What is payroll?

Managing employee payrolls is one of the most crucial, complicated and yet, highly critical HR processes. However, since most manual routine tasks are now being automated by payroll software and hardware solutions, payroll management has become more comfortable. It is because of the employees that companies can grow and flourish and reach their goals. The payment system, thus, needs to be an accurate and speedy one. There are a number of ways in which the payroll system may be used apart from calculating the salaries and disbursing them to the employees.

How do we process payroll accounts?

Companies manage their payroll process in two methods – In house and outsourced. If you want to have control over the timings and want to have the liberty to make changes easily then in-house payroll would be more appropriate for you. Making changes is cheaper and easier with in-house payroll software. It also works best for organisations which pay their employees at different intervals. Companies usually hire payroll services from third parties by way of outsourcing which make the process of accounting for payroll and easy and effortless task. Payroll service provider manages multiple tasks such as tax obligations, employee’s time calculation, preparing checks and salary report management. It eventually reduces the operating cost of the business.

What changes do we see today in processing of Payroll Services?

With the advent of ERP systems, the process has made a shift. Today the ‘Payroll Module’ in a software is totally integrated with the business management solution, which has enabled trouble free payroll processing along with the accounting processes. With automation playing a major role in the way businesses are being managed, payroll services in a software are aimed at making the lives of hiring specialised IT/ HR professionals much easier.

Not just that, since the demand of software being able to multitask has seen an increase, a business owner expects his payroll software services to be highly flexible so that it caters to the increasing needs as the business grows. It should be designed in such a way that there is absolutely no requirements of manual entries. Automatic generation of reports, easy customisation options, simple to use and easy to navigate are some of the key features which business owners look for when choosing a software.

How TallyPrime’s payroll feature will streamline your business process

The payroll feature in TallyPrime is fully integrated with accounting to streamline payroll processing. Organisations can set up and process payroll using simple and complex criteria. A collection of predefined processes in TallyPrime enable error-free automation of payroll process. The payroll feature also provides management related information, statutory forms and reports in the prescribed formats such as:

-

Payslip, payroll statements, attendance and overtime registers

With payroll being such a complicated process with various tasks involved, an automated solution in place helps a great deal in managing this, seamlessly. Keeping this in mind, TallyPrime has given you the provision to choose your action items based on your company’s requirements. A collection of predefined processes in TallyPrime enables error-free automation of payroll process. Further, you can view and handle exceptions effortlessly.

