Paying taxes can feel like a big task, especially when you’re running a business or working as a freelancer or professional. One key aspect of managing your income taxes is paying advance tax. It helps spread your financial obligations across the year, making it easier to stay organised and avoid last-minute stress or large lump-sum payments. This also keeps you safe from penalties.

If you’ve ever wondered what advance tax is, who needs to pay it, or how to pay it online, you’re in the right place. In this blog, we’ll break everything down in a simple way.

What is advance tax?

Advance tax means paying your income tax in instalments throughout the year instead of paying it all at once at the end. It follows the “pay-as-you-earn” method, which simply means you pay tax as you earn your income. This system helps both the taxpayer and the government. While it reduces the burden of paying a large amount at once, it also ensures the government receives a steady flow of income during the year.

Who needs to pay advance tax?

Advance tax is not just for big companies, it applies to many other individuals too. If the total tax payable by a person or business in a financial year is ₹10,000 or more after adjusting for TDS (Tax Deducted at Source), then they’re required to pay advance tax. Here’s who needs to pay it:

- Salaried individuals: If you have a regular salary and your employer deducts TDS, you may not need to worry. However, if you earn extra income from things like rent, interest, capital gains, or freelancing and the total tax on that (after TDS) exceeds ₹10,000, you must pay advance tax on that additional earning.

- Self-employed professionals: This includes doctors, lawyers, designers, consultants, and freelancers. Since no TDS is usually deducted from their income, they must estimate their total yearly income and pay advance tax accordingly.

- Business owners: Whether you run a small shop or a large enterprise if your estimated tax liability (after TDS, if any) is ₹10,000 or more in a year, you are required to pay advance tax.

- Individuals with other income sources: Even if you're not salaried or self-employed, but you earn income from sources like rent, interest, or stock market profits, and your tax payable crosses ₹10,000, then advance tax becomes applicable.

- Investors and traders: People earning short-term or long-term capital gains from shares, mutual funds, property, or crypto must also pay advance tax on those profits.

Who is exempt?

- Senior citizens: If you’re aged 60 or above and do not have income from a business or profession, you’re exempt from paying advance tax even if your tax liability is more than ₹10,000.

Advance tax due dates and penalties for FY 2025-26

Staying aware of advance tax deadlines is essential to avoid interest charges and ensure timely compliance. The Income Tax Department has set specific due dates during the financial year for individuals and businesses to pay their advance tax in instalments. Here are the deadline for paying advance tax:

|

Due date |

Minimum advance tax to be paid |

|

15th June |

15% of total tax liability |

|

15th September |

45% (cumulative) |

|

15th December |

75% (cumulative) |

|

15th March |

100% (full amount) |

Penalties for late payment:

- Interest under Section 234B & 234C of the Income Tax Act 1961 is charged if you fail to pay advance tax on time.

- Interest is calculated monthly on the amount you still owe, so delays can add up quickly.

