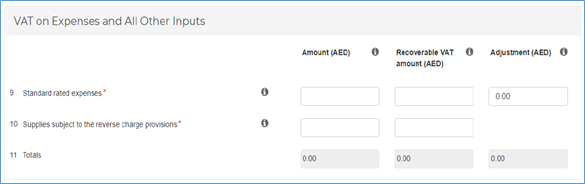

The adjustment column available in box no. 9 'Standard Rated Expenses' should be used to report adjustments pertaining to input VAT claimed in the previous return period.

The adjustments will arise due to any of the following reasons:

- Input VAT adjustments under bad debts relief

- Input VAT apportionment annual adjustments

- Adjustments under the Capital Assets Scheme

Let us discuss these adjustments in detail.

Input VAT adjustments under bad debts relief

This adjustment is related to input tax previously recovered on purchases where you haven’t paid the supplier of those goods or services for more than 6 months after the due date for payment. In such cases, the supplier has an option to claim output VAT which he had already paid to FTA in his previous VAT returns. The supplier can opt for this under the Bad debt relief scheme.

In case, the supplier opts for bad debt relief, the FTA will repay the VAT to the supplier. As result, you will not be entitled to input VAT recovery on such supplies and you should repay it to the FTA. Such adjustment needs to be reported in the ‘Adjustments’ column available in box no. 9. Later, when you pay your supplier the value of purchase along with VAT in the subsequent tax period, you will be entitled to reclaim the Input VAT in VAT return belonging to that tax period.

Based on the nature of adjustment, the value can be positive or negative. When you are asked to repay the input VAT claimed in the previous return, you need to mention the value is negative. To reclaim it, you need to mention it positive.

Input VAT apportionment annual adjustments

The input VAT apportionment annual adjustment is required in the case where you are making taxable and exempt supplies. In such a case, you will not be entitled to recover complete input VAT paid on your purchases or expenses. This is because the input VAT paid on purchases or expenses which are used for making exempt supplies will not be entitled to input VAT recovery.

In such as case, the executive regulation provides the guidelines for calculating the eligible input VAT recovery, especially when you cannot separately identify as to whether it relates to taxable supplies or exempt Supplies. In addition to calculating and reporting the eligible Input VAT recovery in each of VAT return period, you also need to do the calculation at the end of each tax year and accordingly report the difference, if any. These adjustments will be allowed to be made in the first tax period following the end of the tax year.

In order to enable the taxpayers in identifying the tax period in which such adjustment should be reported, the return form is enabled with 'VAT Return Period Reference Number'. If the VAT Return period reference number at the top of the VAT return is Period '1' for any tax year, the taxpayer will include such adjustment in that tax period.

Please note: since this is an annual adjustment, it will only be applicable from the beginning of 2019 onwards. The values included in the adjustments column can either be ‘positive’ or ‘negative’ values

Adjustments under the Capital Assets Scheme

This is applicable only for assets considered under the capital assets scheme. To be considered as capital assets, it should be a single item of expenditure of the business amounting to AED 5,000,000 or more excluding tax, on which tax is payable and which has estimated useful life equal to or longer than 10 years for building and 5 years for other capital assets.

The input tax paid on the purchase of capital assets will be deferred over the period of use of such assets. The input VAT incurred will be adjusted over a period of 10 ten consecutive years for buildings and 5 five consecutive years for other Capital Assets, commencing on the day on which the owner first uses the Capital Asset for the purposes of its Business.

If any of your capital assets are eligible for the Capital Assets Scheme, then the input tax incurred in relation to that capital asset should be adjusted in each tax year, according to the guidelines given the Executive Regulation for a period of either five or ten consecutive years depending on the type of capital asset.

Key points for reporting the input VAT adjustments in VAT Return Form 201

- Only those adjustments which are discussed above should be reported

- Depending on the nature of adjustment, the value can be either positive or negative. To claim or reclaim, you need to mention in positive and to re-pay, it should be negative

- If the adjustments are not applicable, do not include anything in the adjustment column