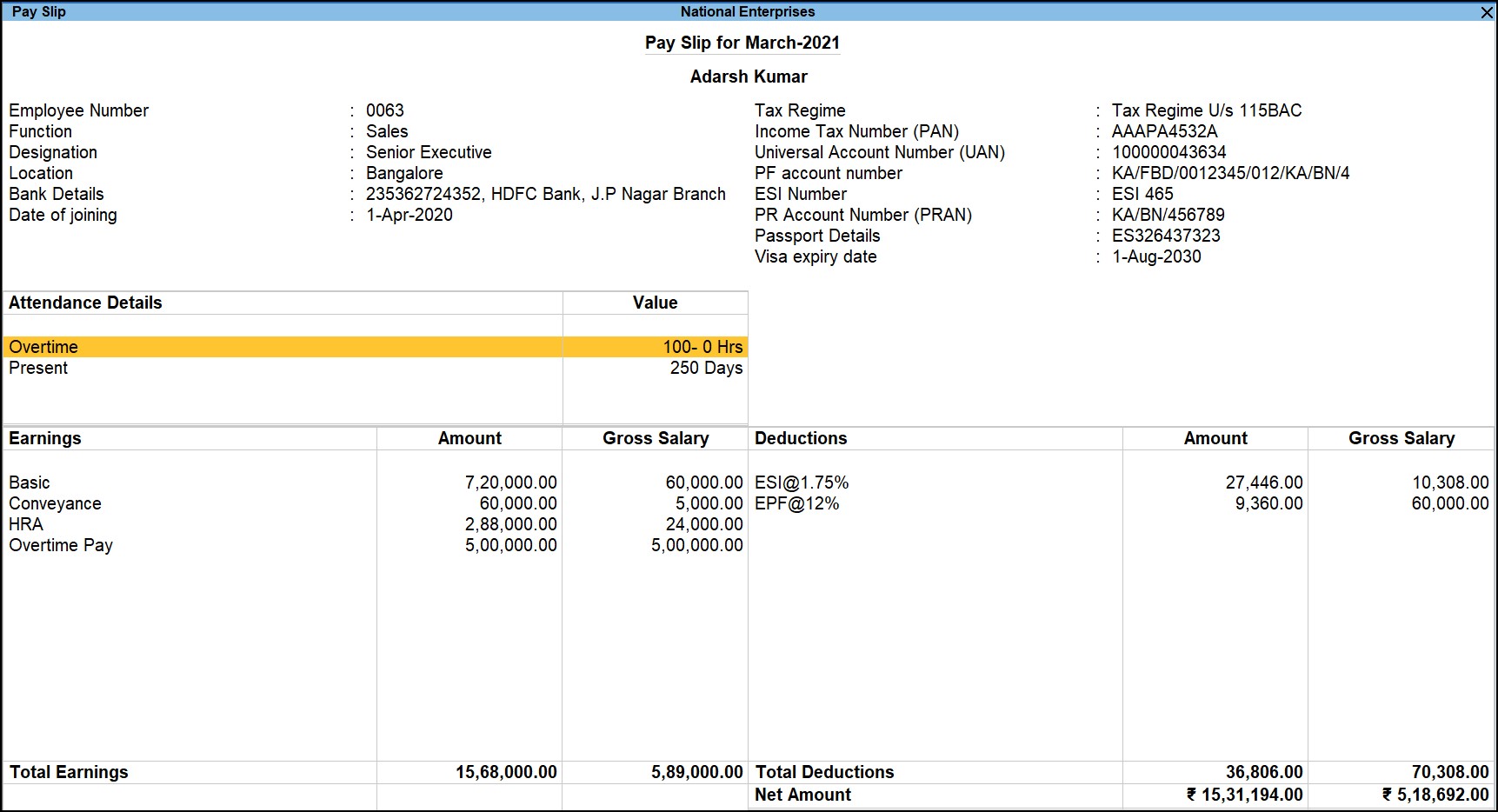

Single payslip in TallyPrime

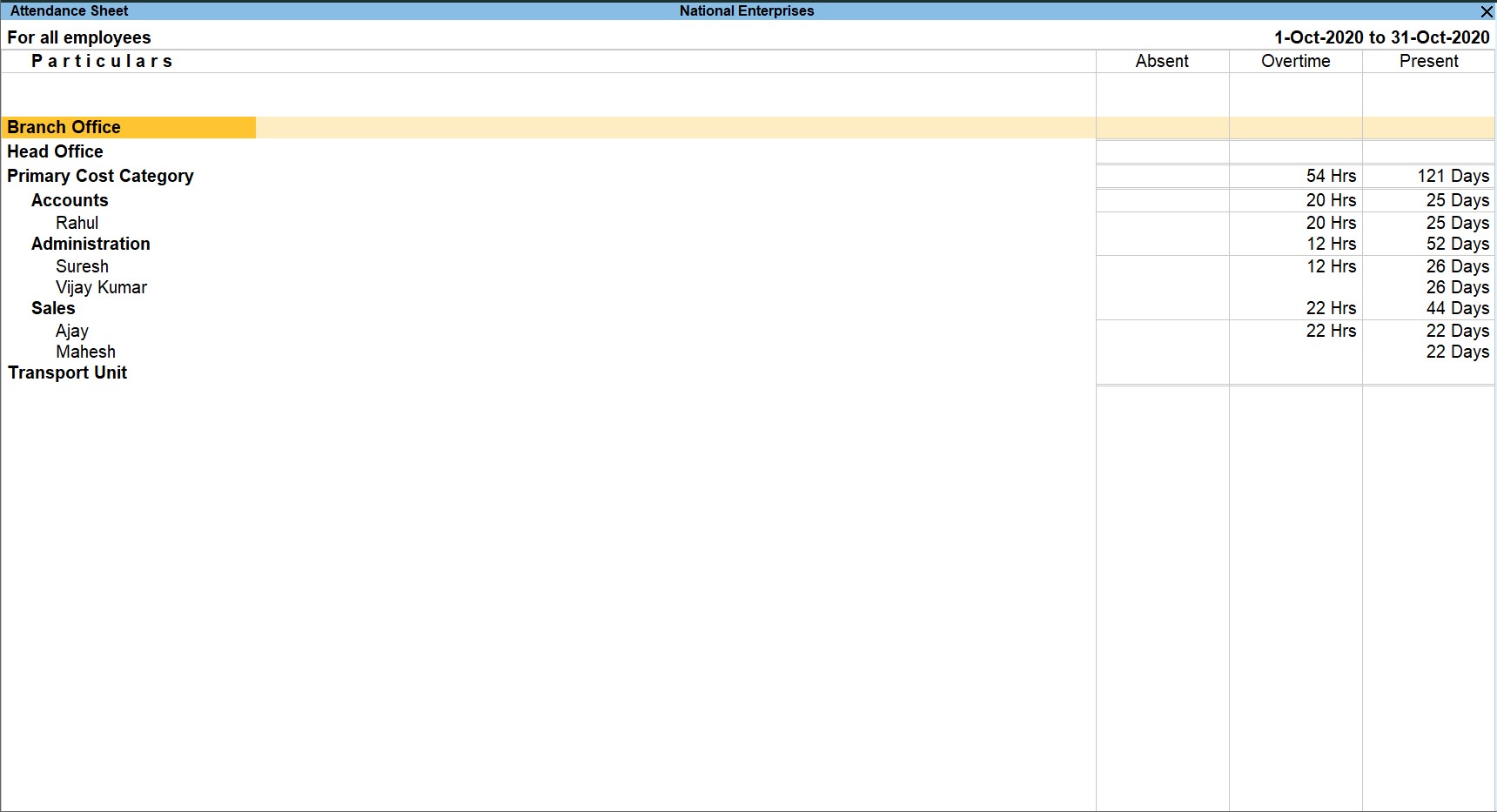

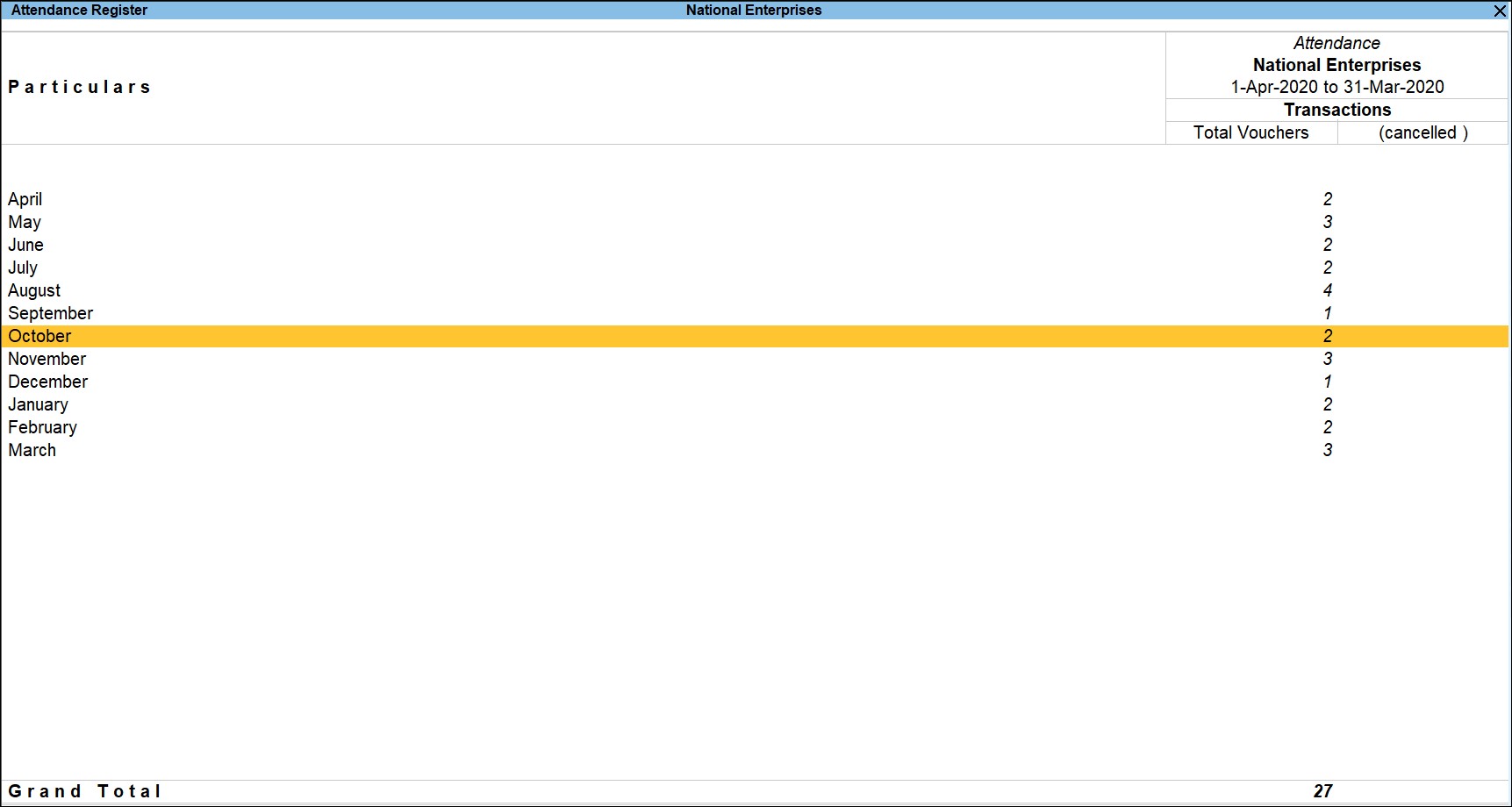

Attendance register in TallyPrime

-

