Introduction to Contra Entry

Have you ever withdrawn money from an ATM, deposited cash into your bank account, or transferred funds between two of your own bank accounts?

If yes — you’ve already performed what accountants call a Contra Entry.

Contra entries are everyday business transactions that occur within an organization’s own accounts, usually involving cash and bank movements. Let’s understand what they mean, how to record them, and how they differ from regular journal entries.

What is Contra Entry? Meaning and Definition

A contra entry is a transaction where money moves between a business's own cash and bank accounts — not to or from any customer or supplier. It affects both the cash account and the bank account of the same business. Examples: depositing shop cash into the bank, withdrawing from the bank for office use, or transferring between two company bank accounts. A contra entry does not affect income, expenses, or profit.

The word contra comes from Latin — it simply means "opposite." In accounting, a contra entry records a transaction where one account goes up and the other goes down — but both accounts belong to the same business.

In plain words: a contra entry records money moving within your own business — not going out to anyone, and not coming in from anyone.

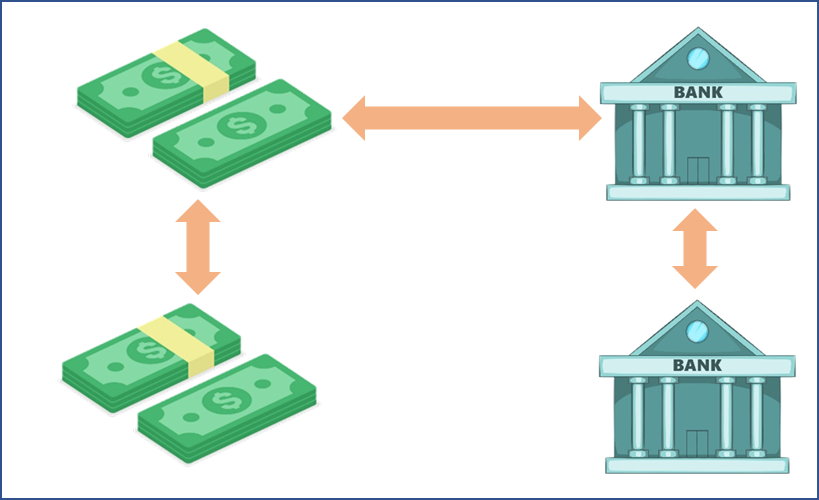

As illustrated in the above image, the following is the list of contra transactions:

- Cash account to Bank account

- Bank account to Cash account

- Bank account to Bank account

- Cash account to Cash account

At the end of the day, Ramesh runs his grocery shop and deposits ₹15,000 of cash sales into his bank account. This is a contra entry. The cash box goes down by ₹15,000 and the bank account goes up by ₹15,000. No supplier was paid; no customer gave money — the money just moved from one pocket to another within the same business.

Types of Contra Entries in Accounting

| Type | Example | Explanation |

|---|---|---|

| Cash → Bank | Depositing cash into the bank | Both cash and bank are affected — cash decreases, bank increases |

| Bank → Cash | Withdrawing money from the bank for office use | Bank decreases, cash increases |

| Bank → Bank | Transferring money between two company bank accounts | One bank decreases, another increases |

| Cash → Cash | Transferring funds from main cash account to petty cash | Internal cash movement for small expenses |

After looking at the above list, you might be wondering about the one which is the mentioned in the last i.e. ‘Cash account to Cash account’

To clear this confusion, we need to understand little more about ‘Petty Cash Account’.

Understanding Petty Cash in Contra Transactions

Most small shops and businesses keep a small amount of physical cash separately for tiny daily expenses — a ₹50 courier charge, ₹100 for a plumber, ₹200 for office stationery. This separate cash is called Petty Cash.

When you move money from your main cash box into the petty cash box, you are moving cash within your own business — not paying anyone. So this is recorded as a Cash-to-Cash Contra Entry.

Purpose of a Contra Entry in Accounting

The purpose of a contra entry in accounting is to record internal fund movements between a business’s cash and bank accounts without affecting income or expenses. These entries ensure accurate cash flow tracking, maintain internal control, and simplify bank reconciliation.

In simple terms, contra entries show how money moves within the business, not outside it. You might wonder if the money is just going from one pocket to another within the same business, why even bother recording it? Here is why it matters:

- Keeps your cash and bank records accurate. If you deposit ₹10,000 in the bank but do not record it, your cash book will still show ₹10,000 that no longer exists. Your records will be wrong.

- Prevents double-counting. A contra entry clearly marks that this is an internal move — not income, not expense — so it does not inflate your sales or cost figures.

- Makes bank reconciliation easy. When your bank statement and your own records match, it means your books are correct. Contra entries are the first step in making that match happen.

- Helps during audits. A clear trail of every cash and bank movement makes it easy for your CA or auditor to verify your accounts quickly.

- Keeps your total assets unchanged. When you move ₹10,000 from cash to bank, your total money is still ₹10,000 — it has just changed form. A contra entry records this correctly without affecting profit or loss.

Examples of Contra Entry

In the below table, we have mentioned different types of business transactions and some of them are contra entry. We have identified one’s which are contra entry with reason.

