- Introduction to Contra Entry

- Definition of Contra Entry

- Examples of Contra Entry

- Double Cash Book Format

Introduction to Contra Entry

Have you ever withdrawn money from an ATM, deposited cash into your bank account, or transferred funds between two of your own bank accounts?

If yes — you’ve already performed what accountants call a Contra Entry.

Contra entries are everyday business transactions that occur within an organization’s own accounts, usually involving cash and bank movements. Let’s understand what they mean, how to record them, and how they differ from regular journal entries.

Definition of Contra Entry

A Contra Entry is a transaction that involves both cash and bank accounts of the same business. In simpler terms, it records internal fund transfers — not payments or receipts from external parties.

The word “contra” comes from Latin, meaning “opposite”. So, when one account (say, Cash) is debited, the other (say, Bank) is credited — creating an opposite effect within the same set of books.

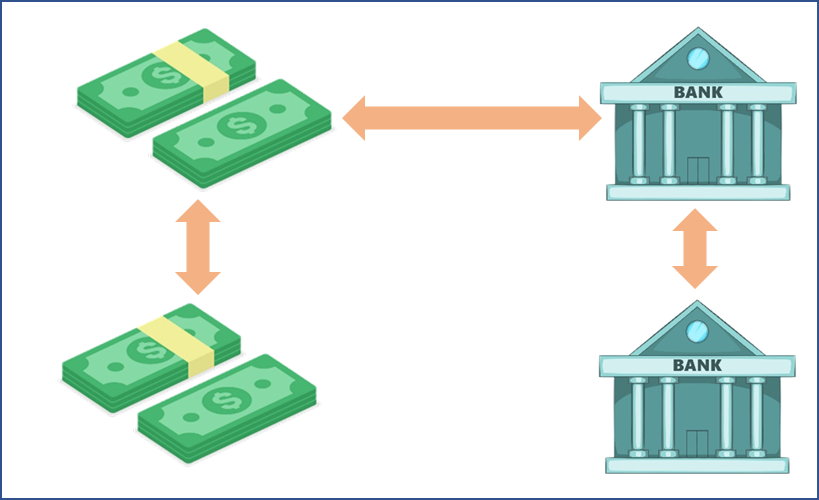

As illustrated in the above image, the following is the list of contra transactions:

- Cash account to Bank account

- Bank account to Cash account

- Bank account to Bank account

- Cash account to Cash account

Types of Contra Transactions

| Type | Example | Explanation |

|---|---|---|

| Cash → Bank | Depositing cash into the bank | Both cash and bank are affected — cash decreases, bank increases |

| Bank → Cash | Withdrawing money from the bank for office use | Bank decreases, cash increases |

| Bank → Bank | Transferring money between two company bank accounts | One bank decreases, another increases |

| Cash → Cash | Transferring funds from main cash account to petty cash | Internal cash movement for small expenses |

After looking at the above list, you might be wondering about the one which is the mentioned in the last i.e. ‘Cash account to Cash account’

To clear this confusion, we need to understand little more about ‘Petty Cash Account’.

Understanding Petty Cash in Contra Transactions

Businesses often maintain a Petty Cash Account to manage small daily expenses such as courier charges, refreshments, and stationery.

When cash is moved from the main cash account to the petty cash account, it’s recorded as a Cash-to-Cash Contra Entry, since both sides belong to the same organization.

Purpose of Contra Entry

The purpose of a contra entry in accounting is to record internal fund movements between a business’s cash and bank accounts without affecting income or expenses. These entries ensure accurate cash flow tracking, maintain internal control, and simplify bank reconciliation.

In simple terms, contra entries show how money moves within the business, not outside it. For example, when a company withdraws cash from a bank for office use or deposits cash into its account, the transaction is recorded as a contra entry.

Key objectives of contra entries include:

- Tracking internal fund transfers between cash and bank accounts.

- Preventing double counting of income or expenses.

- Maintaining clarity for audits and financial reporting.

- Simplifying reconciliation between cash books and bank statements.