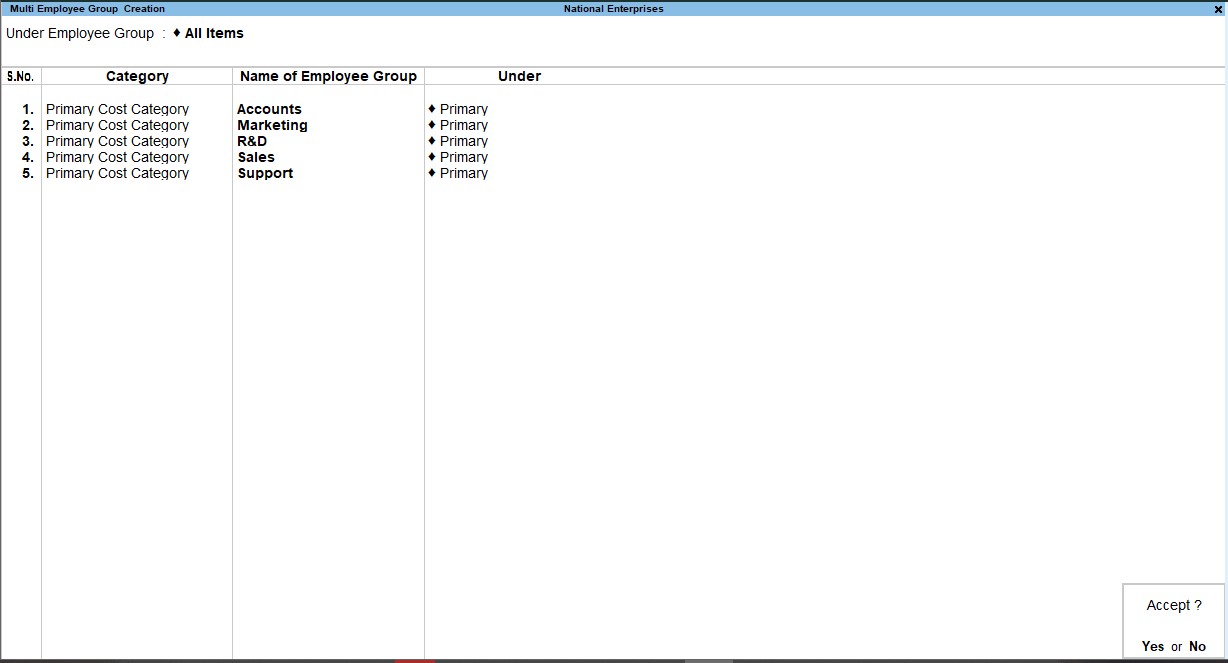

Multiple employee grouping

You can add, delete or change a pay head component or its value for individual employees. To quickly enter the pay structure of each employee, define the Pay Structure for the Employee Group for an employee group using pay heads which are applicable to most employees. You can then copy and apply the same structure to each employee.