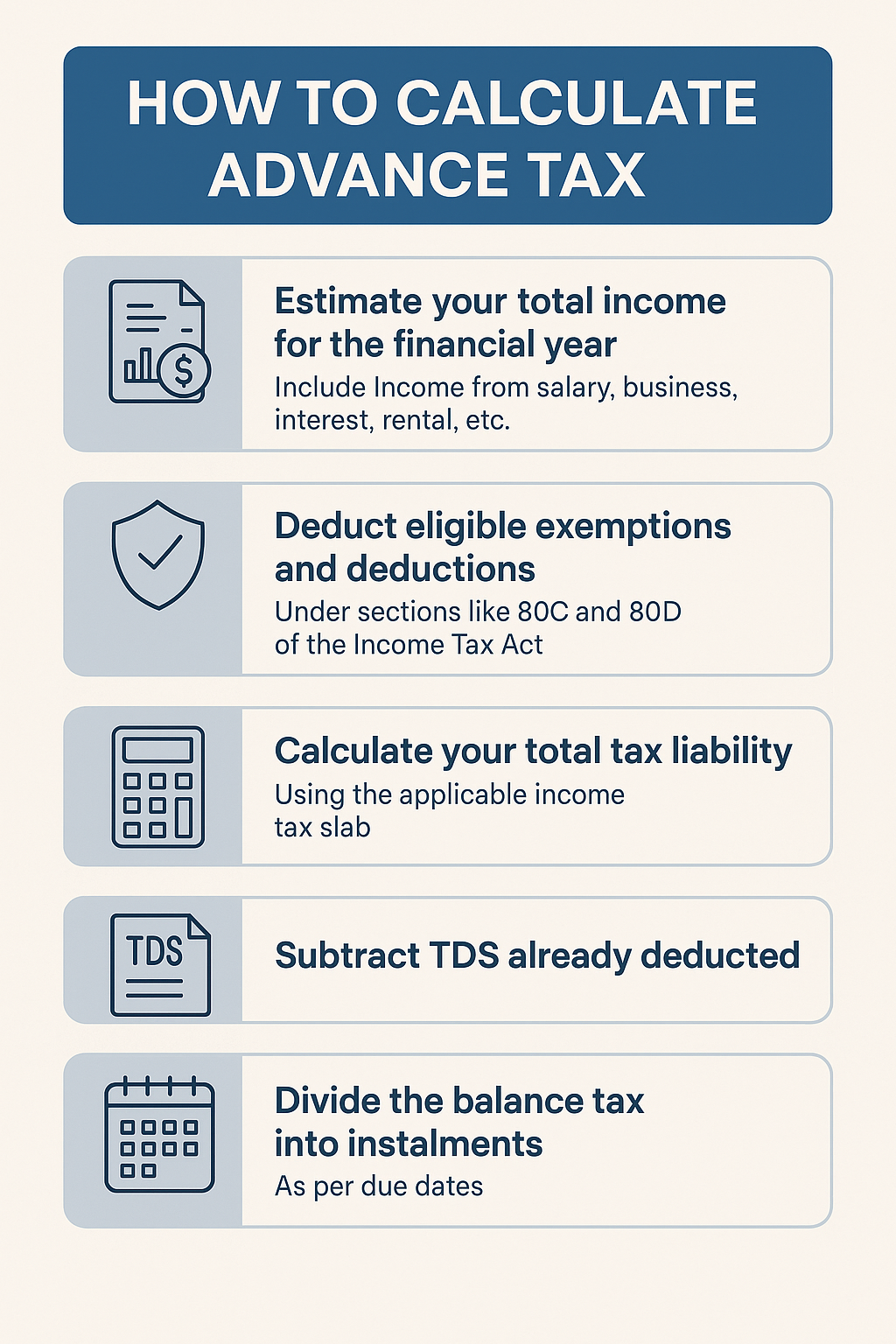

A step-by-step breakdown of advance tax calculation

Calculating advance tax accurately is crucial to avoid interest penalties and ensure smooth financial planning. Here's a simple way to break down the calculation and determine how much you need to pay.

Let’s understand it better through an example:

Let’s say your estimate total income for the year to be ₹12 lakh. After applying deductions under 80C (for investments, insurance, etc.), your tax liability is ₹1.25 lakh. Now, your employer might have deducted some tax at source from your salary (TDS), so let’s say ₹25,000 has already been deducted. This means you still need to pay the remaining tax of ₹1 lakh (₹1.25 lakh - ₹25,000) through advance tax.

Based on the due dates for advance tax, here’s how you would divide the ₹1 lakh payment:

Total tax liability after TDS: ₹1,00,000 (i.e., ₹1.25 lakh - ₹25,000 TDS)

Advance tax instalments:

- By June 15: Pay at least ₹15,000 (15% of ₹1,00,000)

- By September 15: Total paid should be at least ₹45,000 (45% of ₹1,00,000). So, if you already paid ₹15,000 in June, pay an additional ₹30,000 now.

- By December 15: Total paid should be at least ₹75,000 (75% of ₹1,00,000). So, pay another ₹30,000.

- By March 15: Total paid should be ₹1,00,000 (100% of ₹1,00,000). So, pay the remaining ₹25,000.

This way, you’re making smaller, manageable payments throughout the year, instead of a huge amount when you file your return.

Step-by-step process to pay advance tax online

Paying advance tax online has become a quick and convenient process, helping taxpayers meet their obligations without visiting a tax office. With the right details on hand, you can complete the payment securely in just a few minutes. Follow these simple steps to ensure timely and hassle-free submission through the official income tax portal.

- Visit the income tax e-filing portal

- Click on e-Pay Tax under the ‘Quick Links’ section.

- Fill in details like PAN, address, email ID, and mobile number.

- Login using the OTP you received.

- Select 'Proceed' under ‘Advance Tax’.

- Choose the assessment year as FY 2025–26.

- Enter the amount under ‘Advance Tax’ in the appropriate field.

- Choose payment mode— net banking, debit card, UPI, or NEFT.

- Submit the form and complete the payment.

Don’t forget to download the payment receipt for your records and for filing your income tax return.

Common mistakes to avoid

Paying advance tax correctly is crucial to avoid penalties and maintain financial discipline. However, many taxpayers make the following avoidable mistakes that can lead to unnecessary interest charges or compliance issues:

- Wrong assessment year: Always select the correct AY (it's the next year following the current financial year).

- Incorrect challan: Use challan 280 for advance tax. Don’t mix it up with self-assessment tax.

- Missed instalments: Delaying or missing due dates can lead to interest charges.

- No receipt saved: Failing to download the payment confirmation may cause trouble later.

Double-check details before submitting to avoid these issues.

How does TallyPrime make advance tax calculation easier?

TallyPrime is more than just accounting software, it also helps you with your taxes. Here’s how it makes paying advance tax simple:

- Automatic income estimation: TallyPrime tracks your income and can help estimate your tax liability by generating real-time reports and income tax computation statements.

- Real-time TDS tracking: It enables you to record and monitor TDS entries efficiently, so you only pay the remaining amount.

- Timely alerts: Its dashboard and reports give you clear, updated insights and help you stay on top of tax deadlines by showing what you owe and upcoming due dates.

- Accurate calculations: TallyPrime handles the tax calculations, minimising mistakes and saving you time.

Conclusion

Paying advance tax on time is a sign of financial discipline. It helps you avoid stress and penalties. Whether you're a small business owner, a freelancer, or a professional, knowing how and when to pay advance tax is essential.

With tools like TallyPrime, staying compliant becomes much easier. It simplifies tax calculations, tracks due dates, and ensures you're always on top of your financial commitments, making tax management hassle-free.