If you’re someone who enjoys a bit of Pan Masala or has a tobacco habit, the government has a Valentine’s gift for you this February 2026. Unfortunately, it’s not roses or chocolates.

It’s a bigger tax bill.

From 1 February 2026, the way GST and cess apply to tobacco and pan masala is undergoing a major overhaul. This isn’t just a small rate tweak; it’s a complete system reset. Think of it less like a price hike and more like switching from a scooter to a toll-heavy expressway.

Whether you are a manufacturer, trader, retailer, or just a curious consumer, it’s time to spit out old tax knowledge and chew on the new rules.

A Trip Down Memory Lane: The "Sin Tax" Evolution

Tobacco and Pan Masala have always been the naughty students of the tax classroom. They never got the benefit of “essential goods” sympathy sitting.

1. Before 2017 – The Confusion Era: A chaotic mess of excise duties, state VATs, and paperwork was so heavy that trees probably paid indirect tax too.

2. 2017-2025 GST Brings Order (Sort Of): GST arrived with promises of simplicity.

Tobacco and Pan Masala were placed in the 28% GST slab, but with an extra Compensation Cess on top. The idea was simple:“States will lose revenue; let’s compensate them.”

The execution?

Not so simple, many manufacturers legally but creatively kept transaction values low, which kept tax payments low too.

3. The 2026 Reset - The Government Says “Enough”: The government realized the old system was as messy as a Gutkha stain on a fresh white wall. They wanted something simpler to collect but harder to evade.

"Death and taxes are certain, but at least death doesn't get a new GST notification every six months."

