Every business begins with a dream. You’ve got that spark, that “I’m going to make this happen” energy. But passion alone doesn’t pay the bills or keep your team running. To turn your big idea into something real and sustainable, you need a strong plan, and yes, a financial one.

Business plan financials are basically the money map behind your strategy. They show how much funding you’ll need, when you’ll need it, and how you’ll bring it back in.

Accurate financial projections can truly make or break your business. Investors want to see them before they fund you. Banks need them before they approve a loan. And your team relies on those numbers to keep things moving in the right direction.

So whether you’re sketching out your first startup idea or preparing to scale, learning how to build accurate financial projections is a must.

In this blog, we’ll explore what business plan financials actually mean, break down their key parts, and share some templates and tools to make the process easier.

What are business plan financials and why do they matter?

Your business plan financials tell the real story of how your idea can make money and keep things running. They show where the money comes from, where it goes, and what’s left at the end of the day. Before you spend a single pound, these numbers help you see whether your plan actually stands up.

Good financials matter because they give everyone, you, your team, and anyone thinking about investing, a clear view of how your business will work in the real world.

Here’s why they’re so important:

- They bring your ideas to life: Your financials turn a big dream into clear, realistic goals you can actually work towards.

- They make planning easier: You’ll know how much funding to secure, when you’re likely to break even, and what kind of profit you can aim for.

- They help you spot problems early: Seeing gaps or shortfalls before they happen gives you time to make adjustments and avoid surprises.

- They guide better decisions: When your numbers are clear, it’s easier to budget wisely, set targets, and manage growth without losing control.

- They build trust: Strong financials show investors, lenders, and your team that you’ve done the groundwork and understand where your business is heading.

Key components of a business plan financials

Okay, time to dig a little deeper.

You’ve got the idea, you know why financials matter, but what goes into them? The “Components of Business Plan Financials” are the backbone of your whole money story. They’re the sections that show where your business stands now, where it’s headed, and how it plans to get there.

Here’s a closer look at each one:

Income statement (Profit and loss statement)

The income statement shows whether your business is making money or simply getting by. It sums up how much you earn, how much you spend, and what’s left once all the bills are paid.

It usually includes:

- Revenue: The total money earned from sales or services.

- Expenses: All the costs involved in running your business.

- Net profit or loss: What remains once expenses are subtracted from revenue.

Most businesses break this down by month, quarter, or year, so it’s easier to spot trends. You might notice sales peaking during holidays or costs rising after hiring new staff.

This report helps you check if your pricing, sales, and costs are in balance, or if something needs adjusting. Investors pay close attention to it because it shows how efficiently your business operates.

In simple terms, the income statement answers one key question: is the business profitable?

Cash flow statement

Even if your income statement looks great, your business can still run into trouble if you don’t manage your cash properly. That’s when the cash flow statement shows its true value.

This report tracks how money actually moves in and out of your business. It shows three main types of activity:

- Operating activities: Day-to-day transactions like sales income and supplier payments.

- Investing activities: Buying or selling assets such as equipment or property.

- Financing activities: Getting or repaying loans, or bringing in investor funds.

The cash flow statement helps you see if you have enough money to pay bills, handle emergencies, or invest in growth. Cash flow works like fuel for your business. No flow means no movement.

You can also use this online cashflow generator to check out your business's financial health. You’ll know when to hold back on spending and when it’s safe to invest more confidently.

Balance sheet

If you want to see where your business stands financially, the balance sheet is your best friend. It shows what you own, what you owe, and what’s truly yours.

Your balance sheet has three main sections:

- Assets: What your business owns: cash, inventory, buildings, or equipment

- Liabilities: What you owe: loans, bills, or salaries to be paid

- Equity: What’s truly yours (or your investors’) after debts are settled

These three parts always connect through one basic rule: Assets = Liabilities + Equity

When these numbers balance, it means your finances are in good shape. A healthy balance sheet shows stability, which makes lenders and investors more confident about working with you. It also helps you keep track of how much your business is truly worth at any point in time.

