Tally Solutions | Updated on: July 13, 2022

- Automating the invoicing process

- Invoicing template/modes - Item invoice, service invoice

- Discussing payment terms ahead of time

- Invoices should be numbered

- Listing the accepted types of payment on the invoice

- Adding VAT to invoice

- Send invoices on time

- Following up on invoices

- Include a due date in your invoice

An invoice is a document the seller hands the buyer to request payment for goods or services delivered. Invoicing is a vital part of a business that keeps the revenues coming in. Any delays or mistakes in the invoicing process will cost the company money. Invoices can be created manually, through a spreadsheet, or using invoicing software. These options require that the invoice data be entered to generate the invoice and reflected in the accounting and inventory management systems. An accounting system with integrated invoicing ensures no typos or mistakes in invoicing and its related entries. It also speeds up the entire invoicing and bill collection process. An integrated software enables a seamless flow of information across all associated departments for easy approvals and quick processing. Automated invoicing is also scalable, and you can grow your business easily with minimal impact on the effectiveness of invoicing.

Automating the invoicing process

Automated invoice processing uses software to process, create and update invoices using a computerized system. Automation speeds up the creation, approval, and processing of invoices. Your company should be able to create detailed and accurate invoices as soon as the service or product is provided to the buyer. Since an invoice is a demand for payment, care should be taken to ensure that the invoice is for the right service/product and amount. Any mistakes that need to be corrected later will take time and slow down the payment collection from the buyer. Automated invoices enhance cash flow and productivity and also save operational costs. Since the entire invoicing data is stored in the invoice management system, it can be analyzed for trends and insights into buyer behavior. This article tells you more about how to invoice for businesses in Africa.

Invoicing template/modes - Item invoice, service invoice

Every business owner is very concerned with how much money will come in so that they can predict and manage their cash flows. Invoicing customers correctly and quickly is the first step to collecting payments efficiently. An invoice is a statement of the services or items provided and a calculation of the applicable taxes and other levies. The document informs the buyer of what they are paying for and how much they should pay.

Generally, invoices have the following essential components included in them:

A heading that clearly states that the document is an invoice

- Seller’s name and address

- Buyer’s name and address

- Invoice number

- Tax numbers and other necessary registration numbers of the buyer and the seller as required

- Taxation calculation and amounts

- Details of the items such as description, quality, rate, quantity, and amount

- Invoice amount

- The due date for the invoice

- Payment terms

- Payment options

- Signature/digital signature

The only difference between an item and a service invoice is that a service may be billed by hours or some other unit, which is reflected in the rate and quantity listed on the invoice.

