Mobile number and email ID entered in the GST portal is of utmost importance for a registered person, as all notifications with respect to the GST portal will be communicated to the mobile number and email ID specified. Many taxpayers want to know how to change mobile number in GST Registration as well as how to change the e-mail ID in GST Registration as specified in the portal.

How to update e-mail ID and phone number in GST portal

Let us understand the process for this:

1. Login to the GST portal login with your username and password.

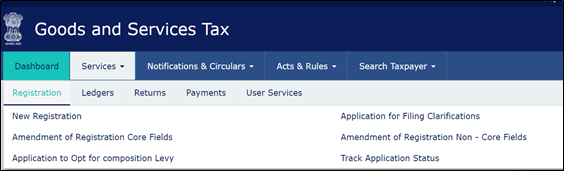

2. Click Services>Registration>Amendment of registration Non-core fields

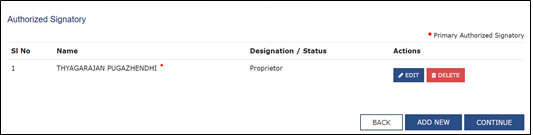

3. The tabs for editing will display. Click the Authorised Signatory

4.The current authorised signatory will be displayed. Click Add New.

5. Specify the details, including the new mobile number and email ID of the signatory. Click the ‘Save’ button to save the details.

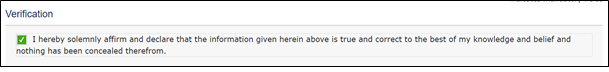

6. Click the Verification

a. Tick the Verification checkbox

b. In the Name of Authorized Signatory drop-down list, select the authorized signatory.

c. In the Place field, enter the name of the place.

d. Select the relevant option to digitally sign the application using Digital Signature Certificate (DSC) or E-Signature or EVC.

7. On submission of the application for correction in GST registration, a message of successful submission of application will be displayed. You will receive an acknowledgement within 15 minutes on the old e-mail address and mobile number.

8. Once the acknowledgment is received or after 15 minutes of submission of application for amendment, login to the GST portal again.

9. Select the Authorised Signatory tab again.

10. Deselect the Primary authorized signatory checkbox for the old signatory and select the newly added signatory as the Primary authorized signatory.

11. Verify the mobile number and email ID mentioned for the newly added signatory and ensure that it is correct.

12. Click the Verification tab and submit the application using DSC/E-Signature/EVC.

13. After submission of the application, you will receive an acknowledgment within 15 minutes on the new email address and mobile number.

Hence, change of mobile number and change of email ID in Goods and Service Tax portal can be done easily, without the approval of an assessing officer or a visit to the Government office.

Read more on DSC, E-sign, and EVC