The balance sheet is a pivotal financial instrument that helps calculate a business's financial health. It also provides a clear lens to tell if a company is sailing smoothly or navigating hazardous waters. When it comes to balance sheets, phrases like "assets," "liabilities," and "equity" can make your head spin if you’re new to reading a balance sheet.

This article will delve into the world of balance sheets, those financial documents that contain the key to comprehending a company's assets and liabilities. It will help you comprehend what it owns, what it owes, and how it all adds up. From interpreting assets like cash and property to solving the puzzle of liabilities like debts and commitments, we'll also walk you through the process.

|

"Understanding balance sheet components in business is like having a compass guiding you through the financial landscape. Assets and liabilities, these two pillars, reveal a company's strengths and commitments." |

Understanding components of balance sheet: Assets and liabilities

Assets and liabilities are the symbolic yin and yang of a company's financial world. Think of assets as a company's treasures, like cash, equipment, and investments. These are the resources that fuel operations and growth. On the other side, liabilities are the company's obligations and debts, the promises it needs to fulfill.

Assets are divided into two squads: current and noncurrent. Current assets, including cash and accounts receivable, are the swift movers, ensuring smooth day-to-day operations flow. Noncurrent assets, like properties and patents, play the long game, contributing to the company's future value.

Liabilities have their categories, too. Current liabilities, short-term debts, and payables keep the balance sheet dancing in harmony. Noncurrent liabilities, such as long-term loans and deferred taxes, reveal the company's big-picture commitments.

Understanding these financial buddies unveils a company's financial health story, helping us see its ability to manage debts and leverage its treasures for success.

Types of assets

In the captivating landscape of a company's balance sheet, assets are the foundation of its financial strength and operational prowess. Assets are the tangible and intangible resources a company possesses, which hold the potential to drive growth, generate revenue, and maintain its operations. Diving into the world of assets reveals a dynamic array of types that offer insight into a company's financial landscape.

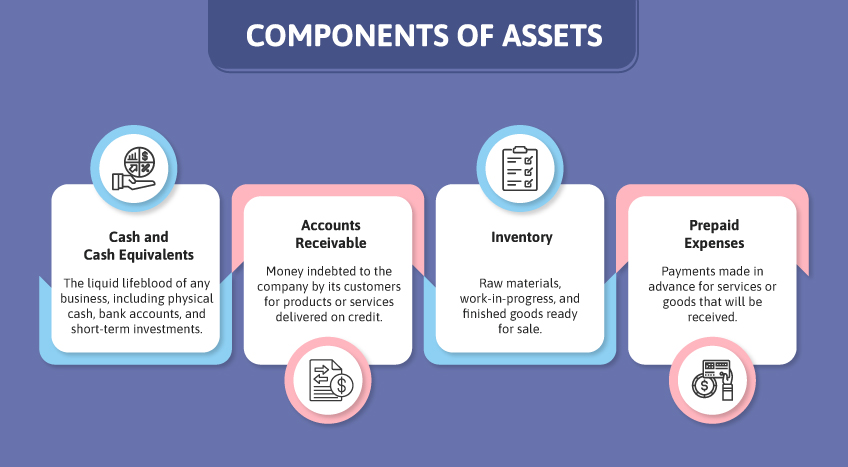

Components of assets

Current assets are the agile sprinters in a company's financial race. These are the pivotal assets that can be easily converted into cash or used up within a short time frame, usually a year or less. The star players in this category include:

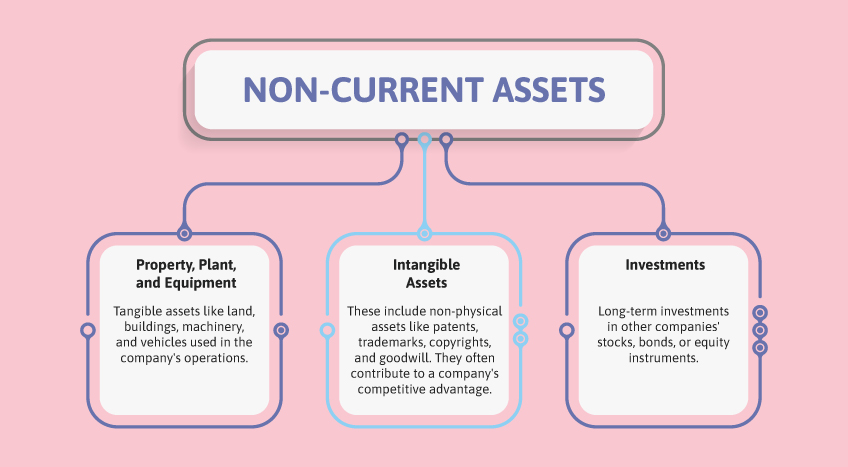

Non-current assets

Noncurrent assets are the marathon runners contributing to a company's long-term value and stability. These assets are not meant to be quickly converted into cash and include:

