The world of business revolves around two key concepts: profit and profitability. You could believe they're the same thing, but wait.

Consider this—profit is the money left in your pocket after paying your bills. Then, what about profitability?

That's the smart game—making your money work for you, creating returns on every dime you put in. These terms are frequently used in the same sentence, even though they are not the same. We'll reveal the true difference between profit and profitability in this article, allowing you to look past the figures and propel your business ahead.

| “Profit vs. Profitability: Unveiling the True Difference and Unlocking Financial Success” |

Profit vs. profitability

Understanding the intricacies between profit and profitability in company finance is like decoding a complex code. These phrases frequently overlap, but they are not twins; they are jigsaw pieces from separate sets.

Let's start with profit—it is the clear figure that appears when your revenue exceeds your costs. The score on the board is visible proof of your financial success. Isn't it very clear?

Instead of focusing on a single figure, focus on profitability and a strategic approach. It's a complicated financial chess game in which you arrange your resources to maximize rewards. Consider this: A company may be prosperous without being loaded with cash by investing intelligently for a better tomorrow.

What is the most important takeaway? Profit catches a snapshot, whereas profitability provides a picture of your financial strategy's terrain. So, the next time these phrases cross your path, remember that profit represents your current situation, and profitability illuminates your financial future.

What exactly is profit?

Simply described, it is the money a company has left over after paying its bills. It's more than just a figure; it's that gold nugget of your financial journey, which is sitting at the bottom of your income statement. However, its relevance goes beyond this fundamental distinction. Profit is more than just fundamental viability; it is the foundation that allows businesses to pursue expansion, innovation, and long-term success.

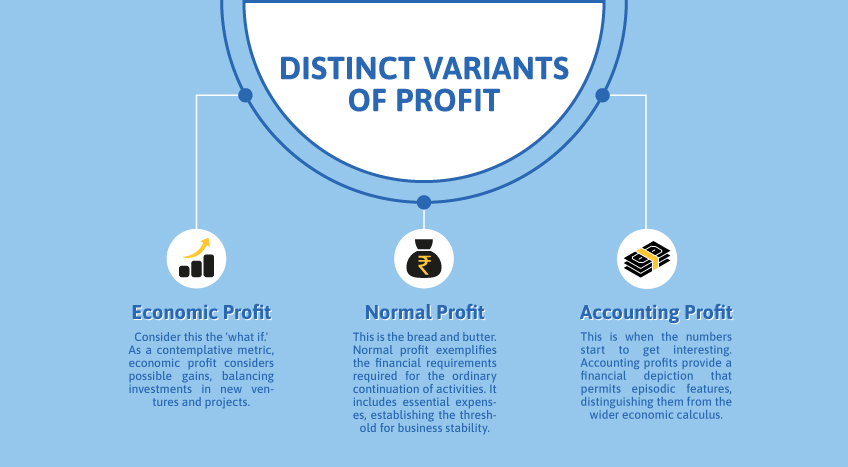

Let us now dive further. Let us look at the distinct variants of profit:

So there you have it, the profit story in a nutshell. When someone mentions profit, realize that it is more than just a term; it is the lifeblood of your company's journey.

What exactly is profitability?

Welcome to the realm of profitability, where statistics become strategy. It's more than just a catchphrase; it's the compass that directs enterprises to financial success.

In essence, profitability is about resource management rather than raw cash. Imagine a chessboard – each move is calculated for maximum gains. That's profitability for you.

Profit is all about doing more with less. It's all about composing a symphony of profits from what you have. Even if a company isn't loaded with cash, it can still be profitable. Isn't it confusing? But here's the trick: good financial decisions may turn little earnings into massive strategic successes.

Consider the following scenario:

- Resource mastery: Profitability is about organizing your assets - time, skill, and treasure - into an arrangement of success.

- Strategic gains: It's a calculated move in which you extract every last drop of return from your assets, making every step count toward your long-term objectives.

- Profit ≠ Profitability: They are related, but they are not the same. The former depicts a numerical number; the latter is a concept emphasized by the strategic use of resources.

Profit and profitability: One and the same? Think again!

At first inspection, profit and profitability may appear identical; aren't they both about earning money? But if you look closely, you'll see that these two financial measures aren't the same. Profit is the absolute amount of money your business earns after expenses. Profitability evaluates this profit figure about variables such as revenue, assets, and investment quantity.

Profit addresses the "how much" question, while profitability deciphers "how well." They are connected, yet they show distinct images.

Remember this the next time profit and profitability cross your mind: there is more to it than just numbers.

Profit & profitability: Do you know how to use them?

Profit represents the actual amount of surplus your business earns after deducting expenses. However, profitability reflects the efficiency of converting inputs such as investment capital, assets, and labor into profit.

Investors prefer to invest in highly profitable companies. It demonstrates that the company is using its resources effectively to maximize profits. Even a modest business with minimal profits can be highly profitable.

Consider both profit and profitability ratios, such as return on investment, to determine the level of efficacy. Together, they provide essential insights into the potential of your company.

Profit or profitability - Which is the better measure of performance?

Profit demonstrates your final earnings in rupees. This number indicates the status of short-term income. Return on investment and other profitability metrics demonstrate how effectively you convert inputs into profits. Profit provides a snapshot, but profitability reflects the longer-term outlook more accurately.

For investors, sustained high profitability indicates that the company is maximizing returns by optimum resource utilization. Even if short-term profits decline, robust profitability indicates the ability to recover and flourish. In other words, profitability emphasizes not only quantity but also the quality of performance. Therefore, while both metrics provide vital insight, profitability is the more potent indicator of a company's future growth and success.

Financial monitoring made simple: What's the secret?

Ready to improve your financial performance? TallyPrime is the ultimate ally on this financial journey. With its comprehensive tools and user-friendly interface, it is your guide to managing your profits and guiding your business toward a brighter future. The future awaits – let's chart it together!