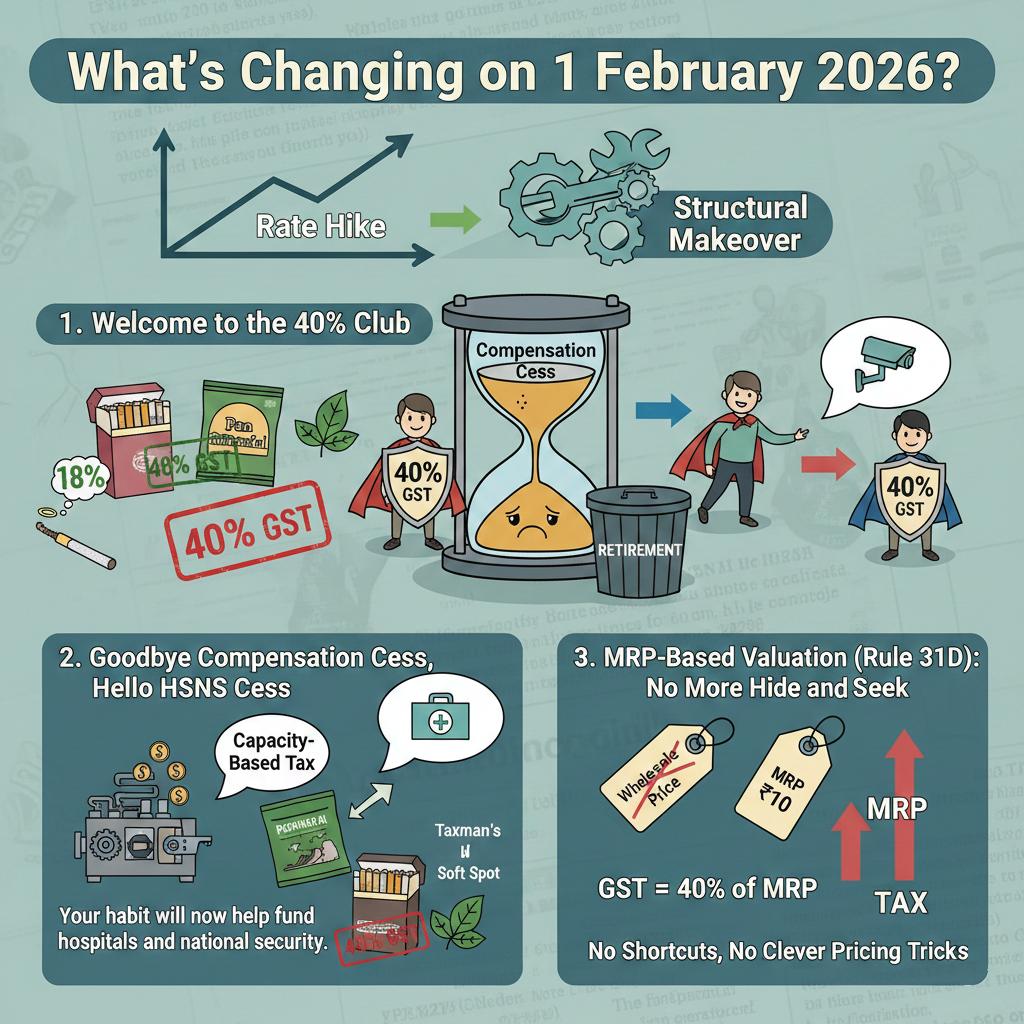

What’s Changing on 1 February 2026?

The biggest change isn't just a rate hike; it’s a structural makeover. The old Compensation Cess is being sent into retirement (not the relaxing kind), and new players are entering the field.

- Welcome to the 40% Club: Say goodbye to the 28% slab for most items. Pan Masala, cigarettes, and manufactured tobacco are moving to a whopping 40% GST rate (20% CGST + 20% SGST).

-

- The Exception: Bedi is the only one getting a bit of a break, staying at an 18% GST rate. Apparently, even the taxman has a soft spot for the "poor man's cigar."

- Goodbye Compensation Cess, Hello HSNS Cess: The "Compensation Cess" is being replaced by the Health and National Security (HSNS) Cess.

-

- Pan Masala: Will now be taxed based on the capacity of the packing machine rather than just sales. If your machine is fast, your tax bill is faster. “Your habit will now help fund hospitals and national security.”

-

- Tobacco & Cigarettes: Will face a newly revamped Additional Excise Duty.

- MRP-Based Valuation (Rule 31D): No More Hide and Seek: Earlier, GST was calculated on the transaction value (wholesale price). From February 2026, it’s based on the Retail Sale Price (MRP).

Example:

If a pouch shows ₹10 as MRP:

- GST is calculated on ₹10

- Not on what the distributor paid

Formula:

