A CFO’s perspective on why accounting and payments must move together

It Started During a GSTR Filing Review

I was reviewing GSTR data with my finance team late one afternoon.

Purchase registers matched.

ITC numbers looked fine.

But when we moved to vendor balances, the picture changed.

Several vendors showed outstanding balances, even though payments had already been made.

The reason wasn’t cash flow.

It wasn’t intent.

It was simple — payments happened outside the accounting system.

Bank portals here.

Spreadsheets there.

Confirmations over email.

That’s when it became clear to me again:

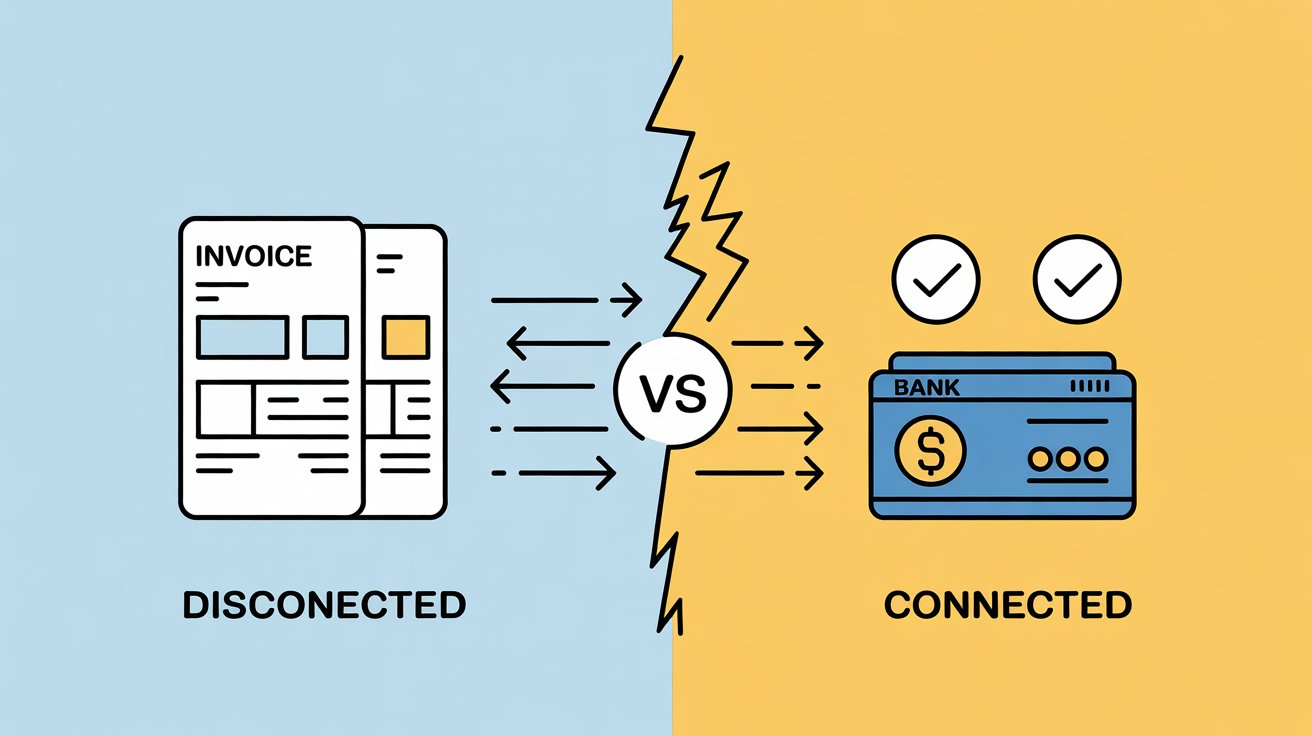

When accounting and payments are disconnected, books never stay clean for long.

The Real Problem Is Not Payment — It’s Visibility

Most businesses today don’t struggle to make payments.

They struggle to track them accurately.

What I see repeatedly:

- invoices booked on time

- payments made separately

- accounting entries updated later — or sometimes never

- month-end reconciliations becoming painful

This leads to:

- wrong vendor ageing

- unnecessary follow-ups

- duplicate payments

- confusion during audits and compliance filings

From a CFO’s lens, this isn’t a people problem.

It’s a process problem.

Why Clean Books Depend on Connected Workflows

Clean books are not created by extra effort.

They are created by fewer manual handoffs.

When payments are initiated separately:

- the same data is entered twice

- errors creep in silently

- accountability becomes unclear

Connected payments change this by ensuring:

- the payment starts from the accounting entry

- vendor, amount, and reference are already mapped

- the transaction closes only after payment is completed

In Tally, connected payment workflows help ensure that:

what is recorded is what gets paid — and what gets paid is what gets recorded.

That loop matters more than speed.

How Tally’s Connected Payments Improve Book Accuracy

From a practical standpoint, connected payments within Tally help businesses:

- initiate payments directly from vouchers

- eliminate duplicate data entry

- automatically update payment status

- maintain accurate vendor balances

This means:

- fewer open items at month-end

- reliable ageing reports

- confidence in payable numbers

- less reconciliation stress

As a CFO, when I look at reports, I don’t want to ask:

“Is this balance real?”

Connected systems help ensure the answer is yes.

Timely Vendor Settlements Are a Process Outcome

Late payments don’t always happen because of lack of funds.

They happen because of:

- approval delays

- unclear payment status

- missed reminders

- dependency on individuals

Tally’s connected approach helps by:

- clearly showing what is due

- linking approvals to accounting records

- reducing follow-ups between teams

- ensuring payments are not “forgotten”

This improves:

- vendor trust

- negotiation power

- supply continuity

In today’s environment, vendors value predictability more than promises.

Audit Readiness Improves When Payments Are Traceable

During audits or GST assessments, one request is common:

“Show the payment proof linked to this entry.”

Disconnected systems turn this into a search exercise.

Connected payments in Tally provide:

- clear linkage between voucher and payment

- easy access to payment references

- consistent data across reports

This results in:

- faster audit closures

- fewer queries

- better compliance confidence

For auditors, traceability is not optional.

For businesses, it should not be accidental.

The CFO Advantage: Control Without Micromanagement

What finance leaders truly want is not more reports —

it’s trust in the numbers.

Connected payments allow CFOs to:

- review real-time payable positions

- rely on vendor balances

- reduce dependency on manual confirmations

- focus on decision-making instead of chasing data

With Tally, finance teams can move from:

“Let me check and get back”

to

“The system already reflects it.”

That shift saves time — and credibility.

Importance for Growing Businesses

As businesses scale:

- transaction volumes increase

- vendor base expands

- compliance scrutiny rises

Disconnected processes that worked earlier start breaking down.

Connected payments ensure that growth does not come at the cost of:

- messy books

- stressed finance teams

- unhappy vendors

This is why modern accounting is no longer just about entries —

it’s about connected financial operations.

Closing Thought: Clean Books Are a Leadership Choice

Clean books don’t happen by chance.

They happen because leaders choose:

- better systems

- fewer manual steps

- connected workflows

Connected payments, when built into accounting — as they are in Tally — help businesses:

- maintain accurate records

- settle vendors on time

- stay audit-ready

- build financial discipline without friction

CFO’s Simple Checklist

- Are payments initiated from accounting entries?

- Is payment status updated automatically?

- Are vendor balances trustworthy at any point in time?

- Can payment proof be retrieved instantly during audits?

If the answer is yes —

Your books are not just clean, they are reliable.