Do you know that numbers speak louder than words? At least in fundraising, they do.

When you start a business and need funds for growth, your promises don’t work. Your figures do. The sales, the revenue, the expenses, and other counts - all speak on your behalf. This helps investors decide whether the venture is investable or not.

To present those figures, companies create financial models, which are spreadsheets that present such figures. Think of it as a strategy map showing how your revenue grows, where your money flows, when you will break even and when you will start making profits, and analyze your business runway.

Investors do not just fund dreams. They fund founders who understand the nuts and bolts of their business and can explain it clearly with logic and proof. A well-built financial brings your vision to life. It highlights that you have thought through potential challenges, planned for growth, and can make smart decisions along the way. It is your strategy, credibility, and game plan all rolled into one. Done right, it turns numbers into confidence, helping investors see your business's real potential.

Building a financial model investors trust

Creating a financial model that investors trust tells a clear story, highlights the important stuff, and makes your business logic impossible to ignore. Below, we will break down the key steps to structure your model, keep it realistic, and make it so easy to follow that investors can’t help but believe in your plan:

Step 1: Start with the right foundations

Before you even open a spreadsheet, pause and ask yourself, “Why am I building this model in the first place?”

There is no one-size-fits-all financial model. The same set of numbers can look very different depending on whether you are:

- Pitching to investors who want to see growth potential and cash flow

- Planning internally to make sure you do not run out of money three months from now

- Preparing updates to show current investors that their money is in safe hands

Each purpose needs a slightly different focus. For example,

- If you are fundraising, the model should say how you are going to grow, and how the investor’s capital will make it happen.

- If you are planning internally, it should say how much you can spend, where you cut back if needed, and what your safety net is.

Same company, same numbers, but different story. For example, here is what different types of businesses usually focus on:

- A SaaS startup highlights recurring revenue, churn rates, and customer acquisition costs

- A D2C brand highlights unit economics, margins, and repeat purchase patterns

- A manufacturing company highlights capex, production cycles, and working capital

When your model reflects the key drivers of your industry, it feels credible and focused. A model that tries to cover everything ends up convincing no one. So, before you enter a single number, set your foundation, focus on the metrics that matter for your industry, and keep the story easy for investors to follow.

Step 2: Keep it transparent and logical

Your financial numbers should be transparent and logical so that investors don't have to guess how you got from one number to the next. If your spreadsheet feels like a puzzle with missing pieces, trust goes out the window.

The best models are built like open books. Anyone looking at them should be able to follow the flow without digging through endless hidden formulas or messy tabs. If an investor asks, “Where did this revenue number come from?” you should be able to point to one neat section instead of scrolling for ten minutes.

The easiest way to do this is by keeping your financial model modular. Break it into clear sections such as:

- Assumptions for inputs like pricing, growth rates, or costs

- Revenue model to show how money comes in

- Cost structure to outline fixed and variable expenses

- Cash flow and runway to highlight how long you can operate before needing more funds

Also, keep formulas clean and transparent. Avoid stuffing multiple calculations into a single cell. Instead, use step-by-step formulas that anyone can trace. If an investor cannot make sense of your spreadsheet in five minutes, it is too complicated.

Clarity builds confidence. A model that is modular and logical makes investors far more likely to trust your projections.

Step 3: Ground your projections in reality

Ambition is good, but numbers that look unrealistic will turn investors away. Aim high, but keep your projections rooted in facts. Start with whatever historical data you already have. Even a few months of revenue, customer growth, or expenses can give a base for your assumptions. If you do not have much data yet, use market research, small pilot runs, or early customer feedback to show your numbers are based on something real.

Then compare with industry standards. Every sector has its rough benchmarks. For example:

- SaaS startups usually show churn rates of 3–7% per month

- Consumer brands cannot assume 90% repeat purchases unless it is something addictive like coffee

- Manufacturing companies follow well-known norms for margins and production costs

When your numbers reflect what is normal in your space, they feel credible. If you expect to do better, explain why. Bold claims are fine as long as you have proof.

The test is simple. If someone from your industry looks at your model, will they nod in agreement or raise an eyebrow? Aim for the nod.

