include certain components such as original invoice number, supplier and buyer registration details, supply value, and tax amount.

Debit note in Oman VAT

A Debit Note is a document recorded by the buyer for returning goods to the supplier. Like Credit notes, the businesses need to record a debit note to increase the tax liability—for example, an increase/escalation in supply price, incorrect tax calculation, etc.

Difference between Credit and Debit note in Oman VAT

|

Credit Note |

Debit Note |

|

Issued for sales return |

Issued for purchase return |

|

The supplier issues the credit note |

Buyer issues a debit note |

|

Recorded to account sales return and all other circumstances that lead to a reduction in tax liability |

Recorded to account purchase return and all other circumstances that lead to increase in tax liability |

|

Recording credit note reduces the output tax liability of the taxpayer |

Recording credit note reduces the input tax credit of the taxpayer |

Read more on Oman VAT