- What is a payroll report?

- 5 types of payroll reports

- How to create a payroll report

- The golden rules of payroll reporting

- Quick and easy payroll reports with TallyPrime

One of the most valuable resources that a company has is its staff. Payroll is an essential part of running a company. In some companies with a large staff, periodic payroll processing and payout can be involved. But, when you use software to process payroll, it becomes a quick and efficient activity. Payroll reports provide detailed and multifaceted perceptions of the company’s payroll. Some payroll reports are required by the authorities and must be prepared and filed in the prescribed format. Other payroll reports are essential for the management to understand payroll better, which is one of their more significant expenses. Monitoring payroll expenses is the basis for managing them better. When you can measure and analyze something, you can manage it.

|

Benefits of Payroll Management Software for Small Businesses in USA |

What is a payroll report?

Payroll reports are the extracts from your company’s payroll system. They tell the reader all they need to know about how much you compensate your human resources. Different payroll reports analyze different aspects of the system. Payroll reports in specific formats are to be submitted to the authorities quarterly or annually, depending on your state and location. Payroll reports are also helpful for management, business owners, stakeholders, lenders, and authorities.

The IRS and other authorities require payroll reports to calculate and verify if the company complies with taxes. Lenders would want to look at the payroll reports to see how many people you employ and how fair your compensation packages are. The Fair Labor Standards Act (FLSA) dictates that you provide every employee with a pay stub. This is essential for the employee to understand how their salary has been computed and the applicable additions and deductions.

Manually computing payroll could be time-consuming depending on the volume of employees and the level of complexity in calculations. Many small companies delay their salary payouts simply because of a delay in payroll processing. Using software to compute payroll is essential for a timely and accurate payroll, and automated payroll processing is also less labor-intensive.

A payroll report needs to have the following information:

Comparative data: You can adequately analyze payroll only when comparing it to the previous periods. A good payroll analysis will compare the newest data to the last period or the same time period in the previous year. Comparative reports help the analyst understand how the company is evolving regarding human resources. It also helps determine the payroll expense trends that the company is experiencing. It is much easier to spot significant changes when the analysis is comparative. For example, the payroll reports may show a sudden fall in human resource recruitment due to economic constraints. A company that is rapidly scaling up may suddenly increase its staffing. Automation of tasks may cause a reduction in staff for repetitive tasks and elevate them to a higher pay profile with more challenging tasks.

Year-to-date data: Some companies use monthly or quarterly reports to analyze payroll. They should also include the annual payroll report. Knowing where the company stands for the year and in the current quarterly period is essential. Business owners and management can plan for their future payroll payout based on the payroll for the year so far. It also helps identify trends and patterns that have occurred in the year.

Pay periods covered: It is vital to clearly label the report with the specific time period that it details. Instead of a generic label that says ‘Q1 Payroll report’, it is better to have a clear heading that says ‘Q1 2022 Payroll Report’. This is essential to prevent confusion and bad decision-making using inaccurate reports.

5 types of payroll reports

- Company Payroll Reports: The company payroll reports give detailed information about the company-wide payroll information, and it is a detailed reporting of the entire company's payroll details for the given time period. Company payroll reports are often used to calculate the taxes and other levies the company owes to the government, e.g., Federal Insurance Contributions Act or FICA taxes.

The payroll register is the all-encompassing source of information about the entire company’s payroll overview. It also breaks down the payout into its components of additions, deductions, and taxes. The company payroll register also breaks down these components into the smallest detail. It can answer questions such as how much the company has paid FICA in a particular quarter or how many hours the employees have worked in the current month. The company payroll is a sensitive report because of the amount of information that it holds. It is not shared outside the company. If required, payroll reports that extract information may be shared with lenders and third parties without the employee’s information. The company payroll report is also called the payroll journal or payroll register.

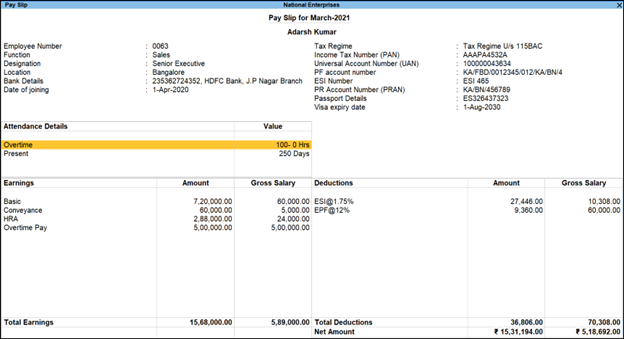

- Employee Payroll Reports: An employee-wise payroll report gives the payroll details of each employee. They are employee-specific extracts of the company’s payroll register, called the employee earnings report or a paystub. It gives a detailed calculator of the employee’s wages, taxes, and deductions. Every employee receives this pay stub every month and should ideally have access to all the past pay stub information.

Sample Payslip in TallyPrime

Sample Payslip in TallyPrime

While the company payroll reports give you the entire picture of the company’s payroll, the employee payroll reports give you employee-wise reports. The FLSA mandates that all employees access their pay stubs to understand their wages/salary, deductions, and taxes. The pay stub can also be used as proof of income when the employee applies for credit, leases, or loans at financial institutions.

- Certified Payroll Reports: Government contractors have to submit weekly payroll reports. The form WH-347 is the required federal form. Local and state authorities may have other equivalents of this form. This report must be submitted without errors. If you have any doubts, enlist the services of a competent accountant to help you file these reports.