Multiple employee grouping in TallyPrime

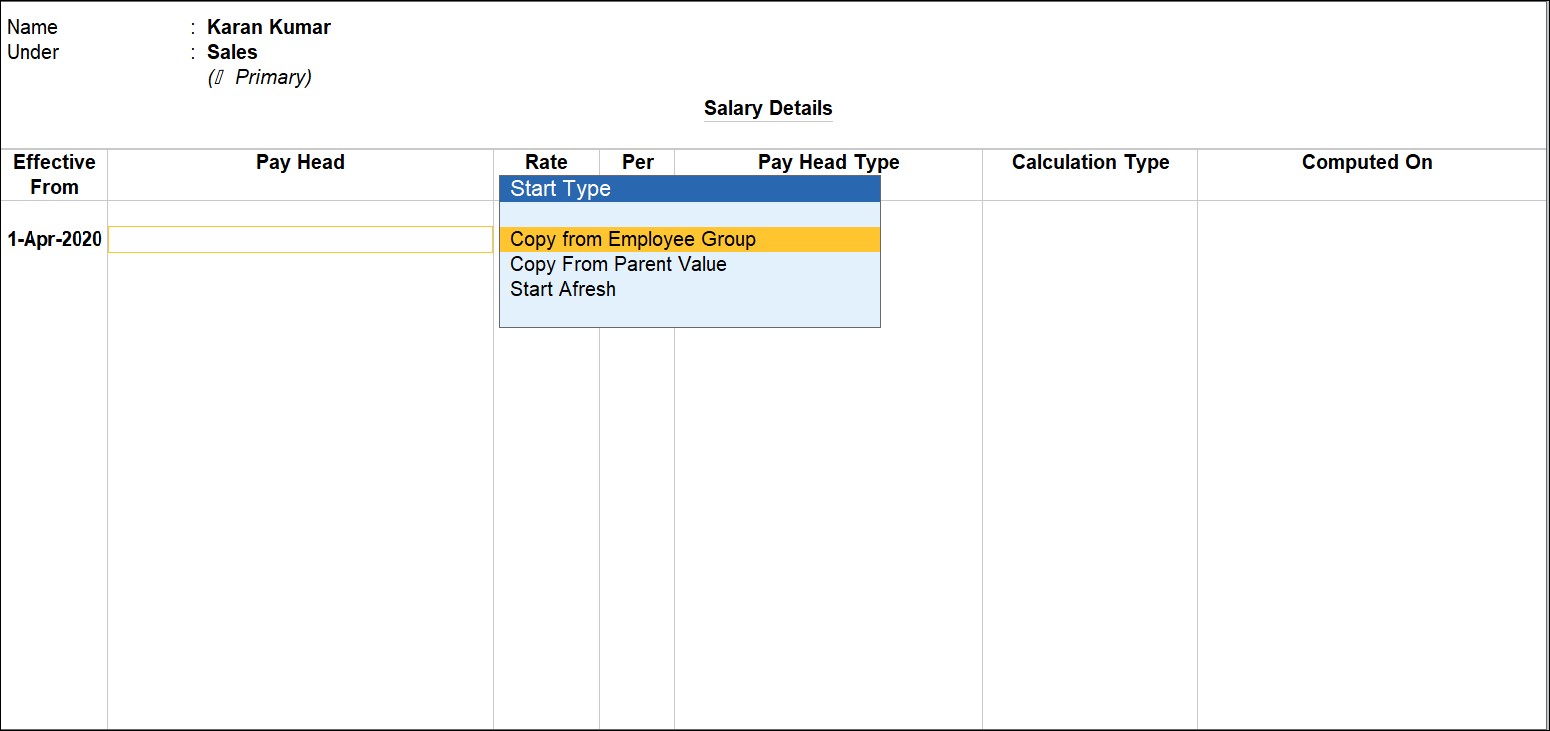

Salary structure gives us the components included in an employee’s pay. However, the tax is calculated based on the taxable nature of each pay head included in the salary structure of the employee. Further, the tax regime applicable to the employee will decide the tax slab, deductions and exemptions to considered to calculate income tax and net salary.