Sales forecast

The sales forecast is where you look ahead and estimate how much you’ll sell in the coming months or years. It’s a mix of research, logic, and a bit of intuition.

The key elements include:

- Sales volume: how many units or services you expect to sell

- Pricing: the average selling price per unit

- Revenue projection: total income expected from those sales

To build your forecast, you can use:

- Past sales data (if you have it)

- Market research and competitor analysis

- Seasonal or industry trends

This forecast isn’t just about guessing future numbers. It helps you plan production, manage inventory, and allocate marketing budgets more effectively. For instance, if your forecast predicts a sales dip in certain months, you can plan promotions or special offers to boost demand.

Break-even analysis

This part is where your hard work starts to get exciting. The break-even analysis tells you the exact moment your business stops losing money and starts making it.

Your break-even point is when your total revenue matches your total expenses. At that stage, you’re covering costs but not earning a profit yet.

It usually includes:

- Fixed costs: Expenses that stay the same, like rent or salaries

- Variable costs: Expenses that change with sales volume, such as materials or shipping

- Break-even point: The number of sales or revenue needed to cover all costs

Knowing this helps you:

- Set smart and achievable sales targets

- Decide the right pricing strategy for your products or services

- Plan expenses wisely so you don’t go over your budget

Once you pass your break-even point, every extra sale becomes profit. That’s why understanding this number is so beneficial, as it gives you a clear target to work towards from day one.

How to create accurate financial projections

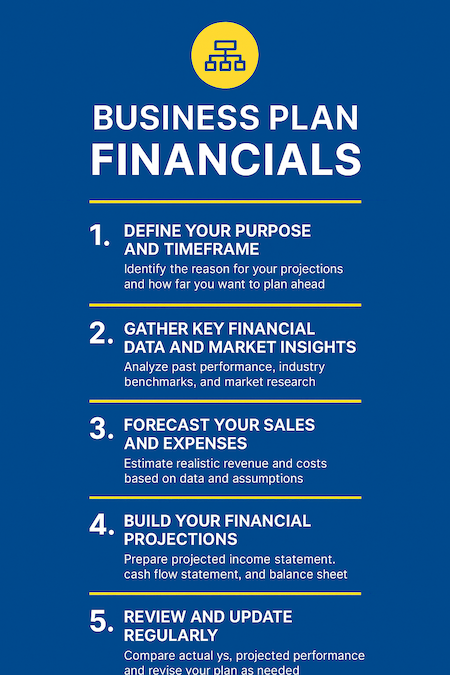

Now that you know what goes into your business plan financials, it’s time to bring those numbers to life. Financial projections might sound intimidating at first, but they’re really just smart projections about your business’s future, based on data, research, and a bit of logic.

Here’s how to do it step by step:

Define your purpose and timeframe

Before diving into the numbers, get clear on why you’re making these projections and how far ahead you want to plan.

Are you preparing them for potential investors, applying for a loan, or just trying to track your own growth? Your purpose will shape how detailed your projections need to be.

Next, set your timeframe. Most businesses create projections for one year, three years, or five years, depending on their goals. For example, startups might focus on shorter-term projections since their numbers change quickly, while established businesses can plan further ahead.

Setting a clear goal and timeline gives direction to the entire process. It’s like setting the destination before starting your financial journey.

Gather key financial data and market insights

You can’t project the future without understanding the past and present. Start by collecting all the relevant numbers and information you already have.

This might include:

- Past sales records

- Expense reports

- Profit and loss statements

- Cash flow data

If you’re a new business without historical data, don’t worry. In that case, look at industry benchmarks, competitor performance, and market research. You can also analyse customer behaviour, demand trends, and pricing in your industry.

The goal is to base your estimates on facts, not guesses. The stronger your data, the more believable and accurate your projections will be.

Estimate your expenses

Every business has two types of expenses: fixed costs and variable costs. Fixed costs stay the same no matter how much you sell (like rent or salaries), while variable costs change depending on your sales (like raw materials, packaging, or delivery costs).