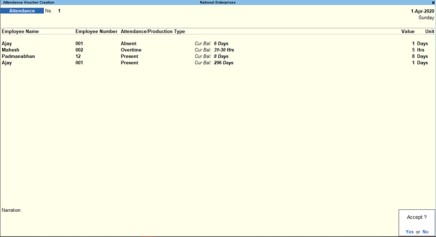

- Time tracking reports: If your company calculates wages based on timesheets, you will need time tracking reports to manage payroll. An efficient time tracking payroll system will calculate the employee’s wages accurately and ensure that you can analyze time attendance metrics. It is easier to answer questions such as, what is the average time worked by an employee, how many employees work overtime etc., with the right tools. Time tracking reports also help managers correlate time management and productivity in the company. Comparing the volume of goods produced with working hours can help assess productivity. Some companies also list the work that each employee was involved in on the timesheet. Analysis of the timesheet data on a micro level and larger scale will reveal areas where there is room for improvement in time management and productivity.

Attendance Time Sheet Reports

Attendance Time Sheet Reports

How to create a payroll report

Payroll reports are most valuable when they are appropriately designed. Keep the following pointers on how to make a payroll report in mind when creating payroll reports:

- Identify the information needed: The report's purpose will tell you what information is required. It is essential only to give the most relevant required information and not overshare any information with third parties. For example, if a potential investor you have approached asks for the payroll details for the last four quarters, you would give them an extract of the payroll register showing how much you paid towards payroll. One would not give out the entire payroll register with individual employee details for such an application. If the potential investor asks for a detailed report, generate a report with the wages, tax deductions, benefits, and other levies.

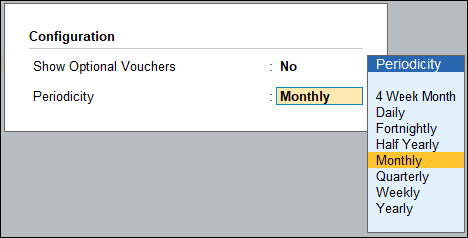

- Choose a time period: Payroll reports should be generated for a specific time period. The government agencies request reports for a set time period. But, when generating payroll reports for other purposes, think about the best way to present the information. Instead of a payroll report for the four quarters, you can compile an annual payroll report with the same information.

Generate Payroll Reports for Specific Time Periods with TallyPrime

Generate Payroll Reports for Specific Time Periods with TallyPrime

- Input payroll data: When you prepare a payroll report manually, you will calculate the required data and either write it or enter it into a spreadsheet or document editor program. This is a time-consuming task that has room for error. You could make mistakes during the manual extraction and calculation of data, and there could also be errors that creep in when keying in the data. An integrated business accounting management system such as TallyPrime manages all the payroll data for you and also updates all the relevant books of accounts. When you need a payroll report, you can generate it with a button click.

- Analyze the results: Payroll reports are a valuable source of information to draw meaningful insights. You should be able to determine how well your company uses its human resources and if any standout issues need resolution. If there are too many overtime payments and production is still low, you would have to get to the root of the problem. Payroll fraud is also easily detected when the reports are analyzed regularly. The right software system with checks and balances helps prevent payroll fraud.

The golden rules of payroll reporting

- Create frequent payroll reports to track expenses: Payroll reports may be required annually or quarterly. But, it is a good practice for a company to generate these reports more frequently and monitor them. Payroll is a significant expense that can directly impact the company's bottom line. Good payroll management requires that the payroll payouts be analyzed for accuracy, compliance, and productivity. Monthly or weekly reports help manage human resources more minutely and maximize productivity. Generating payroll reports through software is effortless, and you can easily create payroll reports for various time periods.

- Make sure the report measures up to performance: The performance and productivity of employees can make or break a company. Payroll reports help identify issues with productivity so that the management can take corrective measures.

- Use accurate payroll software to help: There are different payroll software products available. Choose one that can cope with your volume of payroll. Good payroll software should manage payroll data as required by the company and generate payroll reports in the required formats accurately and quickly. The best payroll management software TallyPrime does this and more. It also updates all the other modules of business accounting with the relevant payroll data. The integrated design of TallyPrime ensures that all information flows through the business without any issues. It also helps perform analyses comparing the productivity or sales figures with payroll. Accurate and quick report generation helps your company comply with the authorities and file all required reports correctly and punctually.

- Hire an accountant: Sometimes, hiring a good accountant is the best investment for a company. Instead of piles of books and registers, empower your accountant with the required software tools. TallyPrime is a favorite with accountants who can quickly extract the information they require through its intuitive design. It helps you manage your payroll system, and you no longer have to worry about how to make a payroll report.

Quick and easy payroll reports with TallyPrime

TallyPrime is a business management software that helps you manage your entire payroll system quickly and efficiently. TallyPrime helps you generate payroll reports at different levels and for various purposes.. It also updates your accounting ledgers and other related reports when you disburse payroll payments. You can create payroll reports for printing or digital copies that can be emailed or shared electronically.

Explore More Products

Read More:

- How to Manage a Payroll – Small Business

- What Are Payroll Taxes?

- Factors to Consider before Buying Bookkeeping Software for Your Business in USA

- Best Billing Software In USA – Things To Look Up Before Purchasing A Billing Software

Popular Articles