“In taxation, as in life, change is constant — the true art lies in making the right adjustments at the right time.”

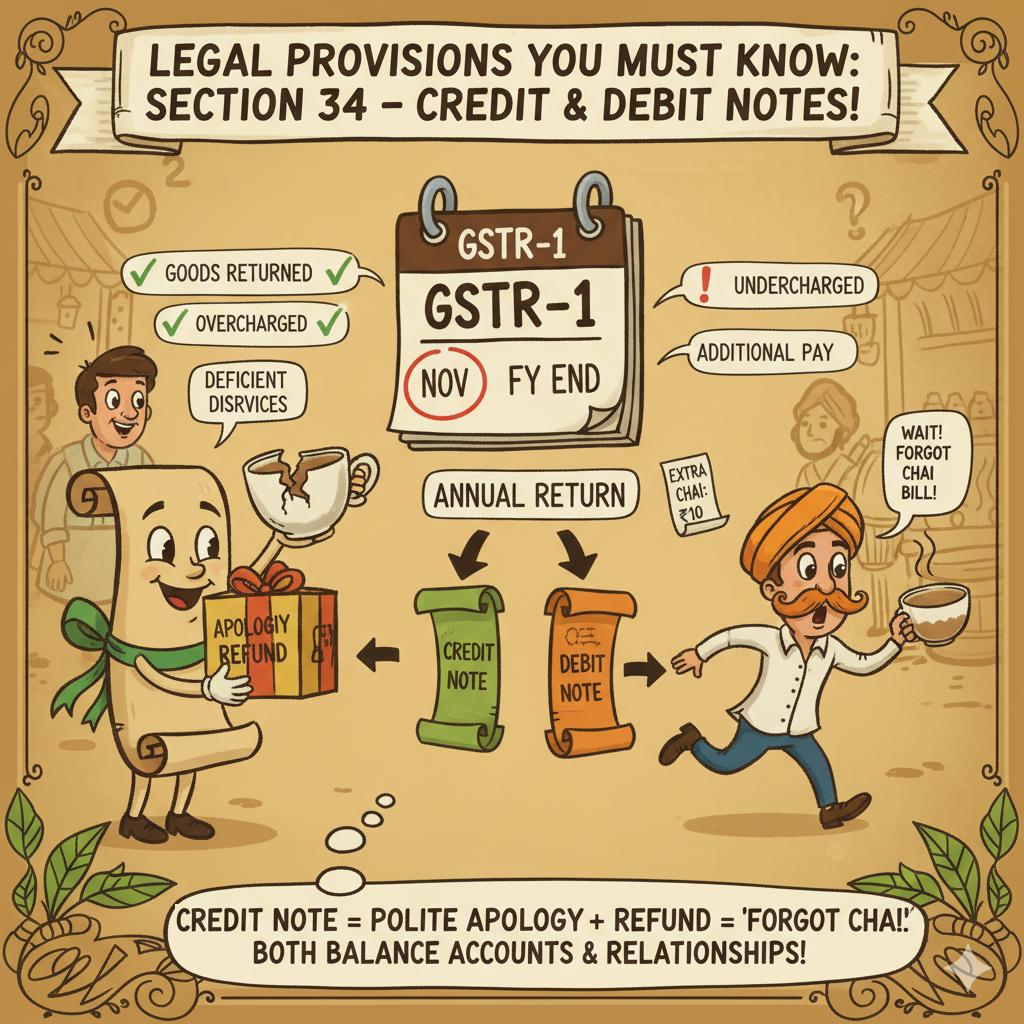

Legal Provisions You Must Know

Section 34 – Credit & Debit Notes

- Credit Note (Sec 34(1)) can be issued when:

✔ Goods returned by recipient

✔ Taxable value/tax charged higher than actual

✔ Goods/services found deficient

✔ Post-sale discount not considered earlier

- Debit Note (Sec 34(3)) can be issued when:

✔ Taxable value/tax charged lower than actual

✔ Additional amount payable later

Both must be declared in GSTR-1 for the month of issue.

Last date for Credit Notes = 30th Nov following FY (or Annual Return filing, whichever earlier).

“In business, a credit note is like a polite apology wrapped with a refund, while a debit note is your way of saying, ‘Wait, I forgot to bill you for that cup of chai!’ Both keep your accounts—and your relationships—balanced.”