Make a list of all your expected expenses, including:

- Rent or office space

- Employee wages

- Marketing and advertising

- Inventory or supplies

- Utilities and maintenance

- Insurance, taxes, and other overheads

Don’t forget to include one-time costs like equipment purchases or launch expenses. It’s better to slightly overestimate than to deal with unexpected costs later.

Having a clear picture of your expenses helps you see how much money you’ll need each month and ensures you’re not underbudgeting anywhere.

Forecast your sales

Now comes the exciting part, i.e., predicting your income. A sales forecast estimates how much you’ll sell and earn during your chosen timeframe.

Start by breaking down your products or services and estimating how many units you expect to sell each month or quarter. Consider factors like pricing, seasonality, competition, and demand trends.

If you already have customers, use past sales data to identify patterns. If you’re just starting out, rely on market research and competitor insights to build an accurate projection.

Avoid the excitement of being overly optimistic. It’s always better to present realistic numbers that you can justify rather than big figures that raise eyebrows.

Your sales forecast sets the stage for your revenue projections, which form the foundation of all your financial planning.

Build your financial projections

Once you’ve got your data, expenses, and sales estimates ready, it’s time to put it all together.

Start by creating:

- Projected income statement: To see your expected revenue, expenses, and profit

- Projected cash flow statement: To track when money will come in and go out

- Projected balance sheet: To understand your business’s assets, liabilities, and equity in the future

These three reports work together to paint a full picture of your financial outlook.

Make sure your numbers make sense. For example, if your sales rise, your production or marketing costs should too. Consistency is key here.

And remember, financial projections aren’t ‘set it and forget it’ documents. Review them regularly, compare them with actual performance, and update them as your business grows or the market changes.

Tips to improve the accuracy of your projections

Creating financial projections is about understanding how your business might perform in the real world. The more honest and realistic your numbers are, the more helpful your plan will be. Even small changes in your assumptions can have a big impact on your results.

Here are a few simple tips to help you make your projections clear, useful, and grounded in reality:

- Base your assumptions on real data: Your projections are only as strong as the assumptions behind them. Instead of guessing, use data from your past performance, industry benchmarks, or credible market research. For example, if you’re estimating sales growth, look at actual trends in your sector or region rather than relying on gut feeling.

- Stay realistic: It’s easy to get carried away with big numbers when you’re optimistic about your business. But investors and lenders can spot unrealistic forecasts from a mile away. Keep your numbers practical and achievable, even if that means being a little conservative. It’s better to exceed expectations than fall short.

- Review and update regularly: Your financial projections aren’t a one-time task. Markets change, customer behaviour shifts, and new costs can appear out of nowhere. Make it a habit to review your projections every quarter (or at least twice a year) and adjust them to match what’s really happening in your business.

- Plan for uncertainties: No matter how accurate your forecast is, surprises will always find a way in. That’s why it’s smart to create multiple scenarios like a best case, worst case, and most likely case. This helps you stay prepared for anything, whether it’s a sudden price hike, market slowdown, or a big new client.

- Get a second opinion: Sometimes, being too close to your numbers can make you overlook details. Share your projections with a trusted accountant, business mentor, or financial advisor. A new opinion can help you spot errors, challenge assumptions, and strengthen your plan before you present it to investors.

Keep track of actual vs projected performance: Once your plan is up and running, don’t just leave it there. Compare your actual results with your projections every month. This helps you see what’s working, what’s not, and where you might have over- or under-estimated. Over time, you’ll become better at forecasting because you’ll learn from your own data.

Conclusion

With the right templates, tools, and realistic assumptions, creating projections becomes much easier and far more useful. Remember, these numbers aren’t fixed; they should evolve as your business grows and the market changes.

Keep your data updated, review your progress often, and let your financials guide your decisions with confidence. After all, your financial plan is the story of your business, told through numbers that matter.