What is GST ITC-04?

GST ITC-04 has to be furnished by registered manufacturers, showing details of inputs or capital goods dispatched or received from a job worker in a quarter.

The details of the following 4 types of transactions need to be furnished in GST ITC-04:

- Inputs or capital goods dispatched to job workers in the quarter

- Inputs or capital goods received from job workers in the quarter

- Inputs or capital goods sent from one job worker to another in the quarter

- Inputs or capital goods supplied from the premises of job workers in the quarter

GST ITC-04 due date

The regular deadline for filing GST ITC-04 will be the 25th of the month succeeding a quarter.

How to file GST ITC-04 in GST portal

To file GST ITC-04 in the GST portal, follow the steps given below:

- Download GST ITC-04 offline tool

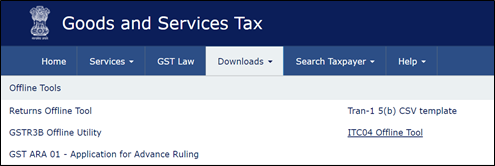

For this, visit the GST Portal. Click Downloads> Offline Tools> ITC04 offline tool.

- Fill the details and validate

The ITC04 offline tool is Excel-based. Internet connection is not required for filling the details in the tool. This tool also has the capability to perform most data entry and business validations, which will help to reduce errors at the time of uploading GST ITC-04 in the portal.

Let us now see the steps to use the ITC04 offline tool:

-

- A .zip file will be downloaded in your computer. Extract the contents. Open the Excel file.

- You will find 3 worksheets in the file:

- Worksheet 1: Import Export file- Use this sheet to import the data file already uploaded in GST portal or error file generated after upload of data in the portal. This can be used to modify the details uploaded in the GST portal before filing of GST ITC-04.

- Worksheet 2: Mfg to JW- The details of inputs or capital goods sent to job worker should be entered in this sheet.

- Worksheet 3: JW to Mfg- The details of inputs or capital goods received back from job workers or sent from one job worker to another or supplied from the job worker’s premises should be entered in this sheet.

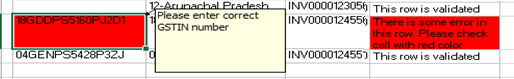

After the details are entered in a sheet, click ‘Validate Sheet’. If any errors are found, the same will be shown along with the details in the column ‘Errors’. You can make the required corrections and ensure to validate the data again. Each row entered in the sheet should show ‘This row is validated’ in the column ‘Errors’.

For example: For wrong GSTIN entered, the error details are shown in the column ‘Errors’ as shown below:

Once the error is corrected, the ‘Errors’ column appears as shown below:

- Generate file to upload

Once the data entered in ‘Mfg to JW’ and ‘JW to Mfg’ sheets are successfully validated, in the ‘Import Export file’ sheet, click ‘Generate file to upload’. The file will be generated in JSON format. Save the file in the computer.

- Upload the JSON file

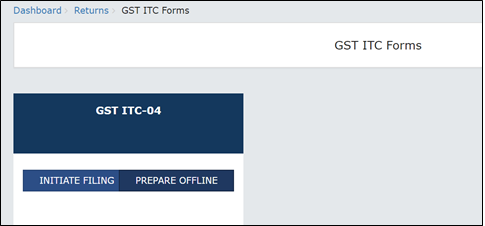

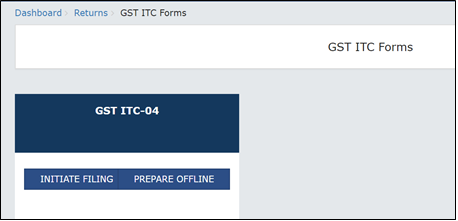

Login to the GST portal using your username and password. Click Services>Returns>ITC Forms. GST ITC-04 will be shown. Click ‘Prepare offline’.

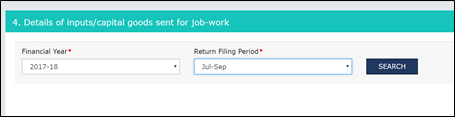

Select the Financial Year, Return filing period and click Search.

Click Choose file and select the JSON file. Once the file is uploaded, it will be validated by the portal. If any errors are found, an error file will be generated. Download the same from the portal. Open the ITC-04 offline tool and in the ‘Import Export file’ sheet, click ‘Import data from File’ to import the error file and make the necessary modifications.

Note: The JSON file uploaded can be edited or new additions can be made, until GST ITC-04 is filed.

- Authenticate and file GST ITC-04

To authenticate and file GST ITC-04, click ‘Initiate filing’.

Select the Financial Year and Return filing period. Click ‘File Return’. Authenticate the file using DSC (Digital Signature Certificate) or EVC (Electronic Verification Code) and submit the return.

Hence, all Principal manufacturers should ensure to furnish details of inputs or capital goods sent or received during a quarter using the ITC04 offline upload tool.