Step 4: Focus on the metrics investors care about

Not every number in your business carries the same weight. Some metrics are nice-to-know, while others are make-or-break for investors. The trick is to highlight the few that tell the real story of your growth, profitability, and survival.

Here are the big ones almost every investor looks for:

- Revenue drivers: Show what fuels your growth. Is it new customer sign-ups, average order value, subscription renewals, or upselling existing clients? Break down where the money comes from so investors can see how growth happens.

- Unit economics: This is where you prove your business can scale. Two numbers matter most here:

- Customer Acquisition Cost (CAC): How much you spend to win one customer.

- Lifetime Value (LTV): How much that customer brings in over time. Your LTV should be clearly higher than your CAC. Otherwise, the business model does not work. Also show contribution margin (revenue – variable costs) to prove each sale adds real profit.

- Cash flow runway and breakeven timeline: Investors always want to know how long your money will last and when the business can stand on its own feet. Show how much money you spend each month, how many months of runway you have left, and when you expect the business to start covering its costs.

When you highlight these key metrics clearly, investors do not have to dig through your model to find the answers they care about most. You are basically saying, “Here’s what drives this business, here’s why it works, and here’s how long the fuel will last.”

Remember, investors care more about these key metrics than fancy charts or long spreadsheets. Focusing on them is the fastest way to build trust.

Step 5: Stress-test your assumptions

Every financial model looks good when everything goes as planned. But investors know that things in the real world rarely go as planned. Markets shift, costs rise, customers behave differently, and sometimes things just take longer than expected.

That is why it is smart to stress-test your model. Do not stop at one set of projections. Instead, build at least three scenarios:

- Base case: Your most realistic expectation

- Best case: What happens if growth is faster or costs are lower than expected

- Worst case: What if sales are slower, churn is higher, or expenses go up unexpectedly

By showing these versions, you prove you have factored in both the upsides and risks. It tells investors you are not blindly optimistic, but prepared for surprises.

It also helps to add buffers, which are just safety margins in your plan. For example, assume it might take a little longer to close deals, or set aside some extra funds for surprise expenses. These small adjustments make your projections more reliable and show investors you are prepared for the unexpected.

Step 6: Prioritise clarity in presentation

You can have the smartest model in the room, but if it looks messy, investors will switch off before they understand it. A financial model should feel clear and simple, not like a maze.

Start with a clean layout. Avoid too many tabs, tiny fonts, or cells filled with colours. Use clear labels, keep enough white space, and make sure the numbers are easy to scan. Add visuals where they help, for example:

- A line chart to show revenue growth

- A bar chart to compare costs

These simple visuals often explain more than long lists of numbers. The goal is not to impress with complexity but to make your model quick to understand. Clarity does not mean oversimplifying. It means investors spend their time thinking about your business, not trying to decode your spreadsheet.

Step 7: Make it investor-friendly

At the end of the day, your financial model is not just for you. It is a tool to win investor confidence. That means the way you present it has to feel open, consistent, and backed by logic. So, you have to

- Be upfront about assumptions: Every model is built on assumptions. How fast customers will grow, what retention will look like, and how much you will spend to acquire them. Do not hide these numbers. Call them out clearly so investors know what your projections are built on. If the assumptions are reasonable, being transparent about them only makes you look stronger.

- Keep everything consistent: Your pitch deck, your model, and the story you tell in the room should all match. If your deck says you will hit a certain revenue milestone in three years, but your model shows it in four, investors will notice. Even small mismatches can create doubt. Align the narrative so your story feels genuine from every angle.

- Defend with logic, not hope: Optimism is great, but investors want proof. If someone challenges your numbers, be ready to explain the “why” behind them. For example:

- Why do you believe churn will stay low

-

- Why your customer acquisition costs will decrease over time

-

- Why your margins will improve as you scale

Showing that you have thought through these points builds credibility. Even if investors disagree with some assumptions, they will respect that your numbers are grounded in logic, not just optimism.