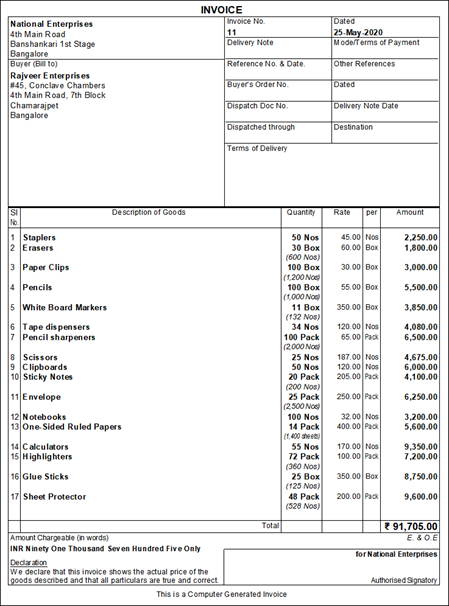

Invoice Generated By TallyPrime

Invoice Generated By TallyPrime

Discussing payment terms ahead of time

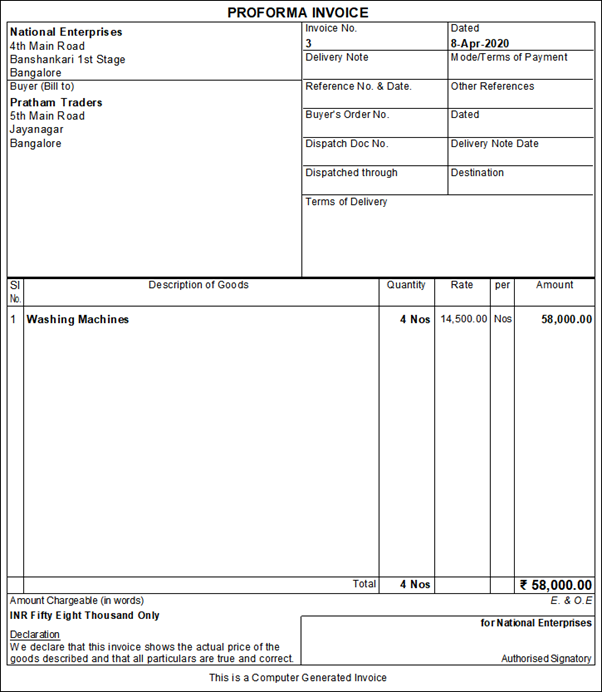

To prevent disputes and misunderstandings at the time of invoicing, it is essential to discuss the terms of payment with the buyer ahead of time. Some companies send the buyer a proforma invoice or a quote before confirming an order. Others may enter into an agreement with the company on payment terms. The time spent negotiating payment terms will prevent delays in collecting payment. At the time of invoicing and payment. If the company has a standard set of terms and conditions that are applied to the invoice, this can be printed on the invoice.

Proforma Invoice - TallyPrime

Proforma Invoice - TallyPrime

Invoices should be numbered

When a business is small, the number of invoices is limited and easily manageable. But, as the business grows, so do the volume of transactions and the number of invoices issued. When buyers place repeat orders, it will be difficult to differentiate between invoices. Numbered invoices are essential to track each invoice without any mistakes easily.

Listing the accepted types of payment on the invoice

The types of payment offered by different sellers differ. Ideally, a seller would offer a wide range of payment options for the buyers’ convenience and speed up the collection of dues. An invoice should clearly state the different types of payments accepted so that the buyer will not have to contact the seller for the information. The required payment transfer details should also be given.

Adding VAT to invoice

The VAT system requires that the invoice trail be clear and unambiguous. Ensure that your invoice complies with all the VAT requirements so the buyer can use the invoice to claim input tax.

Send invoices on time

Collecting payments is the key process to a good cash flow. Sending invoices on time ensures that the buyer will make the payment immediately. Delayed invoices lose the urgency in collecting the payment. If the buyer is not very organized, a delayed invoice is more likely to be misplaced, causing payment delays. The best time to hand over an invoice is as soon as the service or product delivery has been completed.

Following up on invoices

Accounts collectible is responsible for following up on invoices and reminding buyers that they have payments to collect. This is easier when the invoicing system is well organized, and the person can view the unpaid invoices and their data easily. TallyPrime is an invaluable tool that helps you isolate and filter unpaid invoices to make the follow-up easier.

Include a due date in your invoice

It is important to add a due date to an invoice. This informs the buyer of when they are expected to make payment. If there is no pay-by date on the invoice, it creates an ambiguity that may create delayed payments from the buyer.

Take the pain out of your invoice creation and management with TallyPrime. It is the best software that helps you keep up with your invoicing needs, generate invoices instantly, follow unpaid invoices and close those that are paid. TallyPrime’s invoice management saves you time, effort, and money and enhances your team's productivity. Contact us to know more about how to invoice for businesses in Africa with TallyPrime.

Read More:

How to File VAT Returns in iTax Portal?

Filter

Latest Blogs

Comprehensive Inventory Management Software in Kenya

Streamlining Operations: How the Best Business Management VAT Software Boosts Efficiency in Kenya

5 Must Have Reports Insights in Your Dashboard