Examples of Contra Entry

In the below table, we have mentioned different types of business transactions and some of them are contra entry. We have identified one’s which are contra entry with reason.

Remember the contra entry rule ‘Both Cash and Bank should be affected in any given transaction’

|

Entries |

Is it Contra Entry? |

Reasoning |

|

Transferred cash to petty cash 2,500 Ind rupees |

Yes |

Affects both two account - a Cash account and Petty cash |

|

Cash sales 1,750 Ind rupees |

No |

Affects only one account - cash account |

|

Paid to Mr.Yash by cheque 3750 Ind rupees |

No |

Affects only one account - cash account |

|

Received a cheque from M/s Zain and Bros., 4,500 paid into the bank |

No |

Cheque received is equivalent to cash. Affects only one account – Bank account |

|

Received cheque from Mr Alex 6,000 Ind rupees paid into the bank |

No |

Cheque received is equivalent to cash. Affects only one account – Bank account |

|

Cash purchases 2,500 Ind rupees |

No |

Affects only one account - cash account |

|

Paid rent by cheque 2,500 Ind rupees |

No |

Affects only one account - cash account |

|

Cash is withdrawn from bank for office use 2,500 Ind rupees |

Yes |

Affects two accounts – Cash and Bank account – |

|

Cash sales 3,750 Ind rupees |

No |

Affects only one account - cash account |

|

Stationery purchased 1,000 Ind rupees |

No |

Affects only one account - cash account |

|

Cash sales 6750 Ind rupees |

No |

Affects only one account - cash account |

|

Deposited 10,000 Ind rupees to the bank account |

Yes |

Affects two accounts – Cash and bank account – |

|

Withdrew cash for personal use 1,000 Ind rupees |

No |

Affects only one account - cash account |

|

Salaries paid by cheque 9000 Ind rupees |

No |

Affects only one account - cash account |

Recording Contra Entries in the Cash Book

Traditionally, contra entries are recorded in a Double Column Cash Book (with both Cash and Bank columns).

Here’s how it works:

| Date | Particulars | L.F. | Cash (Dr) | Bank (Cr) |

|---|---|---|---|---|

| 09-08 | To Bank (Cash withdrawn from bank) | C | ₹2,500 | - |

| 09-08 | By Cash | C | - | ₹2,500 |

| 21-08 | To Cash (Cash deposited into bank) | C | - | ₹10,000 |

| 21-08 | By Bank | C | ₹10,000 | - |

To record contra entries, traditionally a cash book with cash and bank columns is prepared where both the aspects of the transaction will be entered in the same book which is Contra Book.

In the debit side of the contra book, ‘To Cash A/c’ will be entered under the particulars column and the amount will be entered in the bank column.

In the credit side of the contra book ‘By Bank A/c’ will be entered under the particulars column and the amount will be entered in the cash column.

And all such contra entries are denoted by writing the letter ‘C’ in the L.F. column, on both sides of the cash book. They represent that no posting in respect this is necessary in the ledger.

With automation of accounting using accounting software, these transactions are auto-posted into the relevant ledger and there is less relevance of cash book format discussed above.

Recording Entries in TallyPrime

In TallyPrime, recording a contra entry is simple:

- Go to Gateway of Tally → Accounting Vouchers → F4: Contra.

- Select the account type (Cash or Bank).

- Enter the transfer details (e.g., amount, narration).

- Save and view real-time updates in your ledger.

Example:

If you deposit ₹10,000 cash into your bank —

Bank A/c Dr ₹10,000

To Cash A/c ₹10,000

FAQs

1. What is a Contra Entry?

A contra entry is an accounting transaction involving both cash and bank accounts within the same organization.

2. How do I record a contra entry in TallyPrime?

Use the Contra Voucher (F4) and specify the accounts involved (Cash to Bank, Bank to Cash, etc.).

3. Does a contra entry affect the trial balance?

No, because it involves movement within assets, it doesn’t change the total balance.

4. Why use a Contra Voucher?

It helps track internal fund transfers accurately and simplifies reconciliation between cash and bank balances.