"GST"=("MRP" ×40)/140

So, Increase MRP = Increase tax

No shortcuts, no clever pricing tricks

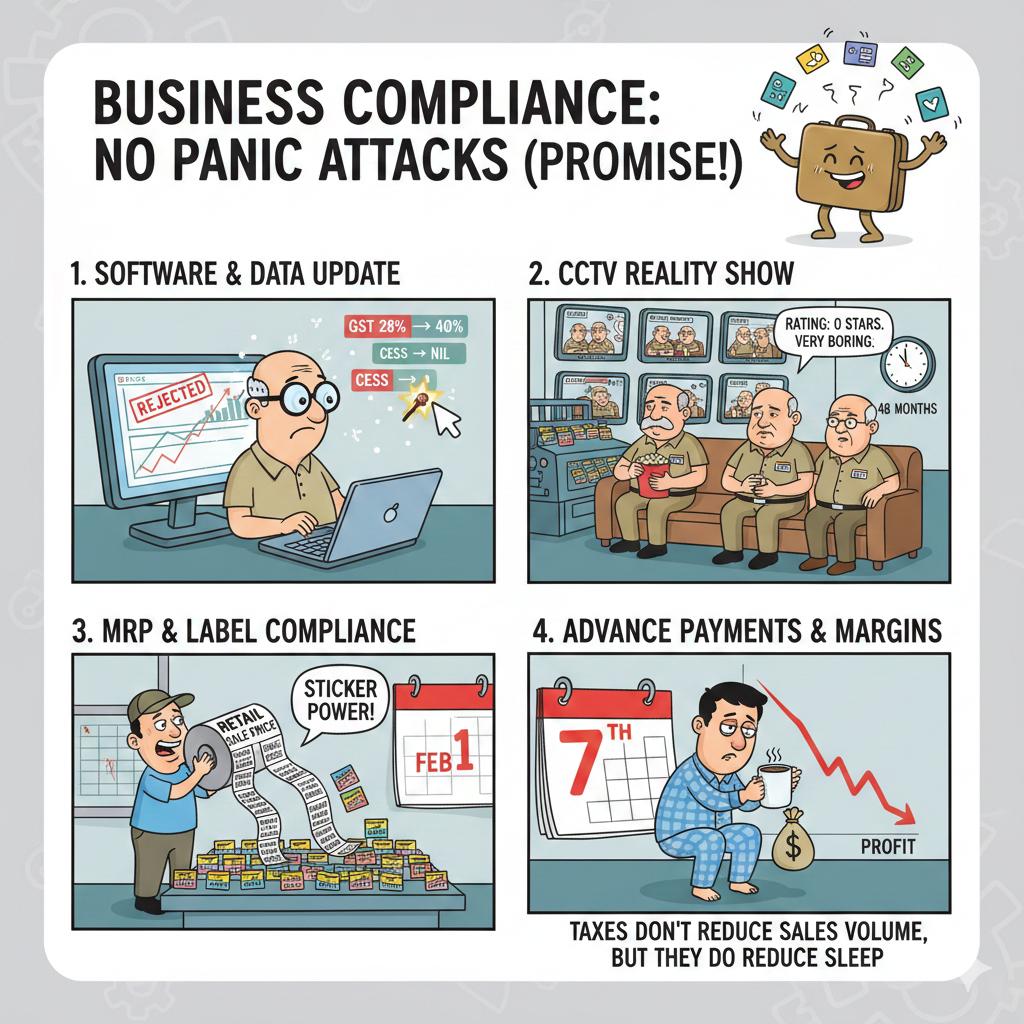

How Businesses Can Prepare (Without Panic Attacks)

If you’re in this business, preparation is not optional, it’s survival.

- Software & Master Data Update

- Change GST rate from 28% to 40%

- Set Compensation Cess to NIL

- Enable Rule 31D valuation

- Update correct HSN codes

If you don’t:

The GST portal will reject your returns faster than a bad online order.

- Packing Machines & CCTV Reality Show

For Pan Masala manufacturers:

- Register under HSNS Cess on the ACES portal

- Declare every packing machine

- Tax depends on maximum rated speed

- Install CCTV cameras covering packing areas

- Store footage for 48 months

Think of it as:

A very boring reality show where GST officers are the only audience.

- MRP & Label Compliance

- Every pack must display Retail Sale Price

- Even tiny “chutki” packs

- Clear old stock before 1 Feb if possible

- Old stock sold later still attracts new rules

Sticker matters more than ever.

- Advance Payments & Margin Reality Check

- HSNS Cess to be paid in advance by the 7th of every month

- Rework pricing and margins

- Post-tax profitability will shrink faster than expected

As many manufacturers will discover:

“Taxes don’t reduce sales volume but they do reduce sleep.”

The 31 January Cut-Off

Before 31 January 2026 comes to an end:

- Do a physical stock count

- Take photos of inventory

- Capture machine readings

This becomes your:

“Shield of Truth” during future audits

The "Pouch" Comparison: How much is the Taxman eating?

To put it in perspective, here is what happens to your favorite pouch from 1 February 2026. Notice how the government's "share" of your habit basically doubles because they are now taxing the full sticker price (MRP), not just the wholesale price.

|

Pouch Price |

Old GST Share (Approx) |

New GST Share (Rule 31D) |

The "Ouch" Factor |

|

₹5 Pouch |

₹0.70 |

₹1.43 |

Government takes 100% more! |

|

₹10 Pouch |

₹1.40 |

₹2.86 |

Almost ₹3 goes straight to GST! |

|

₹50 Pack |

₹7.00 |

₹14.28 |

That's one expensive "shubh mahurat." |

Note: This is just the GST. The HSNS Cess and Excise Duty are like the extra 'Chuna' they are added separately on top!

Final Takeaway

1st February 2026 is not just another effective date.

It is a complete reboot of how tobacco and Pan Masala are taxed.

The government is making one thing very clear:

- If you continue the habit

- You’ll help fund public health

- And national infrastructure

As the saying goes:

“You can’t buy happiness, but at 40% GST, you can definitely buy a small piece of a highway.”