What is Form GST PMT-08?

The Form PMT-08 is used to make payment of self-assessed tax by all quarterly taxpayers under the new GST returns system. This form shall be used in the first two months of the quarter. It is used for declaring and paying the tax liability and claiming the eligible input tax credit. It is to be used by 20th of the next month (for the first two months of the quarter). It will be followed by the filing of RET-1/2/3 by the 25th of the month following the quarter.

Since the taxpayer pays the monthly tax liability through this form, such a form is a replacement for the current form GSTR – 3B. Thus, GST PMT – 08 is used to declare and pay the tax liability and claim eligible input tax credit. Furthermore, the taxpayer must make the payment of self-assessed liabilities through GST PMT – 08 by the 20th of the month succeeding the month for which tax is to be paid. Once the payment is made, the taxpayer needs to file GST RET – 1, GST – RET 2 or GST RET – 3 by the 25th of the month following the quarter to which such a return pertains.

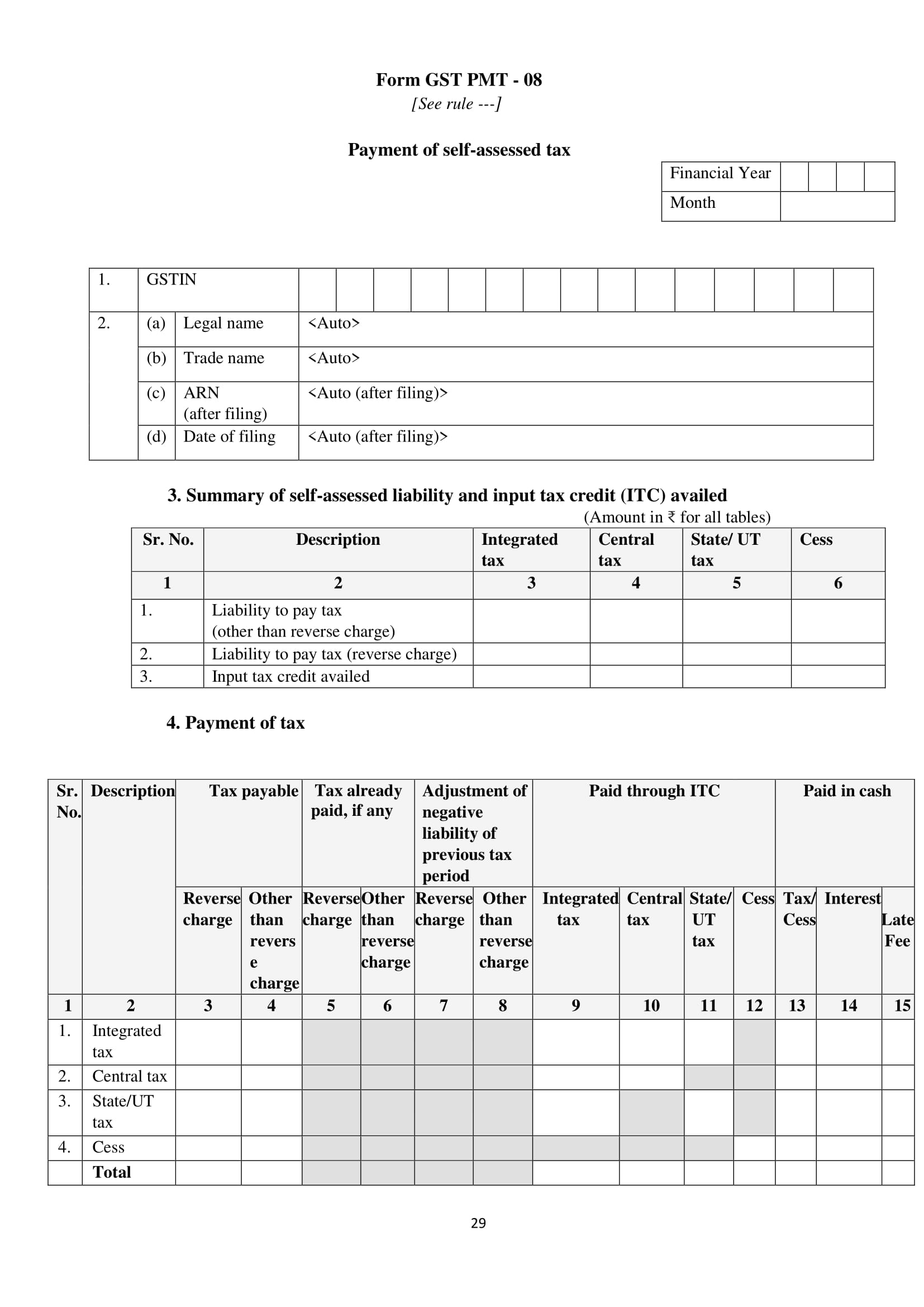

Format of GST PMT-08

Key things to keep in mind while filing GST PMT-08

- PMT-08 form applies to all returns i.e., SAHAJ, SUGAM, and Normal returns (quarterly filing only)

- A taxpayer who opts to do return filing on a quarterly basis needs to make a payment on a monthly basis depending on the supplies initiated within the month

- With the help of this form, only eligible ITC can be claimed

- Self-assessed liabilities will be paid for the initial two months of the quarter for quarterly filers and these amounts shall be populated to RET-1

- The credit of the tax paid within the initial two months of the quarter will be available at the time of return filing for the quarter

- Self-assessed liabilities will be paid within the 20th of every month

Liability can either be settled out of the balance in the electronic cash ledger or electronic credit ledger, whichever is applicable - Tax liability and input tax credit (ITC) availed will be based on self-assessment subject to the adjustment made in the main return of the quarter

- According to Section 50 of the Act, excess ITC claimed/short liability declared will be liable for interest charges. Hence, any late payment will draw interest as per the rate mentioned in Section 50 of the Act

- Also, the declaration in this form needs to be filed even if no supplies were initiated during the month