Employee grouping in TallyPrime

-

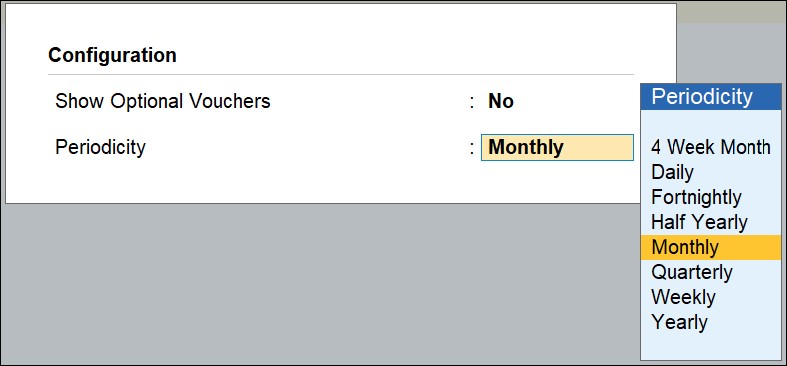

Flexible attendance/Production types

Attendance/production types are used to compute the employee pay and track their presence/productivity. Using TallyPrime, you can create multiple attendance types such as days which are paid (Present, Sick Leave, EL, CL etc.), unpaid (absent LOP), on production (piece work) and so on.

Flexible attendance-production types in TallyPrime

You can display the details of a report in different views with additional details or for a specific period. You can also view other reports related to the current report.

Different types of payroll reports in TallyPrime

TallyPrime also provides a remote facility that can be relied upon and is now easy to access, process and manage the payroll information from anywhere and anytime in the world.

Why TallyPrime is the best payroll software in Dubai

With robust features under the payroll functionality, TallyPrime gives you a whole lot of options to manage this activity in your organisation. No more manual entries and inaccuracies, for TallyPrime makes your payroll management a seamless process. As this module can be managed on its own and provides an impeccable solution, an accountant or any HR personnel of the company can install, organise and manage it.

Check out the key features of TallyPrime’s payroll services:

- Full integration with accounts for simplified payroll processing and accounting

- User-defined classifications and sub-classifications for comprehensive reporting on aspects such as employees, employee groups, pay components, or departments

- Support for user-defined earnings and deductions pay heads

- Flexible and user-defined criteria for simple or complex calculations

- Unlimited grouping of payroll masters

- Support for user-defined production units such as attendance, production, or time-based remuneration units

- Flexible processing period for payroll

- Comprehensive reports for cost centre as well as employee-wise costing

- Predefined processes for accurate and timely salary processing, employee statutory deductions & employer statutory contributions

- Processing payments using the e-payments capability in TallyPrime

- Auto-fill facility to expedite the attendance, payroll and employer’s contribution processes

- Facility to drill-down to the voucher level for any alteration

- Compute arrears of previous period(s)

- Track loan details of employees.

Frequently asked questions

What does payroll software do?

The ‘Payroll Module’ in software is totally integrated with the business management solution, which has enabled trouble-free payroll processing along with the accounting processes. Payroll software help manage and provide solutions to simplify the company's payroll process and any other Human Resources related matter such as talent management and/or benefits. This way you and your people can focus on the work you do best and will help save time and money instead of having to worry about any HR.

What are the benefits of payroll software?

- Simplicity in usage

- Accounting and payroll software do not involve installation of any expensive infrastructure equipment for its functioning

- Implementation of accounting and payroll software is as simple as logging into a secure web portal

- No disruption of work at the office while systems are set up and no downtime with accounting and payroll software

- It is simple in a way that its features can be accessed and learned by any professional with the most basic computer software and business skills

- Ensures security and reliability of data

- Accessibility – Data can be accessed from any machine (computer) at any time

Does every business need payroll software?

Payroll software will help businesses manage their payroll and other HR-related functions, seamlessly. If you are a proprietor with not too many employees to handle, you do not require payroll software. However, as and when your business grows, you may add more employees to manage various functions of your business. That's when, payroll software like TallyPrime will come in handy to manage your business more efficiently.

How is monthly payroll calculated?

For semi-monthly or monthly payroll, use the number 24 or 12, respectively, in your division calculation.

How much does payroll software cost?

Whether you're a small business or an enterprise, Tally's business software caters to all your payroll and accounting needs. See our plans, pricing and buy online.

| Silver Perpetual (Single user edition) | AED 2,340 |

| Gold Perpetual (Unlimited multi-user edition) | AED 7,020 |

Give TallyPrime a free trial today and see how it molds itself with your business processes, seamlessly.

Explore More Products