Each type of asset carries its significance. For instance, current assets reflect a company's short-term liquidity and ability to meet immediate obligations, while noncurrent assets showcase its long-term growth potential and capacity to generate sustainable income.

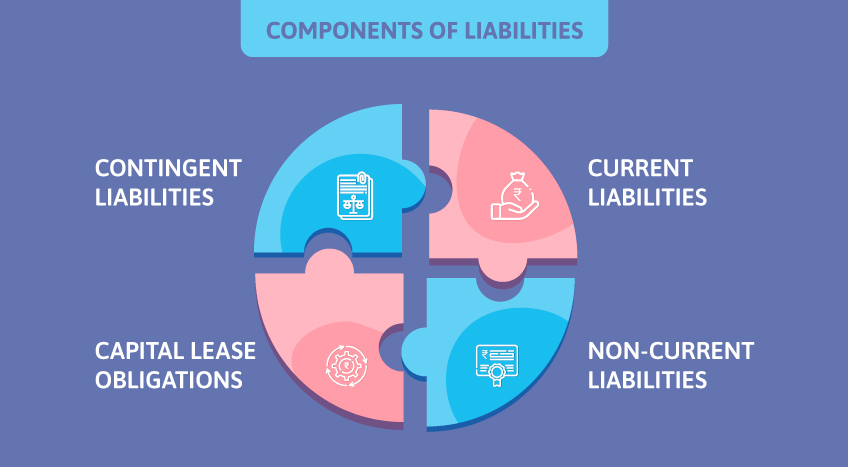

Components of liabilities

When delving into a company's balance sheet, you'll encounter a realm of financial obligations known as liabilities. These commitments are crucial indicators of a firm's financial health and inherent capacity to meet its financial responsibilities. Let's explore the diverse world of liabilities and understand their significance.

Current liabilities

These are short-term obligations that a company is expected to settle within a year or its operating cycle. They keep the day-to-day financial operations ticking smoothly. Examples include accounts payable (money owed to suppliers), short-term loans, and accrued expenses (unpaid expenses like wages or taxes). Current liabilities give insight into a company's liquidity – its ability to cover short-term debts using its current assets.

Non-current liabilities

Also referred to as long-term liabilities, these obligations extend beyond the operating cycle, typically lasting more than a year. They encompass debts and responsibilities that a company needs time to address. Prominent examples include long-term loans, bonds, and deferred tax liabilities. Noncurrent liabilities offer a view into a company's long-term financial stability and capacity to manage long-range commitments.

Contingent liabilities

These are prospective liabilities that may or may not materialize in the future. They arise from uncertainties like pending lawsuits, warranties, or guarantees. While not certain to become actual obligations, they have the potential to impact a company's financial position. It's crucial to disclose these in financial statements to provide a comprehensive view to investors.

Capital lease obligations

When a company leases an asset under conditions that make it economically similar to owning, it incurs capital lease obligations. These liabilities arise from leasing arrangements, where the lessee must make regular lease payments over time. These obligations give insight into a company's use of assets without outright ownership.

Wrapping up

Understanding balance sheet components in business is like having a compass guiding you through the financial landscape. Assets and liabilities, these two pillars, reveal a company's strengths and commitments. By deciphering their language, you gain insight into liquidity, solvency, and overall financial health.

As you embark on this financial literacy journey, consider harnessing the power of tools like Tally Solutions. With Tally's user-friendly software, decoding balance sheets become more intuitive. Tally empowers businesses with accurate, real-time financial insights, allowing and assisting you to make informed decisions and steer your enterprise toward success. Embrace the knowledge, embrace the tools, and master the art of reading balance sheets for a prosperous future.