Section 14 – Change in Rate of Tax

This section explains which GST rate to apply when the time of supply (supply, invoice, payment) is spread around the date of rate change.

As per Section 14 of the CGST Act, the answer depends on 3 key dates:

1️⃣ Date of Supply

2️⃣ Date of Invoice

3️⃣ Date of Payment*

Rule is simple:

If 2 out of 3 events happen before the rate change → Old GST Rate applies

If 2 out of 3 events happen after the rate change → New GST Rate applies

Example (GST reduced from 28% → 18% on 22-09-2025):

Old Rate (28%) applies:

Supply: 18-09-2025

Invoice: 20-09-2025

Payment: 25-09-2025

2 events (Supply + Invoice) before rate change → Old 28%

New Rate (18%) applies:

Supply: 24-09-2025

Invoice: 23-09-2025

Payment: 30-08-2025

2 events (Supply + Invoice) after rate change → New 18%

Note on Payment Date: Book Entry Bank Entry whichever is earlier. If the amount is credited to the bank more than 4 working days after the rate change, the bank credit date will be considered as the payment date.

Thumb Rule: Whichever side (before or after) wins 2 out of 3 events, that GST rate applies.

“GST doesn’t care about your love life, but it definitely cares about your supply date!”

How Sec 14 & Sec 34 Work Together

- Sec 14 = Decides which rate applies on the original invoice.

- Sec 34 = Ensures Credit/Debit Notes follow that same rate, not the new one.

In short: “No matter how the menu changes, your old bill stays the same!”

Rate Change Scenario (Effective 22nd September)

- 12% → 5% (Diary Products became cheaper)

- 5% → Exempt (0%) (Individual Health Insurance Premiums became tax-free)

- 28% → 40% (Motor Car became luxury)

Practical Examples

Example 1: Goods at 12% (Now 5%)

- Sold on 20th Sep (before change, 12%). Invoice = ₹1,000 + ₹120 = ₹1,120.

- Returned on 25th Sep.

👉 Sec 14: Supply was before → Old rate (12%).

👉 Sec 34: Credit Note = at 12%.

Credit Note = ₹500 + ₹60 = ₹560.

Example 2: Goods at 5% (Now Exempt)

- Sold on 18th Sep (before change, 5%). Invoice = ₹500 + ₹25 = ₹525.

- Returned on 23rd Sep.

👉 Sec 14: Old rate 5%.

👉 Sec 34: Credit Note also 5%.

Credit Note = ₹500 + ₹25 = ₹525.

Example 3: Goods at 28% (Now 40%)

- Sold on 19th Sep at 28%. Invoice = ₹10,000 + ₹2,800 = ₹12,800.

- Undercharged ₹2,000 → Debit Note on 24th Sep.

👉 Sec 14: Supply before → Old rate (28%).

👉 Sec 34: Debit Note also 28%.

Debit Note = ₹2,000 + ₹560 = ₹2,560.

Quick Reference Table

|

Situation |

Old Rate |

New Rate (22nd Sep) |

Rate for Credit/Debit Note (Sec 34) |

| Sold at 12% | 12% | 5% | 12% |

| Sold at 5% | 5% | Exempt | 5% |

| Sold 28% | 28% | 40% | 28% |

| New supplies after 22nd Sep | __ | New rate (Sec 14) | New rate |

Key Compliance Points

✔ Sec 14 = Fixes rate depending on supply timing.

✔ Sec 34 = Credit/Debit Notes must stick to original rate.

✔ Must link notes to invoices in GSTR-1.

✔ Credit Notes reduce liability only if recipient reverses ITC.

✔ Deadline for Credit Notes = 30th Nov of next FY.

Quote: “GST has better memory than most partners – it never forgets the original rate!”

Final Words

GST during rate changes can confuse even pros. But here’s the recipe:

- Sec 14 = Chef who decides the rate.

- Sec 34 = Waiter who serves the bill exactly as cooked.

So whether it’s Pizza, Salad, or Ice-cream — remember, your old orders = old tax rate. Only new orders = new tax rate.

“In love, past mistakes can be corrected. In GST, past invoices cannot!”

“GST rates may dance up or down, but credit and debit notes keep the rhythm in balance.”