When an MRP Question Stopped Our GST Filing

We were midway through a routine GST return filing when someone from the team paused and asked a simple question:

“Should we revise the MRP for this batch, or can we continue with the old price?”

It didn’t sound urgent.

But it turned into a 90-minute discussion involving GST rates, excise duty, valuation rules, stock already in circulation, and potential penalties.

That’s when it became clear —

under the new tobacco tax regime, MRP is no longer just a pricing decision. It’s a compliance trigger.

What Changed Under the New Tobacco Tax Regime

Recently, the Government of India revised the tobacco taxation framework, effective 1 February 2026, fundamentally changing how tobacco products are taxed and valued.

Key shifts businesses must understand:

- GST Compensation Cess removed for tobacco products

- GST continues, but now combined with central excise duty

- Additional health/security cess introduced on select products

- For certain tobacco categories, tax valuation is linked to declared MRP, not just invoice value

- Higher focus on retail sale price printed on packs

This means MRP directly influences tax liability, audit exposure, and penalty risk.

Why MRP Accuracy Matters More Than Ever

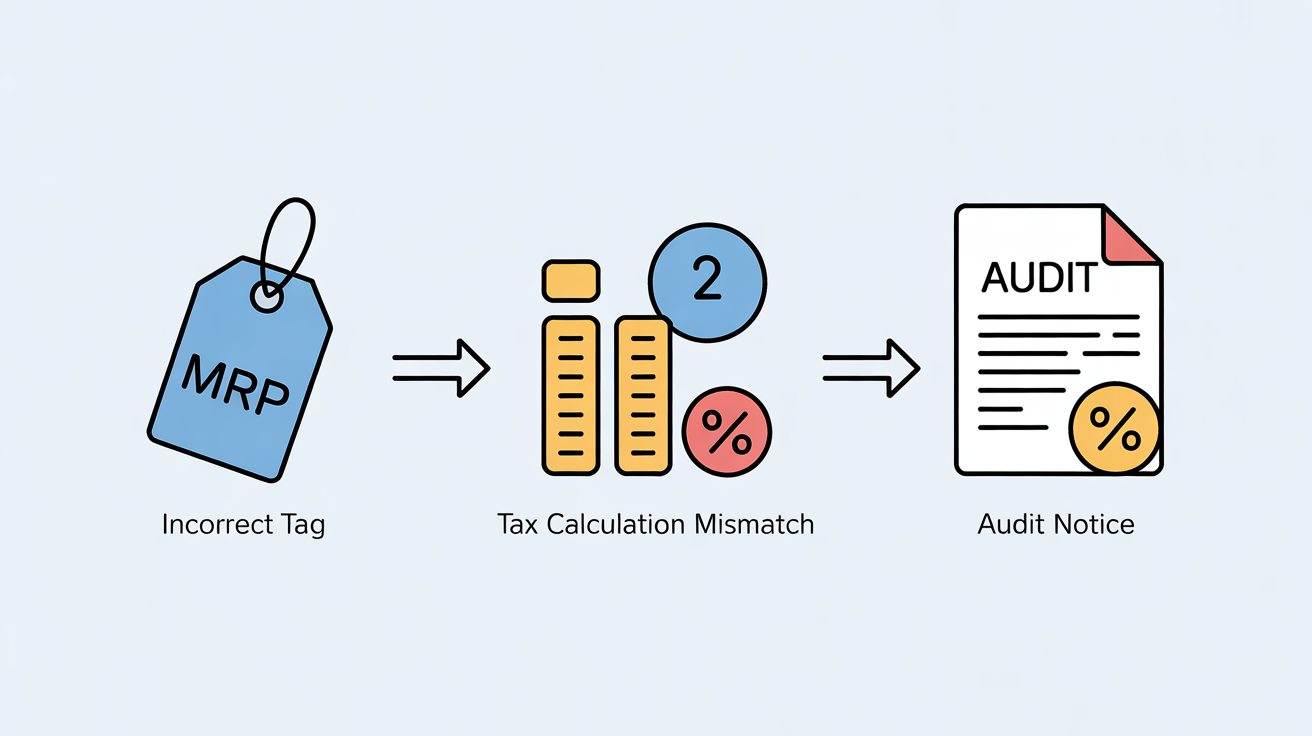

Under the new structure, incorrect or outdated MRP can lead to:

- Short payment of GST or excise duty

- Incorrect valuation under GST rules

- Notices for under-declaration

- Demand for differential tax + interest + penalties

- Disputes during departmental audits

In tobacco businesses, MRP is no longer a marketing decision — it’s a tax declaration.

Common MRP Compliance Mistakes We’re Seeing

From client discussions and internal reviews, these mistakes are becoming frequent:

1. Old MRP Used After Tax Change

Businesses continue selling stock with pre-revision MRPs even when tax structure has changed.

2. Different MRPs for Same Product

Same SKU carrying different MRPs across batches without clear documentation.

3. Mismatch Between MRP & Accounting Masters

MRP printed on packs doesn’t match what’s configured in the accounting system.

4. No Link Between MRP & Tax Computation

Tax calculated on transaction value, while law expects valuation based on MRP.

Each of these may seem minor — until an audit begins.

The Hidden Audit Risk: Stock Already in the Market

One of the biggest practical challenges is transition stock:

- Goods manufactured before the tax change

- Sold after the tax change

- Carrying old MRPs

Without clear tracking:

- Auditors question valuation

- Officers ask for re-calculation

- Businesses struggle to explain pricing logic

This is where clear system records and batch-level visibility become critical.

Practical Compliance Steps Businesses Should Take Now

Here’s what finance teams should focus on immediately:

1. Review & Update MRP Structures

Ensure MRPs reflect the new tax incidence — including excise and cess.

2. Align MRP With Tax Masters

Accounting systems must reflect:

- Correct tax rates

- MRP-based valuation where applicable

- Accurate item classification

3. Track Old vs New Stock Separately

Maintain clear records for:

- Pre-change stock

- Post-change production

4. Document MRP Revision Logic

Keep internal notes explaining:

- Why MRP was changed

- From which date

- For which products

This helps immensely during audits.

Where Accounting Systems Make the Difference

Manually managing MRPs across multiple products, tax slabs, and batches is risky.

In practice, businesses benefit when their accounting system can:

- Maintain item-wise MRPs

- Reflect tax changes without data rework

- Track stock valuation accurately

- Generate clean audit trails

- Support GST, excise, and compliance reporting together

A CFO’s Perspective: Compliance Is About Readiness, Not Reaction

The new tobacco tax regime sends a clear signal:

Pricing decisions must now be compliance-ready.

MRP errors won’t just affect margins —

they can trigger:

- tax demands

- audit objections

- reputational risk

Businesses that proactively align pricing, accounting, and compliance systems will navigate this transition smoothly.

Those who delay will spend time responding to notices instead of running their business.

Final Thought

MRP changes are no longer cosmetic updates on packaging.

They are regulatory declarations with financial consequences.

With frequent tax changes and increased scrutiny, the safest approach is:

- clarity in pricing

- discipline in systems

- readiness for audit

Because under the new regime, what’s printed on the pack must stand up in the books — and before the tax officer.