Remember the contra entry rule ‘Both Cash and Bank should be affected in any given transaction’

|

Entries |

Is it Contra Entry? |

Reasoning |

|

Transferred cash to petty cash 2,500 Ind rupees |

Yes |

Affects both two account - a Cash account and Petty cash |

|

Cash sales 1,750 Ind rupees |

No |

Affects only one account - cash account |

|

Paid to Mr.Yash by cheque 3750 Ind rupees |

No |

Affects only one account - cash account |

|

Received a cheque from M/s Zain and Bros., 4,500 paid into the bank |

No |

Cheque received is equivalent to cash. Affects only one account – Bank account |

|

Received cheque from Mr Alex 6,000 Ind rupees paid into the bank |

No |

Cheque received is equivalent to cash. Affects only one account – Bank account |

|

Cash purchases 2,500 Ind rupees |

No |

Affects only one account - cash account |

|

Paid rent by cheque 2,500 Ind rupees |

No |

Affects only one account - cash account |

|

Cash is withdrawn from bank for office use 2,500 Ind rupees |

Yes |

Affects two accounts – Cash and Bank account – |

|

Cash sales 3,750 Ind rupees |

No |

Affects only one account - cash account |

|

Stationery purchased 1,000 Ind rupees |

No |

Affects only one account - cash account |

|

Cash sales 6750 Ind rupees |

No |

Affects only one account - cash account |

|

Deposited 10,000 Ind rupees to the bank account |

Yes |

Affects two accounts – Cash and bank account – |

|

Withdrew cash for personal use 1,000 Ind rupees |

No |

Affects only one account - cash account |

|

Salaries paid by cheque 9000 Ind rupees |

No |

Affects only one account - cash account |

Out of 14 transactions above, only 3 are contra entries — petty cash transfer, ATM withdrawal for office use, and cash deposit in bank. Notice that in each case, the money stayed inside the business and touched both a cash account and a bank account.

How Contra Entries Are Recorded in the Cash Book

Traditionally, contra entries are recorded in a Double Column Cash Book (with both Cash and Bank columns).

The key feature: when you record a contra entry, the same transaction appears on both sides of the same book — once as a debit and once as a credit. And to mark that no further posting to the ledger is needed, the letter "C" is written in the L.F. (Ledger Folio) column on both sides.

| Date | Particulars | L.F. | Cash (Dr) | Bank (Cr) |

|---|---|---|---|---|

| 09-08 | To Bank (Cash withdrawn from bank) | C | ₹2,500 | - |

| 09-08 | By Cash | C | - | ₹2,500 |

| 21-08 | To Cash (Cash deposited into bank) | C | - | ₹10,000 |

| 21-08 | By Bank | C | ₹10,000 | - |

The "C" in the L.F. column is the accountant's signal that this is a contra entry — meaning both sides of the transaction are already in the same book, so no separate ledger posting is needed.

Today, with accounting software like TallyPrime, you do not need to manually maintain a double column cash book. The software handles all of this automatically — the moment you record a contra entry; it updates both your cash ledger and bank ledger in real time. No manual posting, no risk of forgetting the "C" mark.

Recording Contra Entries in TallyPrime

In TallyPrime, recording a contra entry is simple:

Step 1: Go to Gateway of Tally → Vouchers

Step 2: Select Contra(F4)

Step 3: Select the account type (Cash or Bank) to credit the amount and enter the transfer details (e.g., amount, narration).

Step 4: Save and view real-time updates in your ledger.

Example:

You deposit ₹20,000 cash into Cash from your bank account on 10th September In TallyPrime, you record:

Bank A/c Dr ₹20,000

To Cash A/c ₹20,000

Both accounts update instantly. Your cash balance falls by ₹20,000 and your bank balance rises by ₹20,000 — accurately reflecting the deposit.

Advantages and Disadvantages of Contra Entry

Contra entries in accounting have several advantages, such as simplifying internal fund transfers and maintaining clear records, but they also bring some disadvantages, including increased complexity and the risk of errors in documentation.

Advantages of Contra Entry

- Maintains clear and accurate records by documenting both sides of internal fund transfers, ensuring no duplication and streamlining bookkeeping.

- Facilitates easy bank reconciliation since all transfers between cash and bank accounts are tracked, assisting in identifying and correcting discrepancies.

- Does not affect the overall financial position, as both debit and credit amounts are transferred within the organization's accounts, keeping total assets unchanged.

- Simplifies record-keeping by combining offsetting transactions into one entry, which minimizes manual entry errors and saves time in high-volume environments.

- Enhances transparency for audits and financial analysis by providing a clear trail for fund movements, which aids in effective decision-making.

Disadvantages of Contra Entry

- Increases complexity in record-keeping, especially for businesses with numerous transactions, making it necessary to track both sides meticulously to avoid confusion or mistakes.

- Potential for misinterpretation if supporting documentation is lacking or if staff are not properly trained in handling contra entries.

- Aggregates multiple transactions into one entry, which can obscure the visibility of individual transactions and limit detailed financial analysis.

- Reconciling accounts may become more difficult if errors or omissions occur, requiring regular reviews and robust checks to ensure accuracy.

- Relies heavily on accurate and prompt documentation, increasing the risk of oversight and necessitating rigorous record management systems.

Overall, contra entries are essential for maintaining clarity in financial records but demand stringent internal controls and careful handling to avoid the disadvantages.

Common Mistake to Avoid

Personal cash withdrawals are NOT contra entries. If you take ₹1,000 from the business cash for personal use (buying groceries for home, personal phone bill, etc.), that is called a Drawing — not a contra entry. A drawing goes under your Capital account, not the cash/bank accounts. Only money moving between your own business cash and bank accounts counts as contra.

Conclusion

Contra entries are one of the most common everyday accounting entries for any small business and now you know exactly what they are. Any time money moves between your own cash box and your own bank account, that is a contra entry. It does not affect your income, your expenses, or your profits. It just keeps your records clean and accurate.

The key things to remember both a cash account and a bank account must be affected, no outsider is involved, and personal withdrawals are not contra entries — they are drawings.

If you are recording accounts manually today, understanding contra entries helps you keep your cash book accurate. And if you are using TallyPrime, the software handles all of this for you in few steps keeping every contra entry, bank reconciliation, and ledger update accurate and up to date, so you can focus on running your business instead of managing paperwork.