Why most payment delays begin long before the due date

The Client Call That Wasn’t About Cash

I was reviewing an ageing report late one evening when my phone rang.

It was a long-standing client.

“Our collections are slowing down. Customers aren’t paying on time,” he said.

The cash position wasn’t alarming.

Sales were steady.

Credit terms were clear.

So I asked a simple question:

“Are customers disputing the invoices?”

His answer was honest:

“Not really disputing… but asking for copies again, questioning quantities, dates, or saying they never received the invoice.”

That’s when it clicked.

Many collection delays aren’t about money — they’re about communication gaps.

Where Invoice Disputes Actually Begin

Most invoice disputes don’t start with bad intent.

They start with:

- invoices sent late

- invoices sent through email chains

- missing attachments

- mismatched formats

- manual data re-entry at the customer’s end

By the time the invoice reaches the buyer’s accounting team:

- details don’t match their records

- approvals get delayed

- questions bounce back to sales or finance

Each back-and-forth adds days — sometimes weeks — to collections.

From an accountant’s point of view, this isn’t a collections problem.

It’s a process problem.

Manual Invoice Sharing Creates Silent Friction

Traditional invoice sharing usually looks like this:

- invoice generated in accounting software

- exported as PDF

- emailed manually

- followed up separately

- resent multiple times

Every step introduces:

- delay

- version confusion

- human error

- dependency on individuals

I’ve seen finance teams spend more time proving an invoice is correct than actually collecting the payment.

Cleaner collections require fewer handoffs.