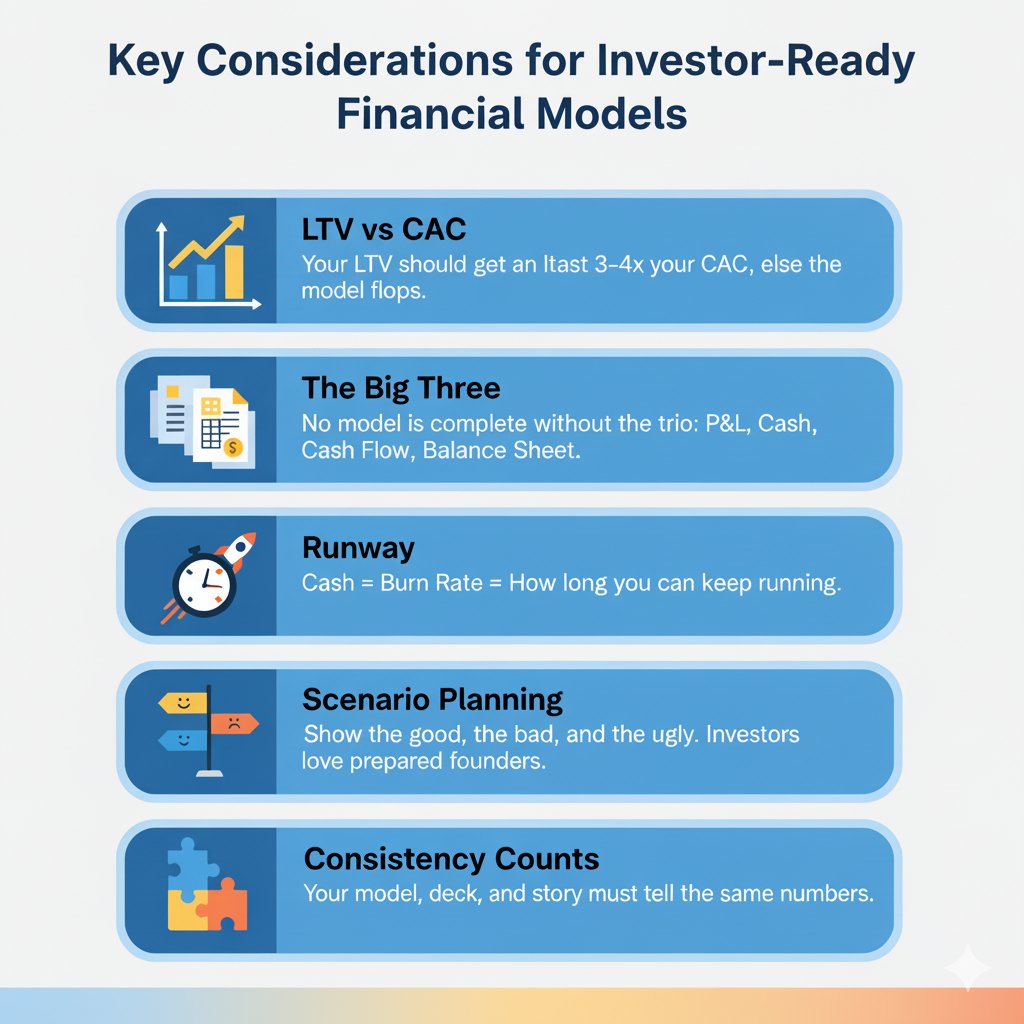

Infographic Content: Key considerations for building investor-ready financial models

- LTV vs CAC: Your LTV should get at least 3–4x your CAC, else the model flops.

- The big three: No model is complete without the trio: P&L, Cash Flow, Balance Sheet.

- Runway: How long can you keep running? Cash ÷ Burn Rate will give the answer.

- Scenario planning: Show the good, the bad, and the ugly. Investors love prepared founders.

- Consistency counts: Your model, deck, and story must tell the same numbers.

Conclusion

A financial model is not just a spreadsheet, but a story of how your business grows, survives challenges, and makes money. What investors really want to see is numbers that are clear, realistic, and backed by logic.

Do that, and your model becomes more than figures on a sheet. It becomes a tool that builds trust and strengthens your fundraising story.