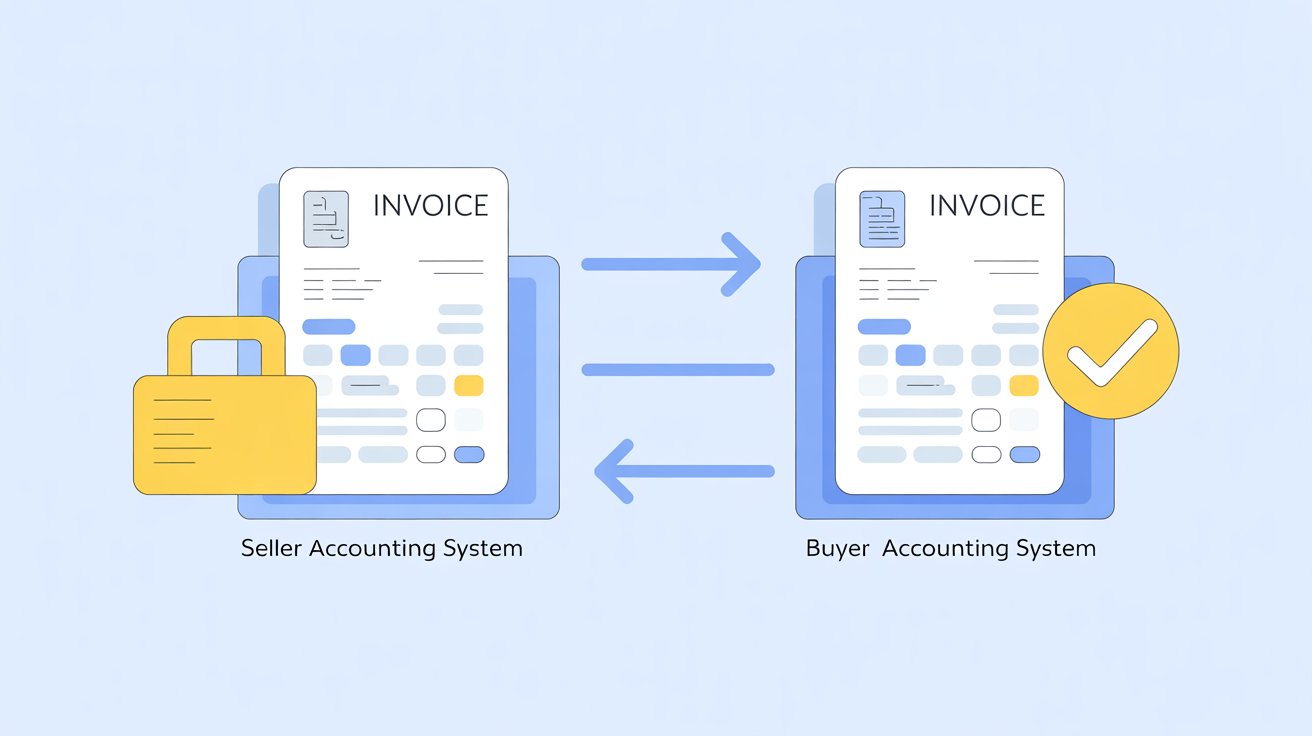

Digital Invoice Exchange Changes the Conversation

Digital invoice exchange removes the uncertainty around:

- when the invoice was sent

- what version was shared

- whether the buyer received it

- whether it matches their records

Instead of sending documents, systems exchange data.

When invoices move digitally between accounting systems:

- data flows directly

- formats are standardized

- discrepancies reduce automatically

- buyer accounting teams process faster

In tools like TallyPrime, digital invoice exchange enables businesses to share invoices directly with the customer’s accounting system, reducing manual intervention on both sides.

The result?

Fewer questions. Faster acceptance. Quicker payment cycles.

Why Disputes Drop When Data Is Shared, Not Re-Entered

Most invoice disputes arise because:

- someone re-entered the data

- quantities or rates were typed differently

- taxes were calculated again

- references were missed

Digital invoice exchange minimizes these risks by:

- transferring invoice data as-is

- preserving original values

- keeping consistent references

When both parties see the same data, disputes reduce naturally.

As a CFO, I’ve noticed:

The moment re-entry stops, disputes slow down.

Faster Acceptance = Faster Collections

Payments don’t wait for reminders.

They wait for invoice acceptance.

Digital invoice exchange helps by:

- reducing approval delays

- speeding up internal processing at the buyer’s end

- minimizing follow-up queries

- creating clarity on payable amounts

For finance teams, this means:

- more predictable cash inflows

- cleaner receivables ageing

- fewer uncomfortable follow-ups

Collections improve not because teams push harder —

but because systems work smarter like Tally.

Better Audit Trails, Better Trust

During audits or reconciliation discussions, a common challenge is:

“Which invoice version is final?”

Digital exchange ensures:

- clear transmission records

- consistent invoice data

- traceable exchange history

For businesses using accounting systems like TallyPrime, this improves:

- audit readiness

- dispute resolution

- confidence during reconciliations

Trust builds when both parties rely on the same source of truth.

The CFO View: Less Chasing, More Control

What finance leaders really want is not faster emails —

it’s fewer questions.

Digital invoice exchange allows CFOs to:

- trust receivable numbers

- reduce dependency on sales follow-ups

- improve cash flow predictability

- maintain cleaner books

It shifts the finance team’s role from:

“Explaining invoices”

to

“Managing cash strategically.”

That shift matters as businesses scale.

Conclusion: Collections Improve When Invoices Are Clear

Late payments don’t always signal a cash problem.

Often, they signal a clarity problem.

Digital invoice exchange helps businesses:

- reduce disputes

- speed up invoice acceptance

- improve collections

- strengthen customer relationships

Simple Finance Checklist

- Are invoices shared digitally or manually?

- Does the customer receive data or just documents?

- Are invoice details re-entered at the buyer’s end?

- Can invoice history be traced easily?

Tools like TallyPrime support this shift by enabling digital invoice exchange directly between businesses, helping reduce manual intervention, improve data accuracy, and bring greater predictability to collections — without changing how finance teams already work.

If the process is clear, collections follow.

Because in accounting,

what is clearly shared gets paid faster.